This comes days after the government in the Union Budget raised the securities transaction tax (STT) on both futures and options trade from October 1 to allay concerns about hyperactive interest in the derivative segment.

Markets regulator Sebi on Tuesday proposed tightening the rules for index derivatives by revising the minimum contract size and requiring upfront collection of option premiums to curb speculative trading.

This comes days after the government in the Union Budget raised the securities transaction tax (STT) on both futures and options trade from October 1 to allay concerns about hyperactive interest in the derivative segment.

Before that, the Economic Survey flagged concerns over rising retail investors' interest in derivative trading. The survey stated that speculative trade has no place in a developing country.

It also pointed out that the sharp increase in retail investor participation in F&O trading is likely driven by humans' gambling instincts.

In its consultation paper, the regulator has proposed measures, including rationalisation of weekly index products, intra-day monitoring of position limits, rationalisation of strike prices, removal of calendar spread benefit on expiry day and increase in near contract expiry margin.

The Securities and Exchange Board of India (Sebi) has sought public comments till August 20 on the proposals.

Considering the growth witnessed in the broad market parameters, the minimum contract size for index derivative contracts should be revised in two phases, Sebi said in its consultation paper.

Under phase 1, the minimum value of the derivatives contract at the time of introduction should be between Rs 15 lakh and Rs 20 lakh. After 6 months, the minimum value of the derivatives contract is to be between the interval of Rs 20 lakh and Rs 30 lakh as a part of phase 2.

The regulator said that the minimum contract size requirement for derivative contracts (Rs 5 lakh to Rs 10 lakh) was last set in 2015.

The regulator has suggested rationalising of options strikes with a uniform strike interval of 4 per cent around the prevailing index price and expanded strike intervals beyond the initial coverage to reduce the number of strikes further from the index price.

There will be a maximum of 50 strikes at the time of introduction, with new strikes introduced daily to maintain these intervals.

Further, Sebi proposed that members should collect option premiums from clients upfront.

On the removal of calendar spread benefits on the expiry day, Sebi suggested that there should be no margin benefit for calendar spread positions on contracts expiring on the same day.

It also proposed that position limits for index derivatives should be monitored intraday by clearing corporations and stock exchanges.

Weekly options contracts should be provided on a single benchmark index of exchange and the Extreme Loss Margin (ELM) should be increased by 3 per cent the day before expiry and further increased by 5 per cent on the expiry day.

These proposed measures are aimed at enhancing investor protection and promoting market stability in derivative markets.

Derivatives market assist in better price discovery, help improve market liquidity and allow investors to manage their risks better.

"However, bursts of speculative hyperactivity in derivative markets, particularly by individual players, can detract from sustained capital formation by endangering both investor protection and market stability," the markets regulator noted.

A study conducted by Sebi in January 2023 found that 89 per cent of individual traders in the equity F&O segment incurred losses.

For FY2023-24, 92.50 lakh unique individuals and firms traded in NSE's index derivatives, incurring a cumulative trading loss of Rs 51,689 crore, excluding transaction costs. About 85 per cent of these traders made net losses.

Futures and Options trading involves contracts that derive their value from an underlying asset, such as stocks or commodities.

Futures contracts obligate the buyer and seller to transact at a predetermined future date and price, while options give the holder the right, but not the obligation, to buy or sell the asset at a set price within a specific period.

These financial instruments are used for hedging risks, speculating on price movements, and arbitraging price differences. However, they come with significant risks, including leverage risk and market volatility, which can lead to substantial losses.

Last month, the Sebi board approved stricter norms for the entry of individual stocks in the derivatives segment. The proposal is aimed at weeding out stocks with consistently low turnover from the F&O segment of the bourses.

![submenu-img]() 'I’ve done my part...': CSK star all-rounder bids adieu to international cricket

'I’ve done my part...': CSK star all-rounder bids adieu to international cricket![submenu-img]() Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...

Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'

Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'![submenu-img]() Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener

Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener![submenu-img]() Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत

Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत![submenu-img]() Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'

Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'![submenu-img]() Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका

Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका![submenu-img]() India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत

India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत![submenu-img]() रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'

रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

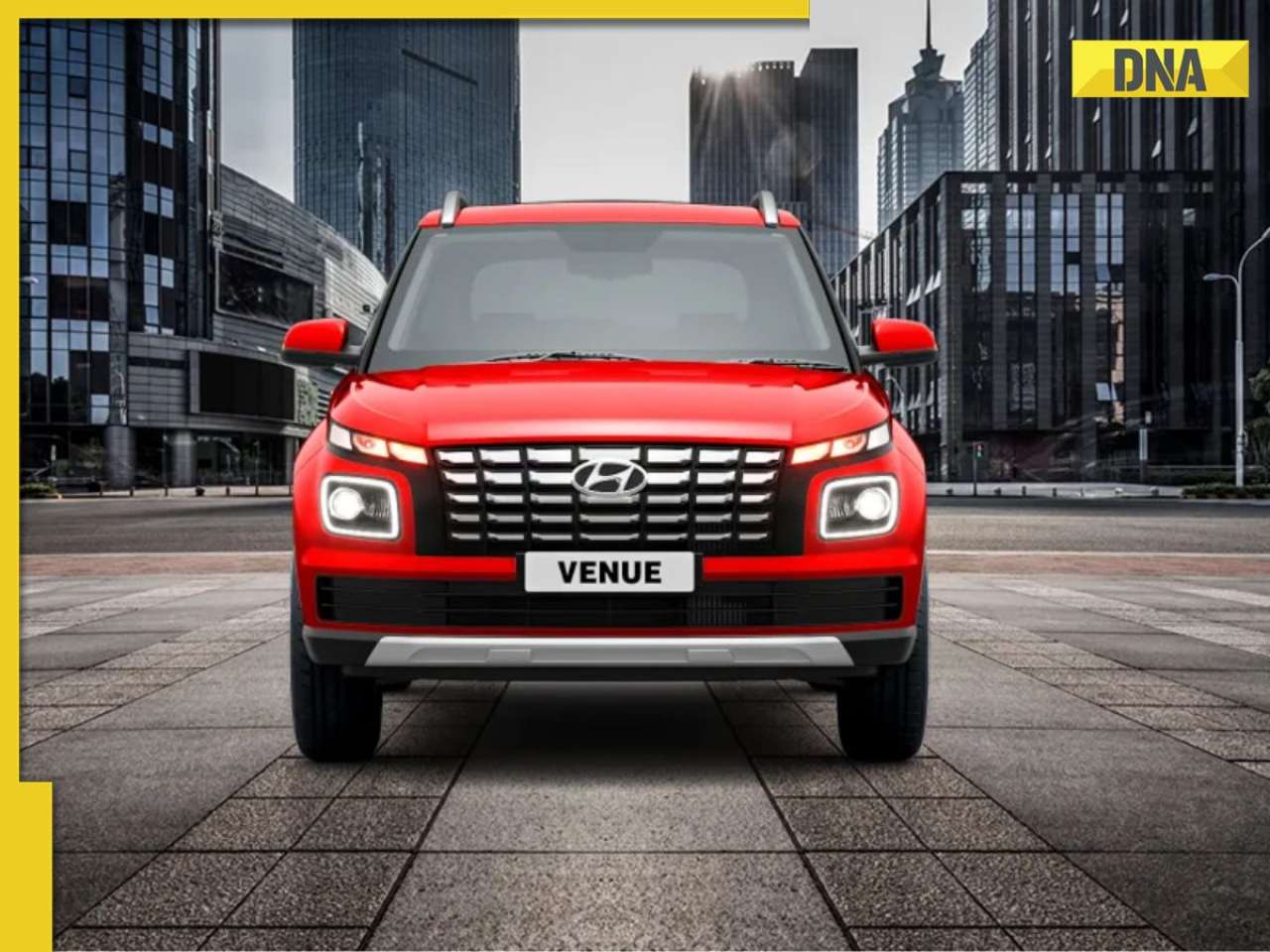

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...

Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...![submenu-img]() Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...

Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...![submenu-img]() Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects

Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects![submenu-img]() Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...

Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...

Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...![submenu-img]() Ratan Tata's company invests Rs 950 crore in this firm, plans to build...

Ratan Tata's company invests Rs 950 crore in this firm, plans to build...![submenu-img]() Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...

Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...![submenu-img]() Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...

Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...![submenu-img]() Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...

Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...![submenu-img]() From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story

From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story![submenu-img]() 6 reasons why you should buy Volkswagen Virtus

6 reasons why you should buy Volkswagen Virtus![submenu-img]() Apple to Amazon: First products launched by big tech giants

Apple to Amazon: First products launched by big tech giants![submenu-img]() Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...

Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...![submenu-img]() This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...

This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day

Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day![submenu-img]() 'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally

'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally![submenu-img]() Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….

Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….![submenu-img]() Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)