Binary options trading presents a unique financial opportunity for investors to speculate on the direction of an asset, typically within a very short timeframe.

This form of trading requires precision, as it hinges on whether an asset’s price will rise above or fall below a specific point at a predetermined time. Given its binary nature—yielding a fixed profit or loss—traders often rely heavily on technical analysis to make informed decisions.

In this procedure, technical indications are essential. They help traders predict future market behavior based on historical price data and volume. By accurately interpreting these indicators, traders can substantially increase their chances of executing successful trades. Among the most reliable and widely used technical indicators in binary options trading are the Moving Averages, the Moving Average Convergence Divergence (MACD), and the Relative Strength Index (RSI). Each offers unique insights into market trends and potential reversal points, making them indispensable in a trader's toolkit.

In this guide, we, dedicated experts of Binaryoptions.com, will delve deep into how these technical indicators can be used to craft effective trading strategies in the binaries market. Our specialists will explore each indicator individually—discussing their setup, interpretation, and practical application to illustrate how they can be leveraged to forecast and capitalize on various trading scenarios.

Technical Indicators: The Basics

Moving Averages

Moving Averages are invaluable in smoothing out short-term fluctuations, revealing the underlying trend direction. By integrating these indicators into their strategies, binary options traders can discern the momentum of market movements and better predict future changes. This can prove crucial in a trading environment where opportunities for gains and losses are decided within minutes or even seconds. There are two primary varieties of moving averages:

- Simple Moving Averages (SMA): This average is calculated by adding the recent closing prices of an asset and dividing that by the number of time periods in the calculation average. For example, a 30-day SMA adds the closing prices of the last 30 days and divides the total by 30.

- Exponential Moving Averages (EMA): Unlike SMA, EMA gives more weight to recent prices, which makes it more responsive to new information. When calculating EMA, a weighting multiplier is applied to the most recent data points.

How they are calculated and plotted on charts:

|

Aspect

|

Simple Moving Averages (SMA)

|

Exponential Moving Averages (EMA)

|

|

Calculation

|

Calculated as the arithmetic mean by adding up the recent closing prices and dividing by the number of time periods.

|

Calculated by applying a multiplier to the most recent data points, which weighs recent prices more heavily than older prices. The formula also incorporates the previous period's EMA.

|

|

Plotting

|

The SMA line is plotted on price charts, drawn alongside the actual price movements of an asset to show the trend visually.

|

Similarly, the EMA line is plotted on the charts, providing a quicker response to price changes due to its focus on more recent prices.

|

How Moving Averages can indicate trends

- Trend Identification: When a moving average line slopes upward, it indicates that the asset’s price is in an uptrend. Conversely, if the line slopes downward, it suggests a downtrend.

- Crossovers: A popular trading signal that involves moving averages is the 'crossover'. This occurs when two moving averages of different lengths cross each other on a chart. For example, a bullish signal is given when a short-term moving average crosses above a longer-term moving average, suggesting the potential for a price increase.

The MACD (Moving Average Convergence Divergence)

The Moving Average Convergence Divergence (MACD) is a powerful technical indicator used by traders to identify trend direction, momentum, and potential reversals. It consists of three components:

- MACD Line: is obtained by deducting the 12-period EMA from the 26-period Exponential Moving Average (EMA).

- Signal Line: It is usually the 9-period EMA of the MACD line, which serves as a catalyst for buy and sell orders.

- Histogram: The MACD line's difference from the signal line is shown by the histogram. When the MACD line crosses above the signal line, the histogram is positive (above the zero line) and suggests bullish momentum. Conversely, when the MACD line is below the signal line, the histogram is negative and indicates bearish momentum.

How MACD Signals Trading Opportunities

MACD provides trading signals through its line crossovers, overbought/oversold conditions, and divergences. Let us look at them in detail:

|

Aspect

|

Details

|

|

Line Crossovers

|

A bullish signal is given when the MACD line crosses above the signal line, suggesting it might be time to buy. A bearish signal, on the other hand, is produced when the MACD line crosses below the signal line, suggesting that there may be a chance to sell.

|

|

Overbought/Oversold Conditions

|

While MACD is not traditionally used to identify overbought or oversold conditions, extreme deviations from the signal line can indicate an asset's price has moved too far, too fast, and may soon revert.

|

|

Divergences

|

When the price of an asset is making new highs while the MACD is failing to reach new highs, or when the price is making new lows but the MACD is not, it suggests the current price trend may be weakening and potentially about to reverse.

|

Example of a MACD Setup in Binary Options Trading

Consider a binary options trader analyzing a potential trade on EUR/USD. If the EUR/USD price chart shows a bullish trend and the MACD line crosses above the signal line, this could be taken as a confirmation to place a 'Call' option, betting that the EUR/USD price will be higher at the option's expiry than at the time of the trade.

Similarly, if the MACD line crosses below the signal line during a bearish trend, it may be prudent to place a 'Put' option, expecting the price to be lower at expiry. In practice, traders might set up a trade as follows:

- Asset: EUR/USD

- Trade Type: Call Option

- Entry Condition: The MACD line crosses above the signal line while both are below the zero line, indicating a strong upward momentum building.

- Expiry: Depending on the timeframe of the chart being analyzed (e.g., if analyzing on a 1-hour chart, setting an expiry of 1-3 hours may be appropriate).

RSI (Relative Strength Index)

On a scale from 0 to 100, the Relative Strength Index (RSI) is a momentum oscillator that gauges the rate and direction of price changes. Developed by J. Welles Wilder, it is one of the most commonly used indicators for gauging market sentiment and potential reversals. The following formula is used to determine the RSI:

RSI=100−(100/1+RS)

Where RS (Relative Strength) is the average gain of up periods during the specified time frame divided by the average loss of down periods. The default time frame for comparing up periods to down periods is 14, as recommended by Wilder, but this can be adjusted to suit different trading strategies and time frames.

An RSI value above 70 indicates that the asset may be overbought and could be primed for a corrective pullback or reversal. This is a signal to traders to consider selling or taking profits if they are in a long position. Conversely, an RSI value below 30 suggests that the asset may be oversold and potentially due for a bounce or reversal upward. This condition might prompt traders to buy or close short positions.

RSI is particularly useful in binary options trading as it helps traders determine optimal entry and exit points. Here’s how traders can use RSI to spot potential reversals:

- Identify Potential Entry Points: When the RSI crosses back above the 30 line from below, it suggests that an oversold market is starting to recover, signaling a potential buying opportunity. Conversely, an RSI falling below the 70 lines from above indicates a market moving from overbought to normal levels, signaling a potential selling or put option opportunity.

- Confirmation with Other Indicators: To increase the reliability of signals, traders often use the RSI in conjunction with other indicators or chart patterns. An instance of a bullish divergence is when an asset's price reaches a new low while the RSI reaches a higher low. This can indicate a weakening downward momentum and a potential bullish reversal.

- Setting Expiry Times: The nature of binary options requires that traders choose an expiry time for their option. Based on RSI readings, if a trader expects a reversal, they might select an expiry that coincides with the expected time it would take for the reversal to impact the price significantly.

Practical Example of an RSI Setup in Binary Options Trading

Suppose a binary options trader is observing the GBP/USD currency pair. If the RSI indicator falls below 30, signaling an oversold condition, the trader might consider purchasing a 'Call' option, betting that the price will rise in the short term. The trader would look for the RSI to begin ascending back toward 30 as a confirmation of increasing buying momentum before entering the trade.

In this scenario, the trader might set an option expiry that aligns with the expected duration of the market's recovery from being oversold, which could be influenced by the time frame of the chart they are analyzing (e.g., a 30-minute chart might suggest an expiry of 1-2 hours).

By integrating RSI into their trading strategy, binary options traders can enhance their decision-making process, helping to align their trades with the underlying market momentum and potentially increasing their chances of a profitable outcome.

Combining Technical Indicators: Advantages of Using Multiple Indicators Together

A popular tactic used by traders to validate trends and signals, lower false signals, and boost trade success rates involves mixing technical indicators. The following are some benefits of blending these indicators:

- Enhanced Signal Accuracy: By using more than one indicator, traders can validate the signals provided by each. If multiple indicators give the same signal, it increases confidence in the trade.

- Diverse Perspectives: Different indicators can provide insights based on various aspects of market behavior like volume, momentum, and trend, offering a more rounded view of market conditions.

- Risk Management: With multiple indicators, traders can better gauge the strength of a price move and set appropriate stop-loss orders, reducing potential losses.

Example of a Combined Strategy Using Moving Averages, MACD, and RSI

A combined strategy using Moving Averages, MACD, and RSI can provide powerful insights into market trends and momentum, making it a robust approach for binary options trading. Here’s how these indicators can work together:

- Trend Confirmation: Start with the Moving Averages to determine the overall trend. If the shorter-term moving average (e.g., 50-day MA) crosses above a longer-term moving average (e.g., 200-day MA), it suggests a bullish trend. Conversely, a bearish trend is indicated by a shorter MA crossing below a longer MA.

- Momentum Confirmation with MACD: Use the MACD to confirm the momentum of the trend observed with the Moving Averages. A positive MACD value (where the MACD line is above the signal line) supports a bullish signal, while a negative MACD value (MACD line below the signal line) supports a bearish signal.

- Overbought/Oversold Conditions with RSI: Finally, incorporate the RSI to identify potential entry or exit points based on overbought or oversold conditions. For example, in a bullish market, an RSI moving back from an oversold condition (below 30) can indicate a good time to enter a long position.

Practical Example Summary

|

Aspect

|

Details

|

|

Visual Setup

|

The chart shows the 50-day MA crossing above the 200-day MA, indicating a bullish trend. MACD histogram displays increasing positive values. RSI moves above 30 from an oversold condition.

|

|

Trade Execution

|

A trader buys a call option, expecting the price to rise. Options expiry is set based on the trend's expected duration, derived from historical volatility and indicators' signals.

|

|

Trade Management

|

Set a stop-loss just below the recent swing low to manage risk if the trend reverses. Plan to exit if MACD declines or RSI exceeds 70, indicating a pullback or reversal.

|

By integrating these indicators, traders can develop a more informed and strategic approach to binary options trading, leveraging the strengths of each indicator to make better-informed decisions that align with market dynamics and reduce exposure to unanticipated market movements. This comprehensive approach allows traders to navigate the complexities of the market with increased precision and confidence.

(This article is part of IndiaDotCom Pvt Ltd’s Consumer Connect Initiative, a paid publication programme. IDPL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The IDPL Editorial team is not responsible for this content.)

![submenu-img]() 'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'

'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

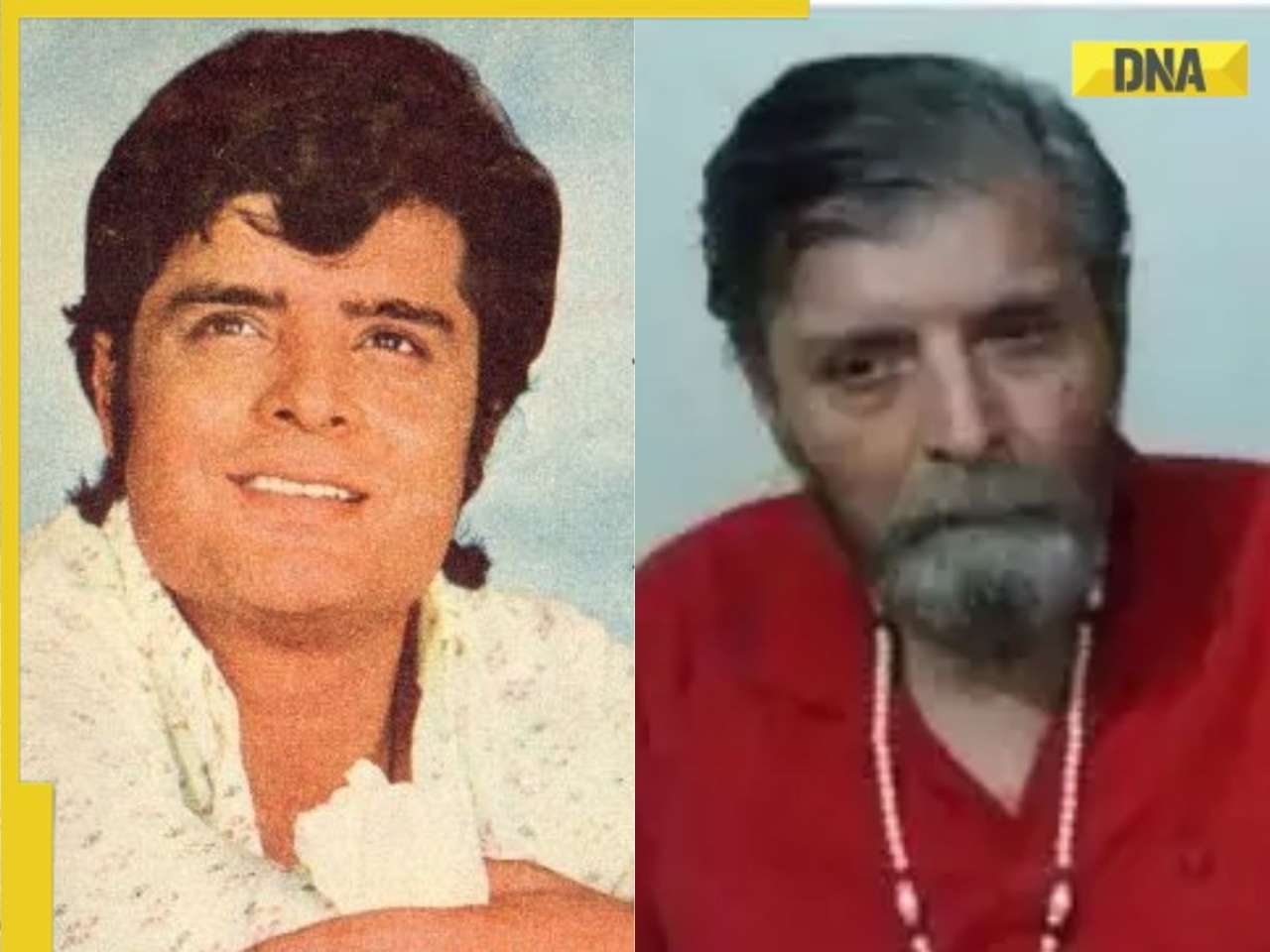

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless

This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() 2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested

2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested![submenu-img]() iPhone 16 लॉन्च, Apple Watch Series 10 से भी उठा पर्दा, जानें इसके रेट और फीचर्स

iPhone 16 लॉन्च, Apple Watch Series 10 से भी उठा पर्दा, जानें इसके रेट और फीचर्स![submenu-img]() Kalindi Express को उड़ाने की साजिश के पीछे था IS का हाथ? खुरासान मॉड्यूल पर गहराया शक

Kalindi Express को उड़ाने की साजिश के पीछे था IS का हाथ? खुरासान मॉड्यूल पर गहराया शक![submenu-img]() Mpox In India: भारत में एमपॉक्स के पहले केस की पुष्टि, स्वास्थ्य मंत्रालय ने कहा- यह एक अलग मामला

Mpox In India: भारत में एमपॉक्स के पहले केस की पुष्टि, स्वास्थ्य मंत्रालय ने कहा- यह एक अलग मामला![submenu-img]() UP Crime News: गोंडा में इंसानियत शर्मसार, नाबालिग के साथ चलती कार में गैंग रेप

UP Crime News: गोंडा में इंसानियत शर्मसार, नाबालिग के साथ चलती कार में गैंग रेप ![submenu-img]() GST Council की मीटि��ंग में बड़ा फैसला, कैंसर की दवा और नमकीन पर टैक्स घटाया

GST Council की मीटि��ंग में बड़ा फैसला, कैंसर की दवा और नमकीन पर टैक्स घटाया![submenu-img]() Hyundai Alcazar facelift launched in India: Check price, design and other features

Hyundai Alcazar facelift launched in India: Check price, design and other features![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...

Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...![submenu-img]() Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…

Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…![submenu-img]() Meet man, who worked as daily wager, cracked NEET exam with AIR...

Meet man, who worked as daily wager, cracked NEET exam with AIR...![submenu-img]() SSC CGL 2024 exam begins today: Check important guidelines, other details here

SSC CGL 2024 exam begins today: Check important guidelines, other details here![submenu-img]() Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...

Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...![submenu-img]() Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder

Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...

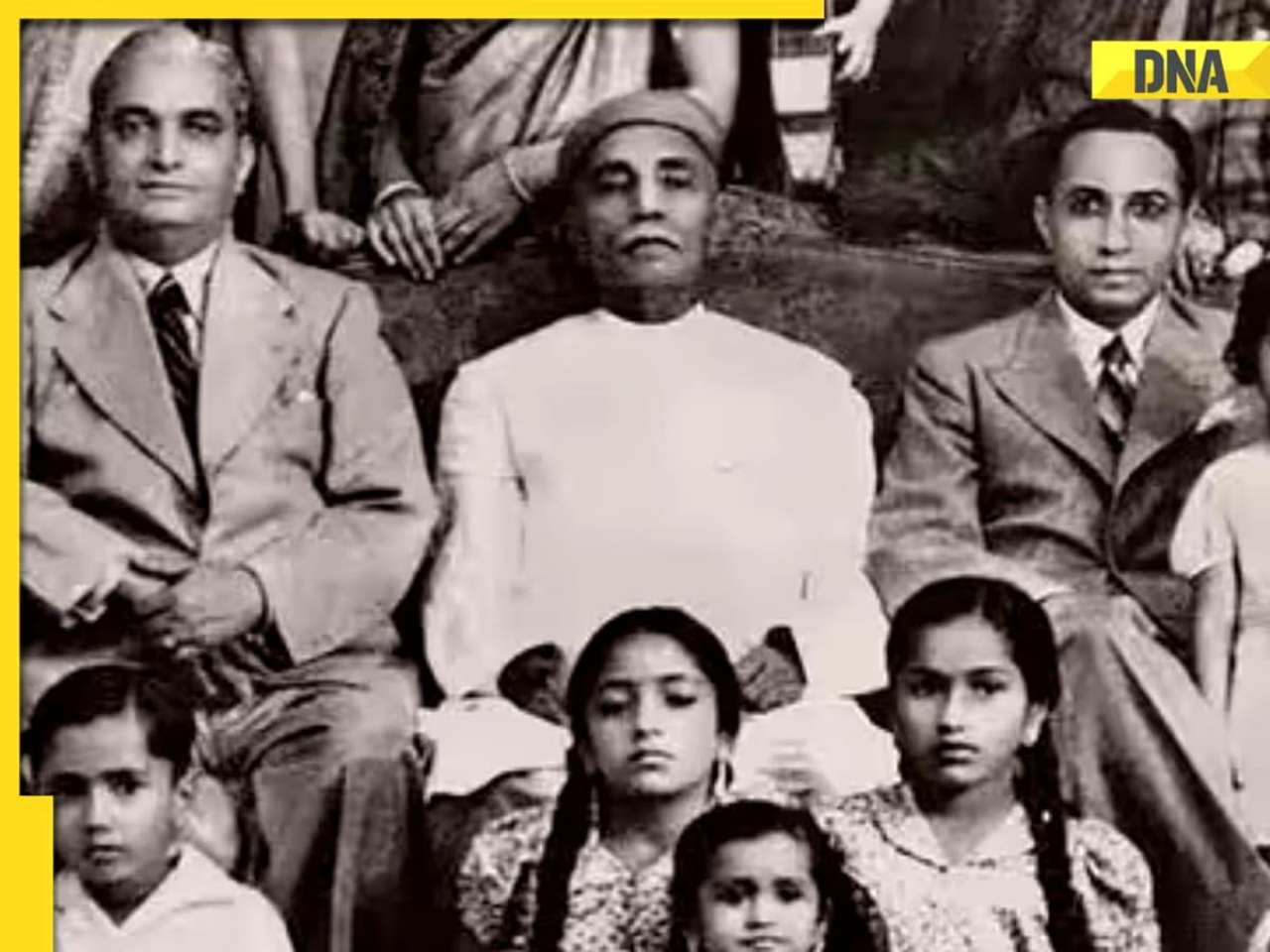

Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...![submenu-img]() Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…

Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…![submenu-img]() Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..

Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..![submenu-img]() Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik

Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik![submenu-img]() Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..

Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..![submenu-img]() This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...

This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...![submenu-img]() 7 countries with most UNESCO World Heritage sites; check how many India has

7 countries with most UNESCO World Heritage sites; check how many India has![submenu-img]() Top five anti-ageing skincare secrets by Nita Ambani

Top five anti-ageing skincare secrets by Nita Ambani![submenu-img]() India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss

India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...

Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...![submenu-img]() First case of Mpox confirmed in India, patient put under isolation

First case of Mpox confirmed in India, patient put under isolation![submenu-img]() Rameshwaram Cafe blast: NIA files chargesheet against four accused

Rameshwaram Cafe blast: NIA files chargesheet against four accused![submenu-img]() Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)