Xi’an, the capital of Shaanxi province and the cradle of the Chinese civilisation, is providing a new army in the form of graduates who are being groomed for employment in China’s outsourcing industry

Xi’an, the capital of Shaanxi province in central China and the cradle of the Chinese civilisation, is best known for its subterranean army of terracotta warriors that the Qin Emperor Shi Huang Di commissioned to protect him in his afterlife.

But today, a new army is marching out from Xi’an’s 100-plus universities and institutes of advanced learning: a be-robed army of graduates who are being groomed for employment in one of China’s emerging new landscapes in the outsourcing industry.

In fact, Xi’an, which has ambitions of becoming China’s BPO capital, is even planning to introduce graduate and post-graduate courses in outsourcing, business process design and business process engineering.

It isn’t just Xi’an, of course. Across several other cities in China — from Beijing to Shanghai to Tier 2 cities like Wuhan, Chengdu, Hangzhou, Xiamen and Dalian — plans are being drawn up to create an enabling environment to facilitate the speedy growth of the outsourcing industry by leveraging the country’s labour efficiency and famed infrastructural facilities.

According to the Global Outsourcing Report, those plans will culminate in a coup d’etat of sorts by 2015, when China is projected to overthrow India as the world’s top outsourcing destination.

“India’s period of competitive advantage (in outsourcing) may be changing rapidly,” notes the Global Outsourcing Report. “Local salaries in India are rising at 20% annually.

It appears that outsourcing to India will be reduced dramatically within the next 10 years as other countries mature and prepare to enter the global economy.”

Not everyone, however, is convinced of the inevitability of China’s rise in the outsourcing space. Just last week, Forrester Research came out with a report, China’s Diminishing Offshore Role, that took a dim view of the offshoring experience in China.

The Forrester study’s findings are significant because barely two years ago, the same agency had said that China was emerging as the key challenger to India.

The latest report by Forrester analyst John McCarthy, based on interviews with executives at 10 large IT services firms, however, concludes that the market in China “has not taken off as expected.”

While there continues to be demand from Japan and multinationals with operations in China, McCarthy says, “the offshore business from the US and Europe has been slow to materalise.” In fact, the report points out, China’s share of global delivery model (GDM) resources for the top services firms like Accenture has dropped, while India and the Philippines have seen far greater investment. Predictably, the Forrester report cites the inadequacy of English-speaking workers and of intellectual property laws and a high employee attrition rate as some of the reasons that underlie the disappointing growth of the outsourcing industry in China.

However, as Arijit Sengupta, a Harvard Business School- and Stanford-educated expert on outsourcing and CEO of technology firm BeyondCore, points out, China’s problems with English proficiency may be overstated. “I used to believe China’s English proficiency problem was an insurmountable barrier.

However, recent experiences have convinced me otherwise.” First, he says, the Chinese government is spending billions of dollars on English training. Second, when it comes to low-end data-entry work, Chinese entrepreneurs have developed process innovations that help them compensate for their weaknesses in English language skills with their strengths in symbol identification and transcription skills.

“The Chinese written language contains more than 3,500 characters, and so the Chinese are exceptionally good at symbol identification and transcription.”

The Forrester report quotes one of the executives it interviewed as saying that offshoring to China becomes viable only if costs in China are 20% cheaper than in India, but that costs in India and China are about the same now.

“Don’t buy the cost argument,” cautions David Scott Lewis, the Beijing-based senior vice-president of Startech Global Corporation, the outsourcing hub for Tsinghua University, China’s premier institute of higher learning.

“The idea that costs are about the same or even higher in China is both true and false. If you do all your work in Beijing, Shanghai or Shenzhen, the costs might be the same as in India.

But there are other options, like Dalian, Xi’an, Chengdu, Xiamen, Jinan… the list goes on and on.” In these Tier 2, 3 and 4 cities, costs are much lower than in the Tier 1 cities, he points out. Sengupta adds, “It is not about short-terms costs which vary widely from city to city in both India and China. In the long term, only the efficient survive.”

Additionally, the Forrester report says, the appreciation of the yuan against the dollar is also adding to the cost of outsourcing to China. According to one estimate, the cost of doing business in China, as a consequence of the rising yuan, could go up by about 10% over the next three years. But then, as Lewis points out, the rupee too has been appreciating against the dollar.

“Forrester’s facts are 100% right, but its view of China’s future importance is almost certainly 100% wrong,” asserts Sengupta. “Forrester says that while Chinese services firms support a vibrant local market, China has not achieved the offshore growth that people expected.

The absence of a significant offshore market is certainly a short-term setback, but the vibrant local market could be a long-term predictor of success. Chinese vendors serving local customers do not enjoy a labour cost advantage relative to their customers and thus have to be much more labour-efficient than Indian vendors.

Once these Chinese firms figure out how to serve US customers, they will become a credible threat to Indian vendors - unless India can get a lot more labour-efficient.

In particular, cautions Sengupta, Indian BPOs should be very careful about ceding low-end BPO work to the Chinese. “Many leading Indian BPOs are focussing on high-end work because the margins there are more attractive… But if Chinese BPOs gain a toe-hold in the low-end work, they will eventually work their way up into high-end work.”

China’s outsourcing industry is, of course, not without its challenges. Roc Yang, CEO of China Data Group, one of China’s largest BPOs, told DNA: “China is not doing as good a job in country-marketing itself in outsourcing as it’s done in manufacturing. Perhaps it’s because BPO is still a new concept in China.

And the industry is so fragmented - and under the administration of at least three ministries… It’s difficult to hear a unified voice from China at the international level.”

In fact, Yang says, Indian companies have it rather good, given the preferential treatment they get from their government and have nothing to fear from China’s perceived rise in outsourcing.

“India and China can play to their strengths, instead of competing against each other. Whereas India has great strengths in language proficiency and software development, China is strong in transaction-based services, and has its own market and in the Asia-Pacific.”

![submenu-img]() Meet Hital Meswani, close aide of Mukesh Ambani, highest paid employee of Reliance, his salary is Rs...

Meet Hital Meswani, close aide of Mukesh Ambani, highest paid employee of Reliance, his salary is Rs...![submenu-img]() Meet man, director of Rs 2,36,000 crore business, his father is...

Meet man, director of Rs 2,36,000 crore business, his father is...![submenu-img]() 'Deeply disheartened': Wrestler Sangram Singh reacts to Vinesh Phogat's retirement after Paris Olympics disqualification

'Deeply disheartened': Wrestler Sangram Singh reacts to Vinesh Phogat's retirement after Paris Olympics disqualification![submenu-img]() After donating Rs 3 crore for Ram Mandir construction, Akshay Kumar donates Rs 1.21 crore for Haji Ali renovation

After donating Rs 3 crore for Ram Mandir construction, Akshay Kumar donates Rs 1.21 crore for Haji Ali renovation![submenu-img]() Paris Olympics: Wrestler Aman Sehrawat enters semifinals of men’s 57 kg event, one win away from medal

Paris Olympics: Wrestler Aman Sehrawat enters semifinals of men’s 57 kg event, one win away from medal![submenu-img]() Aman Sehrawat: अमन सहरावत फाइनल में पहुंचने से चूके, अब पेरिस ओलंपिक में ब्रॉन्ज मेडल के लिए ठोकेंगे दावा

Aman Sehrawat: अमन सहरावत फाइनल में पहुंचने से चूके, अब पेरिस ओलंपिक में ब्रॉन्ज मेडल के लिए ठोकेंगे दावा![submenu-img]() Team India Hockey: 'यह मेडल खास है...' ओलंपिक में हॉकी टीम की जीत पर PM मोदी ने दी बधाई

Team India Hockey: 'यह मेडल खास है...' ओलंपिक में हॉकी टीम की जीत पर PM मोदी ने दी बधाई![submenu-img]() मोदी सरकार ने वक्फ बिल को JPC में भेजने का रखा प्रस्ताव, स्पीकर ओम बिरला बनाएंगे कमेटी

मोदी सरकार ने वक्फ बिल को JPC में भेजने का रखा प्रस्ताव, स्पीकर ओम बिरला बनाएंगे कमेटी![submenu-img]() 'आप इस तरह बात नहीं कर सकते...' अखिलेश यादव ने ऐसा क्या कह दिया कि भड़क गए अमित शाह

'आप इस तरह बात नहीं कर सकते...' अखिलेश यादव ने ऐसा क्या कह दिया कि भड़क गए अमित शाह![submenu-img]() पेरिस से बांग्लादेश लौटने पर मोहम्मद यूनुस का बड़ा बयान, आज लेंगे पीएम पद की शपथ

पेरिस से बांग्लादेश लौटने पर मोहम्मद यूनुस का बड़ा बयान, आज लेंगे पीएम पद की शपथ![submenu-img]() How rich is Drishti IAS owner Vikas Divyakirti? What are his other sources of income apart from coaching UPSC aspirants

How rich is Drishti IAS owner Vikas Divyakirti? What are his other sources of income apart from coaching UPSC aspirants![submenu-img]() After UPSC topper Tina Dabi, Smita Sabharwal, IAS officer Srushti Deshmukh's marksheet goes viral, check her marks

After UPSC topper Tina Dabi, Smita Sabharwal, IAS officer Srushti Deshmukh's marksheet goes viral, check her marks![submenu-img]() Meet woman who left high-paying corporate job, topped UPSC exam with AIR 1 without coaching, she is now posted as...

Meet woman who left high-paying corporate job, topped UPSC exam with AIR 1 without coaching, she is now posted as...![submenu-img]() NEET PG 2024 admit cards to be out today; check steps to download, direct link here

NEET PG 2024 admit cards to be out today; check steps to download, direct link here![submenu-img]() Not Sundar Pichai, Nandan Nilekani or Nikesh Arora…this 'Danveer' of IIT donated 288 crores to his institute

Not Sundar Pichai, Nandan Nilekani or Nikesh Arora…this 'Danveer' of IIT donated 288 crores to his institute![submenu-img]() Buddhadeb Bhattacharya, Stalwart Communist Leader And Former West Bengal CM, Passes Away At 80

Buddhadeb Bhattacharya, Stalwart Communist Leader And Former West Bengal CM, Passes Away At 80![submenu-img]() Vinesh Phogat Disqualification Explained: How Did Vinesh Phogat Miss Medal In Paris Olympics 2024?

Vinesh Phogat Disqualification Explained: How Did Vinesh Phogat Miss Medal In Paris Olympics 2024?![submenu-img]() Vinesh Phogat Disqualification: Vinesh Phogat Appeals To CAS, Asks For Joint Olympic Silver In Paris

Vinesh Phogat Disqualification: Vinesh Phogat Appeals To CAS, Asks For Joint Olympic Silver In Paris![submenu-img]() Who Is Sheikh Rehana Siddiq? Ex-PM Sheikh Hasina's Sister Who Escaped From Bangladesh With Her

Who Is Sheikh Rehana Siddiq? Ex-PM Sheikh Hasina's Sister Who Escaped From Bangladesh With Her![submenu-img]() Vinesh Phogat Disqualification: Why The Indian Wrestler Failed To Shed Extra Weight | Paris 2024

Vinesh Phogat Disqualification: Why The Indian Wrestler Failed To Shed Extra Weight | Paris 2024![submenu-img]() 'Deeply disheartened': Wrestler Sangram Singh reacts to Vinesh Phogat's retirement after Paris Olympics disqualification

'Deeply disheartened': Wrestler Sangram Singh reacts to Vinesh Phogat's retirement after Paris Olympics disqualification![submenu-img]() Paris Olympics: Wrestler Aman Sehrawat enters semifinals of men’s 57 kg event, one win away from medal

Paris Olympics: Wrestler Aman Sehrawat enters semifinals of men’s 57 kg event, one win away from medal![submenu-img]() 'True spirit of a warrior': Abhinav Bindra pens heartfelt note for Vinesh Phogat after Olympics disqualification

'True spirit of a warrior': Abhinav Bindra pens heartfelt note for Vinesh Phogat after Olympics disqualification![submenu-img]() Paris Olympics: Wrestler Aman Sehrawat enters QFs of men’s 57 kg freestyle event, Anshu Malik loses R16 bout

Paris Olympics: Wrestler Aman Sehrawat enters QFs of men’s 57 kg freestyle event, Anshu Malik loses R16 bout![submenu-img]() Meet actor earning Rs 5 crore per day to just have fun at Paris Olympics 2024, once Akshay Kumar's co-star, now does...

Meet actor earning Rs 5 crore per day to just have fun at Paris Olympics 2024, once Akshay Kumar's co-star, now does...![submenu-img]() Once Bollywood's top director, never gave a flop, arrogance ruined his career, is unmarried at 53; now struggling to...

Once Bollywood's top director, never gave a flop, arrogance ruined his career, is unmarried at 53; now struggling to...![submenu-img]() In pics: Neeti Mohan supports Indian athletes with 'unforgettable' live act in blue lehenga at Paris Olympics 2024

In pics: Neeti Mohan supports Indian athletes with 'unforgettable' live act in blue lehenga at Paris Olympics 2024![submenu-img]() Good news for Reliance Jio users: Mukesh Ambani offers 4 affordable plans with benefits priced at...

Good news for Reliance Jio users: Mukesh Ambani offers 4 affordable plans with benefits priced at...![submenu-img]() Inside Nita Ambani, Isha Ambani, Shloka Ambani's exotic jewellery collection

Inside Nita Ambani, Isha Ambani, Shloka Ambani's exotic jewellery collection![submenu-img]() Meet actress, 'bombshell of 2000s' who left India, shares videos of her plush home, now living in...

Meet actress, 'bombshell of 2000s' who left India, shares videos of her plush home, now living in...![submenu-img]() Govt refers Waqf Bill to Joint Parliamentary Committee amid demands for close scrutiny by opposition

Govt refers Waqf Bill to Joint Parliamentary Committee amid demands for close scrutiny by opposition ![submenu-img]() 'No interference in freedom...': Kiren Rijiju backs Waqf Bill in Lok Sabha

'No interference in freedom...': Kiren Rijiju backs Waqf Bill in Lok Sabha![submenu-img]() 'No interference in freedom...', says Kiren Rijiju as he backs Waqf Bill in Lok Sabha

'No interference in freedom...', says Kiren Rijiju as he backs Waqf Bill in Lok Sabha![submenu-img]() SC to hear plea against Bombay HC ban on hijab, burqa in colleges tomorrow

SC to hear plea against Bombay HC ban on hijab, burqa in colleges tomorrow![submenu-img]() 'Bharatiya Zameen Party...': Akhilesh Yadav hits out at centre over introduction of Waqf Bill in LS

'Bharatiya Zameen Party...': Akhilesh Yadav hits out at centre over introduction of Waqf Bill in LS ![submenu-img]() Wings of Refuge: Rafales escort Hasina to safety

Wings of Refuge: Rafales escort Hasina to safety![submenu-img]() Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister

Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister![submenu-img]() DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?

DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?![submenu-img]() DNA Explainer: Why is Bangladesh burning again?

DNA Explainer: Why is Bangladesh burning again?![submenu-img]() Voter Sentiment: Harris outshines Biden among young and non-white voters

Voter Sentiment: Harris outshines Biden among young and non-white voters![submenu-img]() After donating Rs 3 crore for Ram Mandir construction, Akshay Kumar donates Rs 1.21 crore for Haji Ali renovation

After donating Rs 3 crore for Ram Mandir construction, Akshay Kumar donates Rs 1.21 crore for Haji Ali renovation![submenu-img]() This trilogy grossed Rs 136000 crore at box office, but cast just got 'free sandwiches', lead actor was paid Rs 80 lakh

This trilogy grossed Rs 136000 crore at box office, but cast just got 'free sandwiches', lead actor was paid Rs 80 lakh![submenu-img]() Vikram Bhatt reveals why Aamir Khan never worked with him after Ghulam: 'I can't endlessly wait for...'

Vikram Bhatt reveals why Aamir Khan never worked with him after Ghulam: 'I can't endlessly wait for...'![submenu-img]() Gulshan Devaiah says giving silver medal to Vinesh Phogat at Paris Olympics 2024 would be ‘unfair’ to other athletes

Gulshan Devaiah says giving silver medal to Vinesh Phogat at Paris Olympics 2024 would be ‘unfair’ to other athletes![submenu-img]() ‘A beginning of infinite love': Naga Chaitanya, Sobhita Dhulipala engaged in traditional ceremony, first photos out

‘A beginning of infinite love': Naga Chaitanya, Sobhita Dhulipala engaged in traditional ceremony, first photos out![submenu-img]() Viral video: Four lion cubs emerging from their den and playing is the cutest thing you'll see today

Viral video: Four lion cubs emerging from their den and playing is the cutest thing you'll see today![submenu-img]() This is world's smallest tiger, darker than Royal Bengal tiger, is found in...

This is world's smallest tiger, darker than Royal Bengal tiger, is found in...![submenu-img]() DNA Verified: Bangladeshi Hindu cricketer Liton Das’s house set on fire? Know truth here

DNA Verified: Bangladeshi Hindu cricketer Liton Das’s house set on fire? Know truth here![submenu-img]() Heart over hurdles: French athlete proposes to boyfriend after record-breaking Paris Olympics race, watch viral video

Heart over hurdles: French athlete proposes to boyfriend after record-breaking Paris Olympics race, watch viral video![submenu-img]() Condoms provided to athletes at Olympics are far from ordinary, here's why

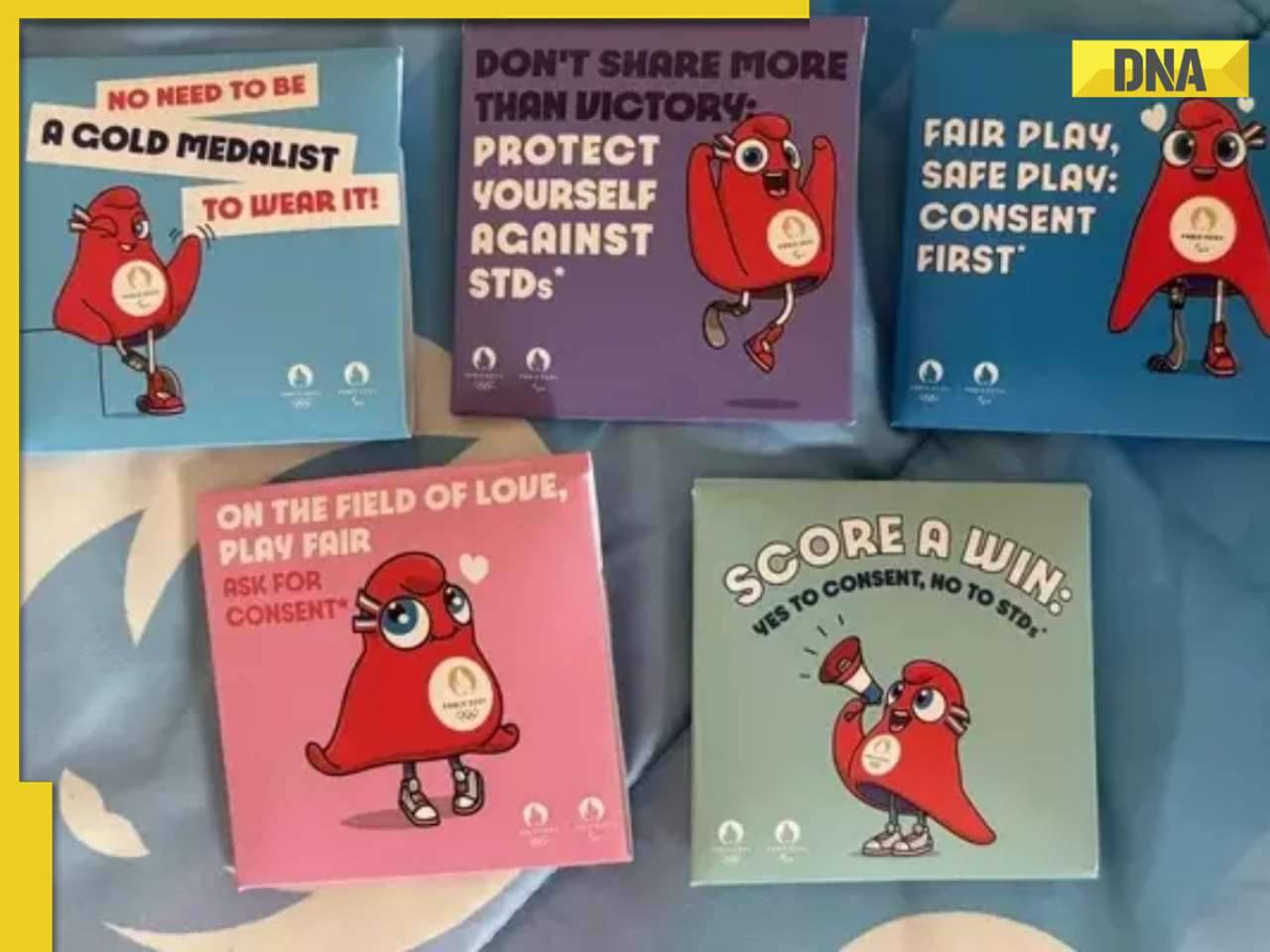

Condoms provided to athletes at Olympics are far from ordinary, here's why

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)