- Home

- Latest News

![submenu-img]() 'People of Jammu and Kashmir were deprived of...': Rahul Gandhi presses for statehood ahead of Assembly polls in J-K

'People of Jammu and Kashmir were deprived of...': Rahul Gandhi presses for statehood ahead of Assembly polls in J-K![submenu-img]() Anushka Sharma returns to Mumbai amid rumours of moving to London; fans note Virat Kohli, Vamika, Akaay's absence

Anushka Sharma returns to Mumbai amid rumours of moving to London; fans note Virat Kohli, Vamika, Akaay's absence![submenu-img]() Vedanta props up rural education in Odisha; over 4,000 students of 50+ schools doled out study kits

Vedanta props up rural education in Odisha; over 4,000 students of 50+ schools doled out study kits![submenu-img]() Big TROUBLE for ex-trainee IAS officer Puja Khedkar as Delhi Police accuse her of....

Big TROUBLE for ex-trainee IAS officer Puja Khedkar as Delhi Police accuse her of....![submenu-img]() Rahul Gandhi meets Olympians Vinesh Phogat, Bajrang Punia ahead of Haryana Assembly elections

Rahul Gandhi meets Olympians Vinesh Phogat, Bajrang Punia ahead of Haryana Assembly elections

- Webstory

- DNA Hindi

![submenu-img]() Haryana BJP Candidate List: हरियाणा में BJP ने जारी की 67 उम्मीदवारों की पहली लिस्ट, CM नायब सैनी लाडवा से लड़ेंगे चुनाव

Haryana BJP Candidate List: हरियाणा में BJP ने जारी की 67 उम्मीदवारों की पहली लिस्ट, CM नायब सैनी लाडवा से लड़ेंगे चुनाव![submenu-img]() VIDEO: स्टालिन को साइकिल चलाते देख राहुल गांधी ने पूछा- हम साथ कब चलाएंगे भाई

VIDEO: स्टालिन को साइकिल चलाते देख राहुल गांधी ने पूछा- हम साथ कब चलाएंगे भाई![submenu-img]() दिल्ली MCD वार्ड कमेटी के चुनावी नतीजे साफ, भाजपा ने मारी बाजी, जानिए क्या रहा AAP का हाल

दिल्ली MCD वार्ड कमेटी के चुनावी नतीजे साफ, भाजपा ने मारी बाजी, जानिए क्या रहा AAP का हाल ![submenu-img]() उचाना से दुष्यंत चौटाला, डबवाली से दिग्विजय लड़ेंगे चुनाव, हरियाणा में JJP-ASP ने जारी की पहली लिस्ट

उचाना से दुष्यंत चौटाला, डबवाली से दिग्विजय लड़ेंगे चुनाव, हरियाणा में JJP-ASP ने जारी की पहली लिस्ट![submenu-img]() SCO vs AUS 1st T20I: 25 गेंद और 80 रन... ट्रेविस हेड का तूफान, ऑस्ट्रेलिया ने 9.4 ओवर में च��ेज कर लिया 150 प्लस टारगेट

SCO vs AUS 1st T20I: 25 गेंद और 80 रन... ट्रेविस हेड का तूफान, ऑस्ट्रेलिया ने 9.4 ओवर में च��ेज कर लिया 150 प्लस टारगेट

- Automobile

![submenu-img]() DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Mahindra Thar Roxx nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Mahindra Thar Roxx nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() 2025 Aston Martin Vanquish revealed: Check expected price, features, top speed

2025 Aston Martin Vanquish revealed: Check expected price, features, top speed![submenu-img]() Jawa 42 FJ launched in India, rivals Royal Enfield Hunter 350: Check price, features, design

Jawa 42 FJ launched in India, rivals Royal Enfield Hunter 350: Check price, features, design

- Education

![submenu-img]() Meet woman who quit high-paying job in abroad for UPSC exam, but failed to crack it thrice, took 3-year break and then…

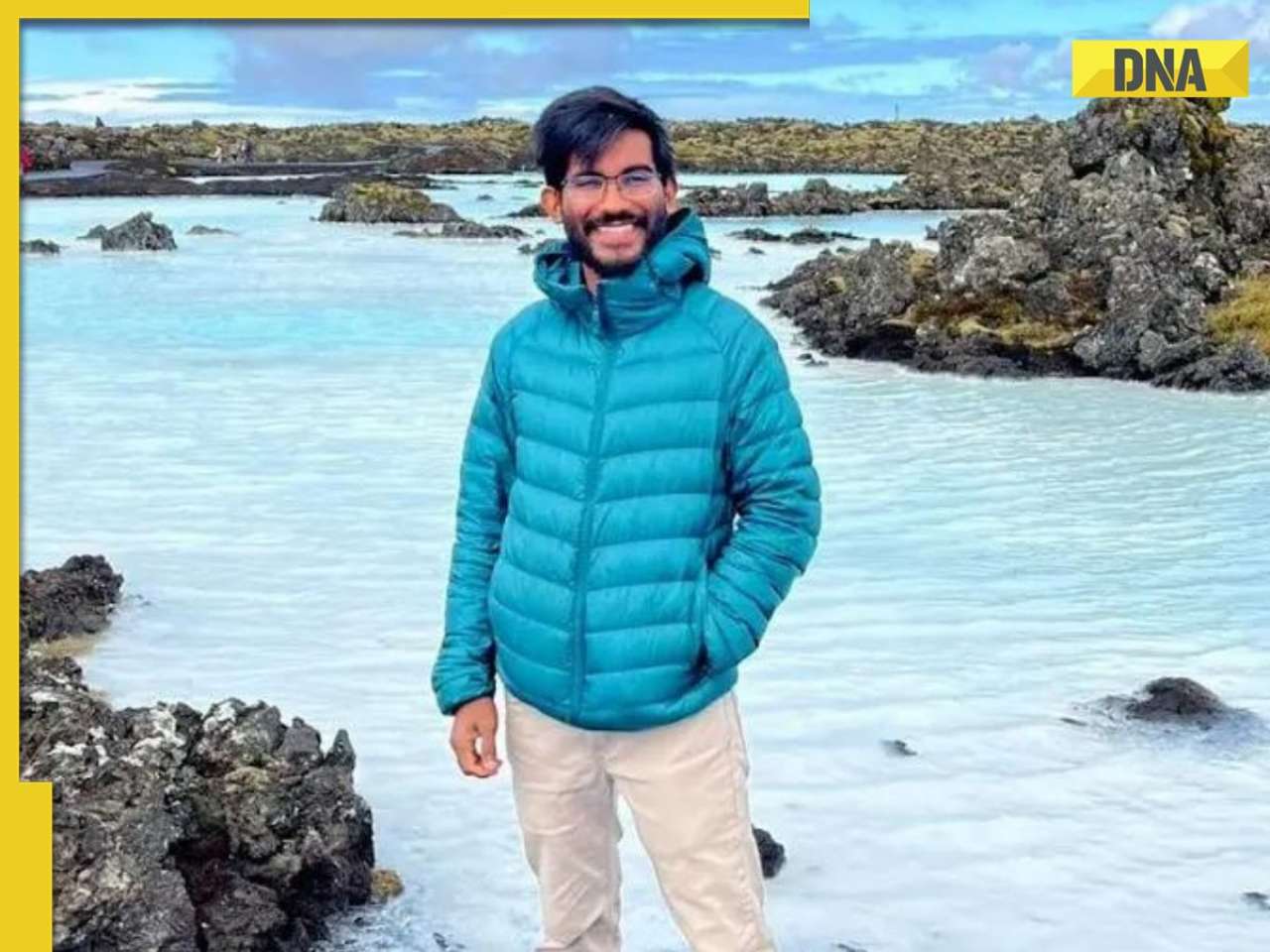

Meet woman who quit high-paying job in abroad for UPSC exam, but failed to crack it thrice, took 3-year break and then…![submenu-img]() Meet man, who worked at Google with Rs 2 crore salary job, took retirement at 29 due to....

Meet man, who worked at Google with Rs 2 crore salary job, took retirement at 29 due to....![submenu-img]() Where is UPSC topper Tina Dabi's sister, IAS officer Ria Dabi?

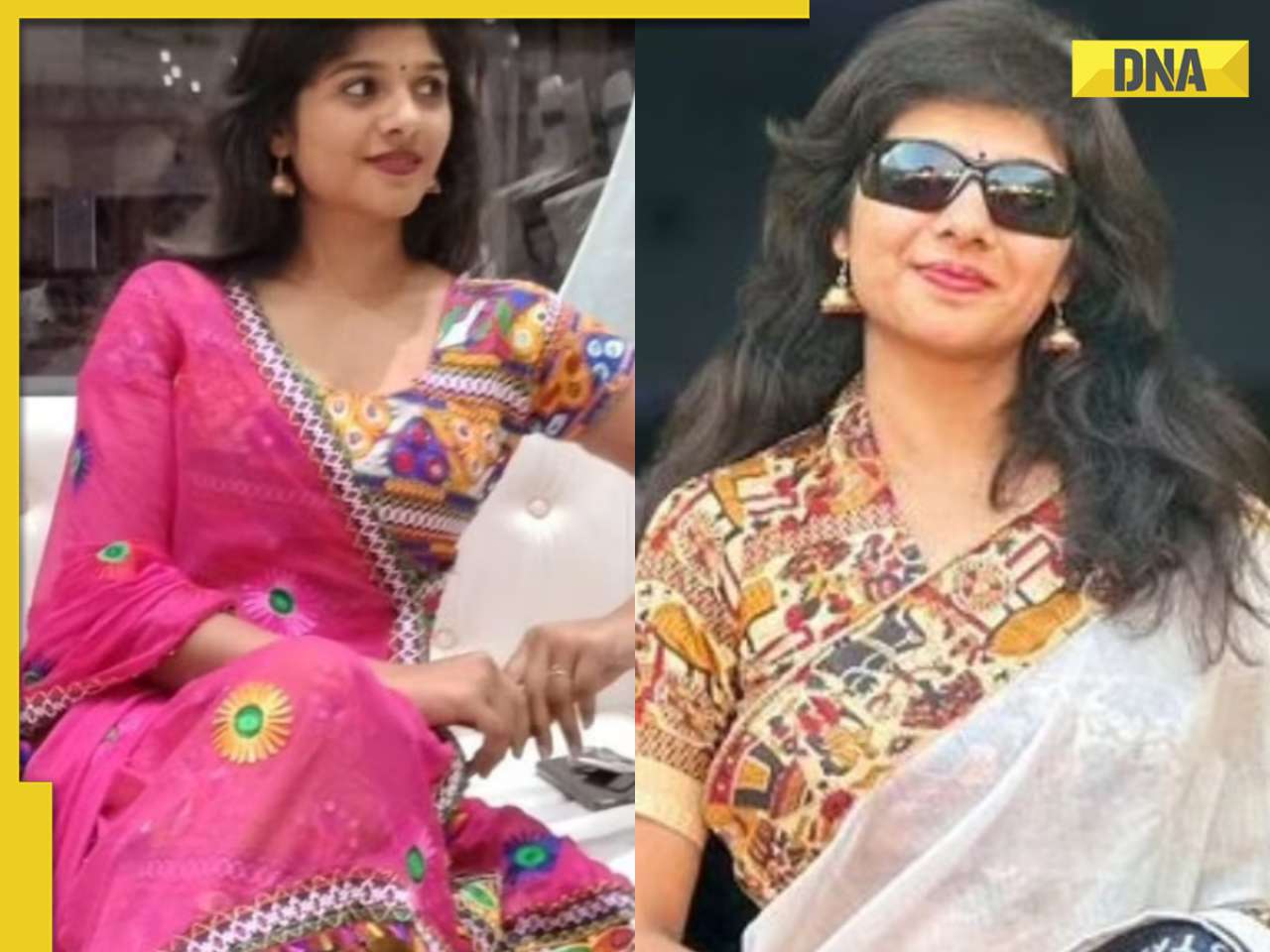

Where is UPSC topper Tina Dabi's sister, IAS officer Ria Dabi?![submenu-img]() Meet IAS Vaishanvi Paul, know how one question helped her crack UPSC exam in...

Meet IAS Vaishanvi Paul, know how one question helped her crack UPSC exam in...![submenu-img]() Meet woman, who got inspired by IAS Tina Dabi, cleared UPSC exam in first attempt, became IPS officer with AIR...

Meet woman, who got inspired by IAS Tina Dabi, cleared UPSC exam in first attempt, became IPS officer with AIR...

- Videos

![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Vinesh Phogat Joins Farmers' Protest At Shambhu Border, Answers On Joining Politics | Congress | BJP

Vinesh Phogat Joins Farmers' Protest At Shambhu Border, Answers On Joining Politics | Congress | BJP![submenu-img]() Tripura Floods: 12 Killed, Over 300 Rescued As Heavy Rains Causes Severe Flooding In Tripura

Tripura Floods: 12 Killed, Over 300 Rescued As Heavy Rains Causes Severe Flooding In Tripura![submenu-img]() Kolkata Doctor Murder: Are Indian Rape Laws Enough? Public Opinion On Stricter Measures

Kolkata Doctor Murder: Are Indian Rape Laws Enough? Public Opinion On Stricter Measures

- Business

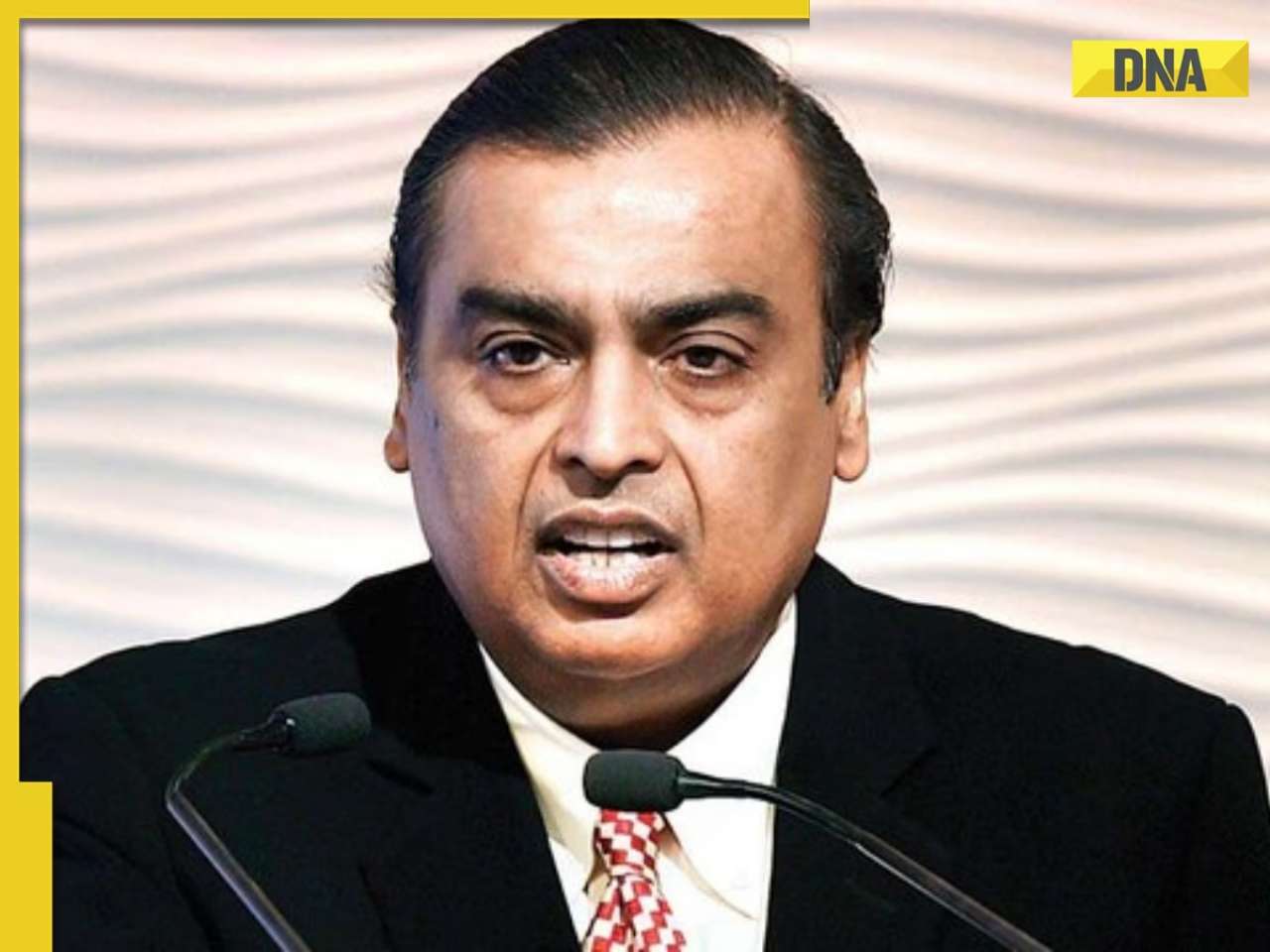

![submenu-img]() Mukesh Ambani's superhit plan for Jio customers: 1.5 GB data for 30 days, unlimited calls for just...

Mukesh Ambani's superhit plan for Jio customers: 1.5 GB data for 30 days, unlimited calls for just...![submenu-img]() Mukesh Ambani's big move, set to challenge HDFC, SBI with...

Mukesh Ambani's big move, set to challenge HDFC, SBI with...![submenu-img]() Meet brothers, who built India's 4th largest pharma firm worth Rs 95876 crore, billionaires with net worth of...

Meet brothers, who built India's 4th largest pharma firm worth Rs 95876 crore, billionaires with net worth of...![submenu-img]() DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features

- Photos

![submenu-img]() This star won National Award at 19, got stuck with bold roles; one controversy ended her career; now lives in poverty

This star won National Award at 19, got stuck with bold roles; one controversy ended her career; now lives in poverty![submenu-img]() India's most profitable film, made in Rs 25 lakh, earned 2000% profit, beat Sholay, Dangal, Baahubali, RRR; it is...

India's most profitable film, made in Rs 25 lakh, earned 2000% profit, beat Sholay, Dangal, Baahubali, RRR; it is...![submenu-img]() Two films had same story, characters; one became India's best film and other Bollywood's biggest flop, the reason is...

Two films had same story, characters; one became India's best film and other Bollywood's biggest flop, the reason is...![submenu-img]() Meet actor who slept on floors, shared room with 8 people, earned Rs 400, later gave Rs 1000 crore blockbuster

Meet actor who slept on floors, shared room with 8 people, earned Rs 400, later gave Rs 1000 crore blockbuster![submenu-img]() Six side-effects of momos you should know

Six side-effects of momos you should know

- India

![submenu-img]() 'People of Jammu and Kashmir were deprived of...': Rahul Gandhi presses for statehood ahead of Assembly polls in J-K

'People of Jammu and Kashmir were deprived of...': Rahul Gandhi presses for statehood ahead of Assembly polls in J-K![submenu-img]() Vedanta props up rural education in Odisha; over 4,000 students of 50+ schools doled out study kits

Vedanta props up rural education in Odisha; over 4,000 students of 50+ schools doled out study kits![submenu-img]() Big TROUBLE for ex-trainee IAS officer Puja Khedkar as Delhi Police accuse her of....

Big TROUBLE for ex-trainee IAS officer Puja Khedkar as Delhi Police accuse her of....![submenu-img]() Rahul Gandhi meets Olympians Vinesh Phogat, Bajrang Punia ahead of Haryana Assembly elections

Rahul Gandhi meets Olympians Vinesh Phogat, Bajrang Punia ahead of Haryana Assembly elections![submenu-img]() 'Would have never collapsed if...': Nitin Gadkari said on Shivaji Maharaj statue collapse

'Would have never collapsed if...': Nitin Gadkari said on Shivaji Maharaj statue collapse

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)