This new rule will not include free withdrawal from ATMs five times a month. You will have to pay separately, which will apply to your withdrawal when you withdraw more than 5000.

ATM Transaction Rules / Limits / Charges: If you withdraw more than 5000 rupees from ATM, now you know that you will have to pay an extra charge on withdrawing this amount. Preparations are being made to change the ATM withdrawal rules after eight years. This new rule will not include free withdrawal from ATMs five times a month. You will have to pay separately, which will apply to your withdrawal when you withdraw more than 5000.

Charge of Rs 24 for withdrawals over 5 thousand

According to media reports, customers will have to pay an additional Rs 24 for withdrawing more than Rs 5000 from an ATM. As per the existing cash withdrawal rules from ATMs, cash withdrawals can be made free five times a month. If a cash withdrawal is made more than five times in a month, a fee of Rs 20 is to be paid on the sixth withdrawal.

Recommendation of RBI Committee

The rules for withdrawing cash from ATMs are being changed based on the recommendations made by a committee of the Reserve Bank of India (RBI). However, the committee's report has not yet been made public. This information is given in the information sought under the Right to Information Act (RTI).

The report was submitted to RBI only in October last year

The committee constituted to review the ATM fee of RBI has submitted its recommendations. Based on this, banks can change the ATM fee after eight years. According to the information given in the RTI, the Reserve Bank committee had suggested reducing cash withdrawals. The committee headed by VG Kannan, the Indian Banks' Association's Chief Executive Officer, has submitted its report to ease the cash withdrawal habit. He submitted this report to the Reserve Bank on 22 October 2019. However, it was never made public. RTI activist Shrikant L had sought information in this regard from RBI through RTI.

![submenu-img]() Big trouble for Byju's as it looks at severe financial crisis due to...

Big trouble for Byju's as it looks at severe financial crisis due to...![submenu-img]() SOP released by Rajasthan police to safeguard threatened live-in couples, married couple

SOP released by Rajasthan police to safeguard threatened live-in couples, married couple![submenu-img]() UP: 5 dead, several injured after 3-storey building collapses in Lucknow

UP: 5 dead, several injured after 3-storey building collapses in Lucknow![submenu-img]() Asian Hockey Champions Trophy 2024: Full schedule, fixtures, live streaming and more details

Asian Hockey Champions Trophy 2024: Full schedule, fixtures, live streaming and more details![submenu-img]() Meet self made woman of India who survived cancer, owns 10 private jets, her business is

Meet self made woman of India who survived cancer, owns 10 private jets, her business is![submenu-img]() Kolkata Rape Murder Case में फांसी की उठ रही मांग, ऐसे में सिलीगुड़ी कोर्ट का बड़ा फैसला, रेप के आरोपी को दी ये सजा

Kolkata Rape Murder Case में फांसी की उठ रही मांग, ऐसे में सिलीगुड़ी कोर्ट का बड़ा फैसला, रेप के आरोपी को दी ये सजा![submenu-img]() Haryana Assembly Elections 2024: कांग्रेस के साथ पर AAP में रार? विधायक बोले- बेमेल गठबंधन, राहुल-प्रियंका पर उठाए सवाल

Haryana Assembly Elections 2024: कांग्रेस के साथ पर AAP में रार? विधायक बोले- बेमेल गठबंधन, राहुल-प्रियंका पर उठाए सवाल![submenu-img]() Hyderabad Airport पर गिरफ्तार हुआ ये एक्टर, CISF ने नशे की हालत में ये काम करते हुए दबोचा

Hyderabad Airport पर गिरफ्तार हुआ ये एक्टर, CISF ने नशे की हालत में ये काम करते हुए दबोचा![submenu-img]() Bangladesh में भारत विरोधी गुट अब राष्ट्रगान के खिलाफ, 'भारतीय' बताकर उठाई बदलने की मांग; सरकार ने दिया ये जवाब

Bangladesh में भारत विरोधी गुट अब राष्ट्रगान के खिलाफ, 'भारतीय' बताकर उठाई बदलने की मांग; सरकार ने दिया ये जवाब![submenu-img]() 'NRC नहीं तो आधार कार्ड नहीं', असम में 'ऑपरेशन घुसपैठिया' के बीच Himanta Biswa Sarma ने तय किया नियम, जानें क्या है पूरी बात

'NRC नहीं तो आधार कार्ड नहीं', असम में 'ऑपरेशन घुसपैठिया' के बीच Himanta Biswa Sarma ने तय किया नियम, जानें क्या है पूरी बात![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

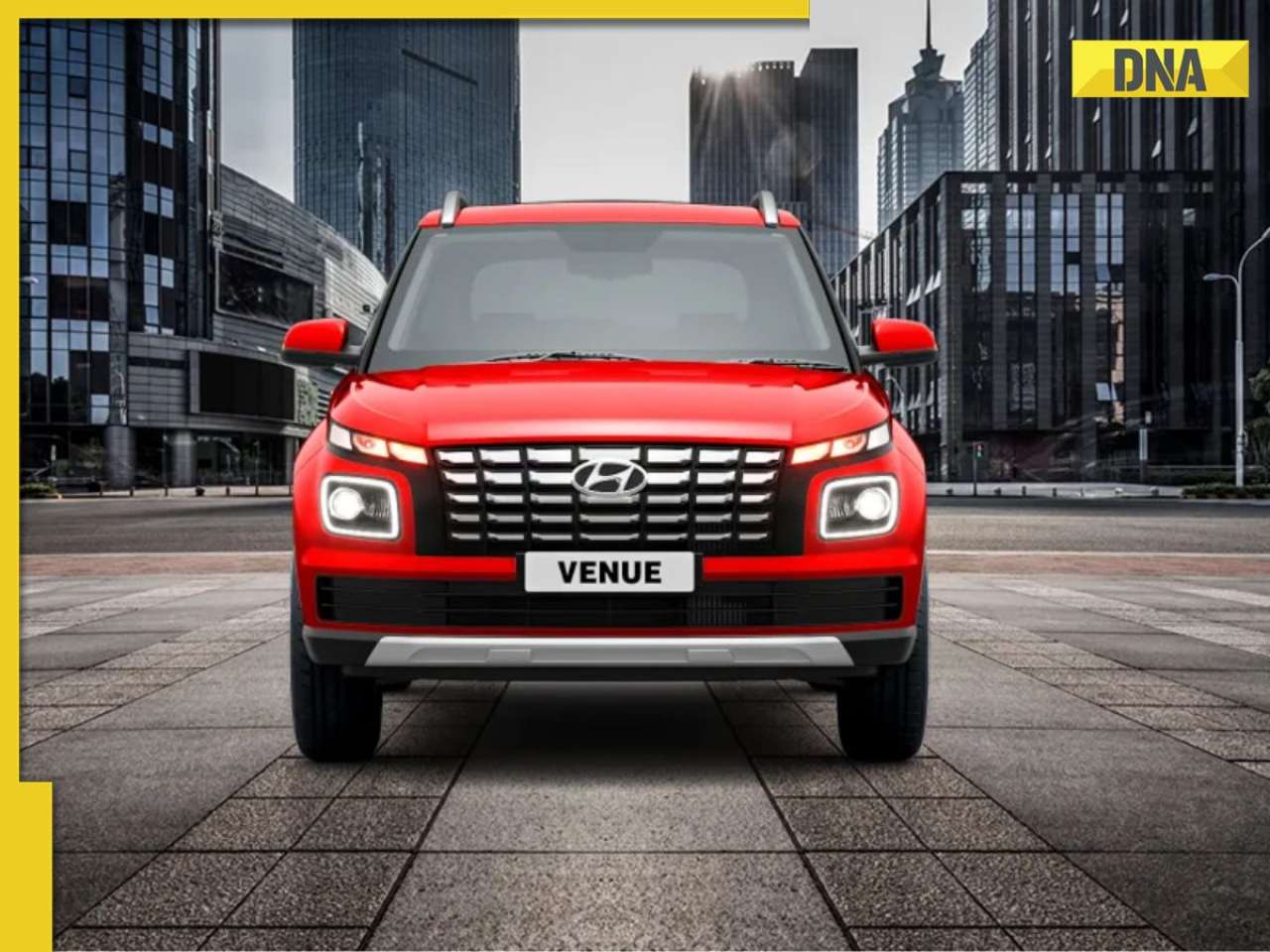

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details

DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details![submenu-img]() Hyundai Creta Knight Edition launched in India: Check price, features, design

Hyundai Creta Knight Edition launched in India: Check price, features, design![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() BIG UPDATE! UGC NET answer key 2024 to be released soon at...

BIG UPDATE! UGC NET answer key 2024 to be released soon at...![submenu-img]() Meet woman, mill worker’s daughter who lost mother during UPSC preparations, still cracked it with AIR 14, she is now...

Meet woman, mill worker’s daughter who lost mother during UPSC preparations, still cracked it with AIR 14, she is now...![submenu-img]() Meet man, 54-year-old engineer who left his high-paying job to crack NEET exam but there's a twist

Meet man, 54-year-old engineer who left his high-paying job to crack NEET exam but there's a twist![submenu-img]() Meet IIT-JEE topper with AIR 1, who quit IIT Bombay after a year due to...

Meet IIT-JEE topper with AIR 1, who quit IIT Bombay after a year due to...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Big trouble for Byju's as it looks at severe financial crisis due to...

Big trouble for Byju's as it looks at severe financial crisis due to...![submenu-img]() Meet self made woman of India who survived cancer, owns 10 private jets, her business is

Meet self made woman of India who survived cancer, owns 10 private jets, her business is![submenu-img]() Meet IITian who failed 7 times in work, went on to built a Rs 8398 crore company, his business is…

Meet IITian who failed 7 times in work, went on to built a Rs 8398 crore company, his business is…![submenu-img]() This college turned down Gautam Adani’s application, after 46 years called to honour him

This college turned down Gautam Adani’s application, after 46 years called to honour him![submenu-img]() Business heartthrob Vaibhav Maloo pursues his childhood dreams in the digital world by launching InfoProfile

Business heartthrob Vaibhav Maloo pursues his childhood dreams in the digital world by launching InfoProfile ![submenu-img]() Meet Yesha Sagar, Indian-Canadian model and actress making waves as cricket presenter

Meet Yesha Sagar, Indian-Canadian model and actress making waves as cricket presenter![submenu-img]() Meet actress who never got lead roles, still turned superstar, one rumour ruined her career, became second wife of...

Meet actress who never got lead roles, still turned superstar, one rumour ruined her career, became second wife of...![submenu-img]() Sundar Pichai to Mark Zuckerberg: 10 tech leaders from Time's 2024 AI 100 list

Sundar Pichai to Mark Zuckerberg: 10 tech leaders from Time's 2024 AI 100 list![submenu-img]() Meet actress worth Rs 10000 cr, among youngest billionaires ever, once had no money for gas, now richer than SRK, Salman

Meet actress worth Rs 10000 cr, among youngest billionaires ever, once had no money for gas, now richer than SRK, Salman![submenu-img]() Top six signs of high cholesterol on face that you must not ignore

Top six signs of high cholesterol on face that you must not ignore ![submenu-img]() SOP released by Rajasthan police to safeguard threatened live-in couples, married couple

SOP released by Rajasthan police to safeguard threatened live-in couples, married couple![submenu-img]() UP: 5 dead, several injured after 3-storey building collapses in Lucknow

UP: 5 dead, several injured after 3-storey building collapses in Lucknow![submenu-img]() Is Flipkart Minutes the new Santa? Bengaluru man gets free PS5 with TV order

Is Flipkart Minutes the new Santa? Bengaluru man gets free PS5 with TV order![submenu-img]() CM Himanta Biswa Sarma sets this condition for new Aadhaar card applicants in Assam

CM Himanta Biswa Sarma sets this condition for new Aadhaar card applicants in Assam![submenu-img]() Government discharges Ex-IAS Trainee Puja Khedkar over examination fraud with immediate effect

Government discharges Ex-IAS Trainee Puja Khedkar over examination fraud with immediate effect

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)