A string of acquisitions over the past 10 years pump up topline, but costs soar too

United Phosphorus, a Gujarat-based ` 2,900-crore crop protection company, finds itself in an unenviable position. The push to drive up sales is facing some pressure from an unlikely quarter - dwindling profitability. And a way out currently doesn’t look that easy.

The company, which had gone for a raft of acquisitions in the past 10 years, had seen its sales and PAT numbers grow at a compounded annual growth rate (CAGR) of approximately 27%. But its PAT margins and return on equity (RoE) languished, which came in much lower compared with its peers.

In the past seven years, its average PAT margin stood at around 10% and RoE at an average of 9%. When compared with Rallis India, a Tata Group crop protection company and a subsidiary of Tata Chemicals, the numbers of United Phosphorus look substantially dwarfed. For Rallis India, the average PAT margin was 19% and the RoE 25% in the same seven years under review.

In fact, Sageraj Bariya, managing partner of Equitorials, an independent research house, said going forward, PAT and PAT margins of the company will continue to stay under pressure. Besides, its share price and margins have also not moved in tandem with sales.

“In the past ten years, the company had acquired over 24 companies worldwide which has increased its topline numbers very rapidly, but at the same time it has put pressure on its margins and profitability, of late,” he said.

Going ahead, the management still feels that the company will continue to post robust sales numbers by virtue of its entry into the Latin American market through the acquisition of Brazilian company DVA, but admitted that its margins will be under pressure.

During a conference call held recently after United Phosphorus declared its Q2 FY12 numbers, S Krishnan, chief financial officer, said: “Seeing the significant volume growth that the business has seen over the last two quarters and the transaction that we did in Brazil recently, we believe the business in terms of revenue growth will grow possibly even higher…. anywhere in the region of 30 to 35%.”

However, he added there are challenges in terms of managing working capital and margins and would manage to keep an earnings before interest, taxes, depreciation, and amortisation (Ebitda) margin in the region of around 19% to 20%.

However, analysts are largely upbeat about the prospects of the company in the short term, which explains their ‘buy’ rating. “We are now building in 31.5% y-o-y revenue growth in FY12F and 15% in FY13F with half the growth in FY12F driven organically,” said Aatash Shah and Vineet Verma from international brokerage Nomura Equity Research in their latest report.

Analysts Rohan Gupta and Balwindar Singh from brokerage Emkay Global said they have revised their revenue estimates to reflect higher revenue contribution from DVA acquisition and higher volume growth being witnessed in Latin American markets.

![submenu-img]() Meta CEO Mark Zuckerberg spotted wearing watch made from…; it costs over Rs…

Meta CEO Mark Zuckerberg spotted wearing watch made from…; it costs over Rs…![submenu-img]() Indian women's chess team wins historic gold at Chess Olympiad 2024

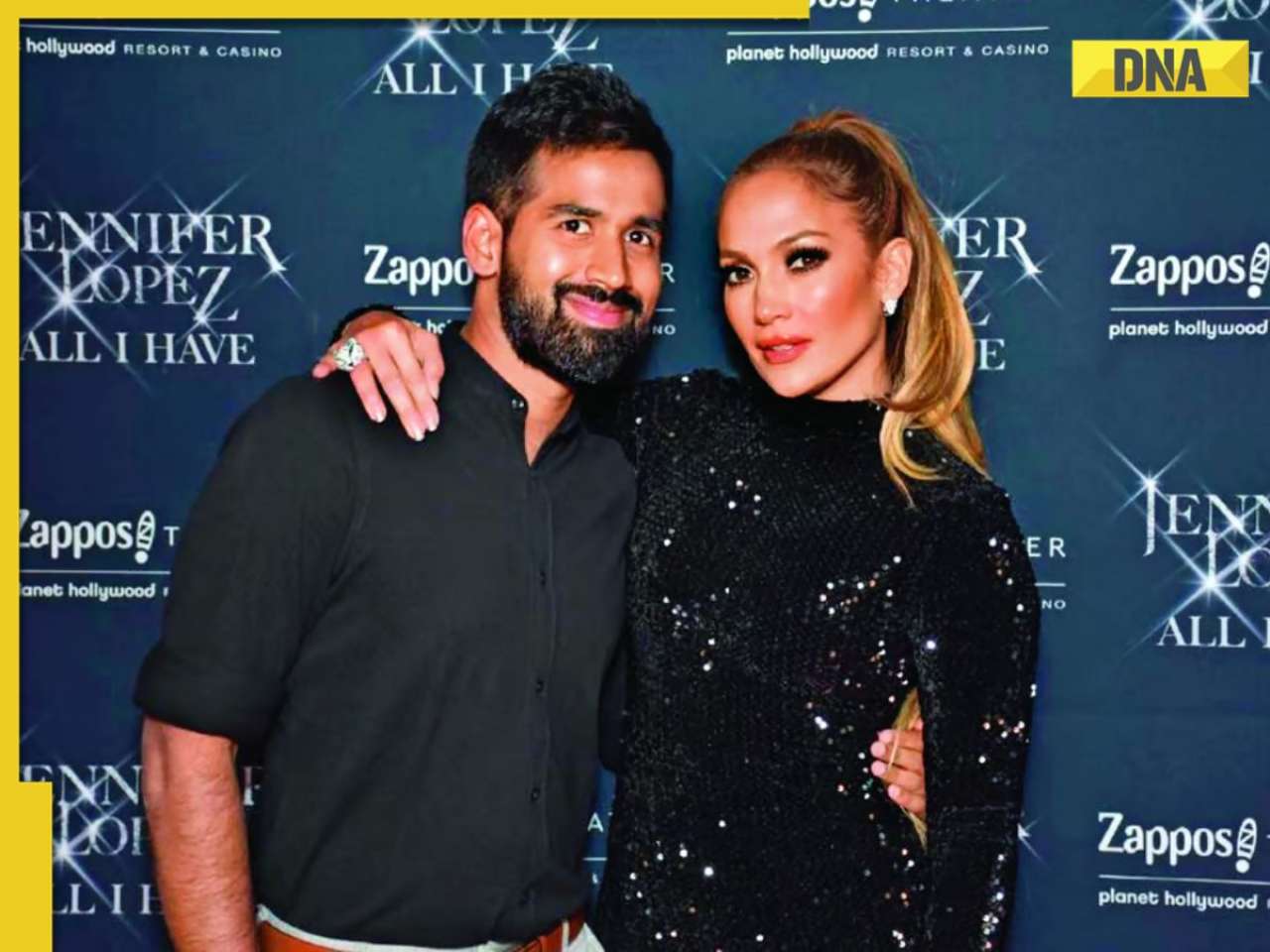

Indian women's chess team wins historic gold at Chess Olympiad 2024![submenu-img]() Meet cricketer-turned-entrepreneur who built Rs 100 crore company backed by Malaika Arora, Shahid Kapoor, Jennifer Lopez

Meet cricketer-turned-entrepreneur who built Rs 100 crore company backed by Malaika Arora, Shahid Kapoor, Jennifer Lopez![submenu-img]() Vir Das invites budding designers to create his outfit as International Emmy Awards host: 'Not going to wear a...'

Vir Das invites budding designers to create his outfit as International Emmy Awards host: 'Not going to wear a...'![submenu-img]() Who is Anura Kumara Dissanayake, new President of Sri Lanka? All you need to know

Who is Anura Kumara Dissanayake, new President of Sri Lanka? All you need to know![submenu-img]() PM Modi USA Visit: अमेरिका में बोले पीएम, 'तीसरे टर्म के लिए हमने तय किए हैं महान लक्ष्य'

PM Modi USA Visit: अमेरिका में बोले पीएम, 'तीसरे टर्म के लिए हमने तय किए हैं महान लक्ष्य'![submenu-img]() Sri Lanka Elections: श्रीलंका के नए राष्ट्रपति होंगे अनुरा दिसानायके, मजदूर का बेटा बना राष्ट्रपति

Sri Lanka Elections: श्रीलंका के नए राष्ट्रपति होंगे अनुरा दिसानायके, मजदूर का बेटा बना राष्ट्रपति![submenu-img]() MP में सेना की स्पेशल ट्रेन उड़ाने की साजिश के पीछे किसका हाथ?, जांच में जुटी NIA, धमाके की आवाज सुन लगाया ब्रेक

MP में सेना की स्पेशल ट्रेन उड़ाने की साजिश के पीछे किसका हाथ?, जांच में जुटी NIA, धमाके की आवाज सुन लगाया ब्रेक![submenu-img]() Bengal Floods: सीएम ममता बनर्जी ने DVC से पानी छोड़ने पर लिखा PM को पत्र, सीनियर अधिकारियों का इस्तीफा

Bengal Floods: सीएम ममता बनर्जी ने DVC से पानी छोड़ने पर लिखा PM को पत्र, सीनियर अधिकारियों का इस्तीफा![submenu-img]() Sridevi की बेटी बन बॉलीवुड में बनाई पहचान, अब Prabhas की इस फिल्म से हिंदी सिनेमा में करेंगी वापसी

Sridevi की बेटी बन बॉलीवुड में बनाई पहचान, अब Prabhas की इस फिल्म से हिंदी सिनेमा में करेंगी वापसी![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() IAS officer Tina Dabi’s schedule shows she studied 11-hour a day; check UPSC topper's marksheet and time table

IAS officer Tina Dabi’s schedule shows she studied 11-hour a day; check UPSC topper's marksheet and time table![submenu-img]() Meet man from Uttar Pradesh who cracked UPSC in first attempt, resigned as IAS officer after 12 years due to...

Meet man from Uttar Pradesh who cracked UPSC in first attempt, resigned as IAS officer after 12 years due to...![submenu-img]() Meet man who once worked as bicycle mechanic, became engineer, then cracked UPSC exam with AIR...

Meet man who once worked as bicycle mechanic, became engineer, then cracked UPSC exam with AIR...![submenu-img]() CBSE registration, LoC submission big update: Important notice for students, check details here...

CBSE registration, LoC submission big update: Important notice for students, check details here...![submenu-img]() CBSE registration, LoC submission big update: Important notice for students, check details here

CBSE registration, LoC submission big update: Important notice for students, check details here![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() Inside pics of Anant Ambani and Radhika Merchant's Dubai villa gifted by Mukesh Ambani and Nita Ambani, worth Rs…

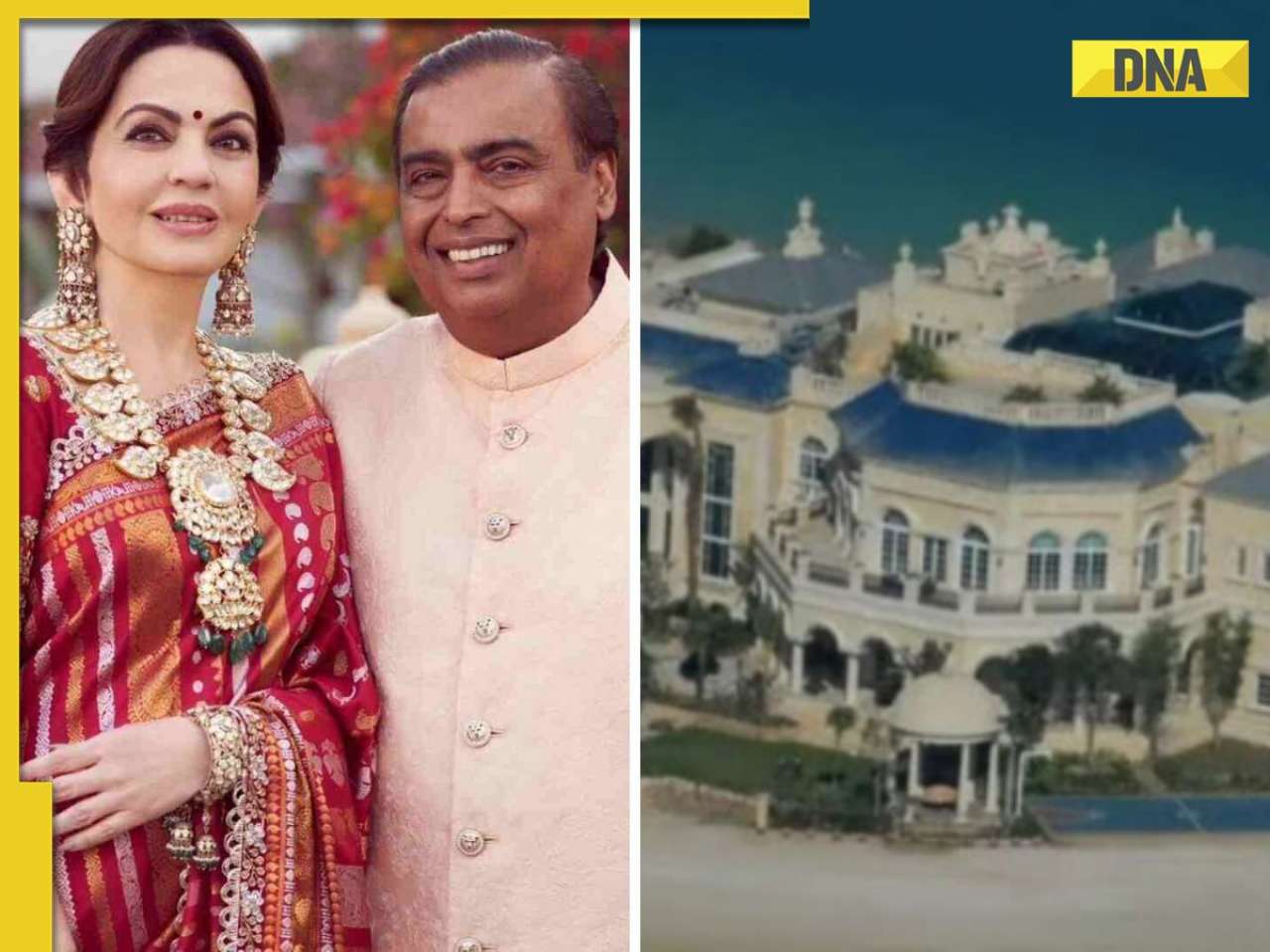

Inside pics of Anant Ambani and Radhika Merchant's Dubai villa gifted by Mukesh Ambani and Nita Ambani, worth Rs…![submenu-img]() Anupam Mittal’s Playbook: The Secrets Behind Building Iconic Brands

Anupam Mittal’s Playbook: The Secrets Behind Building Iconic Brands![submenu-img]() Meet woman, who came to India as tourist, established Rs 49000 crore firm, know her connection with Ratan Tata

Meet woman, who came to India as tourist, established Rs 49000 crore firm, know her connection with Ratan Tata![submenu-img]() Meet Delhi man, whose street food made him 'crorepati', rides BMW to work, his business is...

Meet Delhi man, whose street food made him 'crorepati', rides BMW to work, his business is...![submenu-img]() Meet man, one of Surat's richest, whose son worked at bakery for Rs 200 a day, gift flats to employees, net worth is...

Meet man, one of Surat's richest, whose son worked at bakery for Rs 200 a day, gift flats to employees, net worth is...![submenu-img]() 8 amazing images of distant galaxies by NASA's Hubble Space Telescope

8 amazing images of distant galaxies by NASA's Hubble Space Telescope![submenu-img]() Most luxurious train rides in the world

Most luxurious train rides in the world ![submenu-img]() This star was called ugly child, filed case against mother, slapped Sanjeev Kumar; her husband was burnt alive at...

This star was called ugly child, filed case against mother, slapped Sanjeev Kumar; her husband was burnt alive at...![submenu-img]() 7 foods that can add extra years to your life

7 foods that can add extra years to your life![submenu-img]() In pics: Triptii Dimri sets the stage on fire, raises the temperature in green slit lehenga

In pics: Triptii Dimri sets the stage on fire, raises the temperature in green slit lehenga![submenu-img]() Bystander Intervention: Powerful Tool for Combating Gender-Based Violence AsWellAs Saving Victims of Road Accidents

Bystander Intervention: Powerful Tool for Combating Gender-Based Violence AsWellAs Saving Victims of Road Accidents ![submenu-img]() Uday Bhanu Chib appointed Indian Youth Congress Chief, succeeds Srinivas BV

Uday Bhanu Chib appointed Indian Youth Congress Chief, succeeds Srinivas BV![submenu-img]() Mamata Banerjee writes second letter to PM Modi on devastating 'man-made' flood in South Bengal

Mamata Banerjee writes second letter to PM Modi on devastating 'man-made' flood in South Bengal![submenu-img]() Arighat's Rise: India's Nuclear Might in a Godless World

Arighat's Rise: India's Nuclear Might in a Godless World![submenu-img]() PIL in Supreme Court seeks SIT probe into Tirupati laddu row

PIL in Supreme Court seeks SIT probe into Tirupati laddu row

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)