Reports a 2.6% growth in its pre-tax profit for April-September; defers India IPO due to unfavourable market conditions

Vodafone Plc took a €5 billion hit on account of its India operations and has deferred the initial public offering (IPO) for its Indian arm due to unfavourable market conditions.

The telecom firm on Tuesday reported a 2.6% growth in its pre-tax profit for the April-September period at Rs 6,704 crore.

Underlining that headwinds exist on the regulatory and competitive fronts, the company said its revenue growth came slower than the country’s GDP growth, at 5.9% to Rs 22,579 crore during the six-month period.

“We can see that the GDP is consistently above 7% in the last few years and the telecom industry has however slowed down a little bit, thanks to regulatory pressures as well as competitive pressures. We have witnessed several positive changes in the recent past and these include spectrum availability where the whole lot of spectrum that was available in the country was there for the auction this time,” said Sunil Sood, MD & CEO, Vodafone India Ltd.

Sood said the headwinds faced by the industry will result in an “accelerated consolidation” where the weaker players will be taken over by stronger ones.

“In the short term, there has been a lot of volatility and this is accelerating consolidation, especially of the weaker players. In the long run, we see the data potential and growth will continuously increase and you can see that some of this from the latent demand from the free offer the amount of data that is getting consumed really shows what is the extent of the latent demand actually in the marketplace. Therefore, in the long term, we will see an explosion of data potential and growth. We also feel that we are strongly positioned especially after the spectrum acquisition in the recently-concluded auction,” he said.

Speaking on the GST, Sood said, “Service industry has no removal of excise duty, and therefore, as an industry, we are pitching for the lower band of GST, which is the 12% band.”

About the impairment of €5 billion taken by Vodafone Plc, he said it is an accounting issue which will have no impact on operations. “The impairment charge of €5 billion is a shareholder issue and not really of the Indian operations. IPO will take place when conditions improve and it may not happen in this financial year. We have never mentioned the timeline for the IPO; we have mentioned that we are preparing for an IPO and we continue to execute in those directions. If the conditions are ready and if our shareholders and Board give us the go-ahead to execute the IPO, we will do so,” said Sood.

There was also a drop in its pre-tax margins to 29.6% against 30.5% in the year-ago period.

JIO PRESSURE

The overall average revenue per user was at Rs 186 in the quarter but the voice revenues were impacted by ongoing pressures. In the face of competition posed by Reliance Jio, Sood said pricing will not be a differentiating factor in the long run

![submenu-img]() 'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'

'Life is short': Rashmika Mandanna informs fans about recovery from accident, says 'don’t know if...'![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

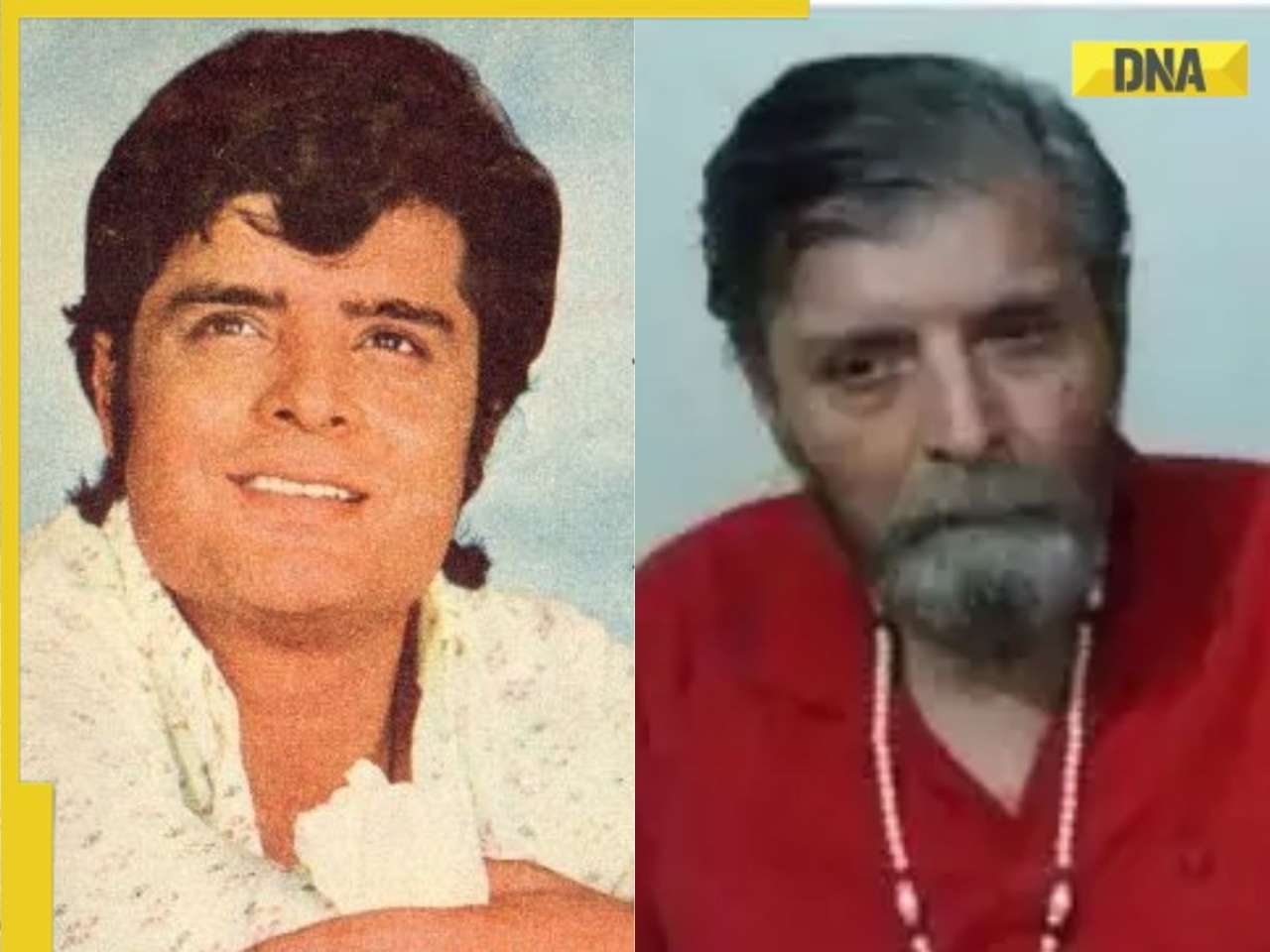

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless

This actor was called Amitabh Bachchan of Punjabi cinema, did 300 films, spent last days in old-age home, died penniless![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() 2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested

2000 cops, chopper, thermal imaging: How 'owner of the Universe' was arrested![submenu-img]() न सीटें मिलीं, न बात बनी...हरियाणा में क्यों टूटा AAP- कांग्रेस का गठबंधन, जानें वजह

न सीटें मिलीं, न बात बनी...हरियाणा में क्यों टूटा AAP- कांग्रेस का गठबंधन, जानें वजह![submenu-img]() J-K Assembly Election: कांग्रेस ने जारी की तीसरी सूची, जानें पार्टी ने किन चेहरों पर जताया भरोसा

J-K Assembly Election: कांग्रेस ने जारी की तीसरी सूची, जानें पार्टी ने किन चेहरों पर जताया भरोसा![submenu-img]() Weather Updates: Delhi-NCR में जारी है मानसून का Mood Swing, राजस्थान में भारी बारिश की बौछार, पढ़िए IMD अलर्ट

Weather Updates: Delhi-NCR में जारी है मानसून का Mood Swing, राजस्थान में भारी बारिश की बौछार, पढ़िए IMD अलर्ट![submenu-img]() Rashifal 5 August 2024: कर्क और वृश्चिक राशि वालों को होगा धनलाभ, जानें आज मेष से मीन तक की राशियों का भाग्यफल

Rashifal 5 August 2024: कर्क और वृश्चिक राशि वालों को होगा धनलाभ, जानें आज मेष से मीन तक की राशियों का भाग्यफल![submenu-img]() Petrol-Diesel Price Today: रोज की तरह आज भी जारी हुए पेट्रोल-डीजल के ताजा दाम, यहां चेक करें Fuel रेट्स

Petrol-Diesel Price Today: रोज की तरह आज भी जारी हुए पेट्रोल-डीजल के ताजा दाम, यहां चेक करें Fuel रेट्स![submenu-img]() Hyundai Alcazar facelift launched in India: Check price, design and other features

Hyundai Alcazar facelift launched in India: Check price, design and other features![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...

Meet man, who left Rs 2800000 salary job, then cracked UPSC exam with AIR 171, became...![submenu-img]() Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…

Meet Rashi Bagga, hired for record-breaking package, had rejected Rs 14 lakh job, not from IIT, IIM…![submenu-img]() Meet man, who worked as daily wager, cracked NEET exam with AIR...

Meet man, who worked as daily wager, cracked NEET exam with AIR...![submenu-img]() SSC CGL 2024 exam begins today: Check important guidelines, other details here

SSC CGL 2024 exam begins today: Check important guidelines, other details here![submenu-img]() Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...

Meet woman who cleared UPSC exam in 1st attempt at 21, got AIR 13 without coaching, but didn’t become IAS, IPS due to...![submenu-img]() Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder

Kolkata Doctor Case: TMC MP Jawhar Sircar To Resign From Rajya Sabha Over Kolkata Doctor Rape-Murder![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...

Meet Indian man with Rs 954520 crore net worth, who is likely to become a trillionaire after...![submenu-img]() Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...

Meet Indian man with Rs 73040 crore net worth, who is set to build India's 'biggest' mall in...![submenu-img]() Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…

Meet Indian man who ran away from house at 12, worked as tailor, now owns Rs 17000 crore company which is world’s best…![submenu-img]() Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..

Meet man who worked as salesman at 13, borrowed Rs 10000 to build Rs 32000 crore firm, now one of India’s richest with..![submenu-img]() Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik

Mistakes To Avoid When Leading A Company Through Digital Transformation – The Experience Of Nikhil Badwaik![submenu-img]() Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..

Made in Rs 63 crore, this film was called next Gadar, superstar wrote movie 20 years ago, it became major flop, earned..![submenu-img]() This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...

This actress worked as telephone operator, became Bollywood superstar despite not knowing Hindi; her film was banned...![submenu-img]() 7 countries with most UNESCO World Heritage sites; check how many India has

7 countries with most UNESCO World Heritage sites; check how many India has![submenu-img]() Top five anti-ageing skincare secrets by Nita Ambani

Top five anti-ageing skincare secrets by Nita Ambani![submenu-img]() India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss

India's longest-running TV show has been on air for 57 years, has 16000 episodes; not KBC, CID, Taarak Mehta, Bigg Boss![submenu-img]() SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings

SK Fortune Group is Changing Pune’s Skyline with new high-rise buildings![submenu-img]() Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...

Delhi court sends AAP MLA Amanatullah Khan to 14-day judicial custody in...![submenu-img]() First case of Mpox confirmed in India, patient put under isolation

First case of Mpox confirmed in India, patient put under isolation![submenu-img]() Rameshwaram Cafe blast: NIA files chargesheet against four accused

Rameshwaram Cafe blast: NIA files chargesheet against four accused![submenu-img]() Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

Weather Update: IMD issues red alert for heavy rainfall in Odisha, other states; check full forecast for this week

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)