These companies plan to raise more than Rs 4,100 crore through the initial public offerings. Here are all the details you should know.

This week there is a huge opportunity in the share market for investors as four companies are launching their Initial Public Offerings (IPO). All these issues will open between December 7 and December 10.

The upcoming IPOs include companies like Rakesh Jhunjhunwala-backed footwear company Metro Brands, distribution technology company RateGain, Shriram Properties and digital map maker MapmyIndia. These companies plan to raise more than Rs 4,100 crore through IPO. If you also want to join this party, here are all the details you should know about the IPO of all the companies.

RateGain IPO

RateGain Travel Technologies is one of the largest distribution technology companies in the world. RateGain's IPO will open on December 7 and close on December 9. The size of the IPO is Rs 1,336 crore. RateGain has fixed the price band at Rs 405-425 per share under its IPO. The lot size has been kept at 35 shares. That is, according to the upper price band, investors will have to invest at least Rs 17,875.

Under this IPO, new shares worth Rs 375 crore will be issued. Whereas under the Offer for Sale (OFS), about 2.26 crore equity shares will be sold. 75 per cent of the issue is reserved for Qualified Institutional Investors (QIBs), 15 per cent for Non-Institutional Investors (NIIs) and 10 per cent for retail investors. The proceeds of the IPO will be used by the company for debt repayment, inorganic growth and general corporate purposes.

Shriram Properties IPO

The IPO of South India's real estate company Shriram Properties is opening on 8 December. It will be open for investment till December 10. The size of the issue is Rs 600 crore and the price band has been fixed at Rs 113-118 per share. The lot size for the issue is 125 shares. That is, according to the upper price of the price band, investors will have to invest at least Rs 14,750. The issue will open for anchor investors on December 7.

Fresh equity shares worth Rs 250 crore will be issued in the IPO of Shriram Properties. Whereas shares worth Rs 350 crore will be sold under the Offer for Sale (OFS). 75 per cent of the issue will be reserved for Qualified Institutional Buyers (QIBs), 15 per cent for non-institutional investors and 10 per cent for retail investors. 3 crore shares are reserved for the employees of the company. The proceeds from the IPO will be used for corporate purposes other than debt repayment.

MapmyIndia IPO

Digital map maker MapmyIndia's IPO will open on 9 December and close on December 13. The company plans to raise up to Rs 1,200 crore through IPO. MapmyIndia has fixed a price band of Rs 1000-1033 per share for the IPO. Map My India IPO will be purely Offer for Sale (OFS) and the lot size has been kept at 14 shares. Investors will have to invest at least Rs 14,462 and the maximum amount that can be invested is Rs 1,88,006.

Metro Brands IPO

The IPO of footwear retail company Metro Brands will be open from December 10 to December 14. Veteran investor Rakesh Jhunjhunwala also has a stake in this company. The company plans to raise Rs 1,000 crore through this issue. Under this IPO, new equity shares worth Rs 295 crore will be issued while the existing promoters and other shareholders of the company will sell 2.14 crore equity shares under the offer for sale (OFS). After this sale of shares, the promoters' stake in the company will come down by about 10 per cent to 75 per cent. This company sells footwear products for men, women, unisex and children all. Metro Brands sells products for all occasions including casual and formal events.

![submenu-img]() T20 World Cup 2024: ICC reprimands Afghanistan captain Rashid Khan ahead of semi-final vs South Africa

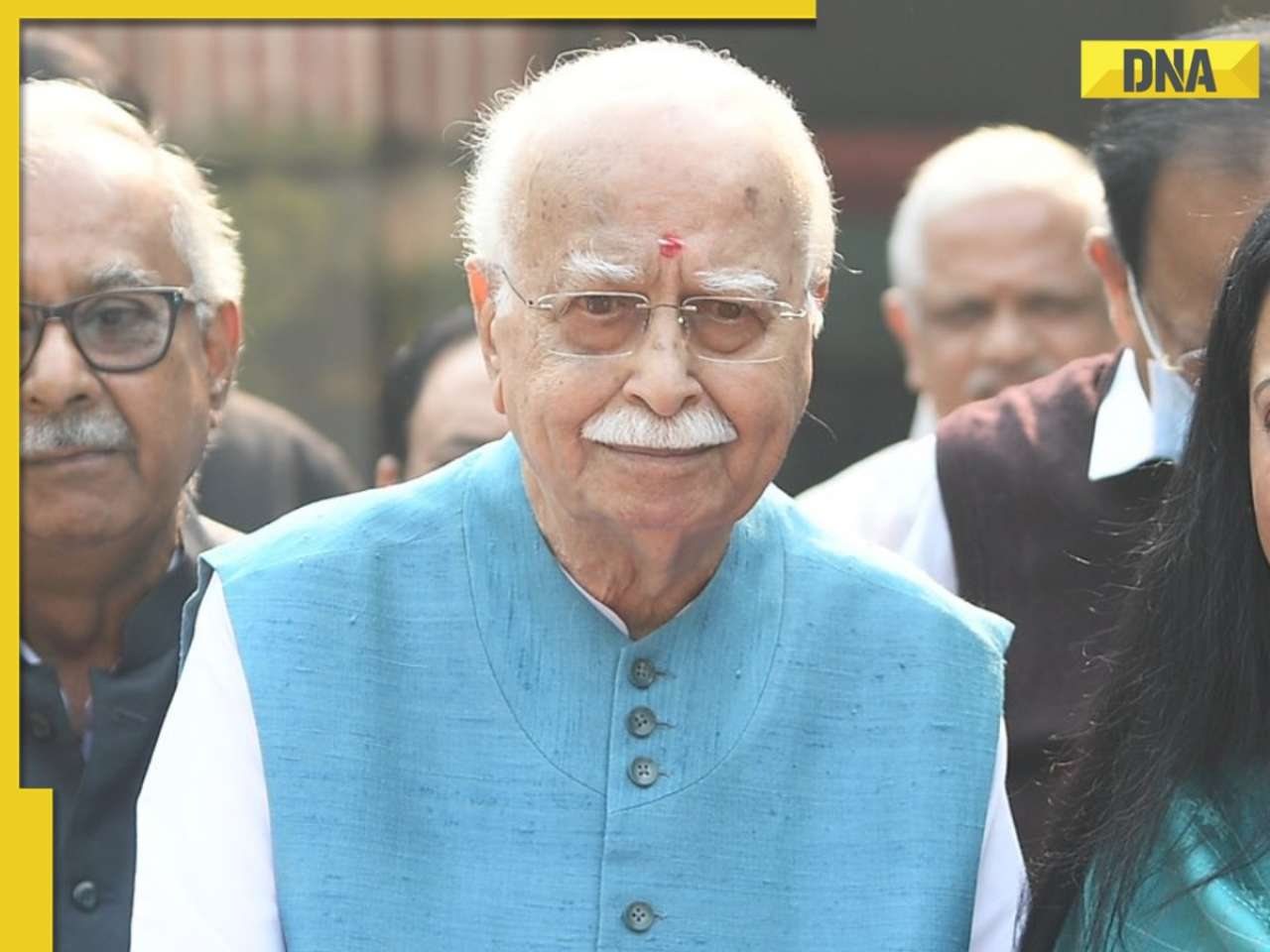

T20 World Cup 2024: ICC reprimands Afghanistan captain Rashid Khan ahead of semi-final vs South Africa![submenu-img]() Veteran BJP leader LK Advani admitted to AIIMS Delhi

Veteran BJP leader LK Advani admitted to AIIMS Delhi![submenu-img]() DNA TV Show: Did Delhi CM Arvind Kejriwal put blame on Manish Sisodia in liquor policy case?

DNA TV Show: Did Delhi CM Arvind Kejriwal put blame on Manish Sisodia in liquor policy case?![submenu-img]() Watch: Shatrughan Sinha shares inside photos, videos from Sonakshi Sinha, Zaheer Iqbal's 'wedding of the century'

Watch: Shatrughan Sinha shares inside photos, videos from Sonakshi Sinha, Zaheer Iqbal's 'wedding of the century'![submenu-img]() Kalki 2898 AD director Nag Ashwin reveals these two south stars will also appear in film, Prabhas reacts: Watch

Kalki 2898 AD director Nag Ashwin reveals these two south stars will also appear in film, Prabhas reacts: Watch![submenu-img]() Meet woman who topped class 10, 12, CLAT, law school, cracked UPSC in 1st attempt without coaching to become IAS with...

Meet woman who topped class 10, 12, CLAT, law school, cracked UPSC in 1st attempt without coaching to become IAS with...![submenu-img]() Meet IIT-JEE topper with AIR 7, daughter of Maths teacher, scored 332 marks in JEE Advanced 2024, planning to...

Meet IIT-JEE topper with AIR 7, daughter of Maths teacher, scored 332 marks in JEE Advanced 2024, planning to...![submenu-img]() UPSC topper IAS Tina Dabi's Class 12 marks goes viral on social media, check her scores in different subjects

UPSC topper IAS Tina Dabi's Class 12 marks goes viral on social media, check her scores in different subjects![submenu-img]() Meet woman who is not from IIT, IIM, VIT, NIT, got job with record-breaking package of...

Meet woman who is not from IIT, IIM, VIT, NIT, got job with record-breaking package of...![submenu-img]() Meet Indian genius who saved lakhs of lives with his discovery, received six Nobel nominations, but never won due to…

Meet Indian genius who saved lakhs of lives with his discovery, received six Nobel nominations, but never won due to…![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive

In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Watch: Shatrughan Sinha shares inside photos, videos from Sonakshi Sinha, Zaheer Iqbal's 'wedding of the century'

Watch: Shatrughan Sinha shares inside photos, videos from Sonakshi Sinha, Zaheer Iqbal's 'wedding of the century'![submenu-img]() Kalki 2898 AD director Nag Ashwin reveals these two south stars will also appear in film, Prabhas reacts: Watch

Kalki 2898 AD director Nag Ashwin reveals these two south stars will also appear in film, Prabhas reacts: Watch![submenu-img]() Kaun Banega Crorepati 16: Amitabh Bachchan introduces thought-provoking campaign, fans say 'eagerly waiting for show'

Kaun Banega Crorepati 16: Amitabh Bachchan introduces thought-provoking campaign, fans say 'eagerly waiting for show'![submenu-img]() Why Kalki 2898 AD makers chose June 27 release date? Know how it is connected to Mahabharata, Lord Vishnu

Why Kalki 2898 AD makers chose June 27 release date? Know how it is connected to Mahabharata, Lord Vishnu![submenu-img]() Ahead of Kalki 2898 AD's release, makers have this request from fans: 'Let's please respect...'

Ahead of Kalki 2898 AD's release, makers have this request from fans: 'Let's please respect...'![submenu-img]() Mukesh Ambani's son Anant Ambani and Radhika Merchant's wedding invite goes viral, watch video here

Mukesh Ambani's son Anant Ambani and Radhika Merchant's wedding invite goes viral, watch video here![submenu-img]() '4 bhk for 15 crore,': Netizens in shock after Noida man's video for house hunt goes viral

'4 bhk for 15 crore,': Netizens in shock after Noida man's video for house hunt goes viral![submenu-img]() Isha Ambani's latest picture with twins is going viral on social media due to...

Isha Ambani's latest picture with twins is going viral on social media due to...![submenu-img]() Gulbadin Naib under scrutiny, may face heavy fine after dramatic Afghanistan win

Gulbadin Naib under scrutiny, may face heavy fine after dramatic Afghanistan win![submenu-img]() Makeover of homeless woman leaves internet stunned, netizens says...

Makeover of homeless woman leaves internet stunned, netizens says...

)

)

)

)

)

)

)