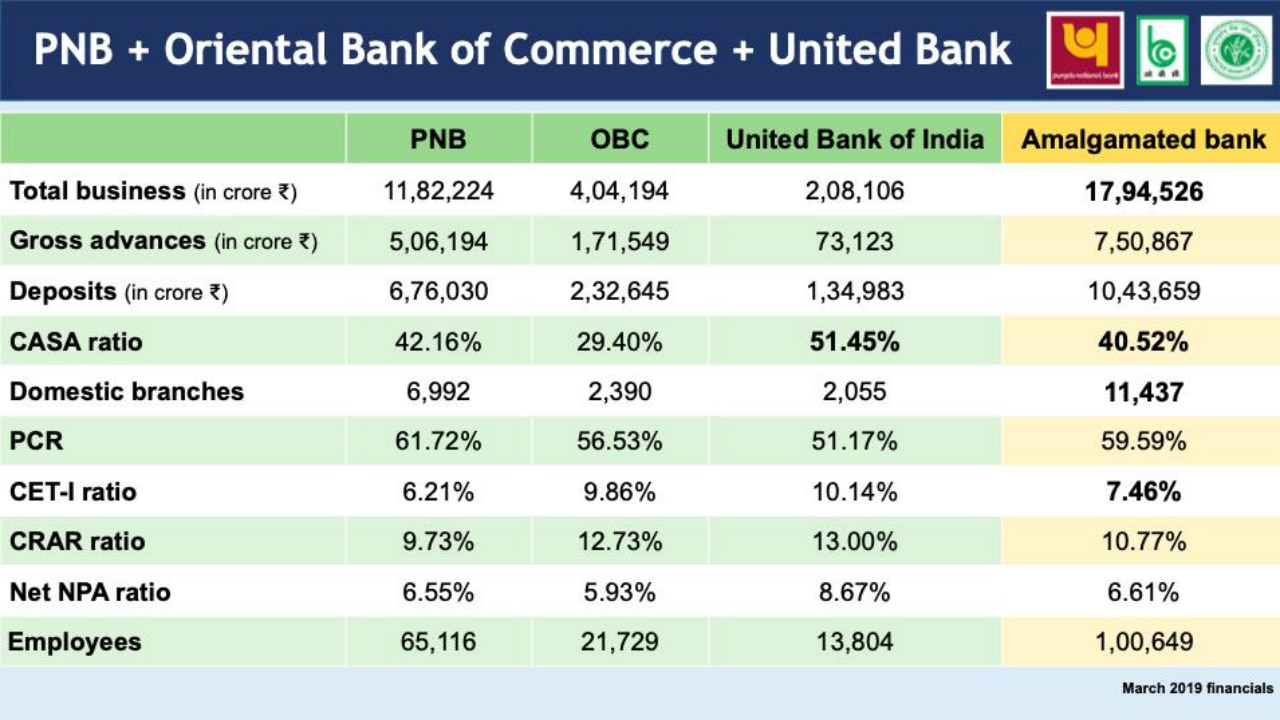

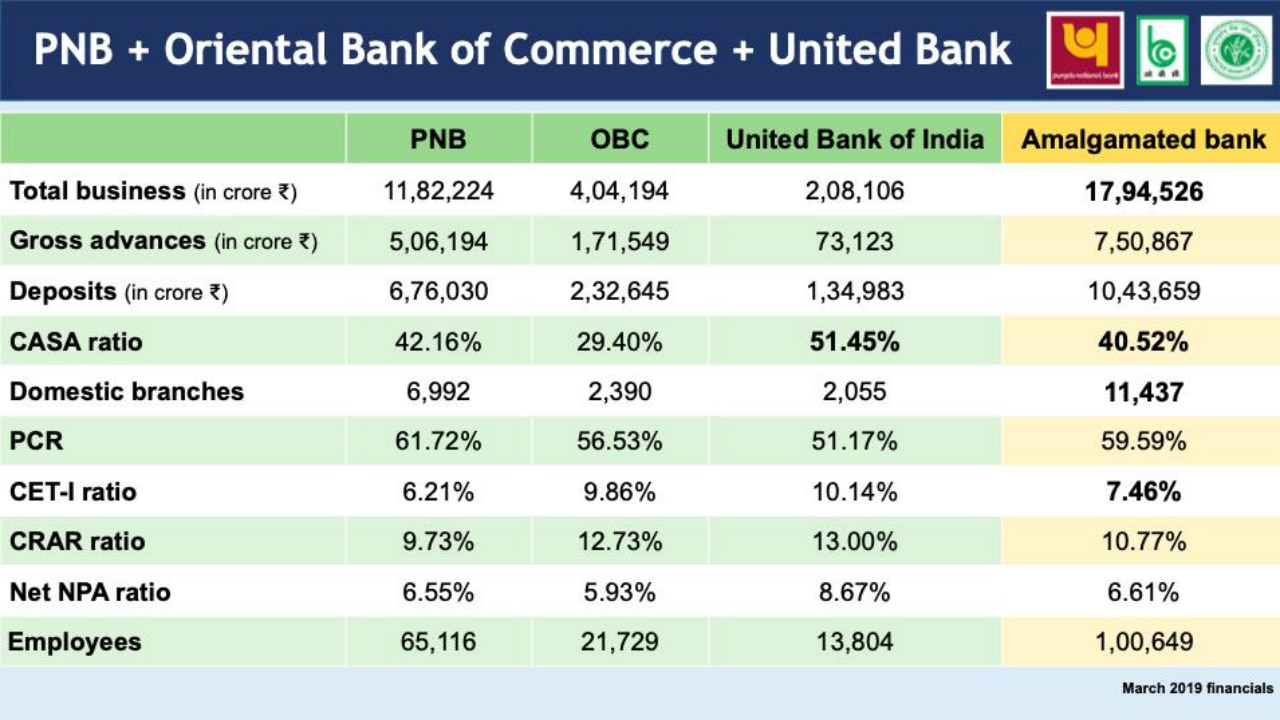

The new PSB will have a total business of nearly Rs 18 lakh crore.

The government on Friday announced the merger of Punjab National Bank, Oriental Bank of Commerce and United Bank of India to create the second-largest banking network in the country with 11,431 branches.

"Punjab National Bank (PNB), Oriental Bank of Commerce (OBC) and United Bank of India (UBI) will be brought together and they shall form the second largest public sector bank (PSB) with the business of Rs 17.95 lakh crore," Finance Minister Nirmala Sitharaman said at a press conference in Delhi.

Also Read: Here is how mega-merger of PSBs will impact bank account holders

She said the creation of next-generation banks was imperative for India to become a US $5 trillion economy in the next five years.

Besides, seven other banks will be merged to form three larger Public Sector Banks (PSBs). The announcement made by Sitharaman covers 10 PSBs which will together form second, third, fourth and seventh largest PSB networks in the country.

Also Read: Sitharaman announces merger of 10 state-run banks to form 4 mega PSBs

Consolidated PNB+OBC+United Bank to be second largest PSB with Rs18 lakh crore business and second-largest branch network in India, Finance Secretary Rajeev Kumar said.

Scale, nationwide and global presence, and high CASA (Current Account Savings Account) to drive growth, he added.

Sitharaman said this will bring the total number of PSBs in India to 12.

"These big banks will have enhanced capacity to increase credit and bigger risk appetite, with national presence and global reach," said Sitharaman. Nearly 88 per cent of all PSB business will be with these consolidated banks," she said.

Also Read: Everything you need to know about new PSBs

All PSU banks will now have a non-executive chairman, a position earlier existed only in State Bank of India (SBI), India's largest lender. The PSBs will have to appoint a Chief Risk Officer, who will be provided market-level compensation. Longer terms will be given to directors on management committees to ensure continuity.

Apart from this, the government announced Rs 55,250 crore upfront as capital infusion in the PSBs.

Last week, Ms Sitharaman had announced that the government would release Rs 70,000 crore for bank capitalisation. While this amount is to be released upfront, she also announced additional lending and liquidity to the tune of Rs 5 lakh crore to PSBs.

(With ANI inputs)

![submenu-img]() MS Dhoni finally reacts to 'Thala for a reason' trend on social media

MS Dhoni finally reacts to 'Thala for a reason' trend on social media![submenu-img]() Shah Rukh Khan called his blockbuster 'rubbish', director reveals superstar 'has a habit of...'

Shah Rukh Khan called his blockbuster 'rubbish', director reveals superstar 'has a habit of...'![submenu-img]() This government bank is to be sold, LIC owns big stake in it, know who all are in the race to buy it

This government bank is to be sold, LIC owns big stake in it, know who all are in the race to buy it![submenu-img]() Meet man, who was office boy at Infosys, earned Rs 9000 monthly, now CEO of two companies, he is...

Meet man, who was office boy at Infosys, earned Rs 9000 monthly, now CEO of two companies, he is...![submenu-img]() 13 Best Websites Offer Free Crochet Patterns

13 Best Websites Offer Free Crochet Patterns![submenu-img]() 'आपकी प्रतिष्ठा को ठेस किसने पहुंचाई.. कौन है आपके पीछे', Akhilesh Yadav ने CM Yogi पर क्यों कसा ये तंज?

'आपकी प्रतिष्ठा को ठेस किसने पहुंचाई.. कौन है आपके पीछे', Akhilesh Yadav ने CM Yogi पर क्यों कसा ये तंज?![submenu-img]() Live: जिस तकनीक से तलाशे जाते हैं क्रिमिनल, उससे तलाशे जा रहे वायनाड में शव

Live: जिस तकनीक से तलाशे जाते हैं क्रिमिनल, उससे तलाशे जा रहे वायनाड में शव![submenu-img]() Neet Paper Leak: 'दोबारा परीक्षा की जरूरत नहीं, दो जगह तक सीमित है लीक' सुप्रीम कोर्ट ने दी NTA को बड़ी सलाह

Neet Paper Leak: 'दोबारा परीक्षा की जरूरत नहीं, दो जगह तक सीमित है लीक' सुप्रीम कोर्ट ने दी NTA को बड़ी सलाह![submenu-img]() 'खुली बांहों से इंतजार में हूं' Rahul Gandhi ने आधी रात को किया ट्वीट बोले- ED Raid की प्लानिंग हो रही

'खुली बांहों से इंतजार में हूं' Rahul Gandhi ने आधी रात को किया ट्वीट बोले- ED Raid की प्लानिंग हो रही![submenu-img]() पिता के 'उधार' का चुकाया 'ब्याज', Paris Olympics में जीता मेडल, अब शूटर Swapnil Kusale को मिली ये खुशख�बरी

पिता के 'उधार' का चुकाया 'ब्याज', Paris Olympics में जीता मेडल, अब शूटर Swapnil Kusale को मिली ये खुशख�बरी![submenu-img]() Meet man, son of daily wager who cleared IIT-JEE, but may not go to IIT due to...

Meet man, son of daily wager who cleared IIT-JEE, but may not go to IIT due to...![submenu-img]() Meet 2023 UPSC toppers who rejected IAS, became IPS and IFS officers, see list

Meet 2023 UPSC toppers who rejected IAS, became IPS and IFS officers, see list![submenu-img]() Meet man who cracked UPSC exam twice, first became IPS, then IAS officer, his AIR was...

Meet man who cracked UPSC exam twice, first became IPS, then IAS officer, his AIR was...![submenu-img]() CTET Result 2024 announced at ctet.nic.in, get direct link, steps to check

CTET Result 2024 announced at ctet.nic.in, get direct link, steps to check![submenu-img]() Who is trainee IAS officer Puja Khedkar, whose provisional candidature is cancelled by UPSC, banned from exams

Who is trainee IAS officer Puja Khedkar, whose provisional candidature is cancelled by UPSC, banned from exams![submenu-img]() Delhi Coaching Centre Tragedy: Vikas Divyakirti Responds To Accusations After Aspirants' Deaths

Delhi Coaching Centre Tragedy: Vikas Divyakirti Responds To Accusations After Aspirants' Deaths![submenu-img]() Lok Sabha: FM Nirmala Sitharaman's 'Italy Mein Halwa' Jibe At Rahul Gandhi | BJP Vs Congress

Lok Sabha: FM Nirmala Sitharaman's 'Italy Mein Halwa' Jibe At Rahul Gandhi | BJP Vs Congress![submenu-img]() Wayanad Landslide Update: Over 140 Lives Lost, 1000+ Rescued By Air Force, Rescue Operation On

Wayanad Landslide Update: Over 140 Lives Lost, 1000+ Rescued By Air Force, Rescue Operation On![submenu-img]() Paris Olympics 2024: Manu Bhaker Shares Her Winning Strategy After Historic Victory

Paris Olympics 2024: Manu Bhaker Shares Her Winning Strategy After Historic Victory![submenu-img]() Anjem Choudary, UK Islamist Preacher, Sentenced To 28 Years In Prison By London Court, Who Is He?

Anjem Choudary, UK Islamist Preacher, Sentenced To 28 Years In Prison By London Court, Who Is He?![submenu-img]() Meet Yusuf Dikec, 51-year-old Turkish shooter who showed up with no special equipment and won silver at Paris Olympics

Meet Yusuf Dikec, 51-year-old Turkish shooter who showed up with no special equipment and won silver at Paris Olympics![submenu-img]() India vs Belgium, Men's Hockey Paris Olympics 2024: India's unbeaten run ends with 1-2 loss against Belgium

India vs Belgium, Men's Hockey Paris Olympics 2024: India's unbeaten run ends with 1-2 loss against Belgium![submenu-img]() Son of Sarpanch, shades of MS Dhoni: Meet Swapnil Kusale, ticket collector who won bronze at Paris Olympics 2024

Son of Sarpanch, shades of MS Dhoni: Meet Swapnil Kusale, ticket collector who won bronze at Paris Olympics 2024![submenu-img]() Paris Olympics 2024: Swapnil Kusale secures third medal for India, wins bronze in men's 50m rifle 3P

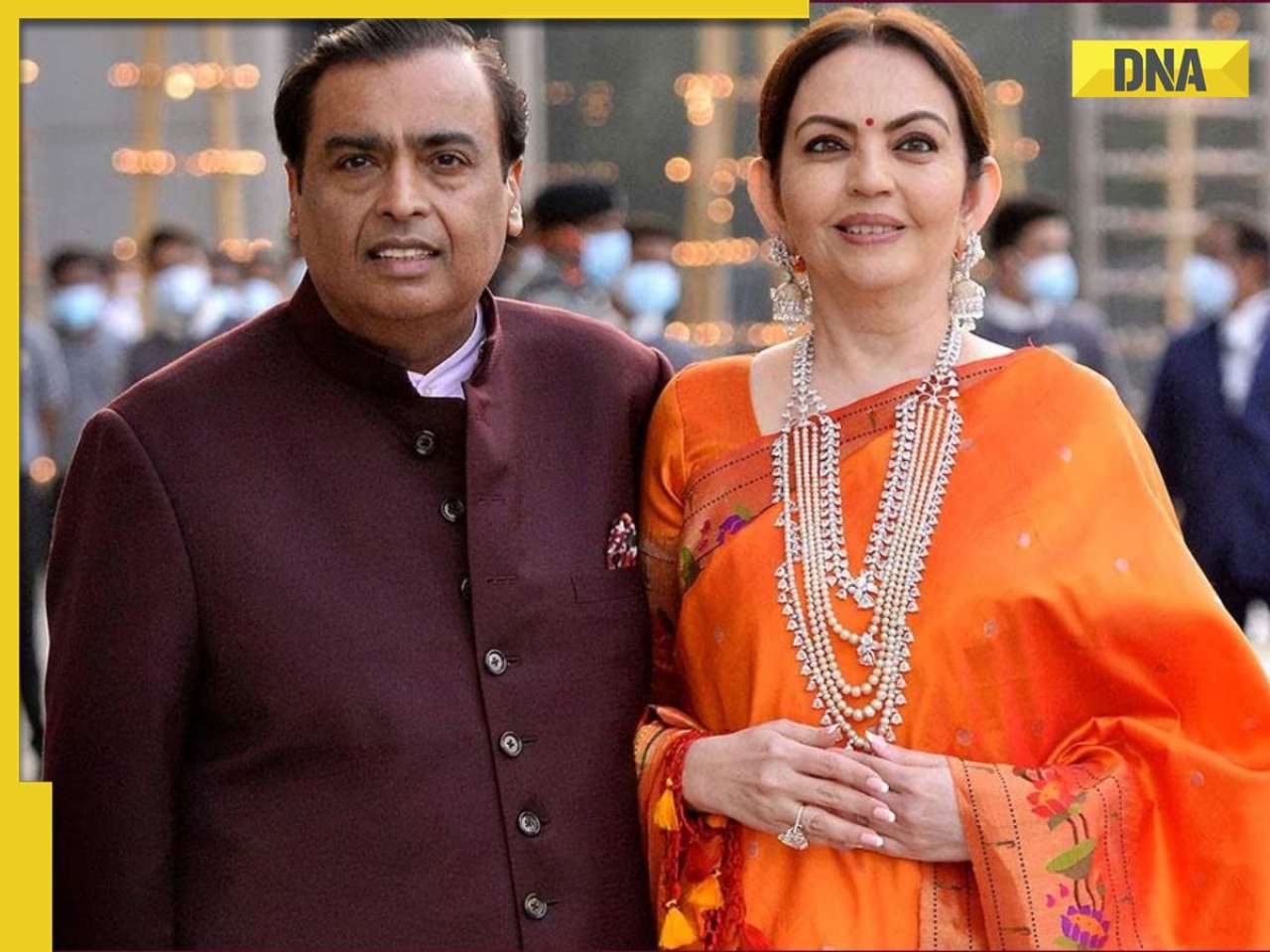

Paris Olympics 2024: Swapnil Kusale secures third medal for India, wins bronze in men's 50m rifle 3P![submenu-img]() Watch: Nita Ambani kisses Anant Ambani, hugs Radhika Merchant as she and Mukesh Ambani leave Paris

Watch: Nita Ambani kisses Anant Ambani, hugs Radhika Merchant as she and Mukesh Ambani leave Paris![submenu-img]() Priyanka Chopra was replaced by Aishwarya Rai in this film, she never worked with director again, movie earned...

Priyanka Chopra was replaced by Aishwarya Rai in this film, she never worked with director again, movie earned...![submenu-img]() Meet Aamir Khan's heroine, who dated star Indian cricketer, has no hits in 7 years; one show changed her life, now...

Meet Aamir Khan's heroine, who dated star Indian cricketer, has no hits in 7 years; one show changed her life, now...![submenu-img]() 8 upcoming new car launches in India in August 2024

8 upcoming new car launches in India in August 2024![submenu-img]() India's richest actress ever owned 1 ton silver, 28 kg gold, 10000 sarees; it's not Aishwarya, Deepika, Priyanka, Rekha

India's richest actress ever owned 1 ton silver, 28 kg gold, 10000 sarees; it's not Aishwarya, Deepika, Priyanka, Rekha![submenu-img]() Remember Aashka Goradia from Kkusum? Was trolled for surgeries, quit acting, now runs Rs 830-crore company that makes...

Remember Aashka Goradia from Kkusum? Was trolled for surgeries, quit acting, now runs Rs 830-crore company that makes...![submenu-img]() FBT Adventures: New Game Changer and Innovator in Destination Management

FBT Adventures: New Game Changer and Innovator in Destination Management![submenu-img]() Former IAS trainee Puja Khedkar's anticipatory bail plea dismissed by Delhi court

Former IAS trainee Puja Khedkar's anticipatory bail plea dismissed by Delhi court![submenu-img]() Mathura temple-mosque dispute: Allahabad HC dismisses Muslim side's petition, says cases maintainable

Mathura temple-mosque dispute: Allahabad HC dismisses Muslim side's petition, says cases maintainable![submenu-img]() Jaipur Rugs Announces Robust Global Expansion Plans and Strong Financial Performance

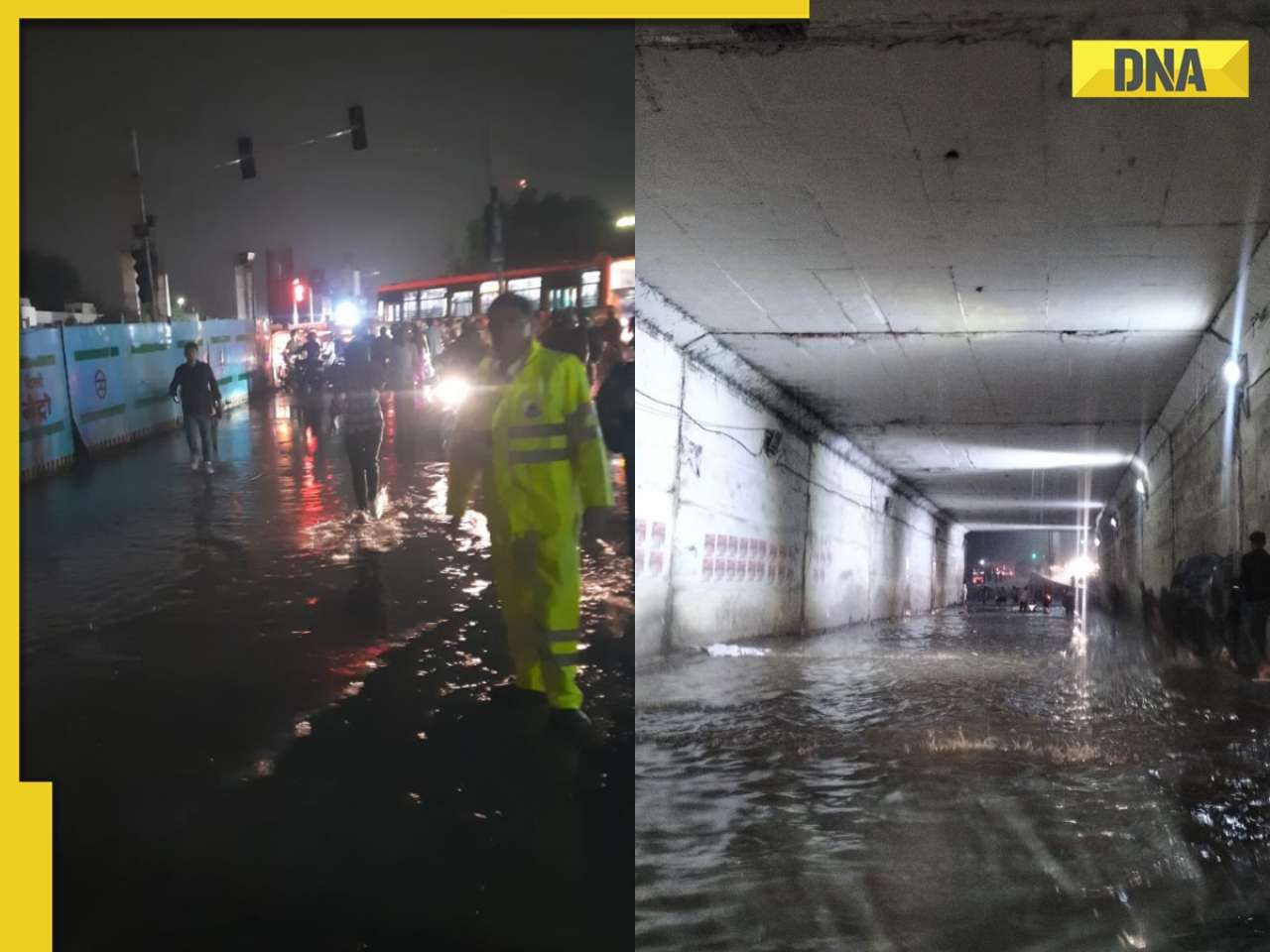

Jaipur Rugs Announces Robust Global Expansion Plans and Strong Financial Performance![submenu-img]() Delhi Rains: Was cloudburst behind sudden heavy rainfall in capital? IMD says this

Delhi Rains: Was cloudburst behind sudden heavy rainfall in capital? IMD says this![submenu-img]() Voter Sentiment: Harris outshines Biden among young and non-white voters

Voter Sentiment: Harris outshines Biden among young and non-white voters![submenu-img]() Beyond the Headlines: India, Pakistan and the hidden agenda of chaotic US poll

Beyond the Headlines: India, Pakistan and the hidden agenda of chaotic US poll![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Shah Rukh Khan called his blockbuster 'rubbish', director reveals superstar 'has a habit of...'

Shah Rukh Khan called his blockbuster 'rubbish', director reveals superstar 'has a habit of...'![submenu-img]() India's biggest female star was tortured by husband, alcohol ruined her; was once rival to Nutan, Madhubala, died at 38

India's biggest female star was tortured by husband, alcohol ruined her; was once rival to Nutan, Madhubala, died at 38![submenu-img]() Shekhar Home trailer: Desi 'Sherlock Holmes' Kay Kay Menon, 'Dr. Watson' Ranvir Shorey unravel mysterious crimes

Shekhar Home trailer: Desi 'Sherlock Holmes' Kay Kay Menon, 'Dr. Watson' Ranvir Shorey unravel mysterious crimes![submenu-img]() Citadel Honey Bunny teaser: Varun Dhawan, Samanth Ruth Prabhu are fierce spies on thrilling journey of survival

Citadel Honey Bunny teaser: Varun Dhawan, Samanth Ruth Prabhu are fierce spies on thrilling journey of survival![submenu-img]() Armaan Malik breaks silence on his religion on Bigg Boss OTT 3, reveals if he's Muslim: 'Aap shayad mujhe...'

Armaan Malik breaks silence on his religion on Bigg Boss OTT 3, reveals if he's Muslim: 'Aap shayad mujhe...'![submenu-img]() Nita Ambani reveals Mukesh Ambani’s favourite snack, have you tried it?

Nita Ambani reveals Mukesh Ambani’s favourite snack, have you tried it?![submenu-img]() Viral video: Lone hippopotamus charges at a pride of lionesses, what happens next will shock you

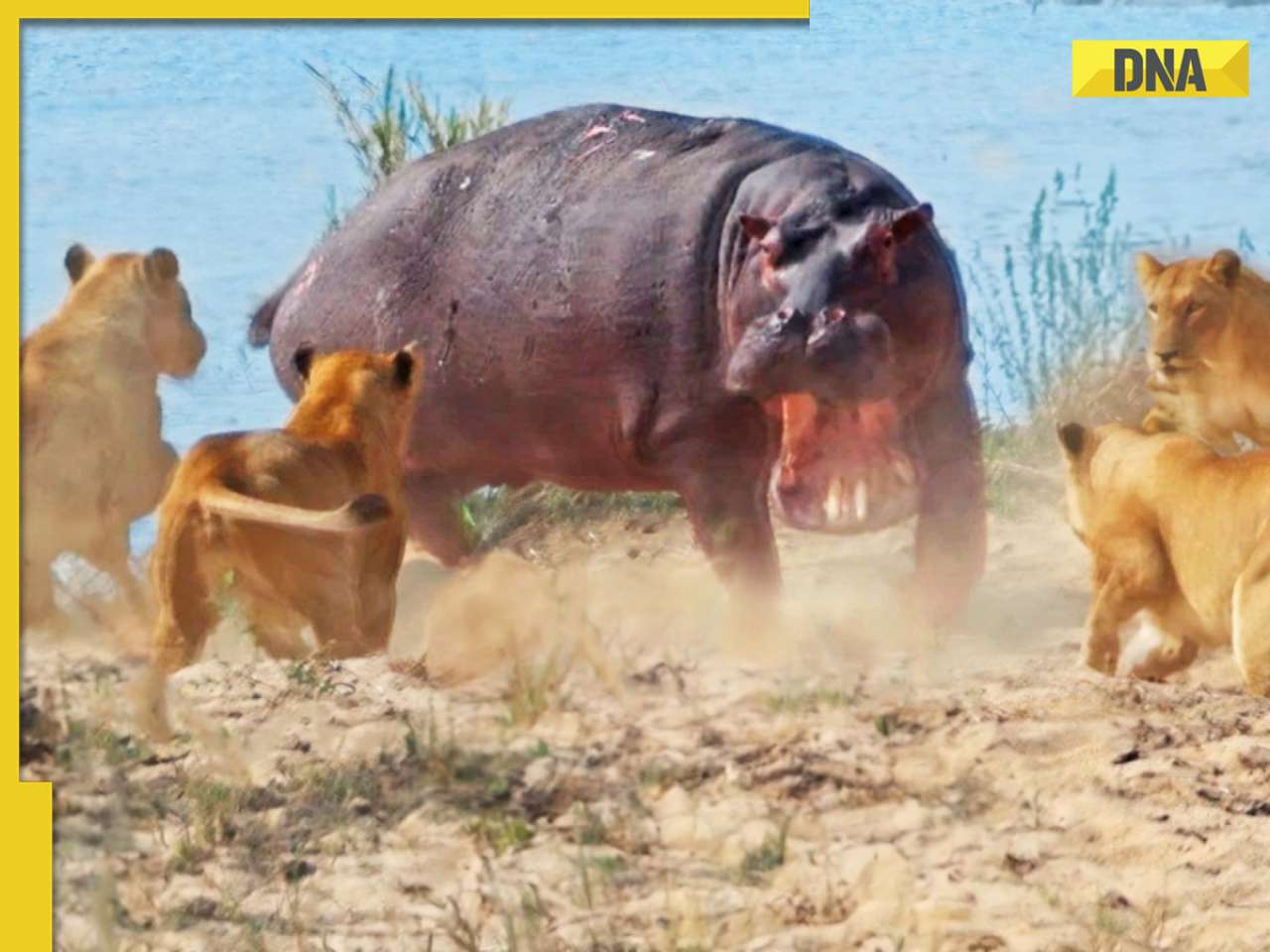

Viral video: Lone hippopotamus charges at a pride of lionesses, what happens next will shock you![submenu-img]() Viral video: Little girl's impressive dance to Tamil song 'Aasa Kooda' wins hearts on internet

Viral video: Little girl's impressive dance to Tamil song 'Aasa Kooda' wins hearts on internet![submenu-img]() Paris Olympics 2024: Turkish Olympic shooter goes viral for...

Paris Olympics 2024: Turkish Olympic shooter goes viral for...![submenu-img]() This city placed the highest numbers of vegetarian orders on Swiggy and it is not Haridwar, Ayodhya or Mathura but...

This city placed the highest numbers of vegetarian orders on Swiggy and it is not Haridwar, Ayodhya or Mathura but...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)