- Home

- Latest News

![submenu-img]() Rohit Sharma: The True Epitome of Leadership in the Cricket World

Rohit Sharma: The True Epitome of Leadership in the Cricket World![submenu-img]() Nature's Powerhouse For Even Skin Tone: Blossom Kochhar Aroma Magic Introduces Anti-Pigmentation Glossy Pack

Nature's Powerhouse For Even Skin Tone: Blossom Kochhar Aroma Magic Introduces Anti-Pigmentation Glossy Pack![submenu-img]() Chef Vikas Khanna sends a special video to Rachana Shah and Rhythm Wagholikar

Chef Vikas Khanna sends a special video to Rachana Shah and Rhythm Wagholikar![submenu-img]() Meet world's richest actor, has only one hit, richer than Shah Rukh Khan, Tom Cruise, his net worth is of $1.4 billion

Meet world's richest actor, has only one hit, richer than Shah Rukh Khan, Tom Cruise, his net worth is of $1.4 billion![submenu-img]() Watch: West Indies spinner Zaida James gets hit on face during Women's T20 World Cup 2024 match

Watch: West Indies spinner Zaida James gets hit on face during Women's T20 World Cup 2024 match

- Webstory

![submenu-img]() Gout tips: 6 Dals (pulses) to avoid if you have high uric acid levels

Gout tips: 6 Dals (pulses) to avoid if you have high uric acid levels![submenu-img]() Bhuvan Bam to Elvish Yadav: Here's how rich these Indian YouTubers are

Bhuvan Bam to Elvish Yadav: Here's how rich these Indian YouTubers are![submenu-img]() 10 countries that pay most amount of taxes

10 countries that pay most amount of taxes

![submenu-img]() Deadliest place on Earth: Closer to the space station than ground

Deadliest place on Earth: Closer to the space station than ground

![submenu-img]() 10 unseen pictures of Aishwarya Rai, Bollywood's eternal diva

10 unseen pictures of Aishwarya Rai, Bollywood's eternal diva

- DNA Hindi

![submenu-img]() Bengal Minor Murder: नाबालिग के अपहरण और हत्या के बाद बंगाल में बवाल, BJP ने ममता सरकार पर दागे सवाल

Bengal Minor Murder: नाबालिग के अपहरण और हत्या के बाद बंगाल में बवाल, BJP ने ममता सरकार पर दागे सवाल![submenu-img]() UP में लेट-लतीफी करने वाले अफसरों पर गिरेगी गाज, CM Yogi Adityanath ने दिया अल्टीमेटम

UP में लेट-लतीफी करने वाले अफसरों पर गिरेगी गाज, CM Yogi Adityanath ने दिया अल्टीमेटम![submenu-img]() Haryana Assembly Election 2024 Live: सुबह 11 बजे तक हुई इतनी वोटिंग, अनिल विज ने किया बड़ा दावा

Haryana Assembly Election 2024 Live: सुबह 11 बजे तक हुई इतनी वोटिंग, अनिल विज ने किया बड़ा दावा![submenu-img]() IND vs BAN 1st T20 Pitch Report: ग्वालियर में होगी रनों की बौछार या चलेगा गेंदबाजों का कहर, जानें कैसा होगा पिच का हाल

IND vs BAN 1st T20 Pitch Report: ग्वालियर में होगी रनों की बौछार या चलेगा गेंदबाजों का कहर, जानें कैसा होगा पिच का हाल![submenu-img]() आखिर कैसा टूटा था Rekha-Amitabh Bachchan का रिश्ता?Jaya Bachchan ने अपनाया था ये हथकंडा

आखिर कैसा टूटा था Rekha-Amitabh Bachchan का रिश्ता?Jaya Bachchan ने अपनाया था ये हथकंडा

- Automobile

![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

- Education

![submenu-img]() Meet woman who begged in childhood, became doctor after 20 years of struggle, now she is...

Meet woman who begged in childhood, became doctor after 20 years of struggle, now she is...![submenu-img]() Meet man, who left govt job as Assistant Excise Officer, used to get Rs 50000000, now works as...

Meet man, who left govt job as Assistant Excise Officer, used to get Rs 50000000, now works as...![submenu-img]() This engineer lands Google job, gets record-breaking offer, not from IIT, NIT

This engineer lands Google job, gets record-breaking offer, not from IIT, NIT![submenu-img]() Haryana schools to remain closed for two days due to elections; check dates here

Haryana schools to remain closed for two days due to elections; check dates here![submenu-img]() Meet man, who bagged AIR 1 in JEE Advance, studied at IIT Bombay, now pursuing PhD at prestigious college in...

Meet man, who bagged AIR 1 in JEE Advance, studied at IIT Bombay, now pursuing PhD at prestigious college in...

- Videos

![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

- Business

![submenu-img]() Anil Ambani's Reliance Power shares plunge by 5% a day after company announces...

Anil Ambani's Reliance Power shares plunge by 5% a day after company announces...![submenu-img]() Meet richest man of Kanpur with whopping net worth of Rs 14000 crore, he is the mastermind behind...

Meet richest man of Kanpur with whopping net worth of Rs 14000 crore, he is the mastermind behind...![submenu-img]() Who is Gia 'Goyal', related to Zomato CEO Deepinder Goyal, with net worth of Rs 142850150000

Who is Gia 'Goyal', related to Zomato CEO Deepinder Goyal, with net worth of Rs 142850150000![submenu-img]() IndiGo's Rakesh Gangwal makes HUGE investment in US Airline, buys 3600000 shares worth Rs....

IndiGo's Rakesh Gangwal makes HUGE investment in US Airline, buys 3600000 shares worth Rs....![submenu-img]() Meet Ahmedabad's RICHEST man, college drop out who has business worth Rs 17000000000000, not Mukesh Ambani, he is...

Meet Ahmedabad's RICHEST man, college drop out who has business worth Rs 17000000000000, not Mukesh Ambani, he is...

- Photos

![submenu-img]() 10 sultry, sexy photos of Aabha Paul that crashed the internet

10 sultry, sexy photos of Aabha Paul that crashed the internet![submenu-img]() From Shah Rukh Khan in Jawan to Jr NTR in Devara Part One: 7 actors who played father-son in blockbuster films

From Shah Rukh Khan in Jawan to Jr NTR in Devara Part One: 7 actors who played father-son in blockbuster films![submenu-img]() Navratri 2024: 5 Bollywood diva-inspired lehengas, sarees for stunning Garba look

Navratri 2024: 5 Bollywood diva-inspired lehengas, sarees for stunning Garba look![submenu-img]() Need vitamin B12? Add these 7 nutrient-packed foods to your diet

Need vitamin B12? Add these 7 nutrient-packed foods to your diet![submenu-img]() Meet actress who survived honour killing, worked in B-grade films still became star; later left Bollywood to become…

Meet actress who survived honour killing, worked in B-grade films still became star; later left Bollywood to become…

- India

![submenu-img]() Launch of the flagship ‘Always Care: Animal Care Centre’ at Manavta Mahotsav on Param Gurudev Namramuni Maharaj Saheb’s

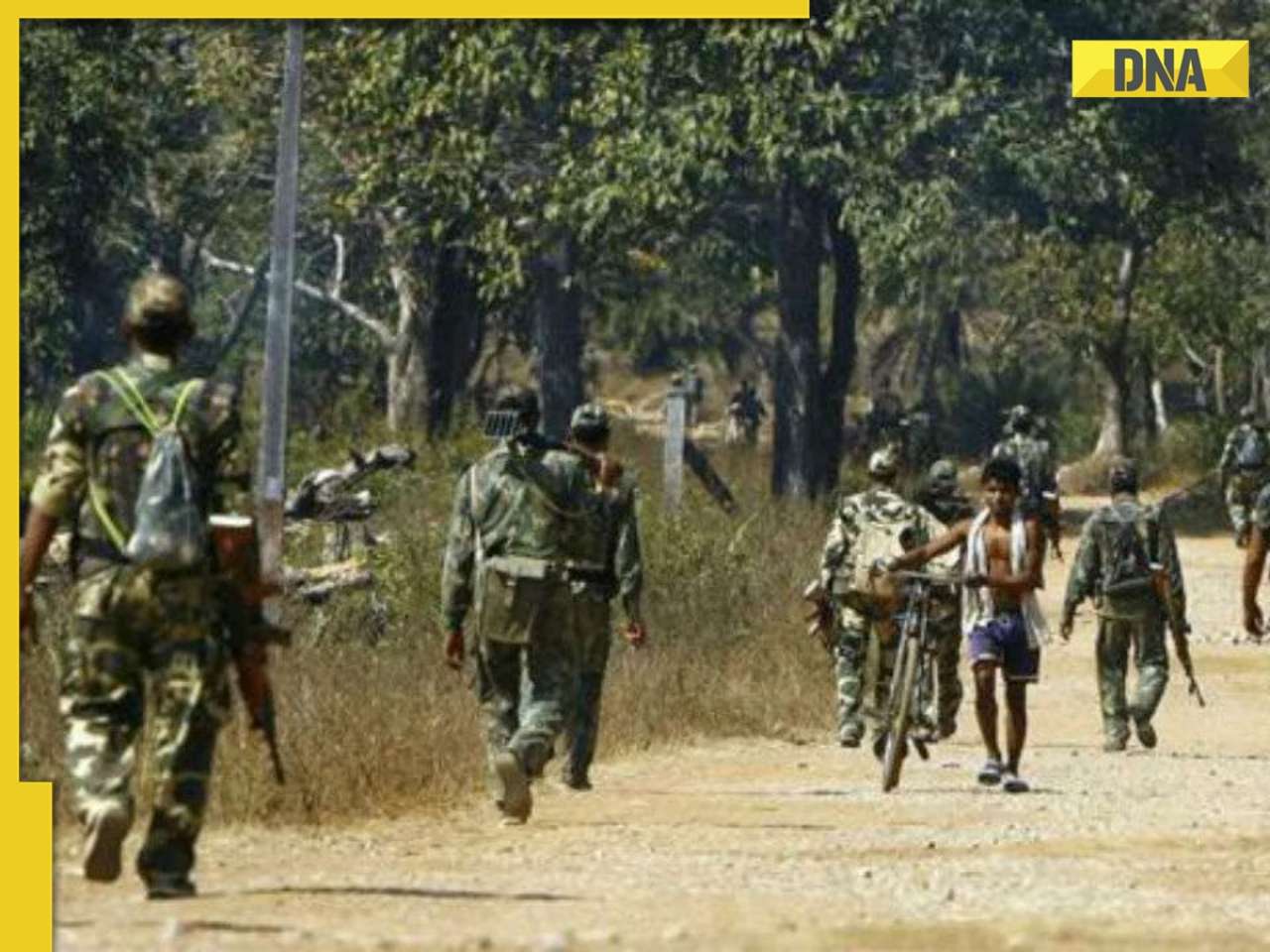

Launch of the flagship ‘Always Care: Animal Care Centre’ at Manavta Mahotsav on Param Gurudev Namramuni Maharaj Saheb’s ![submenu-img]() Chhattisgarh: 28 naxals killed in encounter with police along Dantewada border

Chhattisgarh: 28 naxals killed in encounter with police along Dantewada border![submenu-img]() CBI arrests NIA officer for demanding Rs 2.5 crore bribe, here's what happened

CBI arrests NIA officer for demanding Rs 2.5 crore bribe, here's what happened![submenu-img]() SC rejects petitions seeking review of judgement allowing sub-classification of Scheduled Castes

SC rejects petitions seeking review of judgement allowing sub-classification of Scheduled Castes![submenu-img]() Former cricketer and actor Salil Ankola's mother found dead in Pune flat

Former cricketer and actor Salil Ankola's mother found dead in Pune flat

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)