For many investors who are eagerly searching for a best investment plan after retirement, a strategic combination of NPS and EPF with voluntary contributions through VPF can result in a diversified and stable retirement fund.

Retirement planning requires choosing the right investment strategy that provides the monetary safety net in your golden years. Among the schemes available, The National Pension Scheme (NPS) and Employee Provident Fund (EPF) emerge as two popular schemes that offer retirement benefits in India. Both schemes relay excellent returns, but which is the most suitable option for investment through a retirement lens? This blog determines to compare the features of both schemes, along with benefits and suitability for different retirement objectives and help you choose the best investment plan for retirement in India.

Understanding NPS and EPF - Which one is best retirement plan

National Pension System (NPS)

The National Pension System is a government-backed retirement financial savings scheme launched in January 2004. Its purpose is to provide pension solutions to all Indian citizens, including those who work in the private sector. NPS provides a combination of flexibility, transparency, and tax advantages. NPS is regarded as one of the best investment for retirement planning so check out its features mentioned below :

Key Features of NPS:

- Eligibility: Open to all Indian citizens elderly 18-70.

- Investment Choices: Subscribers can select between Active Choice (in which they can decide the allocation of finances among equity, company bonds, and government securities) and Auto Choice (in which the allocation is achieved mechanically based totally on the subscriber’s age).

- Tax Benefits: Contributions are eligible for tax deductions under Section 80C, 80CCD(1B), and 80CCD(2) of the Income Tax Act.

- Returns: Market-linked returns, which can vary based on the performance of the underlying assets.

- Withdrawal: Partial withdrawals are allowed under certain conditions. At retirement, 60% of the corpus can be withdrawn tax-free, and 40% must be used to purchase an annuity.

Check out the National pension scheme nps calculator to explore how much you need to invest to achieve your financial goal with a National Pension Scheme Investment.

Employees’ Provident Fund (EPF)

The Employees’ Provident Fund is a mandatory savings scheme for salaried employees in India, governed by the Employees' Provident Fund Organisation (EPFO). It is designed to provide a lump sum amount to employees at the time of retirement. So if you are looking for a good investment plan for retirement plan then EPF is something that you can consider, check out its key features below :

Key Features of EPF:

- Eligibility: Mandatory for monthly salaries of up to ₹15,000 in establishments with 20 or more employees.

- Contribution: Both the organisation and the employee contribute 12% of the worker’s simple salary and dearness allowance to the EPF account.

- Tax Benefits: Employee contributions qualify for tax deductions under Section 80C.

- Returns: Offers fixed returns declared annually using the EPFO, usually higher than other constant-profits devices.

- Withdrawal: Allowed on particular events such as retirement, unemployment, or necessary life activities (e.g., marriage, education, clinical emergencies).

Comparing NPS and EPF for choosing the ideal retirement plan for your future

|

|

NPS

|

EPF

|

|

Investment Returns

|

NPS returns are

marketplace-connected, meaning they rely upon the performance of the fairness, corporate bonds, and authorities securities wherein the funds are invested. Historically, NPS has supplied appealing returns, especially in the equity, which could vary between 10-14%.

|

EPF gives constant returns declared yearly using the EPFO. The interest price for EPF has historically ranged between 89%, making it a strong and reliable alternative for risk-averse investors.

|

|

Risk and Flexibility

|

NPS permits subscribers to choose their funding mix, offering more flexibility and the potential for better returns.

However, it additionally comes with higher hazards, specifically in equity.

|

EPF is a low-chance investment with guaranteed returns, making it appropriate for conservative traders. The fixed interest price ensures balance and protection of the corpus.

|

|

Tax Benefits

|

Contributions up to ₹1.5 lakh are tax deductible under Section 80C. An additional ₹50,000 can be claimed under Section 80CCD(1B). Employer contributions are also tax deductible under section 80CCD(2).

Upon retirement, 60% of the corpus can be withdrawn tax-free, while the the remaining 40% must be used to purchase an annuity, subject to tax.

|

Contributions up to ₹1.5 lakh are tax deductible under Section 80C. Maturity gains and corpus withdrawals are tax-free, provided certain conditions are met (such as five years of continuous employment).

|

|

Withdrawal Rules

|

Partial retirement is allowed in certain circumstances such as education, marriage, purchase of a house, and medical treatment.

Upon retirement, 60% of the corpus can be withdrawn tax-free, and 40% must be used to purchase an annuity.

|

Withdrawals are allowed in certain circumstances, such as retirement, unemployment, or specific major life events. If the employee has completed five years of continuous service, the entire corpus is tax-free.

|

Suitability for Different Retirement Goals

NPS: Ideal for Higher Risk Appetite and Long-Term Growth

NPS is appropriate for persons with a high-risk tolerance who are seeking a long-term boom. The flexibility to pick out the funding blend allows for potential better returns, particularly with a better allocation to equities. This makes NPS an appealing alternative for younger investors who have an extended funding horizon and might resist marketplace fluctuations.

EPF: Ideal for Risk-Averse Investors Seeking Stability

EPF is good for conservative traders looking for stability and guaranteed returns. The constant price and tax-free corpus make it a dependable alternative for folks who pick low-hazard funding. It is specifically useful for salaried employees who prefer a trouble-loose, automated deduction from their income.

Creating a Large Tax-Free Corpus Before Retirement via choosing the right investment strategy

One powerful strategy to maximize retirement financial savings is to switch voluntary contributions from the Voluntary Provident Fund (VPF) to the NPS earlier than retirement. Here’s how this can be useful:

Understanding VPF

VPF is an extension of EPF wherein personnel can contribute voluntarily beyond the required 12% of their fundamental profits. The interest rate for VPF is similar to that for EPF, and the contributions are eligible for tax deductions below Section 80C.

Benefits of Transferring VPF Contributions to NPS

1. Higher Returns:

- By moving VPF contributions to NPS, buyers can experience the higher potential returns offered by the usage of the marketplace-linked investments in NPS, mainly in equities.

2. Additional Tax Benefits:

- NPS offers additional tax deductions beneath Section 80CCD(1B) and 80CCD(2), which could assist reduce taxable income similarly.

3. Flexibility in Investment:

- NPS offers the power to choose the investment blend based on individual danger tolerance and retirement dreams.

4. Creating a Large Corpus:

- Regular contributions and better returns can assist create a high corpus over the years, ensuring economic protection in retirement.

Example: Maximizing Retirement Corpus

Assume an individual has been contributing to VPF and decides to switch the amassed corpus to NPS at the age of forty-five. Here’s how the corpus can develop:

- VPF Corpus at Age 45: ₹10,00,000

- Annual Contribution to NPS: ₹1,00,000

●Rate of Return (NPS): 12%

By shifting the VPF corpus and making normal contributions to NPS, the man or woman can benefit from the power of compounding and doubtlessly accumulate a massive corpus by the age of 60.

Conclusion: Which is the Ideal Investment Retirement Plan between NPS and EPF ?

Selecting between NPS and EPF are largely dependent on a person’s financial situation, goal, risk tolerance and retirement plan. While both the schemes offer benefits, a mix of these can provide a balanced, structured retirement portfolio.

Why Choose NPS?

- Increased return potential through market-linked investments.

- Flexibility in choosing the investment mix.

- Additional tax benefits under sections 80CCD(1B) and 80CCD(2).

- Suitable for individuals with high-risk appetites and long-term growth goals.

Why Choose EPF?

- Guaranteed, low-risk fixed returns.

- tax-free corpus when due.

- Suitable for conservative investors looking for comfort and security.

- Automatic deductions for salaried employees.

For many investors who are eagerly searching for a best investment plan after retirement, a strategic combination of NPS and EPF with voluntary contributions through VPF can result in a diversified and stable retirement fund. Investments into the mix regularly, based on investment goals and changing market conditions can further increase the chances of a secure and prosperous retirement.

Don’t miss out on the opportunity to maximize your retirement savings. Start investing in NPS and EPF today to secure your financial future.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

![submenu-img]() 'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'

'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

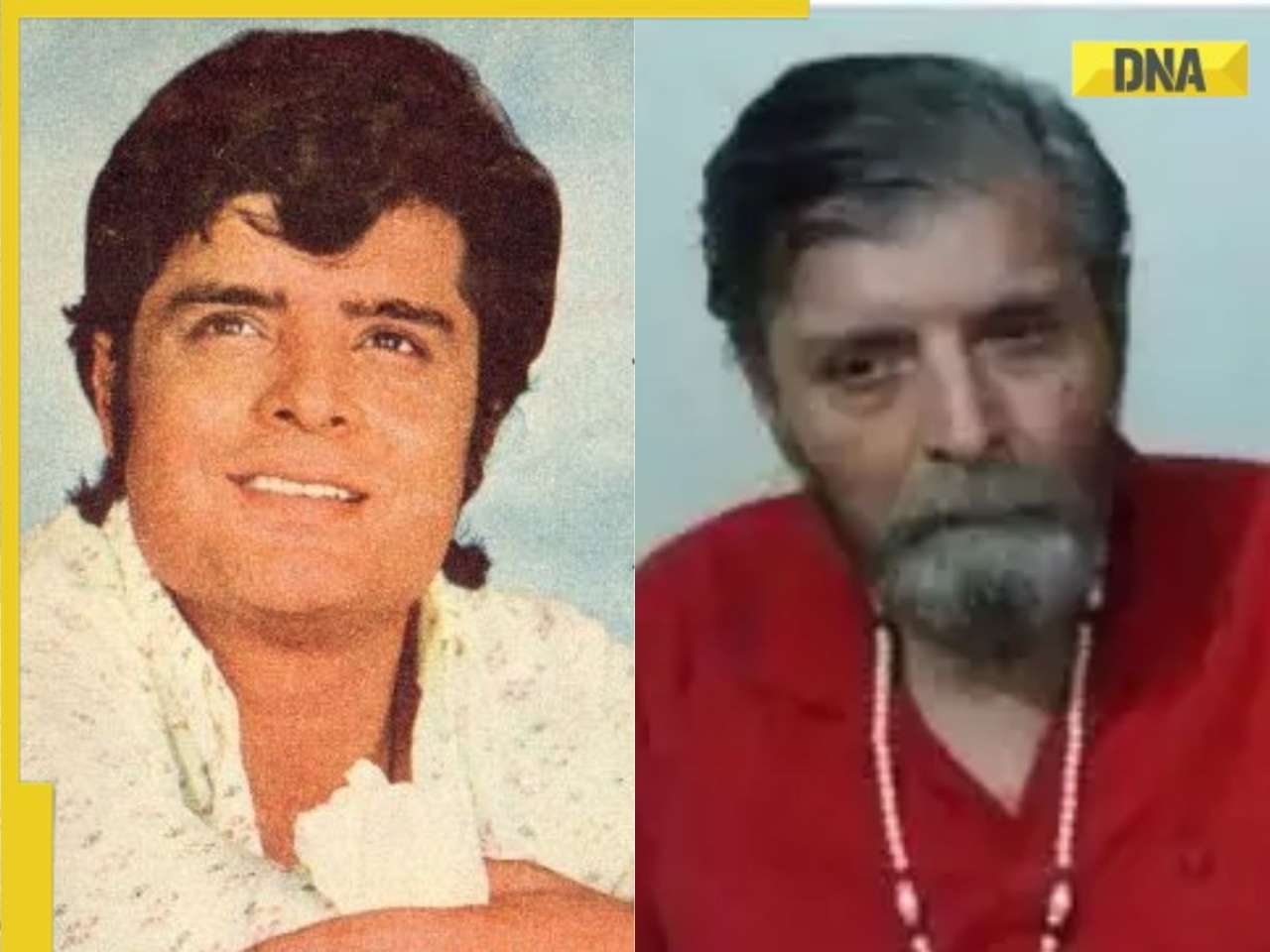

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless

This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() 2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested

2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested![submenu-img]() iPhone 16 लॉन्च, Apple Watch Series 10 से भी उठा पर्दा, जानें इसके रेट और फीचर्स

iPhone 16 लॉन्च, Apple Watch Series 10 से भी उठा पर्दा, जानें इसके रेट और फीचर्स![submenu-img]() Kalindi Express को उड़ाने की साजिश के पीछे था IS का हाथ? खुरासान मॉड्यूल पर गहराया शक

Kalindi Express को उड़ाने की साजिश के पीछे था IS का हाथ? खुरासान मॉड्यूल पर गहराया शक![submenu-img]() Mpox In India: भारत में एमपॉक्स के पहले केस की पुष्टि, स्वास्थ्य मंत्रालय ने कहा- यह एक अलग मामला

Mpox In India: भारत में एमपॉक्स के पहले केस की पुष्टि, स्वास्थ्य मंत्रालय ने कहा- यह एक अलग मामला![submenu-img]() UP Crime News: गोंडा में इंसानियत शर्मसार, नाबालिग के साथ चलती कार में गैंग रेप

UP Crime News: गोंडा में इंसानियत शर्मसार, नाबालिग के साथ चलती कार में गैंग रेप ![submenu-img]() GST Council की मीटि��ंग में बड़ा फैसला, कैंसर की दवा और नमकीन पर टैक्स घटाया

GST Council की मीटि��ंग में बड़ा फैसला, कैंसर की दवा और नमकीन पर टैक्स घटाया![submenu-img]() Hyundai Alcazar facelift launched in India: Check price, design and other features

Hyundai Alcazar facelift launched in India: Check price, design and other features![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...

Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...![submenu-img]() Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…

Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…![submenu-img]() Meet man, who worked as daily wager, cracked NEET exam with AIR...

Meet man, who worked as daily wager, cracked NEET exam with AIR...![submenu-img]() SSC CGL 2024 exam begins today: Check important guidelines, other details here

SSC CGL 2024 exam begins today: Check important guidelines, other details here![submenu-img]() Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...

Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...![submenu-img]() Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder

Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...

Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...![submenu-img]() Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…

Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…![submenu-img]() Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..

Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..![submenu-img]() Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik

Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik![submenu-img]() Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..

Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..![submenu-img]() This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...

This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...![submenu-img]() 7 countries with most UNESCO World Heritage sites; check how many India has

7 countries with most UNESCO World Heritage sites; check how many India has![submenu-img]() Top five anti-ageing skincare secrets by Nita Ambani

Top five anti-ageing skincare secrets by Nita Ambani![submenu-img]() India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss

India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...

Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...![submenu-img]() First case of Mpox confirmed in India, patient put under isolation

First case of Mpox confirmed in India, patient put under isolation![submenu-img]() Rameshwaram Cafe blast: NIA files chargesheet against four accused

Rameshwaram Cafe blast: NIA files chargesheet against four accused![submenu-img]() Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)