Kalyanasundharam Ramachandran has more than a decade of experience in card issuance, lifecycle management, and building and managing Systems of Record (SOR).

In the complex and rapidly evolving world of financial technology, mastering the intricacies of card issuance, lifecycle management, and robust systems of record (SOR) has become a pivotal element of success for financial institutions. This field encompasses the full spectrum of card operations, from issuing physical and virtual cards to managing their entire lifecycle, ensuring seamless functionality and compliance throughout.

The development and implementation of advanced systems of record are essential for handling vast amounts of transactional data, enhancing operational efficiency, and adhering to stringent regulatory requirements. A well-designed card management system not only improves customer satisfaction by reducing wait times and streamlining access but also fortifies security and compliance through real-time data processing and sophisticated risk management.

Kalyanasundharam Ramachandran has more than a decade of experience in card issuance, lifecycle management, and building and managing Systems of Record (SOR). He is highly capable of designing payment processing systems from scratch, covering all aspects, including card issuance, lifecycle management of cards, card transaction processing, and auditing transactions. From the moment a customer taps a card at a POS terminal to the final transfer of money from the customer's account to the merchant's account, Ramachandran has the experience, skills, and expertise to design and implement the entire process.

Kalyanasundharam Ramachandran stands out as a distinguished professional in this arena, having made significant strides in card issuance and lifecycle management. His career is marked by a series of groundbreaking achievements that have set new benchmarks in the industry.

His most notable accomplishment is the creation of a state-of-the-art, scalable card management system that has transformed card operations across multiple geographies. This system integrates both physical and virtual card issuance, allowing for instant virtual card activation upon approval. This innovation has drastically improved customer experience by minimizing wait times and expediting access to financial resources. The technical backbone of this system is a robust microservices architecture, enabling modular integration of various functionalities such as real-time data synchronization and risk management while adhering to global security standards.

Another key milestone in Ramachandran’s career was leading the overhaul of the organization's System of Record (SOR). This project involved transitioning from a legacy system plagued by performance bottlenecks to a cutting-edge platform designed for high efficiency and scalability. The new SOR, equipped with advanced database technologies and custom-developed middleware, handles and analyzes vast datasets with real-time analytics, significantly enhancing operational agility and data integrity. This overhaul not only improved transaction processing speed but also ensured compliance with evolving financial regulations through enhanced reporting and audit capabilities.

His impact extends beyond technological advancements; his work has also driven significant improvements in operational efficiency and customer satisfaction. Today, the framework developed by Kalyanasundharam Ramachandran handles roughly 250,000 card enrollments every month. For every new card issued, a comprehensive set of operations runs in the background, including eligibility checks, card account status verification, risk and compliance assessments, instrument credential generation, lifecycle management, network tokenization enrollment (if eligible), and external event scheduling.

All these processes are efficiently orchestrated by the new framework, leading to a 20% boost in operational efficiency and reduced round-trip delay. Additionally, the instant access to funding instruments through virtual cards provides customers with a seamless card issuance experience, reducing issues related to card activation by 30%. This efficiency not only enhances customer satisfaction but also frees up customer support time, allowing them to focus on other enterprise initiatives.

Kalyanasundharam Ramachandran, in his words, defines: "Usually in any enterprise system, the significance of the System of Record (SOR) is very less pronounced, but in the real world, it’s the wise Rafiki in a complex system. It digests any interaction in the system, starting from attempts, approvals, rejections, lifecycle events management, transactions, and more." He takes pride in architecting one such system where it seamlessly handles roughly 30 million database events on a daily basis, showcasing its robust capacity and reliability. Crafting an SOR to handle all these events efficiently without any lag is a humongous task, and Ramachandran's achievement in this area stands as a testament to his expertise and dedication.

Among the major challenges Ramachandran has overcome are the integration of virtual card technology and the management of card lifecycle events. The integration required a seamless solution to link virtual and physical card systems, which was achieved through a unified platform that synchronized data across both card types. Additionally, automating card lifecycle management processes addressed challenges related to card renewal, loss, or theft, improving response times and operational efficiency.

His work reflects a deep understanding of emerging trends and future directions in card management. He emphasizes the role of digital automation in accelerating card issuance processes and predictive analytics in managing card lifecycles. By leveraging machine learning algorithms and AI-driven insights, systems predict card usage patterns, preemptively address potential issues, and optimize card renewal cycles, significantly reducing downtime and enhancing user experience. Ramachandran envisions the integration of cutting-edge technologies such as blockchain, biometrics, and the Internet of Things (IoT) to further revolutionize card management.

Biometric authentication methods, including fingerprint scanning, facial recognition, and voice recognition, are poised to replace traditional PINs and passwords. This not only enhances security but also streamlines the user experience by enabling instant and secure access to financial services. Imagine a future where a user’s biometric data is securely stored on their card, allowing for instant verification and transaction approval at any point of sale.

IoT integration opens up new possibilities for personalized and contextual banking experiences. Smart devices can communicate with card management systems to provide real-time alerts and insights. For instance, a smart refrigerator could alert a user when it’s time to reorder groceries and facilitate payment directly through the card system, or a car’s onboard system could automatically manage fuel payments and maintenance costs. Furthermore, Ramachandran envisions the use of quantum computing in financial systems to solve complex encryption problems, making transactions faster and more secure. Quantum-resistant cryptographic algorithms could become the standard, protecting financial data from the potential threats posed by quantum computers.

Ramachandran’s forward-thinking approach and strategic technology adoption ensure that financial institutions can stay ahead of market demands and regulatory changes. His vision includes a future where adaptive AI continuously monitors regulatory environments and automatically updates compliance protocols, ensuring seamless adherence to global financial regulations without manual intervention.

Kalyanasundharam Ramachandran’s expertise in card issuance, lifecycle management, and systems of record exemplifies how innovative solutions can drive significant improvements in the financial technology sector. His contributions not only enhance operational efficiency and customer satisfaction but also set new industry standards and actively shape the future. His innovative solutions and strategic foresight set new standards in the industry, driving significant improvements in security, efficiency, and personalization in card management.

![submenu-img]() 'I’ve done my part...': CSK star all-rounder bids adieu to international cricket

'I’ve done my part...': CSK star all-rounder bids adieu to international cricket![submenu-img]() Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...

Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'

Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'![submenu-img]() Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener

Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener![submenu-img]() Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत

Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत![submenu-img]() Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'

Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'![submenu-img]() Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका

Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका![submenu-img]() India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत

India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत![submenu-img]() रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'

रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

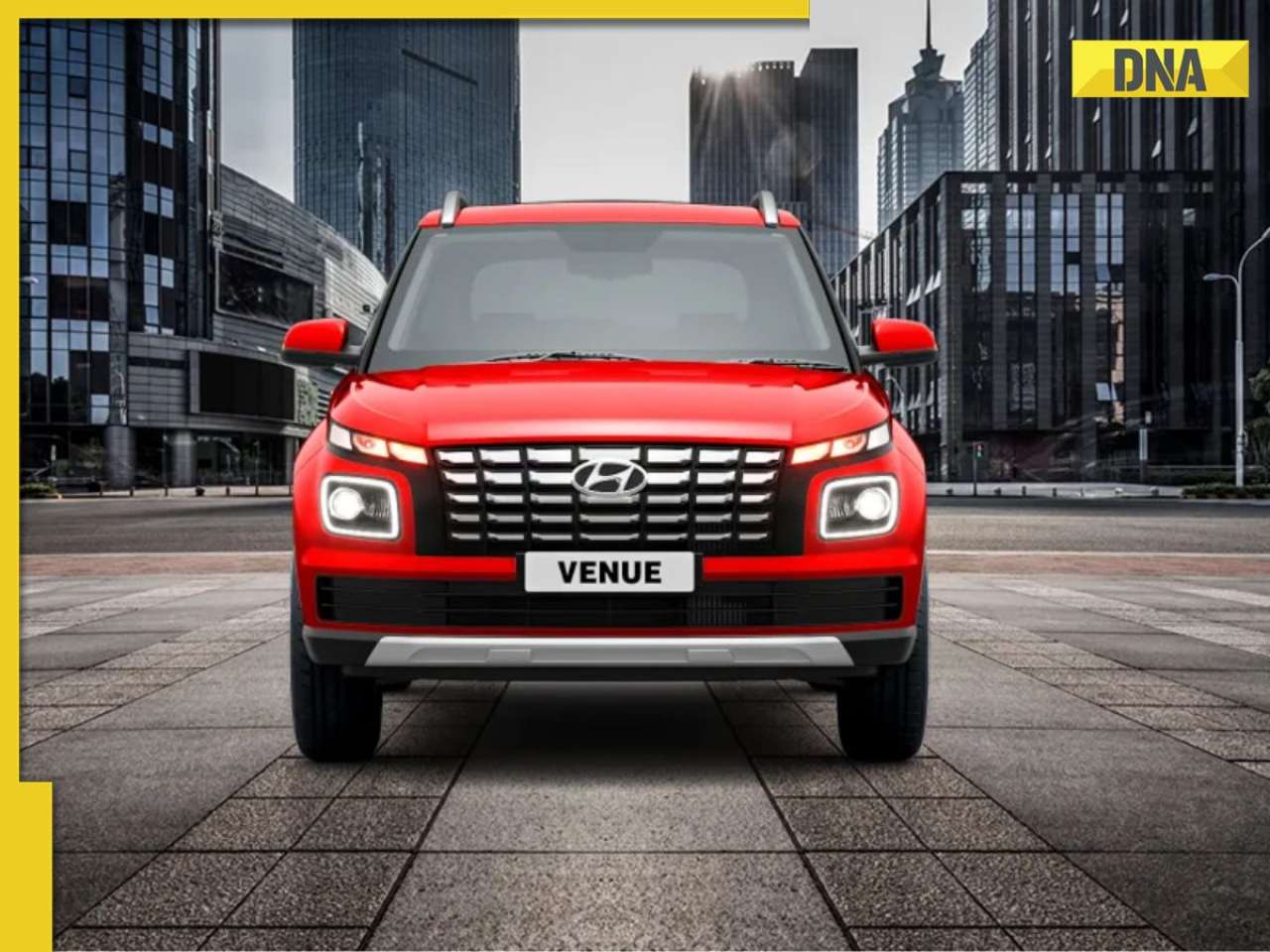

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...

Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...![submenu-img]() Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...

Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...![submenu-img]() Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects

Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects![submenu-img]() Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...

Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...

Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...![submenu-img]() Ratan Tata's company invests Rs 950 crore in this firm, plans to build...

Ratan Tata's company invests Rs 950 crore in this firm, plans to build...![submenu-img]() Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...

Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...![submenu-img]() Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...

Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...![submenu-img]() Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...

Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...![submenu-img]() From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story

From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story![submenu-img]() 6 reasons why you should buy Volkswagen Virtus

6 reasons why you should buy Volkswagen Virtus![submenu-img]() Apple to Amazon: First products launched by big tech giants

Apple to Amazon: First products launched by big tech giants![submenu-img]() Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...

Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...![submenu-img]() This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...

This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day

Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day![submenu-img]() 'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally

'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally![submenu-img]() Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….

Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….![submenu-img]() Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)