In a big boost to the education sector, the Cabinet Committee on Economic Affairs (CCEA) on Wednesday approved the proposal for expanding the scope of Higher Education Financing Agency (HEFA) by enhancing its capital base to Rs 10,000 crore and tasking it to mobilise Rs 1,00,000 crore for Revitalising Infrastructure and Systems in Education (RISE) by 2022.

In order to expand this facility to all institutions, especially those set up after 2014, the central universities which have very little internal resources, and institutions like AIIMS and Kendriya Vidyalayas, the Cabinet Committee on Economic Affairs (CCEA) has approved five conditions for financing under the HEFA and the modalities of repaying the principal portion of the fund.

The technical institutions which are over 10-years-old will have to repay the whole principal portion from the internally generated budgetary resources. Such institutions started between 2008 and 2014 will have to repay 25 per cent of the principal portion from internal resources and receive a grant for the balance of the principal portion.

Central universities which started before 2014 will have to repay 10 per cent of the principal portion from internal resources and will receive a grant for the balance of the principal portion. The Newly Established Institutions (started after 2014) Grant would be provided for complete serving of loan, including principal and interest for funding construction of permanent campuses.

For all other educational institutions and grant-in-aid institutions of the Ministry of Health such as the newly set up AIIMSs and other health institutions, the Kendriya Vidyalayas/Navodaya Vidyalayas would be funded and the Department/Ministry concerned will give a commitment for complete servicing of the principal and interest by ensuring adequate grants to the institution.

The Cabinet has also permitted the HEFA to mobilise Rs 1,00,000 crore over the four years until 2022 to meet the infrastructure needs of these institutions. The CCEA has also approved an increase in the authorised share capital of HEFA to Rs 10,000 crore, and approved infusing additional Government equity of Rs5,000 crore (in addition to Rs 1,000 crore already provided) in HEFA. The CCEA has also approved that the modalities for raising money from the market through government guaranteed bonds and commercial borrowings would be decided in consultation with the Department of Economic Affairs so that the funds are mobilised at the least cost.

Officials here said that this would enable addressing the needs of all educational institutions with differing financial capacity in an inclusive manner. Also it would enable HEFA to leverage additional resources from the market to supplement equity, to be deployed to fund the requirements of institutions. Government guarantees would eliminate the risk factor in bonds issue and attract investment in this important national activity.

The HEFA was set up on May 31, 2017 by the Central Government as a Non-Profit, Non-Banking Financing Company (NBFC) for mobilising extra-budgetary resources for building crucial infrastructure in the higher educational institutions under the Central government. In the existing arrangement, the entire principle portion is repaid by the institution over ten years, and the interest is serviced by the government by providing additional grants to the institution. So far, funding proposals worth Rs 2,016 crore have been approved by the HEFA.

INCREASE IN SHARE CAPITAL

- The CCEA has also approved an increase in the authorised share capital of HEFA to Rs 10,000 crore, and approved infusing additional Government equity of Rs 5,000 cr (in addition to Rs 1,000 cr already provided)

![submenu-img]() Meet Bigg Boss 18 contestant Rajat Dalal, controversial influencer who was booked for rash driving; he’s popular for…

Meet Bigg Boss 18 contestant Rajat Dalal, controversial influencer who was booked for rash driving; he’s popular for…![submenu-img]() Chennai: At least 3 dead, nearly 100 hospitalised after IAF's air show

Chennai: At least 3 dead, nearly 100 hospitalised after IAF's air show![submenu-img]() Chum Darang opens up on apprehensions about doing Salman's Bigg Boss 18: 'It has lot of controversies...' | Exclusive

Chum Darang opens up on apprehensions about doing Salman's Bigg Boss 18: 'It has lot of controversies...' | Exclusive![submenu-img]() Karan Johar breaks silence on Vasan Bala's comment on him sending Jigra script to Alia Bhatt: 'If you see...'

Karan Johar breaks silence on Vasan Bala's comment on him sending Jigra script to Alia Bhatt: 'If you see...'![submenu-img]() IND vs BAN, 1st T20I: Arshdeep Singh, Hardik Pandya star as India beat Bangladesh by 7 wickets, lead series 1-0

IND vs BAN, 1st T20I: Arshdeep Singh, Hardik Pandya star as India beat Bangladesh by 7 wickets, lead series 1-0![submenu-img]() Indian Air Force के एयरशो में बड़ा हादसा, डिहाइड्रेशन और दम घुटने से 3 की मौत, 200 लोगों की हालत खराब

Indian Air Force के एयरशो में बड़ा हादसा, डिहाइड्रेशन और दम घुटने से 3 की मौत, 200 लोगों की हालत खराब![submenu-img]() Bigg Boss 18 premiere: 18 कंटेस्टेंट की हो गई घर म��ें धांसू एंट्री, यहां है पूरी लिस्ट

Bigg Boss 18 premiere: 18 कंटेस्टेंट की हो गई घर म��ें धांसू एंट्री, यहां है पूरी लिस्ट![submenu-img]() बैट हाथ में थाम Rohit Sharma बने Yogi Adityanath, इकाना की पिच पर दिखा यूपी सीएम के बल्ले का जलवा, देखें Photos

बैट हाथ में थाम Rohit Sharma बने Yogi Adityanath, इकाना की पिच पर दिखा यूपी सीएम के बल्ले का जलवा, देखें Photos![submenu-img]() IND vs BAN 1st T20 Highlights: 'यंग' इंडिया के सामने नहीं टिक पाया बांग्लादेश, सूर्यकुमार यादव ब्रिगेड ने 71 गेंद में जीता मैच

IND vs BAN 1st T20 Highlights: 'यंग' इंडिया के सामने नहीं टिक पाया बांग्लादेश, सूर्यकुमार यादव ब्रिगेड ने 71 गेंद में जीता मैच![submenu-img]() AAP नेता सौरभ भारद्वाज ने BJP नेता विजेंद्र गुप्ता के खिलाफ दर्ज कराई शिकायत, महिला से जुड़ा है मामला

AAP नेता सौरभ भारद्वाज ने BJP नेता विजेंद्र गुप्ता के खिलाफ दर्ज कराई शिकायत, महिला से जुड़ा है मामला![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() ISRO Recruitment 2024: Government job vacancies for 103 posts, salary up to Rs 208700, check eligibility, other details

ISRO Recruitment 2024: Government job vacancies for 103 posts, salary up to Rs 208700, check eligibility, other details![submenu-img]() Meet IIT drop out, who cracked JEE twice, cracked UPSC exam to become IAS officer, then resigned due to...

Meet IIT drop out, who cracked JEE twice, cracked UPSC exam to become IAS officer, then resigned due to...![submenu-img]() Meet woman, who failed in four UPSC prelims, missed interview, got panic attack, then finally became...

Meet woman, who failed in four UPSC prelims, missed interview, got panic attack, then finally became...![submenu-img]() Meet IIT graduate, who didn't settle for IPS posting, cracked UPSC exam twice to become...

Meet IIT graduate, who didn't settle for IPS posting, cracked UPSC exam twice to become...![submenu-img]() Meet IIT-JEE topper with 355 marks in JEE Advanced, whose father works at Mukesh Ambani's Reliance Jio, aims to join..

Meet IIT-JEE topper with 355 marks in JEE Advanced, whose father works at Mukesh Ambani's Reliance Jio, aims to join..![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() This man used to sell bhujia, then built Rs 8330 crore company, his business is...

This man used to sell bhujia, then built Rs 8330 crore company, his business is...![submenu-img]() Anil Ambani RISES as value of his company goes up by Rs 24,000 crore, it is...

Anil Ambani RISES as value of his company goes up by Rs 24,000 crore, it is...![submenu-img]() Meet woman, who built her company from zero to Rs 10000000, became CEO at 24, not from IIT, IIM, her business is...

Meet woman, who built her company from zero to Rs 10000000, became CEO at 24, not from IIT, IIM, her business is...![submenu-img]() Pensioners alert! THIS new scam can stop your pension, check details and know how to protect yourself

Pensioners alert! THIS new scam can stop your pension, check details and know how to protect yourself![submenu-img]() Meet woman, who founded Rs 7000 crore brand, got fired from her company due to...

Meet woman, who founded Rs 7000 crore brand, got fired from her company due to...![submenu-img]() Gandii Baat actress Aabha Paul sets Instagram on fire with sultry, sexy photos

Gandii Baat actress Aabha Paul sets Instagram on fire with sultry, sexy photos![submenu-img]() 5 stunning images of space captured by NASA's James Webb telescope

5 stunning images of space captured by NASA's James Webb telescope![submenu-img]() 6 ethnic ensembles from Shraddha Kapoor’s wardrobe that are perfect for festive glam

6 ethnic ensembles from Shraddha Kapoor’s wardrobe that are perfect for festive glam![submenu-img]() Bigg Boss: Top 5 contestants of all seasons of Salman Khan's show

Bigg Boss: Top 5 contestants of all seasons of Salman Khan's show![submenu-img]() Bigg Boss 18 contestants list: Shilpa Shirodkar, Vivian Dsena, Rajat Dalal, Eisha Singh, others to join Salman Khan show

Bigg Boss 18 contestants list: Shilpa Shirodkar, Vivian Dsena, Rajat Dalal, Eisha Singh, others to join Salman Khan show![submenu-img]() Chennai: At least 3 dead, nearly 100 hospitalised after IAF's air show

Chennai: At least 3 dead, nearly 100 hospitalised after IAF's air show![submenu-img]() Scared of DIGITAL ARREST? Here's what you need to do

Scared of DIGITAL ARREST? Here's what you need to do![submenu-img]() UP: Wolf terror ends in Bahraich as villagers kill sixth and final predator

UP: Wolf terror ends in Bahraich as villagers kill sixth and final predator![submenu-img]() Jaishankar meets Maldives President Mohamed Muizzu, says, 'confident that his talks with PM Modi will...'

Jaishankar meets Maldives President Mohamed Muizzu, says, 'confident that his talks with PM Modi will...'![submenu-img]() Weather update: Amid monsoon withdrawals in other states, Delhi-NCR continues to face warm temperatures till...

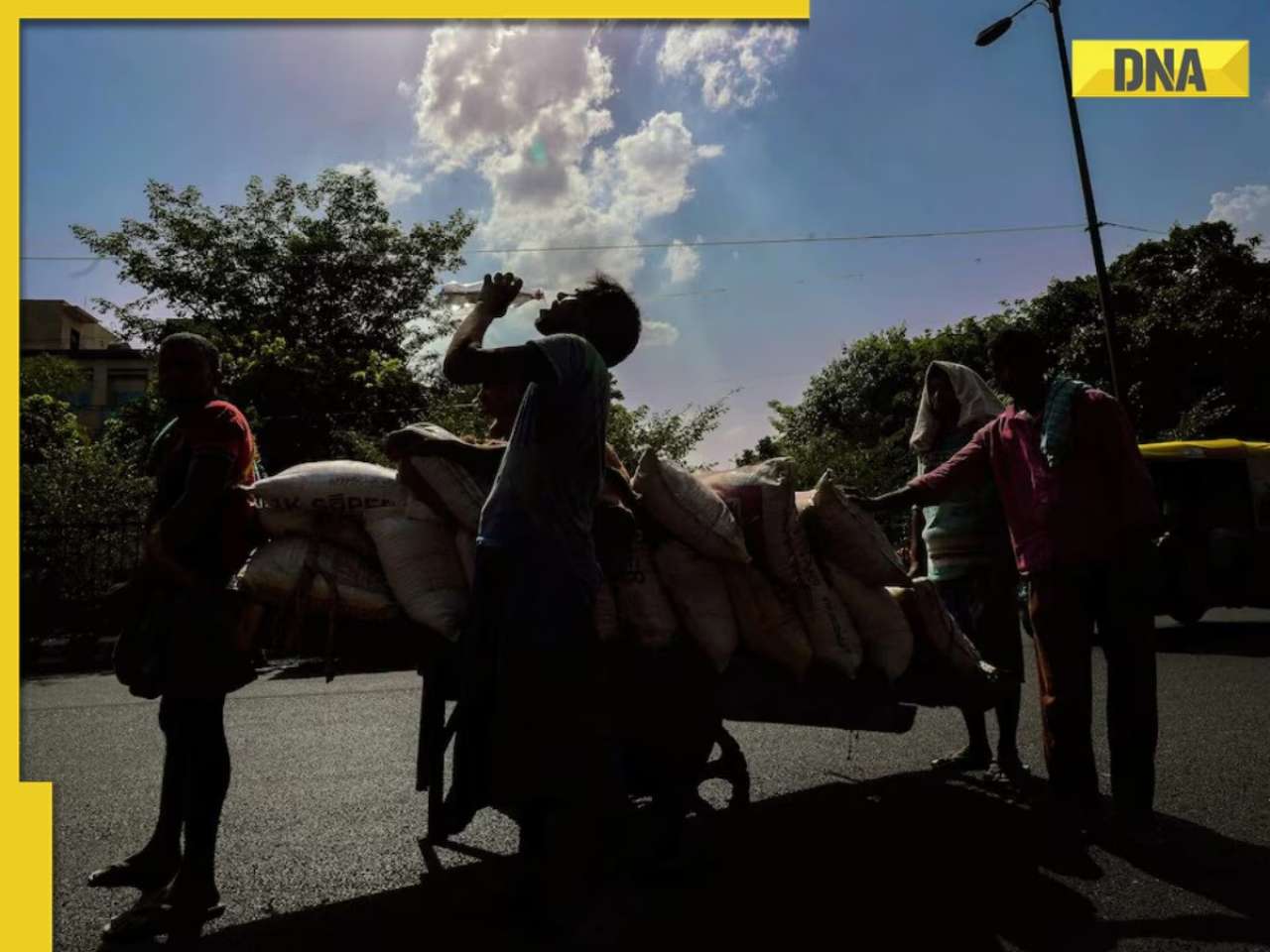

Weather update: Amid monsoon withdrawals in other states, Delhi-NCR continues to face warm temperatures till...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)