Handling your crypto taxes might not be the most thrilling part of trading, but it’s essential for staying within the law.

You’ve just had a successful run in the crypto market, and it’s exciting to see your gains. But when it comes time to handle taxes, you might feel tempted to ignore them and keep your profits hidden. While it

might seem quick and easy, evading crypto taxes in India can lead to severe problems.

In this article, you will learn why paying your crypto taxes honestly is essential. Moreover, it will cover the risks of facing heavy penalties and legal issues and show why taking the right approach is the best way to

protect your gains and stay stress-free.

How Are Crypto Taxed In India?

Here’s a simple breakdown of how cryptocurrency tax in India functions:

CGT (Capital Gains Tax)

When you make gains from trading cryptocurrencies, they’re taxed at 30% plus a 4% health and education cess under Section 115BBH. This rate applies to short-term and long-term capital gains, meaning the tax rate remains unchanged regardless of how long you’ve held the crypto.

This tax applies whenever you transfer digital assets, whether a private investor or a commercial entity. Remember that the only deduction allowed is the cost of acquiring the crypto—no other expenses or deductions can be claimed.

TDS (Tax Deducted at Source)

From July 1, 2022, Section 194S requires a 1% Tax Deducted at Source (TDS) on the transfer of crypto assets. This applies if the transaction amount exceeds INR 50,000 in a financial year, though in some

cases, this threshold is reduced to INR 10,000. The exchange deducts the TDS at the time of the transaction, ensuring that a portion of the tax is paid

upfront.

Income Tax

In addition to capital gains tax, the Income Tax Department (ITD) may treat certain cryptocurrency activities as taxable income. This includes:

● Mining crypto coins

● Receiving crypto as a gift

● Salary paid in cryptocurrency

● Crypto airdrops

● Staking rewards

Later, if you decide to sell, trade, or use these tokens, any gains will be subject to the 30% capital gains tax.

Why Not To Evade Crypto Taxes In India?

The punishment for tax evasion in India depends on how severe the violation is. Here’s a quick overview:

Penalties for Under-Reporting or Misreporting Income

If you underreport or misreport your income, you face significant penalties. The fine can range from 50% to 200% of the tax amount you owe. If you owe INR 1 lakh in taxes, you could pay an additional INR

50,000 to INR 2 lakh in penalties.

In addition to the financial penalty, depending on the severity of the offence, you might also face imprisonment for up to 7 years. This harsh punishment aims to deter tax evasion and ensure compliance

with tax laws.

Charges for Filing Income Tax Returns Late

Filing your income tax return after the deadline comes with penalties. You will be charged interest at 1% per month on the outstanding tax amount. Late fees, ranging from INR 1,000 to INR 5,000, will also apply. If the delay is significant, the total financial burden can become heavy.

Like under-reporting, failing to file on time can also lead to imprisonment for up to 7 years if the offence is severe enough. This stringent approach is intended to encourage timely filing and reduce delays in tax

collection.

Consequences of Failing to Deduct or Deposit TDS

When you fail to deduct Tax Deducted at Source (TDS) or do not deposit the deducted TDS with the government, you are liable for additional charges. This includes interest on the amount that should have been deducted and late fees. The government imposes these penalties to ensure tax deductions are appropriately managed and transferred to the authorities immediately.

Can The Income Tax Department Track My Crypto Transactions?

Yes, the income tax department can track your cryptocurrency transactions. They actively collect data from Indian cryptocurrency exchanges even before implementing the Tax Deducted at Source (TDS)

under the Financial Act 2022.

TDS helps the tax department monitor crypto investments at the point of acquisition. It applies to all crypto transactions, including NFTs, stablecoins, and tokens. The TDS reporting requirements allow the income tax department to access transactional data from domestic exchanges, peer-to-peer transactions, and activities on international exchanges.

To enforce TDS compliance on international exchanges, the Financial Intelligence Unit (FIU) India sent a notice on 28 December 2023 to nine foreign crypto exchanges, banning them for failing to comply with

anti-money laundering policies.

The exchanges affected were Binance, KuCoin, Huobi, Gate.io, Bittrex, MEXC, Kraken, Bitstamp, and Bitfinex. However, Binance and KuCoin have accepted FIU's terms, mak, which has made a legal crypto

exchange in India.

The Finance Ministry of India and the income tax department are continuously working to track and list Virtual Digital Asset (VDA) transactions across the country.

What To Do If You Have Previously Ignored Your Crypto Taxes?

If you need to report cryptocurrency transactions in a previous income tax return, you can take specific steps to correct the situation, though penalties might still apply. First, you should file an updated return under Section 139(8A) using Form ITR-U and the relevant ITR form. You can only file this updated return if you have taxable gains from cryptocurrency transactions for the relevant financial year. If you have incurred a net loss, you can't file an updated return because these losses are not deductible for this purpose.

Remember, you have only 24 months from the end of the tax year to file an updated return. For example, the deadline to file ITR-U for the assessment year 2023-24 (FY 2022-23) is 31 March 2026. Filing an updated return does not exempt you from penalties for unpaid income tax. Still, the penalties are generally less severe than those imposed by the Income Tax Department if they find discrepancies later.

If you file your ITR-U within 12 months from the end of the tax year, you will face a penalty of 25% of the outstanding tax amount plus any interest charges. If you file your ITR after 12 months but before 24 months, the penalty increases to 50% of the outstanding tax amount, along with interest charges.

Conclusion

Handling your crypto taxes might not be the most thrilling part of trading, but it’s essential for staying within the law. Evading taxes might seem like a simple way to keep more of your gains, but it can lead to serious trouble, including hefty fines and legal issues. By facing your tax obligations honestly, you avoid these risks and build a solid foundation for your financial future.

![submenu-img]() 'I’ve done my part...': CSK star all-rounder bids adieu to international cricket

'I’ve done my part...': CSK star all-rounder bids adieu to international cricket![submenu-img]() Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...

Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'

Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'![submenu-img]() Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener

Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener![submenu-img]() Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत

Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत![submenu-img]() Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'

Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'![submenu-img]() Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका

Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका![submenu-img]() India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत

India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत![submenu-img]() रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'

रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

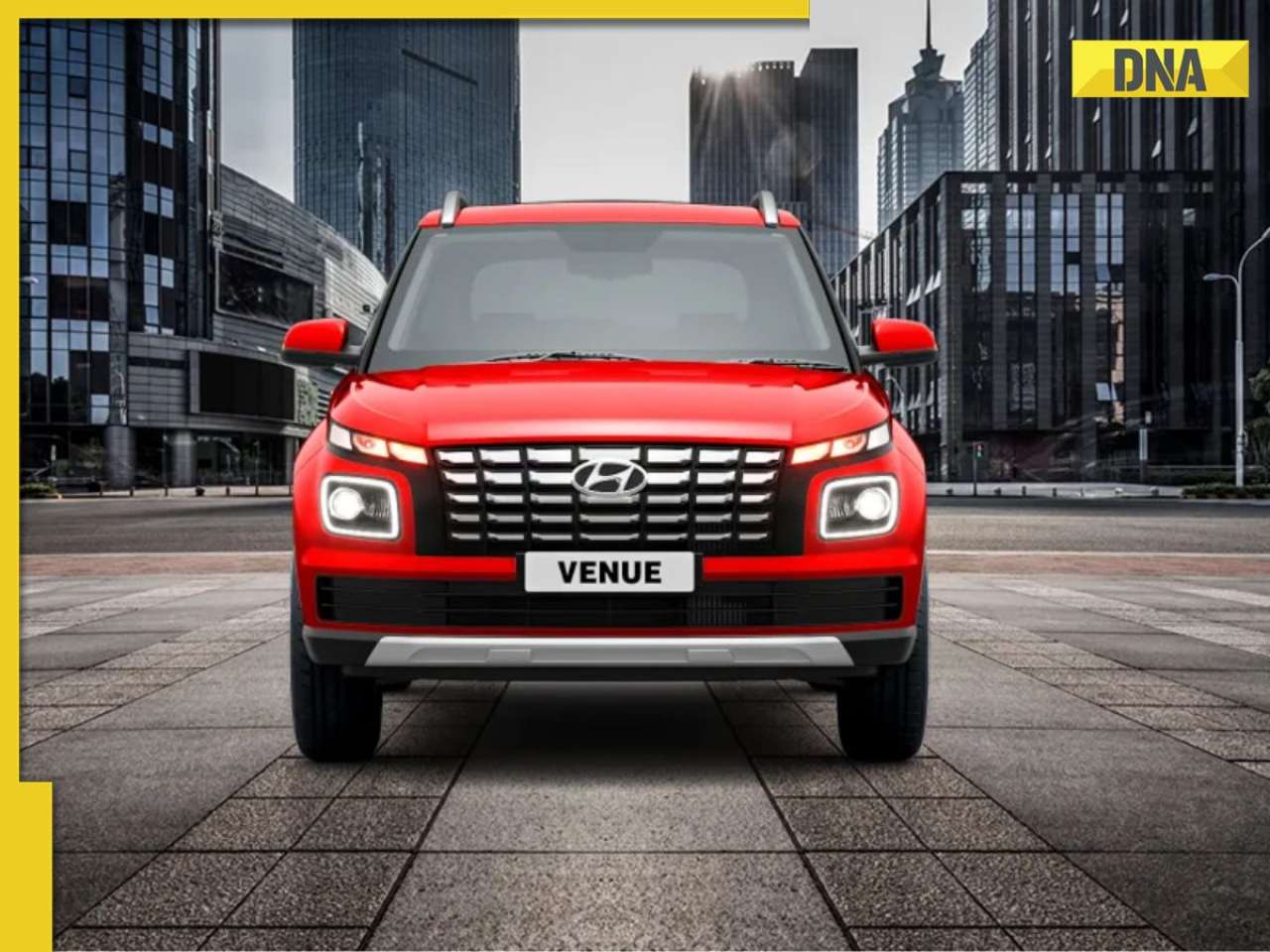

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...

Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...![submenu-img]() Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...

Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...![submenu-img]() Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects

Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects![submenu-img]() Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...

Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...

Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...![submenu-img]() Ratan Tata's company invests Rs 950 crore in this firm, plans to build...

Ratan Tata's company invests Rs 950 crore in this firm, plans to build...![submenu-img]() Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...

Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...![submenu-img]() Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...

Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...![submenu-img]() Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...

Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...![submenu-img]() From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story

From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story![submenu-img]() 6 reasons why you should buy Volkswagen Virtus

6 reasons why you should buy Volkswagen Virtus![submenu-img]() Apple to Amazon: First products launched by big tech giants

Apple to Amazon: First products launched by big tech giants![submenu-img]() Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...

Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...![submenu-img]() This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...

This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day

Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day![submenu-img]() 'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally

'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally![submenu-img]() Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….

Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….![submenu-img]() Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)