The credit growth figures released by the Reserve Bank of India (RBI) on Wednesday showed that the credit growth for Indian banks during the fortnight ending March 18 showed a slight rise of just Rs 29,140 crore to Rs 72,77,650 crore, with most of the growth coming from the retail sector, and a tepid growth in the corporate book.

This fiscal-end, banks have refrained from taking one-day deposit or one-day credit as they shift their focus from balance-sheet expansion to the management of bad debt.

While the non-performing assets (NPAs) are expected to be high, banks are expected to reap huge treasury gains as they will be able to write back depreciation on the investments and also book profits with the yields on the government securities falling by 0.30% in the quarter. According to the estimates by rating agency Icra, gross NPAs is likely to increase from Rs 4.5 lakh crore (6% as on December 31, 2015) to increase to Rs 4.8-5.3 lakh crore by March 2016.

The credit growth figures released by the Reserve Bank of India (RBI) on Wednesday showed that the credit growth for Indian banks during the fortnight ending March 18 showed a slight rise of just Rs 29,140 crore to Rs 72,77,650 crore, with most of the growth coming from the retail sector, and a tepid growth in the corporate book. The deposits during the fortnight ended March 18 also dipped by Rs 27,930 crore during this period.

A senior State Bank of India (SBI) official told dna, "Treasury income is expected to be very good this quarter. Investment gains and write-back from depreciation will boost our profitability. But the gains are largely going to be mitigated by the high provisions the bank will have to make for the bad loans that are expected to remain at the same levels as the preceding quarter."

Usually, the fourth quarter is the time when banks undertake a drive to build their balance-sheet by contracting one-day or short-term deposits and short-term credit, generally from their long-standing customers to boost their lending and deposit books. But this year, bankers from at least five banks said that balance-sheet was not their focus and so credit growth and deposit growth for the fourth quarter, which will be announced with a lag of a month, will reflect the right picture of the existing appetite for bank credit and deposit.

According to the RBI data on a year-to-date basis, about 44% of the incremental credit growth was driven by retail loans. Credit to small and medium enterprises declined 11% and credit to large industries grew at 7%, most of which, according to bankers, were working capital or short-term corporate credit by companies. Bigger banks such as the State Bank of India (SBI) also grew their books by refinance opportunities – that is taking over loans from other banks both in the corporate and retail loans.

Another banker said, "Our credit growth figure is lower than all previous years. We will start the new financial year on a clean slate. No ultra short-term deposits or credit have been contracted."

Religare Securities said in a note, "We do not see credit growth for 2015-16 improving beyond 12%. A mild uptick was seen in personal loans which grew by 19.2% over the previous year, largely driven by a 19% growth in housing loans. Large corporate loans were steady at 7% and advances against FDs grew sharply at 12.5% and vehicle loans declined to 12.3% over the previous year."

A senior private sector banker said, "The temptation to build balance-sheet by giving short-term loans and getting short-term deposits is absent this time. With the RBI strongly against these practices, most banks have shunned the bulk deposits that usually come from loyal customers."

The conversion of about Rs 1 lakh crore Uday bonds issued by the state governments on behalf of the state electricity boards (SEBs) will also shift some NPAs or stressed assets from the loan book to the investment book of banks. State governments of both Rajasthan and Uttar Pradesh have signed the agreement for converting their respective SEB loans into bonds. With yields set to fall further with the expectation of a rate cut by the Reserve Bank of India (RBI), there is a scramble from pension funds, insurance companies, mutual funds and new private sector banks such as Kotak Mahindra Bank to subscribe to these bonds.

![submenu-img]() Meta CEO Mark Zuckerberg spotted wearing watch made from…; it costs over Rs…

Meta CEO Mark Zuckerberg spotted wearing watch made from…; it costs over Rs…![submenu-img]() Indian women's chess team wins historic gold at Chess Olympiad 2024

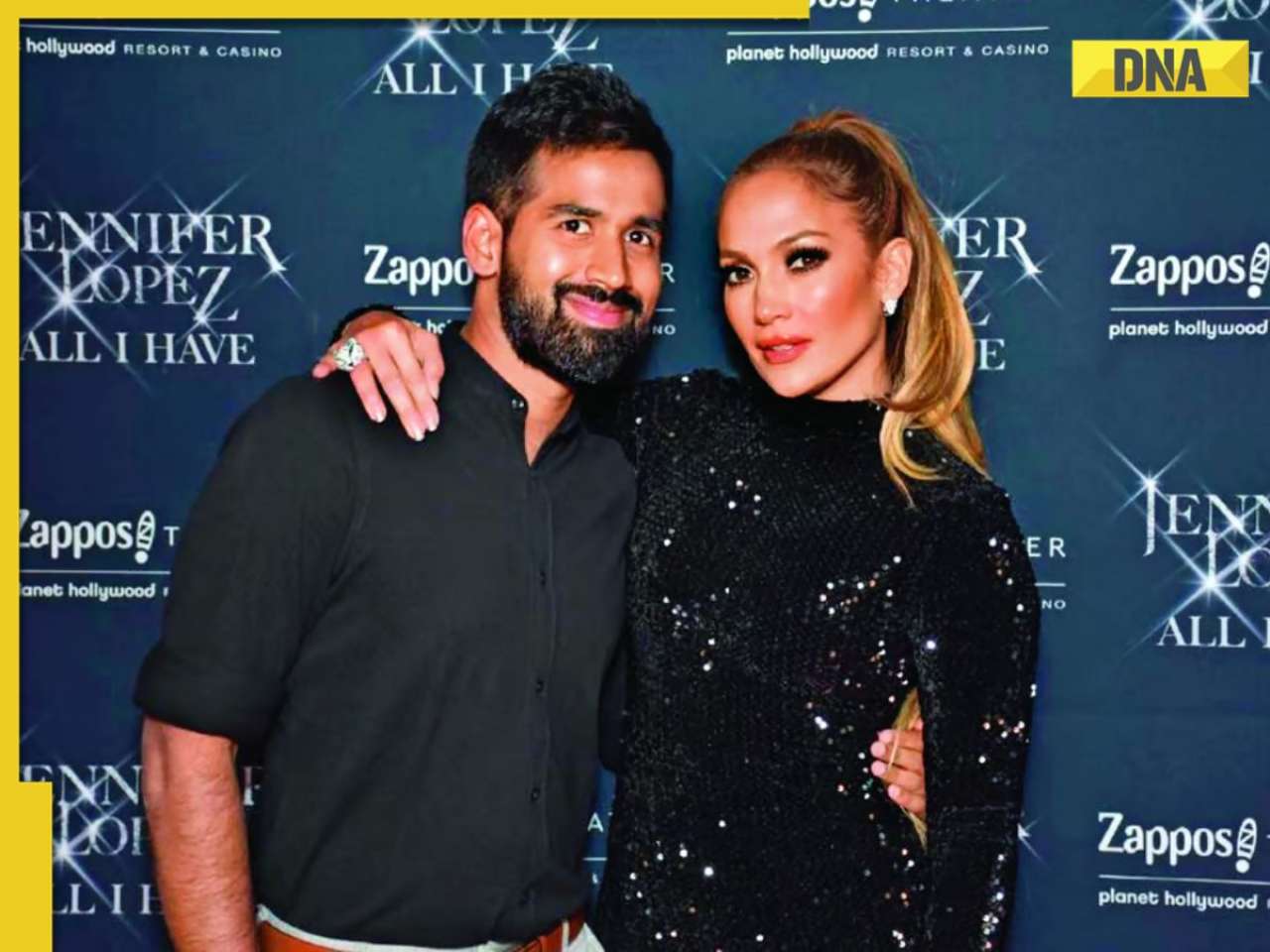

Indian women's chess team wins historic gold at Chess Olympiad 2024![submenu-img]() Meet cricketer-turned-entrepreneur who built Rs 100 crore company backed by Malaika Arora, Shahid Kapoor, Jennifer Lopez

Meet cricketer-turned-entrepreneur who built Rs 100 crore company backed by Malaika Arora, Shahid Kapoor, Jennifer Lopez![submenu-img]() Vir Das invites budding designers to create his outfit as International Emmy Awards host: 'Not going to wear a...'

Vir Das invites budding designers to create his outfit as International Emmy Awards host: 'Not going to wear a...'![submenu-img]() Who is Anura Kumara Dissanayake, new President of Sri Lanka? All you need to know

Who is Anura Kumara Dissanayake, new President of Sri Lanka? All you need to know![submenu-img]() UP News: AMU की फ्रेशर पार्टी में शाकाहारी हिंदू छात्रों को परोसा Chicken Momos, हुआ जमकर हंगामा

UP News: AMU की फ्रेशर पार्टी में शाकाहारी हिंदू छात्रों को परोसा Chicken Momos, हुआ जमकर हंगामा![submenu-img]() PM Modi ने अमेरिका के राष्ट्रपति Joe Biden को गिफ्ट की ट्रेन, जानें क्या है इसकी खासियत

PM Modi ने अमेरिका के राष्ट्रपति Joe Biden को गिफ्ट की ट्रेन, जानें क्या है इसकी खासियत![submenu-img]() Chirag Paswan और नीतीश कुमार के बीच हो गई ��सुलह, विधानसभा चुनाव के लिए तय हुई शर्तें?

Chirag Paswan और नीतीश कुमार के बीच हो गई ��सुलह, विधानसभा चुनाव के लिए तय हुई शर्तें?![submenu-img]() 'वार्ता से निकालें समाधान', इजरायल-हमास युद्ध के बीच फिलिस्तीनी राष्ट्रपति महमूद अब्बास से मिले पीएम मोदी

'वार्ता से निकालें समाधान', इजरायल-हमास युद्ध के बीच फिलिस्तीनी राष्ट्रपति महमूद अब्बास से मिले पीएम मोदी![submenu-img]() राजस्थान CET की परीक्षा देने वाले हैं तो जान लें ड्रेस कोड, RSMSSB ने जारी की गाइडलाइंस

राजस्थान CET की परीक्षा देने वाले हैं तो जान लें ड्रेस कोड, RSMSSB ने जारी की गाइडलाइंस![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() Maruti Suzuki launches new Swift CNG, check price, mileage, other features

Maruti Suzuki launches new Swift CNG, check price, mileage, other features![submenu-img]() ‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...

‘30 LPA, 3BHK, no in-laws’: Woman earning Rs 1.32 lakh salary lists demands for future husband, netizens say...![submenu-img]() In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…

In a big EV push, Centre launches Rs 10900 crore PM E-Drive scheme to replace…![submenu-img]() World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…

World’s longest car has helipad, swimming pool, mini-golf course, can seat over…; it cost…![submenu-img]() IAS officer Tina Dabi’s schedule shows she studied 11-hour a day; check UPSC topper's marksheet and time table

IAS officer Tina Dabi’s schedule shows she studied 11-hour a day; check UPSC topper's marksheet and time table![submenu-img]() Meet man from Uttar Pradesh who cracked UPSC in first attempt, resigned as IAS officer after 12 years due to...

Meet man from Uttar Pradesh who cracked UPSC in first attempt, resigned as IAS officer after 12 years due to...![submenu-img]() Meet man who once worked as bicycle mechanic, became engineer, then cracked UPSC exam with AIR...

Meet man who once worked as bicycle mechanic, became engineer, then cracked UPSC exam with AIR...![submenu-img]() CBSE registration, LoC submission big update: Important notice for students, check details here...

CBSE registration, LoC submission big update: Important notice for students, check details here...![submenu-img]() CBSE registration, LoC submission big update: Important notice for students, check details here

CBSE registration, LoC submission big update: Important notice for students, check details here![submenu-img]() Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical

Congress President Kharge Slams & Opposes 'One Nation, One Election' Proposal, Calls It Impractical![submenu-img]() Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval

Why 'One Nation One Election' Is important? Ashwini Vaishnaw Explains After It Gets Cabinet Approval![submenu-img]() Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?

Jammu Kashmir Assembly Election 2024 Phase 1 Highlights: What Happened In First phase In J&K Polls?![submenu-img]() One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0

One Nation One Election: Centre Clears Proposal, Bill To Be Introduced In Winter Session | Modi 3.0![submenu-img]() Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed

Haryana Elections 2024: Is BJP Set To Lose In Haryana? Anti-Incumbency And Other Factors Analysed![submenu-img]() Inside pics of Anant Ambani and Radhika Merchant's Dubai villa gifted by Mukesh Ambani and Nita Ambani, worth Rs…

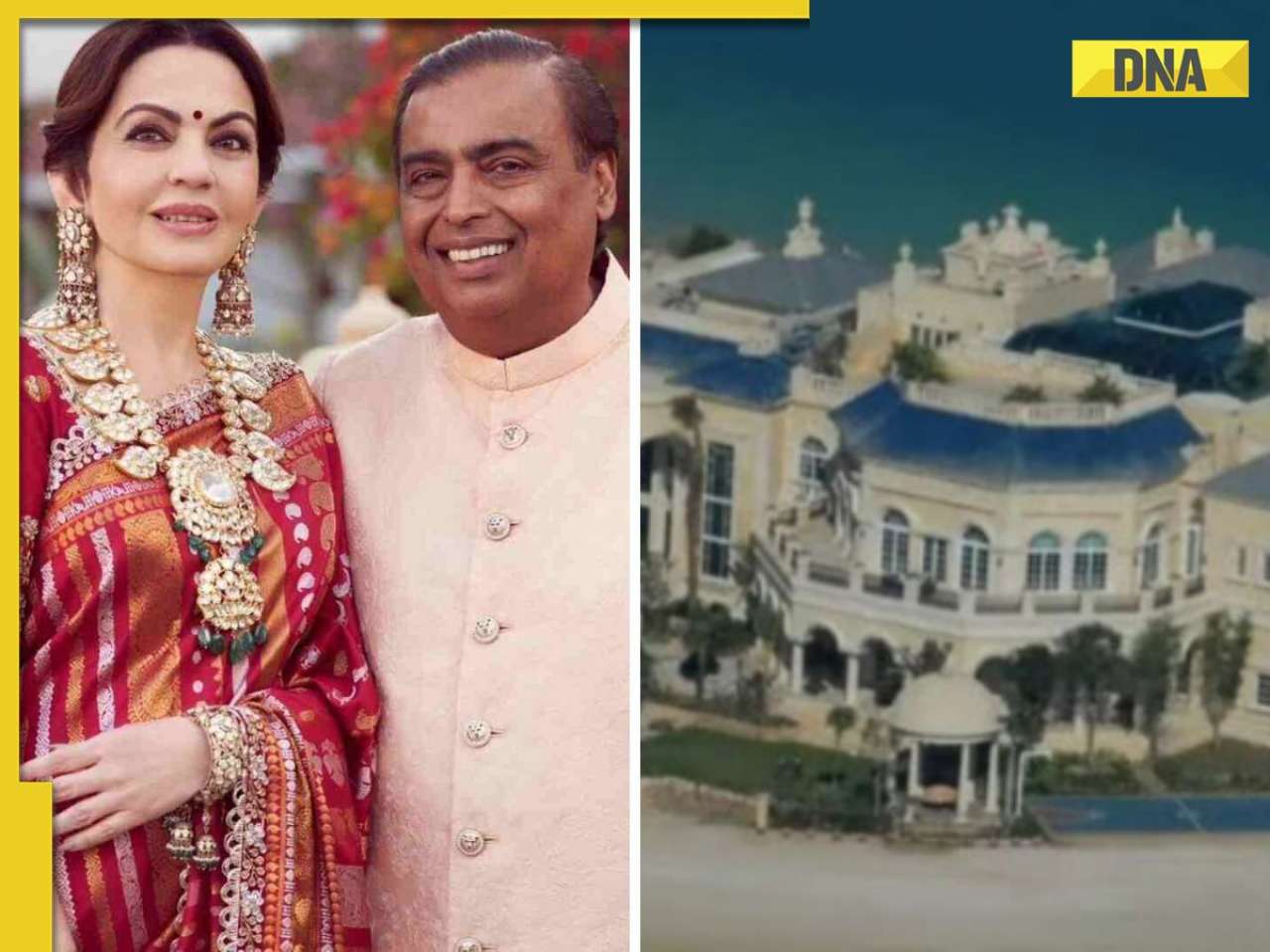

Inside pics of Anant Ambani and Radhika Merchant's Dubai villa gifted by Mukesh Ambani and Nita Ambani, worth Rs…![submenu-img]() Anupam Mittal’s Playbook: The Secrets Behind Building Iconic Brands

Anupam Mittal’s Playbook: The Secrets Behind Building Iconic Brands![submenu-img]() Meet woman, who came to India as tourist, established Rs 49000 crore firm, know her connection with Ratan Tata

Meet woman, who came to India as tourist, established Rs 49000 crore firm, know her connection with Ratan Tata![submenu-img]() Meet Delhi man, whose street food made him 'crorepati', rides BMW to work, his business is...

Meet Delhi man, whose street food made him 'crorepati', rides BMW to work, his business is...![submenu-img]() Meet man, one of Surat's richest, whose son worked at bakery for Rs 200 a day, gift flats to employees, net worth is...

Meet man, one of Surat's richest, whose son worked at bakery for Rs 200 a day, gift flats to employees, net worth is...![submenu-img]() 8 amazing images of distant galaxies by NASA's Hubble Space Telescope

8 amazing images of distant galaxies by NASA's Hubble Space Telescope![submenu-img]() Most luxurious train rides in the world

Most luxurious train rides in the world ![submenu-img]() This star was called ugly child, filed case against mother, slapped Sanjeev Kumar; her husband was burnt alive at...

This star was called ugly child, filed case against mother, slapped Sanjeev Kumar; her husband was burnt alive at...![submenu-img]() 7 foods that can add extra years to your life

7 foods that can add extra years to your life![submenu-img]() In pics: Triptii Dimri sets the stage on fire, raises the temperature in green slit lehenga

In pics: Triptii Dimri sets the stage on fire, raises the temperature in green slit lehenga![submenu-img]() Bystander Intervention: Powerful Tool for Combating Gender-Based Violence AsWellAs Saving Victims of Road Accidents

Bystander Intervention: Powerful Tool for Combating Gender-Based Violence AsWellAs Saving Victims of Road Accidents ![submenu-img]() Uday Bhanu Chib appointed Indian Youth Congress Chief, succeeds Srinivas BV

Uday Bhanu Chib appointed Indian Youth Congress Chief, succeeds Srinivas BV![submenu-img]() Mamata Banerjee writes second letter to PM Modi on devastating 'man-made' flood in South Bengal

Mamata Banerjee writes second letter to PM Modi on devastating 'man-made' flood in South Bengal![submenu-img]() Arighat's Rise: India's Nuclear Might in a Godless World

Arighat's Rise: India's Nuclear Might in a Godless World![submenu-img]() PIL in Supreme Court seeks SIT probe into Tirupati laddu row

PIL in Supreme Court seeks SIT probe into Tirupati laddu row

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)