- LATEST

- WEBSTORY

- TRENDING

PERSONAL FINANCE

Brace for higher motor insurance

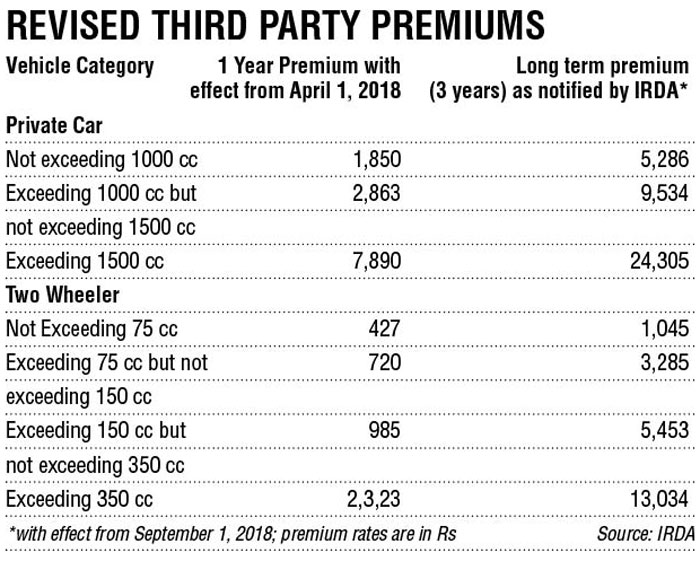

New vehicle buyers will have to factor in bigger amount for insurance premium, as third-party cover will have to be compulsorily bought for three years for cars and five years for two-wheelers

TRENDING NOW

If you are planning to buy a new vehicle car or bike, be prepared to shell out more than you had budgeted for. From September 1 the own damage component of motor insurance will increase by up to five times. The premium amount would depend on the engine capacity of the vehicle.

Following the Supreme Court order making the purchase of long-term third-party motor insurance mandatory, Insurance Regulatory and Development Authority of India (Irdai) has notified new rates for third-party premiums for two- and four-wheelers, effective September 1.

In July, the apex court passed an order making it compulsory for new two-wheelers to have five-year long third-party motor insurance and for new cars to have three-year long third-party insurance. This was to reduce the number of vehicles plying without insurance and to ensure that accident victims get the rightful compensation.

Earlier, third-party motor insurance had to be bought on an annual basis. A comprehensive motor insurance policy has two components. The own damage component pays for any damage to or theft of your own vehicle. The other component - third-party premium, mandatory for every vehicle owner, covers damage to other people's vehicle or property in the case of an accident. The compensation for accident victims is also paid out of this compensation.

Following this, the insurance regulator issued detailed guidelines on how the policy should be structured.

According to Irdai guidelines, from September 1, insurance companies will issue only three-year third-party insurance policies for new cars and five-year third-party insurance policies for new two-wheelers. The premium will be collected for the entire term at the time of sale of insurance.

No third-party insurance will be cancelled by either the insurer or the insured except on the following grounds:

(a) Double insurance

(b) Vehicle not in use anymore because of total loss or constructive total loss

(c) ln the event the vehicle is sold and/or transferred

With regard to the own damage component, the regulator said companies may offer policyholder two options:

Long-term package cover offering both third-party insurance and own damage insurance for three years or five yearsA bundled cover with a three-year or five-year term (as applicable) for the third-party component and a one-year term for the own damage

With regard to the own damage component of the long-term package covers, the regulator said that insurers may price it in line with their current approach for pricing.

The regulator added that all add-ons, currently existing with the insurer, may be offered on a long-term basis, as part of the package cover co-terminus with the basic product. The insurers may price them in line with their current approach for pricing.

With regard to the Insured Declared Value (IDV) for long-term package cover, insurers shall take cognisance of the movement of IDV over time for all relevant purposes including underwriting, pricing and settlement of claims. No claim bonus would be applicable on own damage component only when the policy term has been completed, said Irdai.

"Usually, third-party premiums increase every year. Now, the advantage is that the customer gets certainty of the premium over the entire period of the policy. In case of own damage, the premium goes down because the Insured Declared Value (IDV) decreases due to depreciation. But in case of a long-term comprehensive policy, we can factor in the IDV since it is a structured discount. Companies can foresee how the IDV will go down,'' said Sanjay Datta, chief - underwriting and claims, ICICI Lombard General Insurance.

While the long-term motor insurance product is only for new vehicles, SBI General Insurance is working on an option to offer it to customers with existing vehicles as well, said Puneet Sahni, head- product development.

"On the customers' end, the lump sum amount to be paid up front increases marginally for a long-term policy. However, it is negligible when compared to the total amount paid over three years including increase in TP premium annually, in the case of regular motor insurance cover," he said.

If cash flow is an issue for consumers, remember it is just a small percentage in the entire cost of the new vehicle. There could be premium financing options available, Datta added.

It is advisable to buy a long-term comprehensive policy if you can afford it, said Kapil Mehta, co-founder, SecureNow Insurance Broker. "If you buy only the third-party insurance for the long term and buy own damage insurance for only one year, then chances are that you may forget to renew it at the end of the year. If you buy a comprehensive plan for the long term, you can be done with it,'' he said.

However, according to Animesh Das, head of product strategy, ACKO General Insurance, it is advisable to take a three-year third year policy and a one-year own damage policy so that one gets an option to shift the insurer in the second year for own damage coverage, in case of non-satisfactory service levels.

Due to the increase in cost, at the time of car/bike purchase, customers may end up negotiating on the variants/features of the car/bike, in case of budget constraint.

"As per the currently applicable regulations, insurers cannot offer part payment or EMI for the insurance. Though, a customer can get it factored into loan amount from his loan provider,'' Das added.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)