The Reserve Bank of India (RBI) today announced an increase in the transaction limit from Rs 1 lakh to Rs 5 lakh per transaction for tax payments through the Unified Payments Interface (UPI).

The Reserve Bank of India (RBI) today announced an increase in the transaction limit from Rs 1 lakh to Rs 5 lakh per transaction for tax payments through the Unified Payments Interface (UPI). The increase in limit aims to simplify and facilitate higher-value tax transactions for consumers.

RBI Governor Shaktikanta Das said, "Currently, the transaction limit for UPI is Rs 1 lakh except for certain categories of payments that have higher limits. We have decided to enhance the limit for tax payments through UPI to Rs 5 lakh per transaction. This will make it easier for consumers to make tax payments using UPI."

The existing UPI cap of Rs 1 lakh has undergone regular assessments and modifications for various transaction categories like stock markets, IPO registrations, loan repayments, insurance, healthcare, and education services. With the recent update, tax payments, which are both common and substantial in amount, will now enjoy the advantages of this raised threshold.

The RBI has unveiled a fresh UPI attribute named 'Delegated Payments' alongside the increased transaction limit.

This functionality empowers a primary user to grant authorisation to a secondary user to conduct UPI transactions within a set limit from the primary user's bank account. The secondary user is not required to possess a distinct UPI-linked bank account. This innovation is anticipated to enhance the uptake of digital payments by enhancing convenience.

Governor Das confirmed that the repo rate would stay steady at 6.5%. In addition, the RBI unveiled various initiatives to improve the digital lending environment.

One of the steps involves establishing a public database through a regulated organisation to guarantee precise credit details. Lenders must now submit credit details to Credit Information Companies (CIC) biweekly, which will provide borrowers with faster updates.

Moreover, the RBI is reducing the cheque clearance period from two business days to a few hours, resulting in a substantial acceleration of the process.

![submenu-img]() 'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'

'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

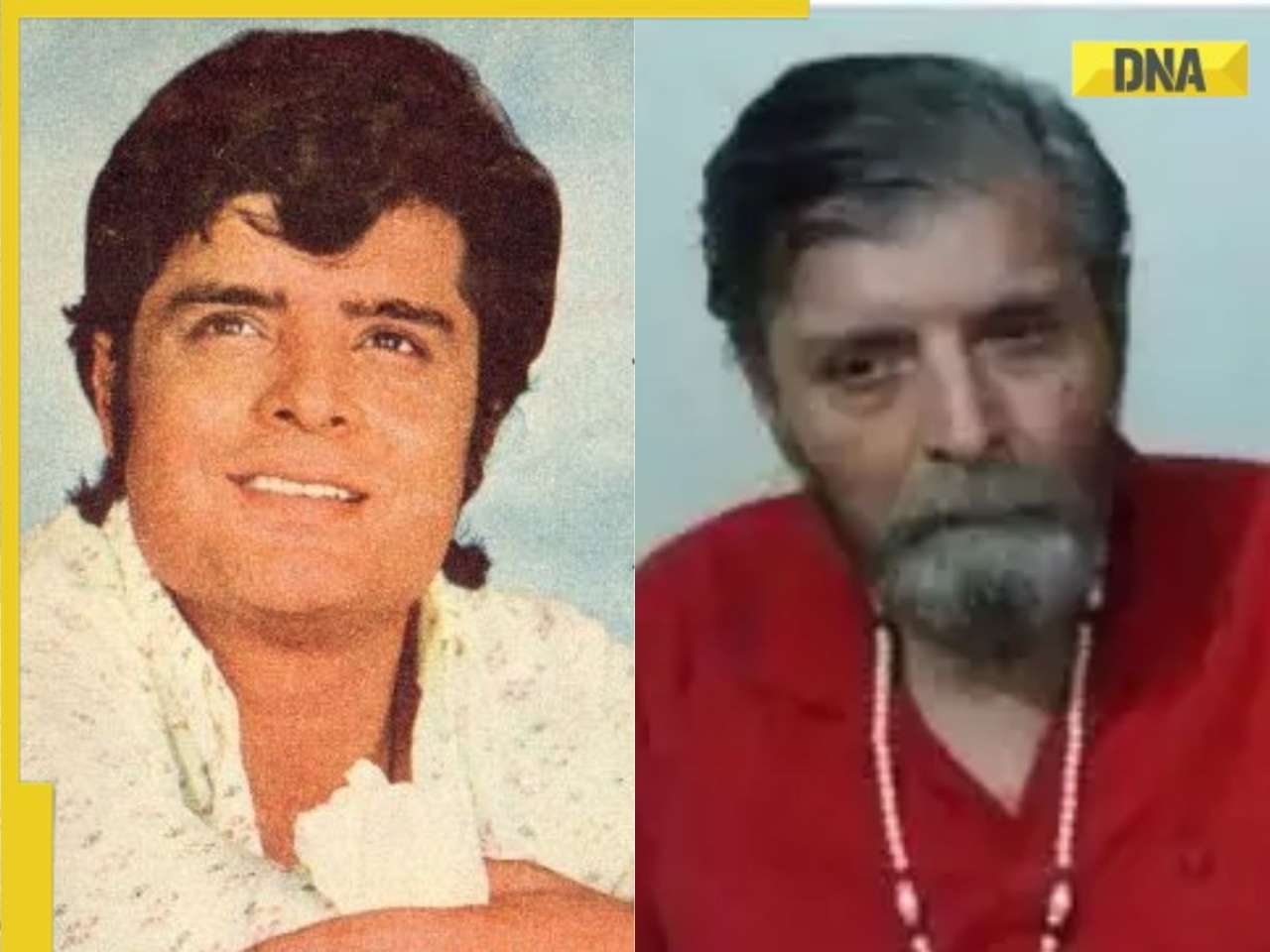

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless

This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() 2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested

2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested![submenu-img]() iPhone 16 लॉन्च, Apple Watch Series 10 से भी उठा पर्दा, जानें इसके रेट और फीचर्स

iPhone 16 लॉन्च, Apple Watch Series 10 से भी उठा पर्दा, जानें इसके रेट और फीचर्स![submenu-img]() Kalindi Express को उड़ाने की साजिश के पीछे था IS का हाथ? खुरासान मॉड्यूल पर गहराया शक

Kalindi Express को उड़ाने की साजिश के पीछे था IS का हाथ? खुरासान मॉड्यूल पर गहराया शक![submenu-img]() Mpox In India: भारत में एमपॉक्स के पहले केस की पुष्टि, स्वास्थ्य मंत्रालय ने कहा- यह एक अलग मामला

Mpox In India: भारत में एमपॉक्स के पहले केस की पुष्टि, स्वास्थ्य मंत्रालय ने कहा- यह एक अलग मामला![submenu-img]() UP Crime News: गोंडा में इंसानियत शर्मसार, नाबालिग के साथ चलती कार में गैंग रेप

UP Crime News: गोंडा में इंसानियत शर्मसार, नाबालिग के साथ चलती कार में गैंग रेप ![submenu-img]() GST Council की मीटिंग में बड़ा फैसला, कैंसर की दवा और नमकीन पर टैक्स घटाया

GST Council की मीटिंग में बड़ा फैसला, कैंसर की दवा और नमकीन पर टैक्स घटाया![submenu-img]() Hyundai Alcazar facelift launched in India: Check price, design and other features

Hyundai Alcazar facelift launched in India: Check price, design and other features![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...

Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...![submenu-img]() Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…

Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…![submenu-img]() Meet man, who worked as daily wager, cracked NEET exam with AIR...

Meet man, who worked as daily wager, cracked NEET exam with AIR...![submenu-img]() SSC CGL 2024 exam begins today: Check important guidelines, other details here

SSC CGL 2024 exam begins today: Check important guidelines, other details here![submenu-img]() Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...

Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...![submenu-img]() Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder

Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...

Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...![submenu-img]() Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…

Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…![submenu-img]() Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..

Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..![submenu-img]() Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik

Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik![submenu-img]() Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..

Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..![submenu-img]() This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...

This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...![submenu-img]() 7 countries with most UNESCO World Heritage sites; check how many India has

7 countries with most UNESCO World Heritage sites; check how many India has![submenu-img]() Top five anti-ageing skincare secrets by Nita Ambani

Top five anti-ageing skincare secrets by Nita Ambani![submenu-img]() India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss

India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...

Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...![submenu-img]() First case of Mpox confirmed in India, patient put under isolation

First case of Mpox confirmed in India, patient put under isolation![submenu-img]() Rameshwaram Cafe blast: NIA files chargesheet against four accused

Rameshwaram Cafe blast: NIA files chargesheet against four accused![submenu-img]() Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)