To ensure that life’s uncertainties do not catch you off-guard, create an emergency fund to act as a cushion

The most anticipated season of the year, monsoon, is finally upon us. Apart from charging the economy, tipper-tapper of rain plays a crucial role in nourishing human spirits by unleashing the real beauty of nature. A perfect time to pause and reflect, monsoon serves as not only an inspiration to harness our creative side but also an important reminder to prepare for rainy days.

While monsoon offers much to rejoice about, the unpredictability associated with rains requires us to be cautious as well. Hence, we follow the news to prepare better, taking due precautions when stepping out, and stocking up on groceries for emergencies. However, unforeseen situations are not just limited to the weather. Such events can unfold in any sphere of our life, setting us back on our chosen path. It is, therefore, important to prepare for the unexpected, especially financially.

The unexpected can drain your finances

Life is full of unpredictable events. Sudden unemployment, a major vehicle repair, a medical procedure, or an unavoidable renovation at home, impact your finances. In the absence of a dedicated fund for such emergencies, you tend to draw from your savings, putting your financial goals in jeopardy. Building an emergency fund is thus crucial for the following reasons:

1. It gives you the financial freedom to make a few bold choices. For instance, if you wish to start your own business, this fund can ensure that you do not have to compromise on your day to day expenses. Similarly, if you have a must-to-be undertaken repair at home, you can carry out the same comfortably if you have an emergency fund in place.

2. An emergency fund negates the need to swipe your credit card to finance unforeseen expenses. Use of credit card may seem to be the only resort in such situations, but the debt-trap its usage creates can be harmful to your financial health.

3. To meet a sudden financial contingency, people end up to mortgaging their assets, thereby compromising the financial security of their families. A dedicated fund can help to cushion the financial blow by safeguarding the family wealth.

4. Financial stress has emerged as a cause of concern. Money-related insecurities flare this stress, generating long-term health repercussions. An emergency fund provides much-needed peace of mind by imparting us the confidence to handle unexpected situations boldly.

Steady efforts equip you to handle uncertainties

To ensure that life's uncertainties do not catch you off-guard, create an emergency fund to act as a cushion. Below are a few handy tips to make this process simpler for you:

1. Your emergency fund should have enough to support 6-12 months expenses. To arrive at this figure, list down all spends that you will incur in a month when you have to live frugally within limited means. This list will include expenses like rent and utilities, which cannot be avoided, but will not contain discretionary spends like holidays and eating out. Multiply this figure by 6 to come up with the minimum amount you need to accumulate in your emergency fund.

2. Set a timeline for yourself. Keep in mind that creating an emergency fund is a priority, but it should not be at the cost of compromising on your financial goals like retirement and children's education. Ensure that this timeframe is not rigid to stress you out, nor too vague to delay the process.

3. Start building this fund with regular contributions. One way to go about it could be to give an auto instruction to your bank, directing a certain sum from your salary account every month to a saving account or a recurring deposit (RD). While a recurring account will offer you higher interest, it will also lock in your money for a fixed period. Hence, it would be wise to use the RD route for 2-3 years duration.

4. Since interest on savings accounts is minimum, as an alternate strategy, you can also bifurcate your emergency fund between short-term and long-term. You can adopt this approach once you have accumulated a certain percentage of your targeted sum. Keep the short-term funds liquid and easily accessible. For long-term, invest in bonds or good debt funds to earn higher returns at minimum risk, without compromising on liquidity.

5. Remember, insurance and retirement should be a part of your financial plans, over and above the emergency fund. Opt for a term life policy to secure the future of your family in an unfortunate event of death. A mediclaim policy to cover emergency health expenses should also be a part of your financial plan. A retirement fund in place will help to maintain your lifestyle even in the absence of a steady income. Building up an emergency fund in addition to these basics will equip you better to deal with the unpredictable.

6. Strive to add a surplus to the emergency funds whenever you come across a windfall. For instance, after you have paid your debt from your annual bonus, you can divert a certain percentage to the emergency fund. Similarly, if you decide to cut down on your outings to save more, try to add some amount from this saving to your emergency fund.

7. An emergency fund is only for emergencies. Do not tap this fund to sponsor your impulse trip or buy a newly launched smartphone.

8. Annually review the progress that you are making on your emergency fund. See if the amount to be accumulated needs adjustment in the light of changing life situations. Also, assess if the progress that you are making is in line with the timelines that you decided. This exercise will help you carry out a course correction if need be.

By making steady efforts, you can better handle surprise financial expenses without derailing your overall well-being in the process.

The writer is MD and CEO at Axis Securities

![submenu-img]() India set to play in Hong Kong Cricket Sixes, tournament to also feature Pakistan; will be held from…

India set to play in Hong Kong Cricket Sixes, tournament to also feature Pakistan; will be held from…![submenu-img]() PAK vs ENG: Babar Azam faces backlash for his disappointing innings on batting-friendly Multan pitch

PAK vs ENG: Babar Azam faces backlash for his disappointing innings on batting-friendly Multan pitch![submenu-img]() Khel Khel Mein OTT release date: When, where to watch Akshay Kumar, Taapsee Pannu, Fardeen Khan's comedy

Khel Khel Mein OTT release date: When, where to watch Akshay Kumar, Taapsee Pannu, Fardeen Khan's comedy![submenu-img]() Meet man who worked at oil refinery to save money for his firm, now owns business worth Rs 80000 crore

Meet man who worked at oil refinery to save money for his firm, now owns business worth Rs 80000 crore![submenu-img]() Bigg Boss 18: Shehzada Dhami argues with Vivian Dsena over how TV actors have changed, netizens say 'senior se kuch...'

Bigg Boss 18: Shehzada Dhami argues with Vivian Dsena over how TV actors have changed, netizens say 'senior se kuch...'![submenu-img]() Haryana Elections: पहले पोस्टल बैलेट, फिर EVM... हरियाणा में किसके सिर सजेगा ताज? जानें काउंटिंग से जुड़ी 5 बड़ी बातें

Haryana Elections: पहले पोस्टल बैलेट, फिर EVM... हरियाणा में किसके सिर सजेगा ताज? जानें काउंटिंग से जुड़ी 5 बड़ी बातें![submenu-img]() क्या J-K में उपराज्यपाल की पावर से पलट सकता है 'खेल', समझें 5 विधायकों को नॉमिनेट करने का सियासी गणित

क्या J-K में उपराज्यपाल की पावर से पलट सकता है 'खेल', समझें 5 विधायकों को नॉमिनेट करने का सियासी गणित![submenu-img]() दलित के घर पहुंचे राहुल गांधी, किचन में पकाई चने के साग की सब्जी और तुवर दाल, देखें Video

दलित के घर पहुंचे राहुल गांधी, किचन में पकाई चने के साग की सब्जी और तुवर दाल, देखें Video![submenu-img]() हैदराबाद में Emraan Hashmi के साथ हादसा, गले में लगी चोट, Goodachari 2 की कर रहे थे शूटिंग

हैदराबाद में Emraan Hashmi के साथ हादसा, गले में लगी चोट, Goodachari 2 की कर रहे थे शूटिंग ![submenu-img]() Bhupinder Singh Hooda दिल्ली से रोहतक लगातार मिला रहे फोन, नतीजों से पहले ही CM रेस के लिए चला दांव

Bhupinder Singh Hooda दिल्ली से रोहतक लगातार मिला रहे फोन, नतीजों से पहले ही CM रेस के लिए चला दांव![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Meet Bhavik Bansal who cracked NEET with AIR 1, topped AIIMS MBBS entrance exam, he is now...

Meet Bhavik Bansal who cracked NEET with AIR 1, topped AIIMS MBBS entrance exam, he is now...![submenu-img]() Meet IIT-JEE topper with 334 marks in JEE Advanced, went to IIT Bombay with AIR 1, left after a year due to....

Meet IIT-JEE topper with 334 marks in JEE Advanced, went to IIT Bombay with AIR 1, left after a year due to....![submenu-img]() GATE 2025: Registration ends today, apply with late fee at...

GATE 2025: Registration ends today, apply with late fee at...![submenu-img]() ISRO Recruitment 2024: Government job vacancies for 103 posts, salary up to Rs 208700, check eligibility, other details

ISRO Recruitment 2024: Government job vacancies for 103 posts, salary up to Rs 208700, check eligibility, other details![submenu-img]() Meet IIT drop out, who cracked JEE twice, cracked UPSC exam to become IAS officer, then resigned due to...

Meet IIT drop out, who cracked JEE twice, cracked UPSC exam to become IAS officer, then resigned due to...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() Meet man who worked at oil refinery to save money for his firm, now owns business worth Rs 80000 crore

Meet man who worked at oil refinery to save money for his firm, now owns business worth Rs 80000 crore![submenu-img]() Mukesh Ambani, Isha Ambani’s platform brings another global brand in India, launches...

Mukesh Ambani, Isha Ambani’s platform brings another global brand in India, launches...![submenu-img]() How much Tata Group's top leadership earn? Check salaries of chairman Chandrasekaran and others

How much Tata Group's top leadership earn? Check salaries of chairman Chandrasekaran and others![submenu-img]() Mukesh Ambani's Reliance Jio seeks revised paper on satellite spectrum allocation, alleges...

Mukesh Ambani's Reliance Jio seeks revised paper on satellite spectrum allocation, alleges...![submenu-img]() Ratan Tata's company teams up with Rs 47991 crore bank, set to boost...

Ratan Tata's company teams up with Rs 47991 crore bank, set to boost...![submenu-img]() 6 reasons to avoid buying a black car

6 reasons to avoid buying a black car![submenu-img]() In pics: Kareena Kapoor looks mermerising in statement Manish Malhotra saree at Singham Again trailer launch

In pics: Kareena Kapoor looks mermerising in statement Manish Malhotra saree at Singham Again trailer launch![submenu-img]() Top 6 high-rated restaurants owned by celebs in Delhi NCR

Top 6 high-rated restaurants owned by celebs in Delhi NCR![submenu-img]() From Munnar to Hampi: 6 most popular tourist places in South India

From Munnar to Hampi: 6 most popular tourist places in South India![submenu-img]() From Caves to Igloo Stay: 6 unique hotels to explore in India

From Caves to Igloo Stay: 6 unique hotels to explore in India ![submenu-img]() 'Have no objections': Farooq Abdullah on taking rival PDP's support for govt formation

'Have no objections': Farooq Abdullah on taking rival PDP's support for govt formation![submenu-img]() Weather Update: IMD predicts heavy rains for THESE states, issues yellow alert in parts of Kerala till..; check forecast

Weather Update: IMD predicts heavy rains for THESE states, issues yellow alert in parts of Kerala till..; check forecast![submenu-img]() RG Kar case: Sanjoy Roy raped, murdered Kolkata doctor, says CBI in its chargesheet

RG Kar case: Sanjoy Roy raped, murdered Kolkata doctor, says CBI in its chargesheet![submenu-img]() Ratan Tata visited hospital but all is well, read what his statement says

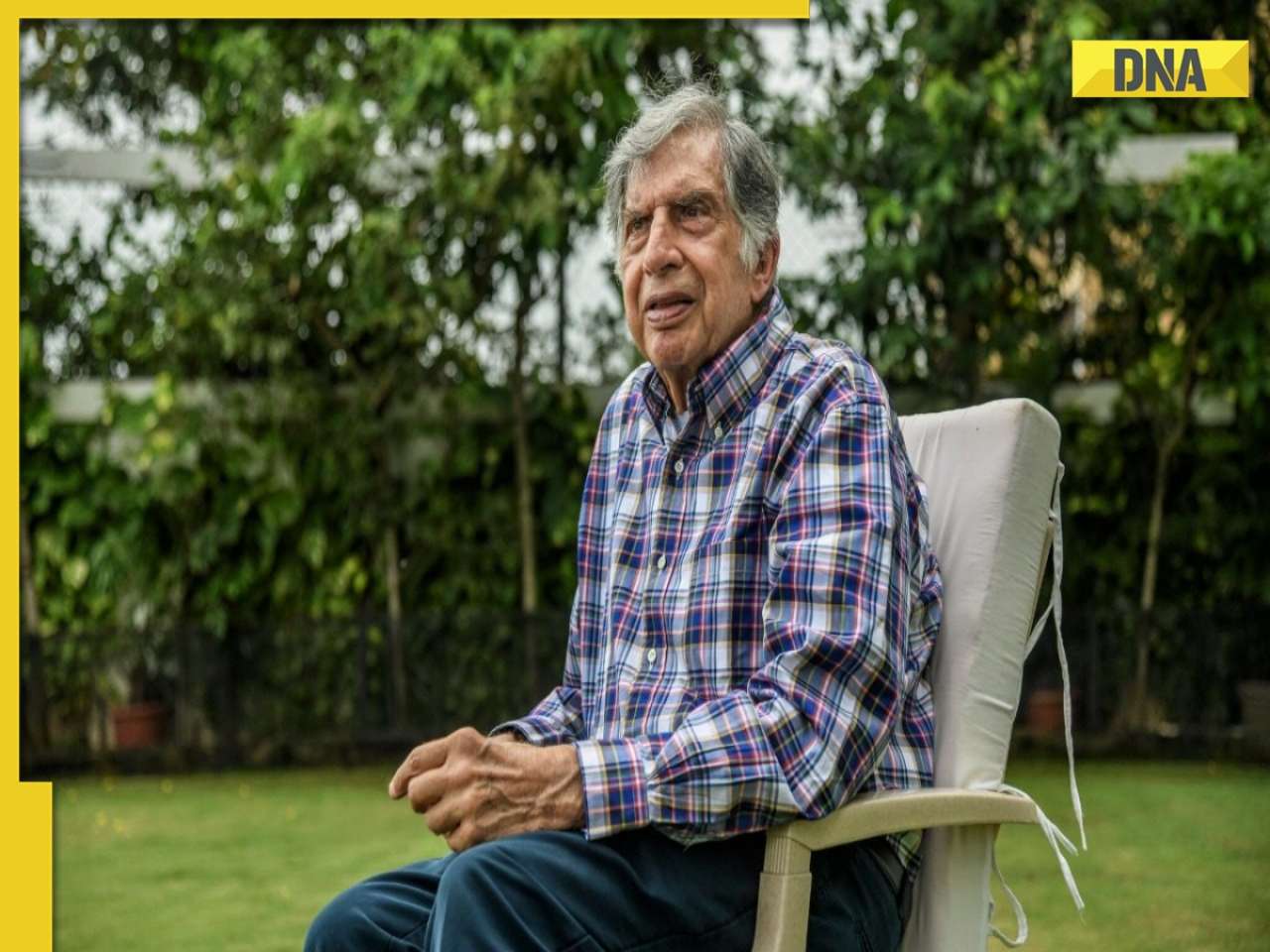

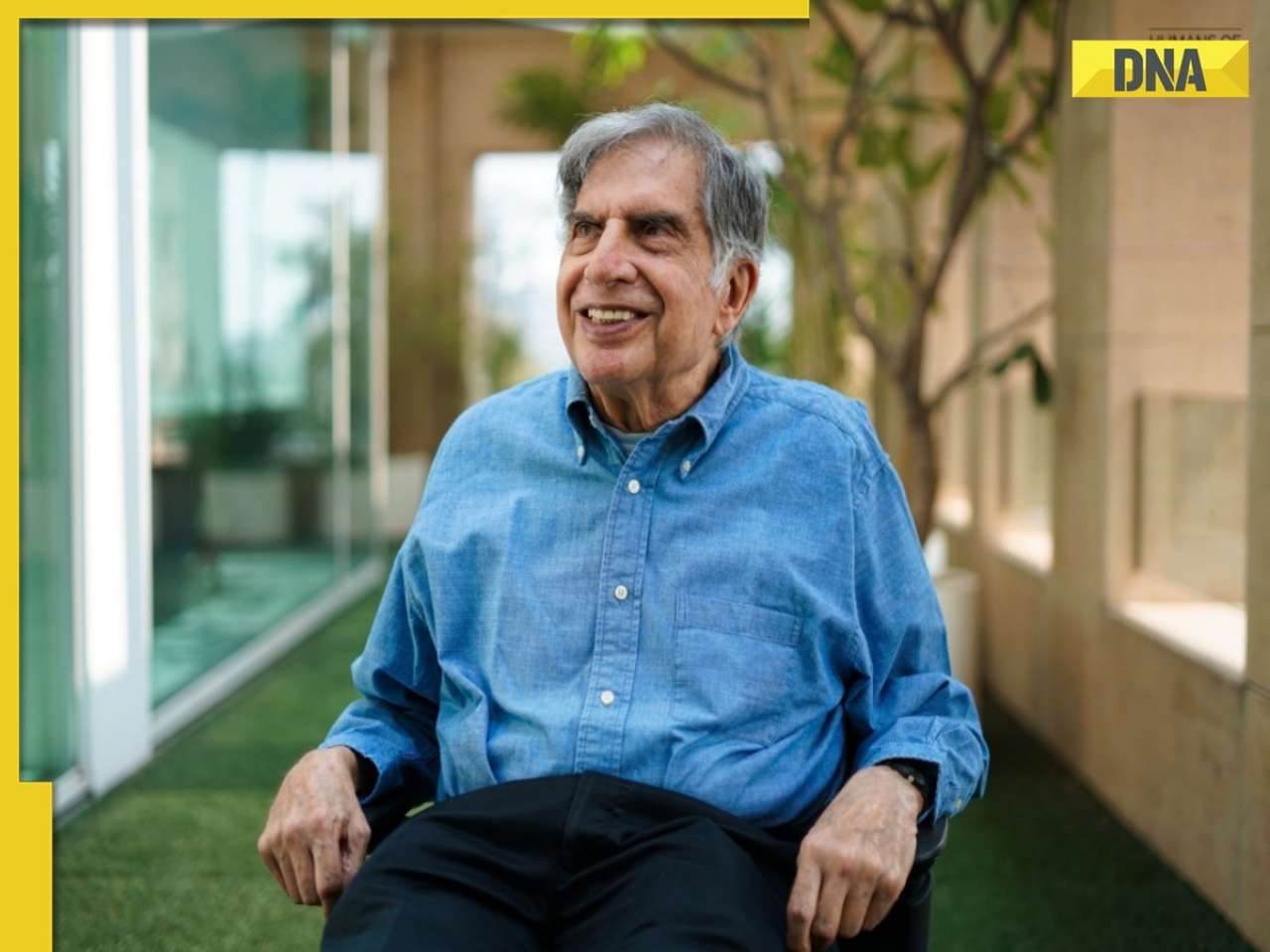

Ratan Tata visited hospital but all is well, read what his statement says![submenu-img]() Ratan Tata rushed to hospital, admitted to Mumbai's Breach Candy

Ratan Tata rushed to hospital, admitted to Mumbai's Breach Candy

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)