Registering a private limited company has become a desirable choice for many Indian businessmen in the ever-changing corporate scene of today.

Once thought to be difficult and costly, the procedure has been greatly simplified with online registration. This article will walk you through cost-effective company registration in India.

Why Choose a Private Limited Company?

Understanding why a private limited company structure is preferred among Indian companies can help you better understand the registration procedure. This kind of business provides limited liability, therefore shielding the personal assets of owners from business debt. Clients, partners, and investors also find it more reliable. Furthermore, ownership among members may be readily passed and there are certain tax benefits over other corporate forms.

Utilize Online Registration Platforms

Using online platforms is the core of affordable business registration in India. Integrating several services, the Ministry of Corporate Affairs (MCA) has developed the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form. Using this online portal will help to drastically save the expenses related to many trips to government agencies and actual paperwork. Before beginning the procedure, you should get acquainted with the SPICe+ form and make sure all necessary paperwork is digitized and easily accessible.

Choose a Unique Company Name Wisely

Selecting a distinctive business name is a crucial first step available for free via the MCA's name availability check tool. Having several names available can help you to prevent delays should your first pick be turned down. Steer clear of names like those of current businesses or trademarks and make sure the name conforms to MCA policies to avoid rejection.

Draft Your Own MOA and AOA

While many business owners choose professional assistance, creating your own Memorandum of Association (MOA) and Articles of Association (AOA) can save a lot of money. Templates available on the MCA website might provide a basis. Tailor these templates to meet the particular requirements of your business, but before you finalize, carefully go over and grasp every phrase.

Obtain Digital Signatures Certificate (DSC) Economically

Online business registration calls for a Digital Signatures Certificate (DSC). Comparing pricing from many Certifying Authorities (CAs) certified by the Controller of Certifying Authorities (CCA) helps one to choose the most affordable choice. Search for package offers including applications for Director Identification Number (DIN) and DSC. Starting with a one-year validity DSC will assist in saving upfront expenses.

Apply for Director Identification Number (DIN) During Incorporation

Obtaining a Director Identification Number (DIN) has been easier and may now be done concurrently with business formation using the SPICe+ form. Integration of this kind saves money and time. Make sure all suggested directors have their PAN cards and Aadhaar cards available; double-check all personal information to prevent rejection and further expenses.

Opt for a Registered Office Address Strategically

Strategic decisions on the location of a registered office may result in significant savings. Your business needs a registered office address, however initially it does not have to be a commercial location. If local zoning rules allow a home address, think about utilizing one; otherwise, investigate shared offices or virtual office services for a professional address at a fraction of the expense. Just be sure that if you are renting a space from the property owner, you have the correct NOC from them.

Handle Company Seal and Stationery In-House

Although not required, many businesses nevertheless utilize stationery and a corporate seal. Dealing with this internally might be a somewhat cheap strategy. To save per-unit expenses, purchase corporate seals and stationery in volume and use internet design tools to create a basic but professional company logo. To reduce the need for physical stationery, whenever feasible think about digital substitutes.

Leverage Free or Low-Cost Compliance Management Tools

Maintaining compliance with many legal criteria is vital, but if improperly handled it may be expensive. For filing deadlines, use free reminder services; furthermore, look at low-cost compliance management tools meant for startups. Establishing a disciplined internal compliance task tracking and management system may also assist in controlling expenses.

Conclusion

In India, registering a private limited business doesn't have to be expensive. You may drastically save the expenses related to starting a business by using internet resources, managing certain tasks yourself, and choosing strategic directions. Remember, even if cost-cutting is crucial, make sure you never compromise professional standards or legal compliance. Your private limited company will be effectively and economically established with careful planning and smart execution, therefore laying a solid basis for your commercial success in India's dynamic economic scene.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

![submenu-img]() 'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'

'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

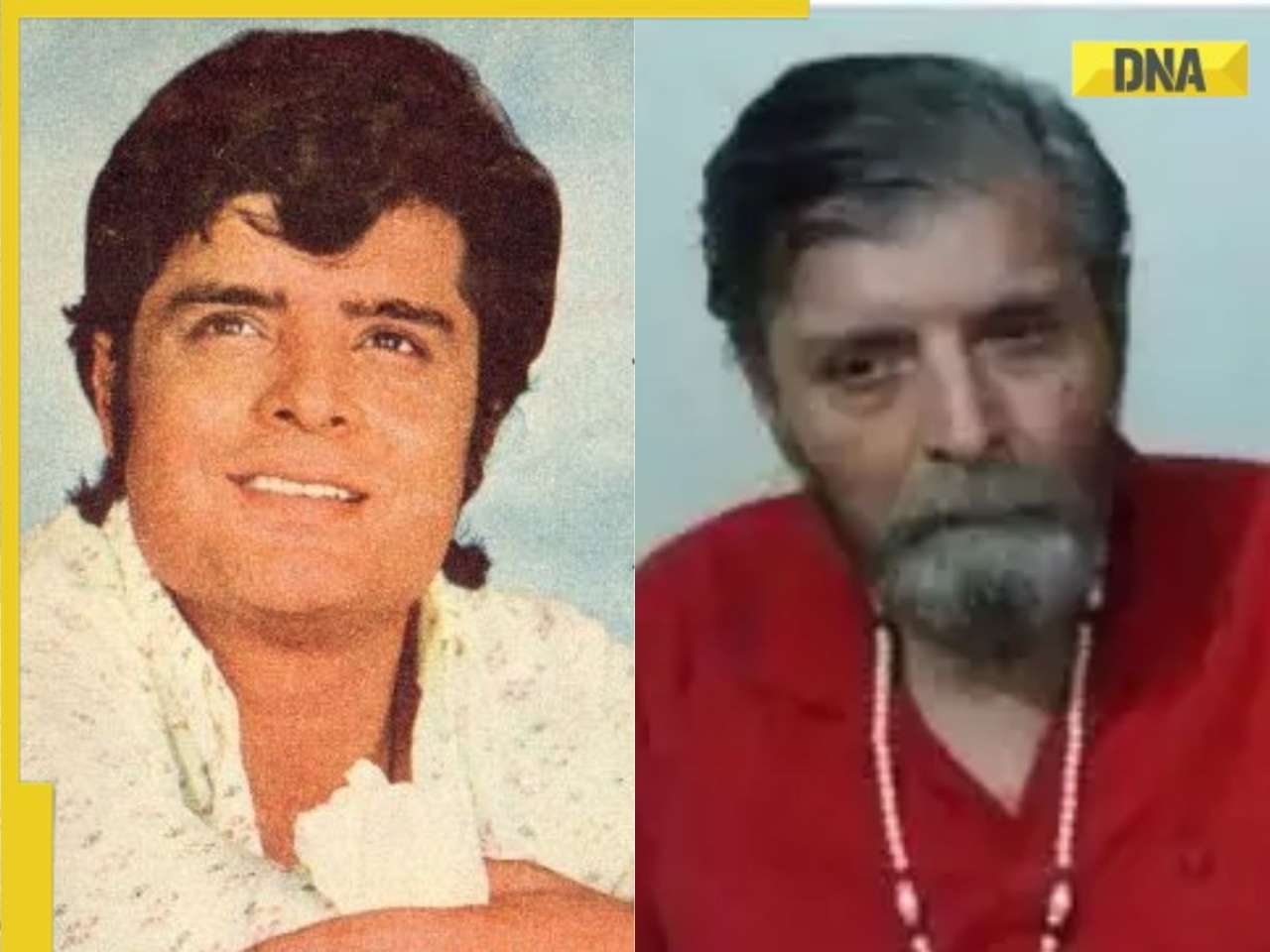

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless

This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() 2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested

2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested![submenu-img]() iPhone 16 लॉन्च, Apple Watch Series 10 से भी उठा पर्दा, जानें इसके रेट और फीचर्स

iPhone 16 लॉन्च, Apple Watch Series 10 से भी उठा पर्दा, जानें इसके रेट और फीचर्स![submenu-img]() Kalindi Express को उड़ाने की साजिश के पीछे था IS का हाथ? खुरासान मॉड्यूल पर गहराया शक

Kalindi Express को उड़ाने की साजिश के पीछे था IS का हाथ? खुरासान मॉड्यूल पर गहराया शक![submenu-img]() Mpox In India: भारत में एमपॉक्स के पहले केस की पुष्टि, स्वास्थ्य मंत्रालय ने कहा- यह एक अलग मामला

Mpox In India: भारत में एमपॉक्स के पहले केस की पुष्टि, स्वास्थ्य मंत्रालय ने कहा- यह एक अलग मामला![submenu-img]() UP Crime News: गोंडा में इंसानियत शर्मसार, नाबालिग के साथ चलती कार में गैंग रेप

UP Crime News: गोंडा में इंसानियत शर्मसार, नाबालिग के साथ चलती कार में गैंग रेप ![submenu-img]() GST Council की मीटि��ंग में बड़ा फैसला, कैंसर की दवा और नमकीन पर टैक्स घटाया

GST Council की मीटि��ंग में बड़ा फैसला, कैंसर की दवा और नमकीन पर टैक्स घटाया![submenu-img]() Hyundai Alcazar facelift launched in India: Check price, design and other features

Hyundai Alcazar facelift launched in India: Check price, design and other features![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

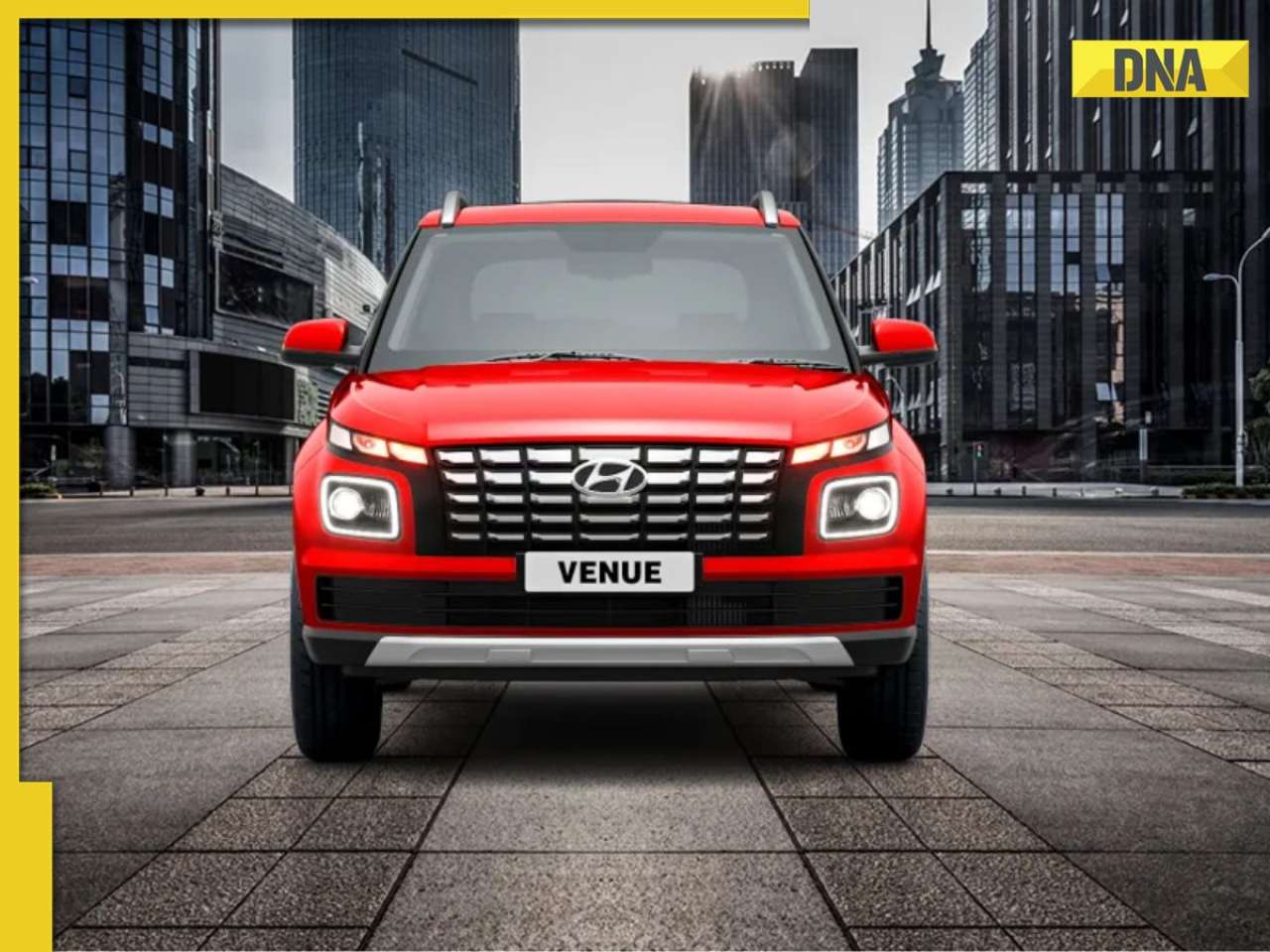

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...

Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...![submenu-img]() Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…

Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…![submenu-img]() Meet man, who worked as daily wager, cracked NEET exam with AIR...

Meet man, who worked as daily wager, cracked NEET exam with AIR...![submenu-img]() SSC CGL 2024 exam begins today: Check important guidelines, other details here

SSC CGL 2024 exam begins today: Check important guidelines, other details here![submenu-img]() Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...

Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...![submenu-img]() Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder

Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...

Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...![submenu-img]() Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…

Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…![submenu-img]() Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..

Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..![submenu-img]() Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik

Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik![submenu-img]() Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..

Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..![submenu-img]() This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...

This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...![submenu-img]() 7 countries with most UNESCO World Heritage sites; check how many India has

7 countries with most UNESCO World Heritage sites; check how many India has![submenu-img]() Top five anti-ageing skincare secrets by Nita Ambani

Top five anti-ageing skincare secrets by Nita Ambani![submenu-img]() India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss

India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...

Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...![submenu-img]() First case of Mpox confirmed in India, patient put under isolation

First case of Mpox confirmed in India, patient put under isolation![submenu-img]() Rameshwaram Cafe blast: NIA files chargesheet against four accused

Rameshwaram Cafe blast: NIA files chargesheet against four accused![submenu-img]() Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)