Have you ever been curious about how to begin your investment journey with limited funds? Or perhaps you are looking for a way to invest constantly without any hassle of timing the market? Here’s where Systematic Investment Plans (SIPs) can help.

By investing small amounts periodically, you can take advantage of the power of compounding and prepare for a robust financial future. Discussed here ways an SIP can play an integral role in financial planning for young professionals.

1) Importance of starting early

Beginning your SIPs early can make a considerable difference to your financial growth. The compounding effect works best when investments are performed over a longer duration. By beginning early, young professionals can accumulate a considerable corpus by the time they reach their goals. For example, using a mutual fund calculator, you can see how a small amount invested regularly can grow considerably over time owing to compound interest. The earlier you begin, the more time your money gets to grow, which can result in greater wealth accumulation than beginning later in life. Moreover, beginning early endows the flexibility to step up your SIP amount gradually as your income grows.

2) Aligning SIPs with financial goals

SIPs are versatile and can be aligned with distinct goals such as purchasing a home, financing higher education or planning a vacation trip. It is crucial to figure out your short-term and long-term goals and select the correct SIP mutual fund schemes that line up with these objectives. For short-term goals, debt or hybrid mutual fund schemes may be favourable, while equity mutual funds are often recommended for long-term goals owing to their potential to yield higher returns. Whether you are planning for retirement or saving for a down payment on a house, SIPs can assist you in systematically attaining these financial goals. By mapping your SIPs to specific goals, you can track your progress and remain motivated to continue investing.

3) Choosing the right mutual funds

Selecting the right mutual funds is essential for the success of your SIP investments. Factors you must consider are the fund’s previous performance, expense ratio and the fund manager’s track record. Diversifying your investments through distinct mutual funds, such as debt, equity and hybrid funds, can help balance returns and risk. Equity funds tend to offer higher returns but come with higher risk, while debt funds are usually safer with more stable returns. It is advisable to get in touch with a financial professional to choose the most favourable funds depending on your risk tolerance level and goals. A well-selected portfolio can enhance the SIP's performance and help you attain your objectives efficiently.

4) Tax benefits of SIPs

Investing in SIPs can even offer tax benefits, especially via Equity-Linked Savings Schemes (ELSS). Under Section 80C, investments up to ₹1.50 lakh in ELSS funds qualify for tax deductions. This dual benefit of potential wealth creation and tax saving makes SIPs an enticing option for young professionals looking to optimise their tax liability. ELSS funds have a lock-in period of three years, which is shorter than other tax-saving instruments. This makes them an attractive and flexible option for tax-conscious investors. By investing in ELSS via SIPs, you can disseminate your investment over the years and lower the burden of making a lump sum investment at the end of the financial year.

5) Automating investments for consistency

One of the prudent features of SIP is the potential to automate your investments. By setting up an automatic debit from your bank account, you ensure your investments are disciplined and consistent. This automation eliminates the temptation to time the market, which can be a common mistake among investors. Consistent investing through SIPs assists in averaging out the investment cost over time, commonly called rupee cost averaging. This strategy lowers the effect of market volatility and assists in accumulating more units when prices are low. Automation even makes it simpler to stick to your investment plan without the need for constant assessment and manual transactions.

6) Adapting SIPs during market volatility

Market volatility is inevitable, but SIPs can help you manage such scenarios. During market downturns, the fixed investment amount purchases more mutual fund units and during market upswings, it purchases fewer units. This approach assists in averaging the buying cost over time and potentially lowers the effect of market volatility. It is essential to remain invested and avoid withdrawing during market downturns to maximise the benefits of SIPs. Long-term investors can benefit from market volatility by continuing their SIPs for the long term. Always remember, remaining committed to your SIPs during both bad and good market phases can assist attain your financial goals effectively.

Ending note

SIPs play a crucial role in financial planning for young professionals. They promote disciplined investing, offer compounding benefits, and provide flexibility to align with distinct goals. By choosing the correct mutual funds, leveraging tax benefits, automating investments, and remaining resilient during market volatility, SIPs can considerably enhance your financial health. So, do not procrastinate; begin with investments early, and remain consistent for a prosperous financial future.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

![submenu-img]() 'I’ve done my part...': CSK star all-rounder bids adieu to international cricket

'I’ve done my part...': CSK star all-rounder bids adieu to international cricket![submenu-img]() Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...

Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'

Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'![submenu-img]() Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener

Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener![submenu-img]() Uttar Pradesh News: 'दंड संहिता की जगह बुलडोजर...' Akhilesh Yadav ने Yogi Adityanath पर साधा निशाना

Uttar Pradesh News: 'दंड संहिता की जगह बुलडोजर...' Akhilesh Yadav ने Yogi Adityanath पर साधा निशाना![submenu-img]() 'कम बोलें, घर पर रहें', US में राहुल गांधी का RSS पर तंज, महिलाओं को लेकर यही है उनका प्लान

'कम बोलें, घर पर रहें', US में राहुल गांधी का RSS पर तंज, महिलाओं को लेकर यही है उनका प्लान ![submenu-img]() Ranchi Crime News: अब रांची के अस्पताल की लिफ्ट में महिला डॉक्टर से गंदी हरकत, मच गया बवाल

Ranchi Crime News: अब रांची के अस्पताल की लिफ्ट में महिला डॉक्टर से गंदी हरकत, मच गया बवाल![submenu-img]() Karnataka Road Accident: सरकारी बस में बैठे यात्री ने की उल्टी, दो कारों में हो गई भीषण टक्कर, मां-बेटे समत 6 लोगों की मौत

Karnataka Road Accident: सरकारी बस में बैठे यात्री ने की उल्टी, दो कारों में हो गई भीषण टक्कर, मां-बेटे समत 6 लोगों की मौत![submenu-img]() कर्जदारों पर बैंकों का दोहरी मार, लोन हुआ महंगा, सरकारी बैंकों के बाद अब HDFC ने भी बढ़ाए ब्याज के दर

कर्जदारों पर बैंकों का दोहरी मार, लोन हुआ महंगा, सरकारी बैंकों के बाद अब HDFC ने भी बढ़ाए ब्याज के दर![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

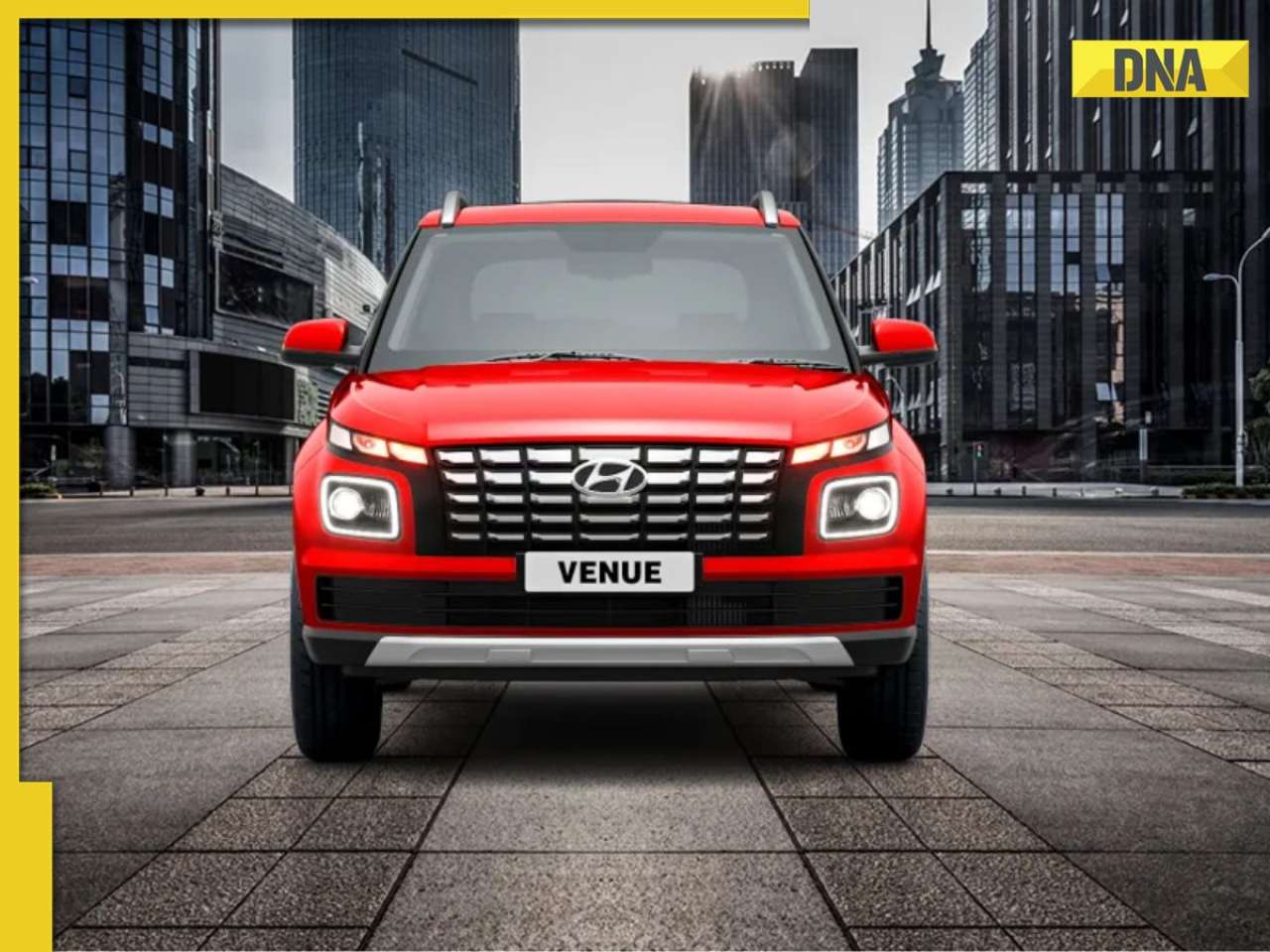

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...

Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...![submenu-img]() Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...

Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...![submenu-img]() Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects

Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects![submenu-img]() Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...

Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...

Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...![submenu-img]() Ratan Tata's company invests Rs 950 crore in this firm, plans to build...

Ratan Tata's company invests Rs 950 crore in this firm, plans to build...![submenu-img]() Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...

Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...![submenu-img]() Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...

Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...![submenu-img]() Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...

Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...![submenu-img]() From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story

From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story![submenu-img]() 6 reasons why you should buy Volkswagen Virtus

6 reasons why you should buy Volkswagen Virtus![submenu-img]() Apple to Amazon: First products launched by big tech giants

Apple to Amazon: First products launched by big tech giants![submenu-img]() Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...

Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...![submenu-img]() This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...

This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day

Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day![submenu-img]() 'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally

'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally![submenu-img]() Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….

Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….![submenu-img]() Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)