If you have more than one PAN number, get them cancelled or else you could be charged a fine of Rs 10,000

Has your application for a credit card or loan been rejected? One reason could be because you have two PAN cards against your name. This is because lenders see this as a leading indicator of fraud and hence, don’t want to engage with customers.

PANs in 11,46,796 cases were deleted or deactivated where multiple PANs were found allotted to one person, according to a reply filed in response to a question raised in the parliament, in July 2017.

If an individual who has misplaced his existing PAN card and applied for a new one, gets a new PAN number, it is a genuine mistake. But since records will show that you have two PAN numbers, it rings alarm bells for lenders. As per government rules, one cannot apply for a credit card unless one has a PAN card.

“We do come across cases of customers who try to create a new identity by using a new PAN number in order to apply for loans or credit cards. They do this in order to get over their past credit history which may be bad,’’ a private sector bank retail lending head said.

Impact of duplicate PAN cards

While applying for a new PAN number the individual may change the name by one initial or the date of birth by one day or one year in order to get a new PAN number and create a new identity.

“It is very easy to get a PAN card today. So, we reject cases of dual PAN cards unless the customer comes to us and says it is an error because it is a crime to hold two PAN numbers’’ a bank official said.

Vaishali Kasture, country head, Experian India, also agrees that data on duplicate PAN cards and PAN number inconsistencies have been a constant fraud trend.

“Out of all the cases where lenders have declined applications due to fraudulent reasons, we have seen around 8.5% of them being rejected as the applicant data is mapped to multiple PAN cards. This value increases to about 12% for loans amounting over Rs 50,000. The key purpose of the fraudsters in such situations is that they circumvent the existing systemic checks that are done primarily before approving a loan,’’ she said.

Holding multiple PAN cards usually do not have an impact on the individual’s credit score or history as the latter is connected to the performance of the loan disbursed and does not include any fraudulent information hence is difficult to detect. Thus, for detection of this type of fraud, the traditional checks will not be able to spot multiple PAN ownership cases as they are not equipped to run multiple checks across parameters on applications wherein such cases are detected. For detecting these types of frauds multiple rounds of checks would be essential, which only credit bureaus are able to do with their specialised fraud detection services.

An individual who has defaulted on his earlier loans or credit card payments will have poor credit score and history and will find it difficult to get a new loan. Such an individual can create a duplicate identity by getting a new PAN card. This becomes an intentional fraud, said Anubhav Jain, co-founder and head of risk, Quebera, an online lending platform.

“When we run our loan and credit applications through credit bureaus and discover a case of dual PAN card, we find that most of these cases have a history of default. So we reject them. And given that we incur cost on acquiring customers, it is a huge expense for us,’’ Jain said.

What to do

If you are applying for a new PAN card to replace your earlier one, make sure you apply for a duplicate card and not a new one. This will ensure that the same PAN number is issued. If you have more than one PAN number, get them cancelled or else you could be charged a fine of Rs 10,000.

HOW TO CANCEL DUPLICATE PAN CARD

- Fill form 49A for “Change or Correction in PAN’, mention PAN number to be cancelled

- Submit this to the NSDL office along with a letter to the IT assessing officer of your respective jurisdiction

- Mention details as per your PAN card-full name, date of birth, details of PAN to be retained and of those of the duplicate one to be cancelled

- Also, submit a copy of the PAN to be cancelled

- Get an acknowledgement from the assessing officer

![submenu-img]() Meet actress, Dilip Kumar, Amitabh's heroine who slapped Sanjeev Kumar, filed case against her mom, is related to...

Meet actress, Dilip Kumar, Amitabh's heroine who slapped Sanjeev Kumar, filed case against her mom, is related to...![submenu-img]() IND vs BAN, 1st T20I Dream11 prediction: Fantasy cricket tips for India vs Bangladesh

IND vs BAN, 1st T20I Dream11 prediction: Fantasy cricket tips for India vs Bangladesh![submenu-img]() Zomato CEO Deepinder Goyal reveals he was ‘kicked out’ of Shark Tank India season 4 by…

Zomato CEO Deepinder Goyal reveals he was ‘kicked out’ of Shark Tank India season 4 by…![submenu-img]() Harsh Goenka shares three lessons for success he learnt from Mukesh Ambani, says, 'I have always...'

Harsh Goenka shares three lessons for success he learnt from Mukesh Ambani, says, 'I have always...'![submenu-img]() Nagarjuna Akkineni in trouble? Complaint filed against Telugu star over Hyderabad's Convention centre

Nagarjuna Akkineni in trouble? Complaint filed against Telugu star over Hyderabad's Convention centre![submenu-img]() IND vs BAN Highlights: पहले टी20 में भारत ने बांग्लादेश को रौंदा, हार्दिक पंड्या ने छक्के से जिताया मैच

IND vs BAN Highlights: पहले टी20 में भारत ने बांग्लादेश को रौंदा, हार्दिक पंड्या ने छक्के से जिताया मैच![submenu-img]() Bigg Boss 18 premiere live updates: शो में अब तक इन कंटेस्टेंट ने कर ली धमाकेदार एंट्री, यहां देखें लिस्ट

Bigg Boss 18 premiere live updates: शो में अब तक इन कंटेस्टेंट ने कर ली धमाकेदार एंट्री, यहां देखें लिस्ट![submenu-img]() OLA EV Issue: 'सर्विस सेंटर आ जा, वरना चुप बैठ' क्यों भिड़ गए कॉमेडियन Kunal Kamra और ओला फाउंडर Bhavish Aggarwal

OLA EV Issue: 'सर्विस सेंटर आ जा, वरना चुप बैठ' क्यों भिड़ गए कॉमेडियन Kunal Kamra और ओला फाउंडर Bhavish Aggarwal![submenu-img]() Bhopal Drugs Factory: भोपाल में 1,800 करोड़ रुपये की ड्रग्स जब्त, फैक्ट्री में वॉशिंग पाउडर जैसे हो रही थी पैक

Bhopal Drugs Factory: भोपाल में 1,800 करोड़ रुपये की ड्रग्स जब्त, फैक्ट्री में वॉशिंग पाउडर जैसे हो रही थी पैक![submenu-img]() बच्ची के शरीर से बह रहा था खून, मां-मां पुकार रही थी..., गांव के ही आदमी ने किया 6 साल की मासूम के साथ दुष्कर्म

बच्ची के शरीर से बह रहा था खून, मां-मां पुकार रही थी..., गांव के ही आदमी ने किया 6 साल की मासूम के साथ दुष्कर्म![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Meet woman, who failed in four UPSC prelims, missed interview, got panic attack, then finally became...

Meet woman, who failed in four UPSC prelims, missed interview, got panic attack, then finally became...![submenu-img]() Meet IIT graduate, who didn't settle for IPS posting, cracked UPSC exam twice to become...

Meet IIT graduate, who didn't settle for IPS posting, cracked UPSC exam twice to become...![submenu-img]() Meet IIT-JEE topper with 355 marks in JEE Advanced, whose father works at Mukesh Ambani's Reliance Jio, aims to join..

Meet IIT-JEE topper with 355 marks in JEE Advanced, whose father works at Mukesh Ambani's Reliance Jio, aims to join..![submenu-img]() Meet woman who begged in childhood, became doctor after 20 years of struggle, now she is...

Meet woman who begged in childhood, became doctor after 20 years of struggle, now she is...![submenu-img]() Meet man, who left govt job as Assistant Excise Officer, used to get Rs 50000000, now works as...

Meet man, who left govt job as Assistant Excise Officer, used to get Rs 50000000, now works as...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() BIG boost for Mukesh Ambani's Jio Financial Services, to challenge ICICI, SBI bank as his company gets SEBI nod for...

BIG boost for Mukesh Ambani's Jio Financial Services, to challenge ICICI, SBI bank as his company gets SEBI nod for...![submenu-img]() Anil Ambani-led company's total debt stands at Rs 40413 crore but...

Anil Ambani-led company's total debt stands at Rs 40413 crore but...![submenu-img]() These siblings overtake Gautam Adani in billionaires list, combined net worth more than Elon Musk, they are…

These siblings overtake Gautam Adani in billionaires list, combined net worth more than Elon Musk, they are…![submenu-img]() Meet wife of famous Indian cricketer, who cracked CS exam, now earns crores by selling cakes, her net worth is...

Meet wife of famous Indian cricketer, who cracked CS exam, now earns crores by selling cakes, her net worth is...![submenu-img]() Success story in every spray: How Toxic Male Perfume captured India's heart and market

Success story in every spray: How Toxic Male Perfume captured India's heart and market![submenu-img]() 10 Aabha Paul photos and videos that rule Instagram

10 Aabha Paul photos and videos that rule Instagram![submenu-img]() India’s most expensive cars and their owners

India’s most expensive cars and their owners![submenu-img]() Who is IIT professor Chetan Solanki aka 'Solar Gandhi'who went viral for his torn socks?

Who is IIT professor Chetan Solanki aka 'Solar Gandhi'who went viral for his torn socks?![submenu-img]() Bigg Boss 18: Step into cave-hotel themed BB house with 107 cameras, luxurious bathroom, scary jail, spacious bedroom

Bigg Boss 18: Step into cave-hotel themed BB house with 107 cameras, luxurious bathroom, scary jail, spacious bedroom![submenu-img]() All about Anupama Parameswaran, who played simpleton in debut film, became famous for bold scenes, dated..

All about Anupama Parameswaran, who played simpleton in debut film, became famous for bold scenes, dated..![submenu-img]() J-K Elections 2024: Exit polls give edge to Congress-NC alliance, BJP likely to win…

J-K Elections 2024: Exit polls give edge to Congress-NC alliance, BJP likely to win…![submenu-img]() Haryana Exit Poll Results 2024: Pollsters predict major win for Congress, setback for BJP

Haryana Exit Poll Results 2024: Pollsters predict major win for Congress, setback for BJP![submenu-img]() Former cricketer and actor Salil Ankola's mother found dead, police say injury...

Former cricketer and actor Salil Ankola's mother found dead, police say injury...![submenu-img]() NCRTC kicks off trial runs of Namo Bharat trains on Sahibabad-New Ashok Nagar route: Check speed, timings and distance

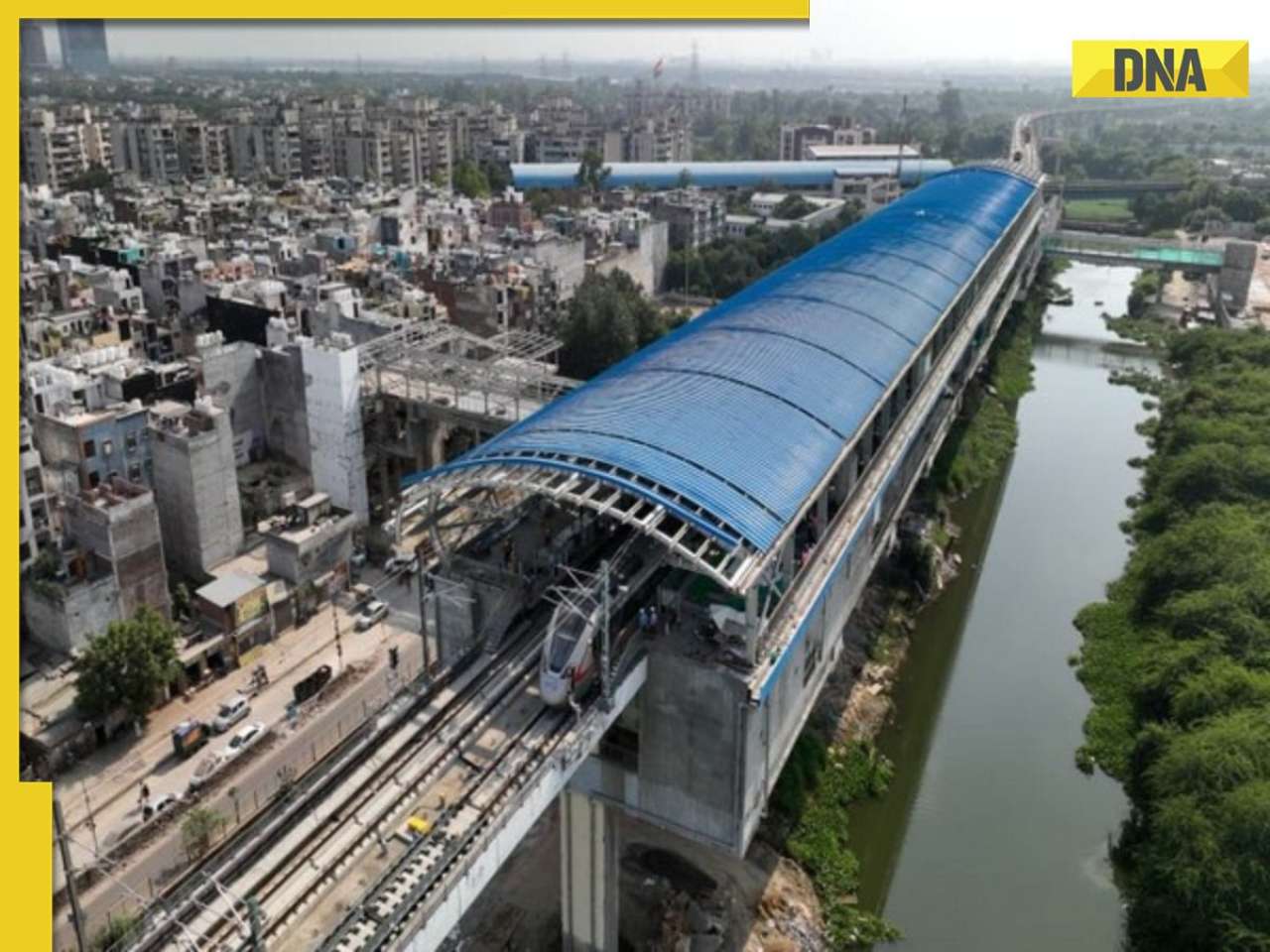

NCRTC kicks off trial runs of Namo Bharat trains on Sahibabad-New Ashok Nagar route: Check speed, timings and distance![submenu-img]() 'Gave up arms, adopted Gandhian way of...': Separatist Yasin Malik in court

'Gave up arms, adopted Gandhian way of...': Separatist Yasin Malik in court

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)