The Indian electronic sector is expected to reach $300 billion by 2025, a portion of which Tata Group will pursue through Tata Electronics.

Tata Group, which currently has 29 publicly listed companies with a market capitalization of USD 314 billion (Rs 23.4 trillion) as of December 31, 2021, may be planning a different IPO. By 2025, India's electronics market is expected to be worth USD 300 billion, and the Tata Group intends to capitalise on this growth by establishing a subsidiary called Tata Electronics Pvt Ltd. (TEPL). Established in 2020, this greenfield enterprise is based in the Krishnagiri area of Tamil Nadu and produces precision electronic components.

Tata Sons Chairman Natarajan Chandrasekaran has confirmed the company's intentions to enter the semiconductor market, which is expected to generate $1 trillion in sales worldwide by 2030, according to Business Today. The first step is to establish an Outsourced Semiconductor Assembly and Test (OSAT) facility under Tata Electronics' umbrella. Assembling, testing, marking, and packaging (ATMP) is a vital part of the semiconductor manufacturing process since no chip may be utilised in a product until it has been through this procedure. Raja Manickam was brought on as CEO of Tata Electronics OSAT India to help with this.

Even though OSAT technology is simple to create and accounts for around 75 to 80 per cent of the market, the Tata Group may decide against investing in it. Instead, the business is looking at Advanced Packaging, a method that takes inspiration from wafer fabs and is directed by engineers. This last aspect is becoming more significance as industry heavyweights like TSMC and Intel develop increasingly sophisticated nodes. Tata Electronics, and other prospective OSATs, would need to import processed wafers from outside since India currently lacks any fabs.

Tata Electronics signed an MoU with the government of Tamil Nadu in February 2021 to establish a plant for producing mobile components. The planned Krishnagiri factory would have required an investment of Rs 4,684 crore by the firm. N Chandrasekaran, at the time, had referred to this endeavour as a "very huge undertaking in precision engineering and manufacturing" that would build up the country's potential. Meanwhile, discussions between Tata Group and Wistron have progressed to the point that the two companies may soon form a joint venture to produce iPhones in India.

Also, READ: Missed credit card payment due date? Here’s how to avoid late fee

It might take anywhere from five to seven years for Tata Electronics Private Limited to be ready for an initial public offering (IPO), but business choices seldom follow a strict timeline. It's worth keeping an eye on this particular unlisted Tata Group subsidiary, Tata Electronics, because of the partnerships it will form with other, well-known companies.

![submenu-img]() SA vs WI, Women's T20 World Cup: Predicted playing XIs, live streaming, pitch report and weather forecast

SA vs WI, Women's T20 World Cup: Predicted playing XIs, live streaming, pitch report and weather forecast![submenu-img]() Malayalam actor Mohan Raj, known for playing iconic villain Keerikadan Jose in Mohanlal's Kireedam, passes away

Malayalam actor Mohan Raj, known for playing iconic villain Keerikadan Jose in Mohanlal's Kireedam, passes away![submenu-img]() Salman Khan talks about hosting Bigg Boss for 14 years, reacts to new twist in 18th season: 'It has always been about..'

Salman Khan talks about hosting Bigg Boss for 14 years, reacts to new twist in 18th season: 'It has always been about..'![submenu-img]() Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...

Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...![submenu-img]() Vijay Kiragandur, producer who made blockbusters KGF, Kantara possible, turns 48

Vijay Kiragandur, producer who made blockbusters KGF, Kantara possible, turns 48![submenu-img]() 5 ways to reduce cholesterol levels during Navratri fast

5 ways to reduce cholesterol levels during Navratri fast ![submenu-img]() 5 effective ways to control uric acid levels during Navratri fast

5 effective ways to control uric acid levels during Navratri fast![submenu-img]() Impressive educational qualification of Aishwarya Rai

Impressive educational qualification of Aishwarya Rai![submenu-img]() 5 images of deep space captured by NASA's Hubble Telescope

5 images of deep space captured by NASA's Hubble Telescope![submenu-img]() AI imagines Marvel superheroes celebrating Durga Puja 2024 in Kolkata

AI imagines Marvel superheroes celebrating Durga Puja 2024 in Kolkata![submenu-img]() 'RSS का लक्ष्य मजबूत हिंदू समाज बनाना', शताब्दी वर्ष को लेकर संघ प्रमुख मोहन भागवत का बड़ा बयान

'RSS का लक्ष्य मजबूत हिंदू समाज बनाना', शताब्दी वर्ष को लेकर संघ प्रमुख मोहन भागवत का बड़ा बयान![submenu-img]() 'ये हमारा भी त्योहार', कनाडा के पीएम ट्रूडो ने नवरात्रि की दी बधाई, हिंदुओं को लेकर कही ये बात

'ये हमारा भी त्योहार', कनाडा के पीएम ट्रूडो ने नवरात्रि की दी बधाई, हिंदुओं को लेकर कही ये बात![submenu-img]() कभी IAS, कभी RAW एजेंट बनकर लोगों को ठगने वाली जोया गिरफ्तार, पुरुषों की आवाज निकालने में थी एक्सपर्ट

कभी IAS, कभी RAW एजेंट बनकर लोगों को ठगने वाली जोया गिरफ्तार, पुरुषों की आवाज निकालने में थी एक्सपर्ट![submenu-img]() 'जज साहब मुझे मेकअप करना है', सुनवाई से पहले लड़की की डिमांड सुन चौंक गए लोग, जानिए पूरा मामला

'जज साहब मुझे मेकअप करना है', सुनवाई से पहले लड़की की डिमांड सुन चौंक गए लोग, जानिए पूरा मामला![submenu-img]() UP: अमेठी में दलित परिवार के चार लोगों की हत्या, घर में घुसकर मारी थी गोली, जानें पूरा मामला

UP: अमेठी में दलित परिवार के चार लोगों की हत्या, घर में घुसकर मारी थी गोली, जानें पूरा मामला![submenu-img]() This company overtakes Ratan Tata's firm to become India’s…; it is owned by…

This company overtakes Ratan Tata's firm to become India’s…; it is owned by…![submenu-img]() Mahindra Thar ROXX booking to start from..., check waiting period, details

Mahindra Thar ROXX booking to start from..., check waiting period, details![submenu-img]() BMW launches CE 02 electric scooter in India; price starts at Rs…

BMW launches CE 02 electric scooter in India; price starts at Rs…![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Meet man, who bagged AIR 1 in JEE Advance, studied at IIT Bombay, now pursuing PhD at prestigious college in...

Meet man, who bagged AIR 1 in JEE Advance, studied at IIT Bombay, now pursuing PhD at prestigious college in...![submenu-img]() This was India's most educated man, had 20 degrees, cracked UPSC twice but quit IAS job due to...

This was India's most educated man, had 20 degrees, cracked UPSC twice but quit IAS job due to...![submenu-img]() RRB Railway Recruitment 2024: Sarkari naukri alert for 14298 posts, know how to apply online at rrbapply.gov.in before..

RRB Railway Recruitment 2024: Sarkari naukri alert for 14298 posts, know how to apply online at rrbapply.gov.in before..![submenu-img]() Meet IAS officer, BITS graduate who left high-paying job at Google, got highest marks in UPSC exam, he is...

Meet IAS officer, BITS graduate who left high-paying job at Google, got highest marks in UPSC exam, he is...![submenu-img]() Meet man who quit his job at ISRO, then began taxi company, its turnover is Rs...

Meet man who quit his job at ISRO, then began taxi company, its turnover is Rs...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...

Anil Ambani's Reliance Power approves Rs 4200 crore plan as shares hit over...![submenu-img]() Good news for these central govt employees, Cabinet approves Rs 2029 crore bonus ahead of Diwali; check details

Good news for these central govt employees, Cabinet approves Rs 2029 crore bonus ahead of Diwali; check details![submenu-img]() Mukesh Ambani's Reliance loses Rs 77606 crore in just one day, market cap drops to...

Mukesh Ambani's Reliance loses Rs 77606 crore in just one day, market cap drops to...![submenu-img]() Meet woman whose father once owned private airlines in India, her connection with Lalit Modi was...

Meet woman whose father once owned private airlines in India, her connection with Lalit Modi was...![submenu-img]() Mukesh Ambani adds another aircraft to his flying fleet, buys India’s first Boeing 737 MAX 9 for Rs...

Mukesh Ambani adds another aircraft to his flying fleet, buys India’s first Boeing 737 MAX 9 for Rs...![submenu-img]() 10 times Aabha Paul brought the internet down with her sultry photos, sexy videos

10 times Aabha Paul brought the internet down with her sultry photos, sexy videos![submenu-img]() OTT Releases This Week: The Greatest of All Time, CTRL, The Signature, The Tribe, latest films, series to binge-watch

OTT Releases This Week: The Greatest of All Time, CTRL, The Signature, The Tribe, latest films, series to binge-watch![submenu-img]() 10 thirst trap, sizzling hot photos of Avneet Kaur

10 thirst trap, sizzling hot photos of Avneet Kaur![submenu-img]() 6 mesmerising images of Nebula captured by NASA's Hubble Telescope

6 mesmerising images of Nebula captured by NASA's Hubble Telescope![submenu-img]() From Har Ki Pauri to Shivpuri: 6 places to visit in Haridwar and Rishikesh

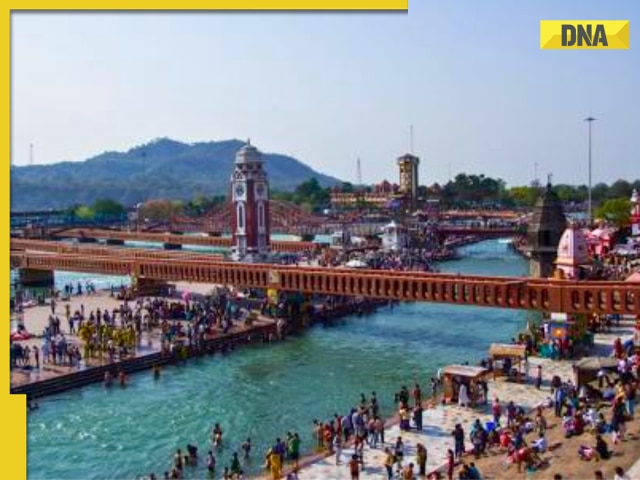

From Har Ki Pauri to Shivpuri: 6 places to visit in Haridwar and Rishikesh![submenu-img]() 'Biased and agenda-driven': India dismisses USCIRF report on religious freedom

'Biased and agenda-driven': India dismisses USCIRF report on religious freedom![submenu-img]() Bank fraud: Fake SBI branch uncovered in Chhattisgarh, locals duped with fake recruitment drives and bank services

Bank fraud: Fake SBI branch uncovered in Chhattisgarh, locals duped with fake recruitment drives and bank services![submenu-img]() This politician was seeking votes for BJP in a speech, an hour later joined Congress, he is…

This politician was seeking votes for BJP in a speech, an hour later joined Congress, he is…![submenu-img]() Halal meat exports: India rolls out fresh guidelines with effect from October 16

Halal meat exports: India rolls out fresh guidelines with effect from October 16![submenu-img]() Isha Foundation row: SC transfers plea from Madras High Court to itself, asks police not to...

Isha Foundation row: SC transfers plea from Madras High Court to itself, asks police not to...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)