Restaurateurs had earlier complained of missing out on business and customers spending less after the new tax rate came into affect.

Ordering that extra starter or dessert at restaurants may not leave a larger dent in your wallet from today, as the central government had announced that it would reduce the goods and services tax (GST) levied at restaurants from 12 and 18 percent to five percent from November 15. However, till late on Tuesday night, it was unclear whether the cut in GST would roll out from the date announced, as a formal notification from the government was awaited.

Restaurateurs had earlier complained of missing out on business and customers spending less after the new tax rate came into affect. A number of them said that the business was down by over 20 percent, and home delivery and take away orders were also hit.

When GST came into force, there was a uniform 18 percent levied on restaurants that had both AC and non-AC sections, and 12 percent GST was levied on only non-AC restaurants.

"For the past few months, our business, particularly the home delivery and parcels, was badly affected, hitting 30 percent of our business," said Adarsh Shetty, president of AHAR, the Indian Hotel and Restaurant Association.

"There was no reason why a customer who was not sitting in the restaurant should be paying so much tax. Restaurants that had only 10 seats in AC room and 50 in non-AC were finding the same tax unbearable. Now there is rationalization across the board and we are informing our customers," he added.

"Even though a notification is not out yet, we have decided to pass on the benefit of a lower GST rate to our customers. All our members will be charging 5 percent GST from tomorrow. Even if the notification arrives later, we believe it will mention November 15 as the date for the reduced tax to kick in," Shetty added.

"We have already put up a notice outside our restaurant informing our guests that the GST rate is down and we look forward to passing on the benefit to them" said Mahesh Karkera, owner of popular eatery Mahesh Lunch Home in the Fort area in South Mumbai.

"I fall in the category of common man and so it does make a difference to me when it comes to eating out. From 18 percent, if they are reducing it to five percent, it will certainly make a difference on when to go out for a get-together," said Judith Monteiro, a resident of Dadar.

However, Ankit Chona, MD, Havmor said, "While the FM has said that the tax will be reduced from Wednesday, there is no government notification in this regard. The proposed 5% GST is without Input Tax Credit (ITC), which defeats the very purpose of GST. We would have preferred a 12% GST with ITC. Without ITC we will not get tax paid on buying of materials. For example we by In-house ice cream where GST is 18% but we will not get ITC. We will have to charge 5% on the selling amount. Government's argument that restaurant players are not passing the tax benefit would not hold true in longer run as those not becoming competitive will lose, as this sector is extremely competitive."

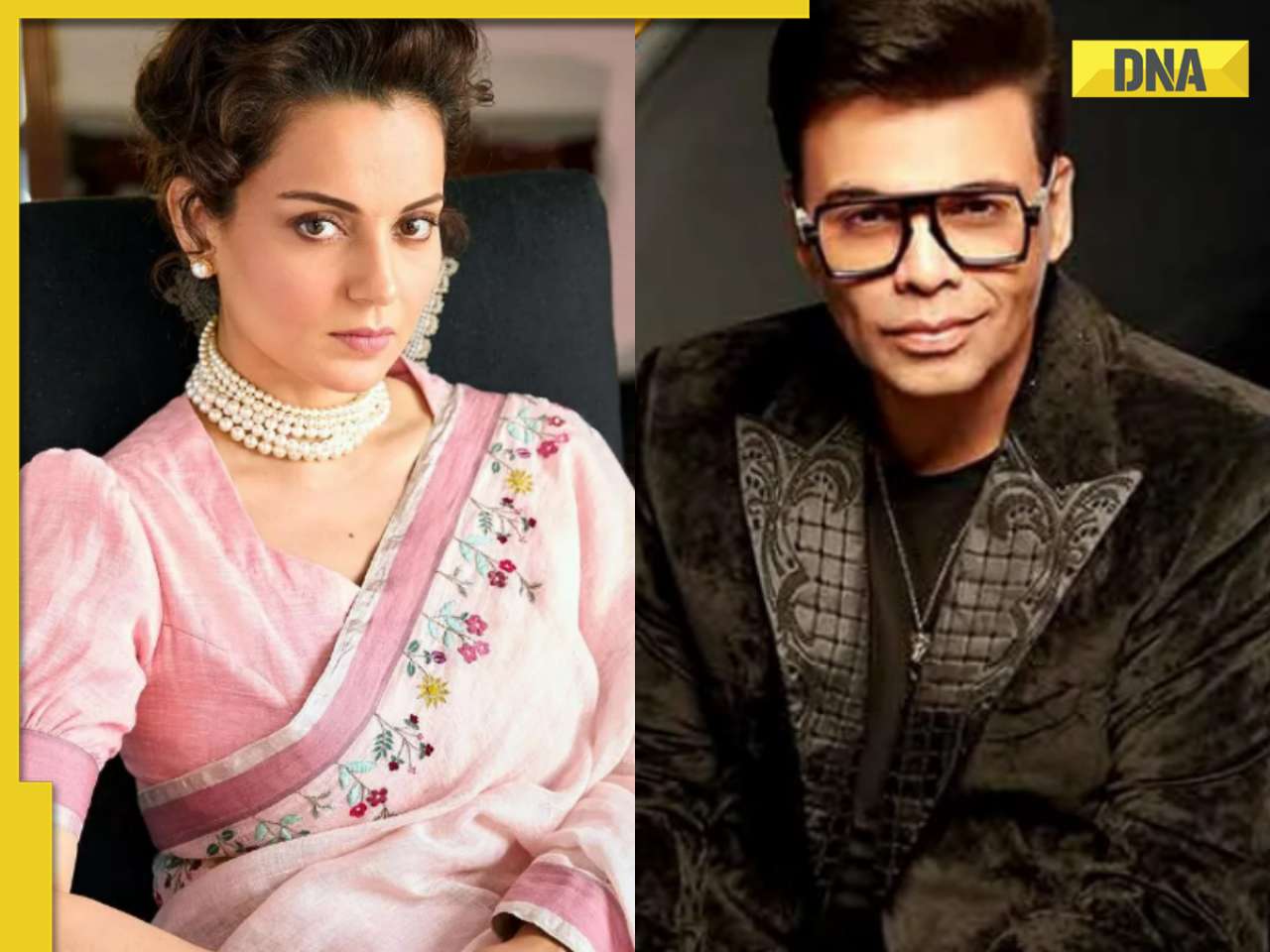

![submenu-img]() 'He is very...': Kangana Ranaut recalls Koffee With Karan episode, says Karan Johar will play this role in her biopic

'He is very...': Kangana Ranaut recalls Koffee With Karan episode, says Karan Johar will play this role in her biopic![submenu-img]() Indian Ocean's Rahul Ram, Amit Kilam react to co-founder Susmit Sen's police complaint against them: 'We have not...'

Indian Ocean's Rahul Ram, Amit Kilam react to co-founder Susmit Sen's police complaint against them: 'We have not...'![submenu-img]() Meet Rubina Francis, bike mechanic's daughter who overcame leg dysfunction to win bronze at Paris Paralympics

Meet Rubina Francis, bike mechanic's daughter who overcame leg dysfunction to win bronze at Paris Paralympics![submenu-img]() Mukesh Ambani set to challenge SBI, HDFC, ICICI as his company gets ready to launch…

Mukesh Ambani set to challenge SBI, HDFC, ICICI as his company gets ready to launch…![submenu-img]() Meet man who once sold tea, now gives free coaching for government jobs, he is....

Meet man who once sold tea, now gives free coaching for government jobs, he is....![submenu-img]() Bahraich Bhedia: बहराइच में फिर भेड़िये ने किया हमला, 7 साल के मासूम को बनाया निशाना, ग्रामीणों ने सुनाई अपनी व्यथा

Bahraich Bhedia: बहराइच में फिर भेड़िये ने किया हमला, 7 साल के मासूम को बनाया निशाना, ग्रामीणों ने सुनाई अपनी व्यथा![submenu-img]() 'नेपाल की अपनी अलग पहचान है....' PM ओली ने बांग्लादेश की स्थिति पर दी बड़ी प्रतिक्रिया

'नेपाल की अपनी अलग पहचान है....' PM ओली ने बांग्लादेश की स्थिति पर दी बड़ी प्रतिक्रिया ![submenu-img]() Assam Namaz Break: 'क्या कामाख्या मंदिर में बलि प्रथा बंद करेंगे?' अपनों ने ही पूछा CM सरमा से ये बड़ा सवाल

Assam Namaz Break: 'क्या कामाख्या मंदिर में बलि प्रथा बंद करेंगे?' अपनों ने ही पूछा CM सरमा से ये बड़ा सवाल![submenu-img]() Brazil ने लगाया 'X' पर बैन, जिद पर अड़े Elon Musk, दिया ये जवाब

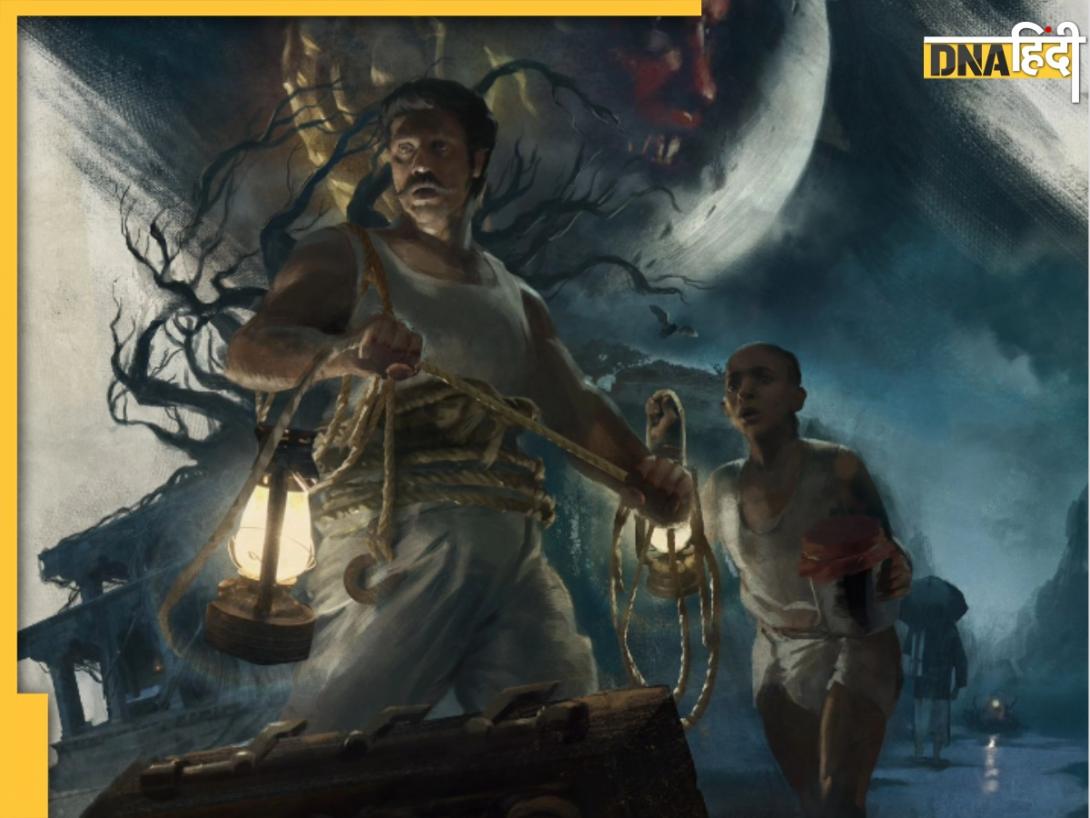

Brazil ने लगाया 'X' पर बैन, जिद पर अड़े Elon Musk, दिया ये जवाब![submenu-img]() 6 साल बाद एक बार फिर दर्शकों को डराने आ रही है Tumbbad, जानें किस दिन सिनेमाघरों में होगी रिलीज

6 साल बाद एक बार फिर दर्शकों को डराने आ रही है Tumbbad, जानें किस दिन सिनेमाघरों में होगी रिलीज![submenu-img]() Meet man who once sold tea, now gives free coaching for government jobs, he is....

Meet man who once sold tea, now gives free coaching for government jobs, he is....![submenu-img]() Meet IIT-JEE topper with AIR 1, joined IIT Bombay, left after 2 years without graduation, he is now…

Meet IIT-JEE topper with AIR 1, joined IIT Bombay, left after 2 years without graduation, he is now…![submenu-img]() CBSE Board Exam 2025: Big UPDATE students need to know

CBSE Board Exam 2025: Big UPDATE students need to know![submenu-img]() NEET PG 2024 scorecard expected today at natboard.edu.in, check counselling details

NEET PG 2024 scorecard expected today at natboard.edu.in, check counselling details![submenu-img]() Meet woman, who lived like 'monk' to clear UPSC exam, became IAS officer in third attempt, is now posted at...

Meet woman, who lived like 'monk' to clear UPSC exam, became IAS officer in third attempt, is now posted at...![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Vinesh Phogat Joins Farmers' Protest At Shambhu Border, Answers On Joining Politics | Congress | BJP

Vinesh Phogat Joins Farmers' Protest At Shambhu Border, Answers On Joining Politics | Congress | BJP![submenu-img]() Tripura Floods: 12 Killed, Over 300 Rescued As Heavy Rains Causes Severe Flooding In Tripura

Tripura Floods: 12 Killed, Over 300 Rescued As Heavy Rains Causes Severe Flooding In Tripura![submenu-img]() Kolkata Doctor Murder: Are Indian Rape Laws Enough? Public Opinion On Stricter Measures

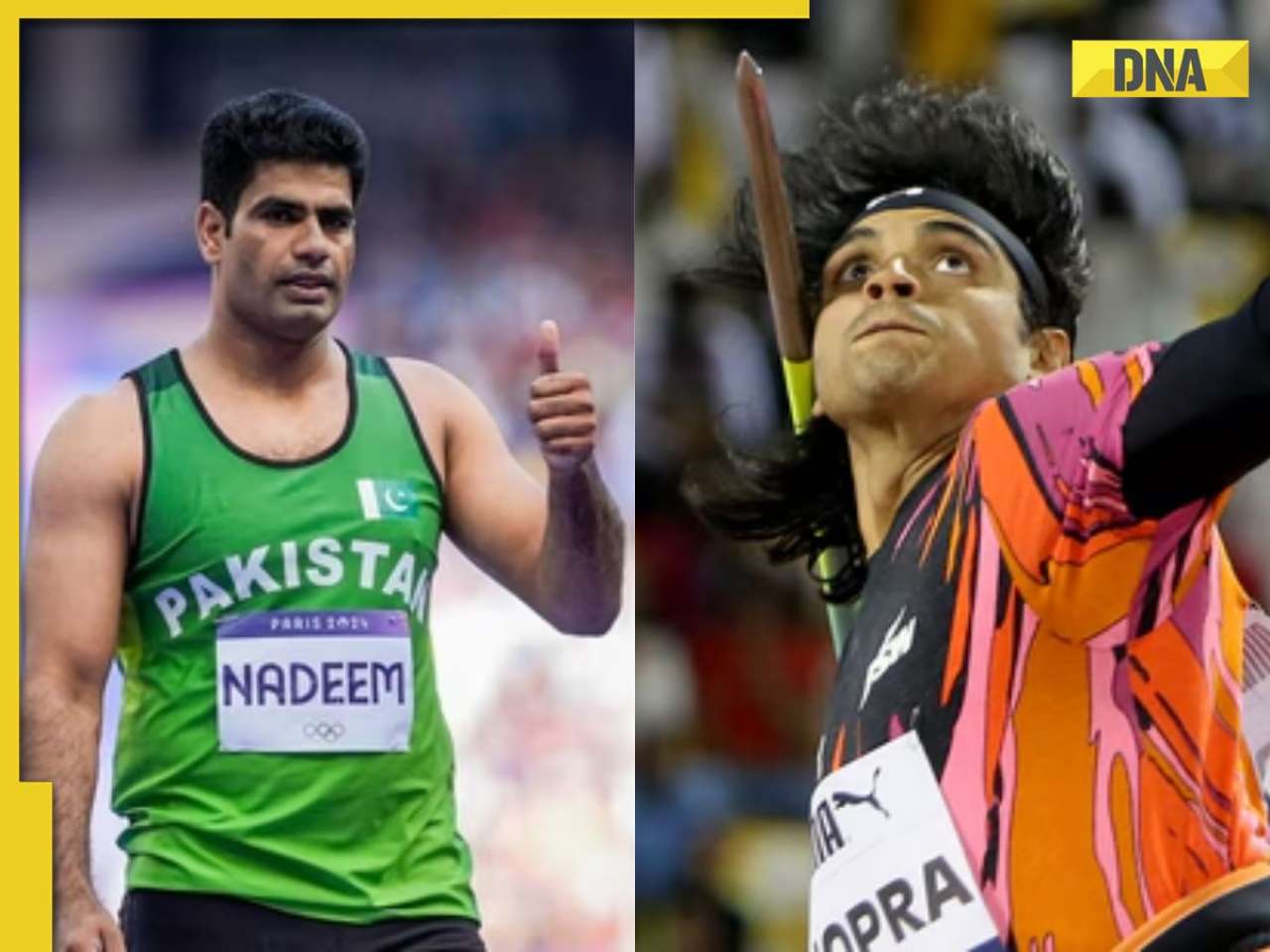

Kolkata Doctor Murder: Are Indian Rape Laws Enough? Public Opinion On Stricter Measures![submenu-img]() Neeraj Chopra, Manu Bhaker, Vinesh Phogat: How much did brand value of star athletes jump after Paris Olympics?

Neeraj Chopra, Manu Bhaker, Vinesh Phogat: How much did brand value of star athletes jump after Paris Olympics?![submenu-img]() Manu Bhaker wants to spend time with this Indian sportsperson and it's not Neeraj Chopra

Manu Bhaker wants to spend time with this Indian sportsperson and it's not Neeraj Chopra![submenu-img]() Neeraj Chopra's net worth before Olympics was Rs 25 cr, Arshad's net worth was Rs 80 lakh, their current net worth is...

Neeraj Chopra's net worth before Olympics was Rs 25 cr, Arshad's net worth was Rs 80 lakh, their current net worth is...![submenu-img]() Vinesh Phogat's net worth was just Rs 5 crore before Paris Olympics, her current net worth is Rs…

Vinesh Phogat's net worth was just Rs 5 crore before Paris Olympics, her current net worth is Rs…![submenu-img]() What is the price, length and weight of Neeraj Chopra and Olympic gold medalist Arshad Nadeem's javelin?

What is the price, length and weight of Neeraj Chopra and Olympic gold medalist Arshad Nadeem's javelin?![submenu-img]() Shraddha Kapoor was replaced in this film; movie faced several delays, bombed at box office, didn't earn even Rs 2 crore

Shraddha Kapoor was replaced in this film; movie faced several delays, bombed at box office, didn't earn even Rs 2 crore![submenu-img]() Bull Riding to Heli-Skiing: A look at 10 most dangerous sports in the world

Bull Riding to Heli-Skiing: A look at 10 most dangerous sports in the world![submenu-img]() Top seven-seater car launches in India in 2024

Top seven-seater car launches in India in 2024![submenu-img]() From Virat Kohli, MS Dhoni to Rohit Sharma, Hardik Pandya: Luxury cars owned by star India cricketers

From Virat Kohli, MS Dhoni to Rohit Sharma, Hardik Pandya: Luxury cars owned by star India cricketers![submenu-img]() Aadhaar update, credit card rules, and more: 5 big financial changes from September 1

Aadhaar update, credit card rules, and more: 5 big financial changes from September 1![submenu-img]() IMD predicts ‘above normal’ rainfall in September, heavy showers in these states; check full forecast here

IMD predicts ‘above normal’ rainfall in September, heavy showers in these states; check full forecast here![submenu-img]() Mahayuti or Maha Vikas Aghadi - The picture of women's safety in Maharashtra remains unchanged

Mahayuti or Maha Vikas Aghadi - The picture of women's safety in Maharashtra remains unchanged![submenu-img]() Haryana assembly election date changed, polling on October 5, counting of votes on...

Haryana assembly election date changed, polling on October 5, counting of votes on...![submenu-img]() John Abraham talks about producers' lack of faith, appreciates Nitish Rajput for being unbiased

John Abraham talks about producers' lack of faith, appreciates Nitish Rajput for being unbiased![submenu-img]() BJP leader Giriraj Singh attacked in Bihar's Begusarai, Union Minister says, 'he would not...'

BJP leader Giriraj Singh attacked in Bihar's Begusarai, Union Minister says, 'he would not...'![submenu-img]() Malayalam cinema's sexual abuse scandal explained: How sexual assault of star in 2017 led to Mollywood's #MeToo moment

Malayalam cinema's sexual abuse scandal explained: How sexual assault of star in 2017 led to Mollywood's #MeToo moment![submenu-img]() Jammu and Kashmir Assembly elections: What is delimitation that paved the road for these Elections?

Jammu and Kashmir Assembly elections: What is delimitation that paved the road for these Elections?![submenu-img]() Wings of Refuge: Rafales escort Hasina to safety

Wings of Refuge: Rafales escort Hasina to safety![submenu-img]() Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister

Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister![submenu-img]() DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?

DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)