- LATEST

- WEBSTORY

- TRENDING

BUSINESS

Big setback for Byju Raveendran, Byju’s loses appeal of Rs 10039 crore loan default ruling in...

BYJU's, from US-based lenders, had raised USD 1.2 billion Term Loan B (TLB) -- a loan which is issued by institutional investors, through its holding company Byju's Alpha.

TRENDING NOW

In a big setback for BYJU's founder Byju Raveendran, the Delaware Supreme Court has upheld a ruling favouring Byju's lenders represented by Glas Trust LLC. The court ruling has affirmed that edtech firm BYJU's has defaulted on USD 1.2 billion (Rs 10039 crore) Term Loan B.

BYJU's US-based lenders on Tuesday said the Delaware Supreme Court affirmed the previous ruling by Delaware Court of Chancery's and said an event of default had occurred under the credit agreement and entitled BYJU's lenders and their administrative agent, GLAS Trust for action against the company.

BYJU's, from US-based lenders, had raised USD 1.2 billion Term Loan B (TLB) -- a loan which is issued by institutional investors, through its holding company Byju's Alpha. The lenders through their administrative agent GLAS Trust approached Delaware Court of Chancery alleged default in the payments under the loan agreement and sought early payment of the USD 1.2 billion TLB. Think and Learn, which owns BYJU's brand, had contested the claim but the Delaware Court of Chancery ruled in favour of the lenders.

According to a statement of the steering committee of the ad hoc group of term loan lenders, BYJU'S founder and CEO Byju Raveendran and his brother Riju Ravindran have voluntarily conceded that BYJU's was in default of credit agreement by October 2022.

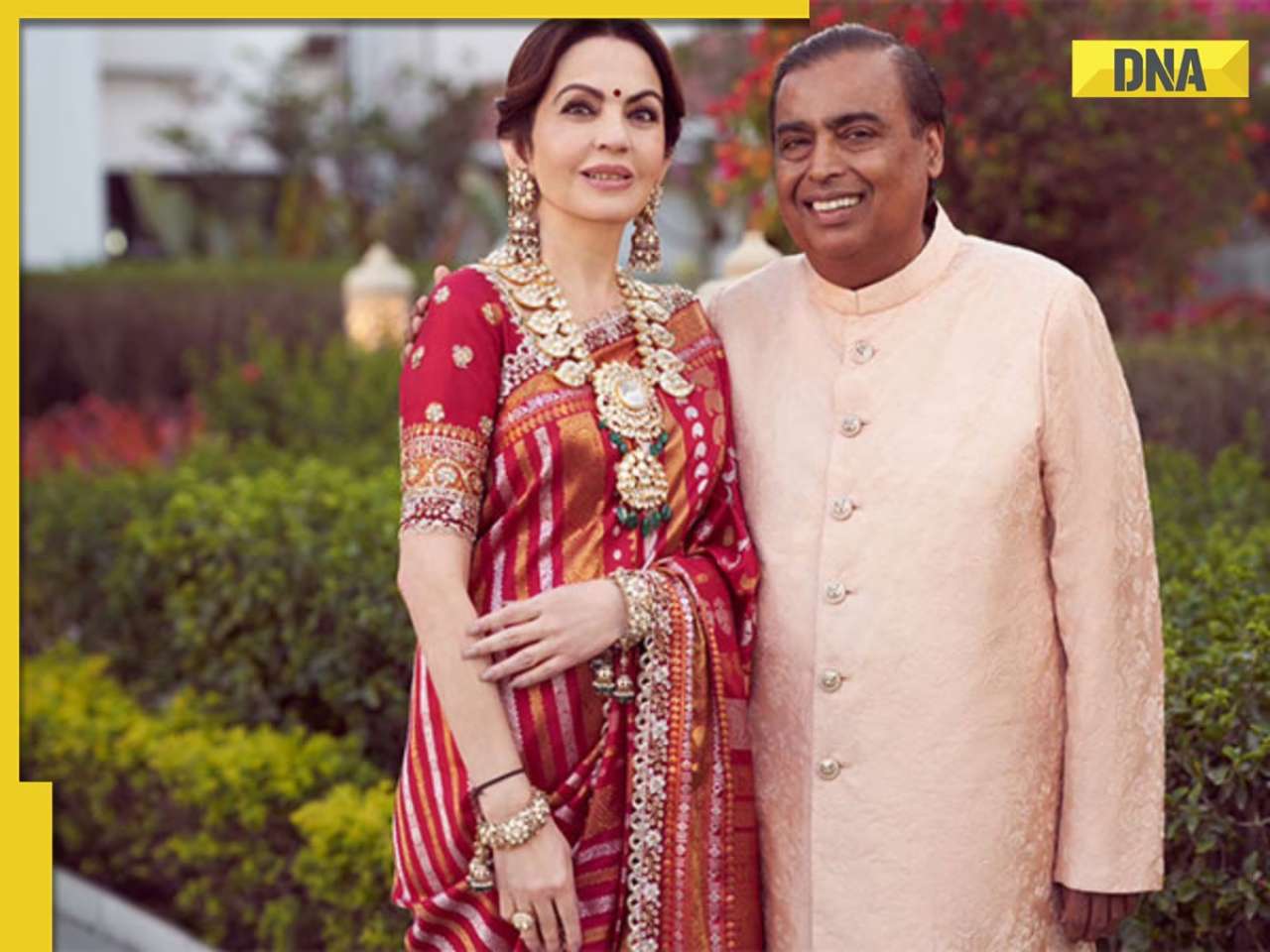

READ | Mukesh Ambani's Reliance teams up with govt company for India's biggest...

"We are gratified that the Delaware Supreme Court decisively affirmed what we have known all along: BYJU's breached and defaulted on the credit agreement it knowingly and willingly entered into. "Most notably, this ruling confirms that BYJU's was in default, which both Byju and Riju personally acknowledged when they signed multiple amendments to the credit agreement on BYJU's behalf from October 2022 to January 2023," the committee said.

A query sent to BYJU's did not elicit any immediate reply. The US-based lenders through GLAS Trust had filed claims of USD 1.35 billion dues in Indian courts during ongoing insolvency proceedings against the edtech firm. In the latest statement, the lenders have raised their total claim to USD 1.5 billion. The committee said that the Delaware Supreme Court ruling has validated that the lenders were well within their contractual rights to accelerate the Term Loan and take control of BYJU's Alpha Inc.

(Except for the headline, this story has not been edited by DNA staff and is published from PTI)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)