LIC policy provides insurance coverage and savings for financial emergencies.

Life Insurance Corporation of India (LIC) is a trusted investment option that provides the dual benefits of life insurance coverage and savings. In case of a financial emergency, the savings accumulated through LIC policies can come in handy. However, if the need for funds is urgent, policyholders can opt for policy surrender to access their funds.

Policyholders must keep in mind that policy surrender can only be done after a minimum of three years of premium payments. Surrendering the policy before maturity can result in significant financial losses as the surrender value of the policy decreases.

The surrender value is the amount equivalent to the policy's value that the policyholder receives upon surrendering the policy or withdrawing money from LIC. If the policy is regular, the surrender value is calculated based on the premiums paid for the first three years. If the policy is surrendered before three years, there is no surrender value.

Policyholders who have paid the premium for the policy for at least three years are entitled to the surrender value. In the case of policies surrendered before three years, policyholders are only entitled to 30 per cent of the premium paid, excluding the premium paid for the previous year. This means that the premium paid in the first year is considered as zero.

Policyholders who wish to surrender their LIC policy must provide certain documents, including the bond document of the LIC policy, request for payment of surrender value, LIC surrender form (Form 5074), LIC NEFT form, bank account details, original ID proof like Aadhaar card, PAN card or driving license, a canceled bank check, and the reason for the policy's closure must be given in writing.

Investing in LIC policies can provide a reliable source of savings and life insurance coverage. However, policyholders must be aware of the rules and regulations related to policy surrender to avoid financial losses.

Read more: UPI Payment: Know what to do if you accidentally transfer money to wrong UPI account

![submenu-img]() Israel launches strikes on Yemeni Houthi targets after killing dozens of Hezbollah members in Lebanon

Israel launches strikes on Yemeni Houthi targets after killing dozens of Hezbollah members in Lebanon![submenu-img]() Haryana Elections 2024: BJP expels 8 rebels, including Sandeep Garg, for contesting as Independents

Haryana Elections 2024: BJP expels 8 rebels, including Sandeep Garg, for contesting as Independents![submenu-img]() IPL 2025: How much salary will MS Dhoni earn if CSK retain him as uncapped player?

IPL 2025: How much salary will MS Dhoni earn if CSK retain him as uncapped player?![submenu-img]() UPI QR code is down, this is how SBI is fixing the problem

UPI QR code is down, this is how SBI is fixing the problem![submenu-img]() Shocking! Viral influencer who married herself dies by suicide at 26

Shocking! Viral influencer who married herself dies by suicide at 26![submenu-img]() Nepal में बाढ़ और लैंडस्लाइड से मची तबाही, 170 लगों की मौत, कई लापता, यूपी-बिहार के इन जिलों पर बड़ा खतरा

Nepal में बाढ़ और लैंडस्लाइड से मची तबाही, 170 लगों की मौत, कई लापता, यूपी-बिहार के इन जिलों पर बड़ा खतरा![submenu-img]() BJP मेंबर्स बनाने का ऐसा जोश, नेटवर्क नहीं मिला तो पेड़ पर चढ़े कार्यकर्ता

BJP मेंबर्स बनाने का ऐसा जोश, नेटवर्क नहीं मिला तो पेड़ पर चढ़े कार्यकर्ता ![submenu-img]() Austria Election: 'राष्ट्रवादी' फ्रीडम पार्टी की जीत, दूस�रे विश्व युद्ध के बाद पहली बार बन रही इस दल की सरकार

Austria Election: 'राष्ट्रवादी' फ्रीडम पार्टी की जीत, दूस�रे विश्व युद्ध के बाद पहली बार बन रही इस दल की सरकार![submenu-img]() J-K Elections: जम्मू की सीटों पर BJP और Congress-NC में किसका पलड़ा भारी, जानें यहां के सियासी समीकरण

J-K Elections: जम्मू की सीटों पर BJP और Congress-NC में किसका पलड़ा भारी, जानें यहां के सियासी समीकरण![submenu-img]() 'मेरे देश के लोग फिलिस्तीन को नहीं जानते', मोहम्मद बिन सलमान के बयान ने खड़े किए सवाल

'मेरे देश के लोग फिलिस्तीन को नहीं जानते', मोहम्मद बिन सलमान के बयान ने खड़े किए सवाल![submenu-img]() Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…

Mahindra Thar Roxx 4x4 prices revealed, starts at Rs…![submenu-img]() Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...

Sebi gives nod to Hyundai India's Rs 20,000 crore IPO, listing month is...![submenu-img]() Tata launches Nexon iCNG, check price, mileage, other features

Tata launches Nexon iCNG, check price, mileage, other features![submenu-img]() This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…

This Indian car brand set to acquire 50% stake in Skoda Auto Volkswagen India, deal will cost Rs…![submenu-img]() Ford to return to India after 2 years with reopening of....

Ford to return to India after 2 years with reopening of....![submenu-img]() This man was behind IT giant valued at over Rs 13.78 lakh crore, born in Peshawar, also known as father of...

This man was behind IT giant valued at over Rs 13.78 lakh crore, born in Peshawar, also known as father of...![submenu-img]() Meet woman, who scored highest marks in UPSC interview history, not Tina Dabi, Smita Sabharwal, she is...

Meet woman, who scored highest marks in UPSC interview history, not Tina Dabi, Smita Sabharwal, she is...![submenu-img]() Meet India's youngest woman to crack UPSC exam at age 21, secured AIR 13, but didn't become IAS due to...

Meet India's youngest woman to crack UPSC exam at age 21, secured AIR 13, but didn't become IAS due to...![submenu-img]() Meet India’s first female IAS officer, also second woman to crack UPSC exam, she was posted at...

Meet India’s first female IAS officer, also second woman to crack UPSC exam, she was posted at...![submenu-img]() Meet man, bangle seller who cracked UPSC exam despite being specially abled, becomes IAS officer with AIR...

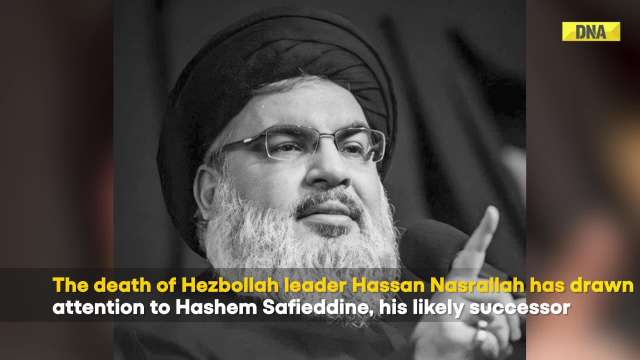

Meet man, bangle seller who cracked UPSC exam despite being specially abled, becomes IAS officer with AIR...![submenu-img]() After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon

After Hassan Nasrallah's Death, This Cleric Is Now Tipped To Be Hezbollah Leader | Israel | Lebanon![submenu-img]() Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War

Hashem Safieddine, Cousin Of Hassan Nasrallah To Become Hezbollah's New Chief | Israel-Lebanon War![submenu-img]() Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain

Israel Hezbollah War: Nasrallah's Death, A Turning Point for Hezbollah's Future? Experts Explain![submenu-img]() Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts

Israel Hezbollah War: Hassan Nasrallah's Death Leads To Protests In J&K, Ex-CM Mehbooba Mufti Reacts![submenu-img]() Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir

Israel Hezbollah War: Nasrallah's Death Leads To Protest By Women & Children In Jammu And Kashmir![submenu-img]() Big relief for GST taxpayers: Clear old dues without extra costs; here’s how

Big relief for GST taxpayers: Clear old dues without extra costs; here’s how![submenu-img]() Learn to play the Reliance way, Mukesh Ambani ready to disrupt the toy market

Learn to play the Reliance way, Mukesh Ambani ready to disrupt the toy market![submenu-img]() Ratan Tata's BIG move as Tata Sons set to buy 13% in...

Ratan Tata's BIG move as Tata Sons set to buy 13% in...![submenu-img]() Meet Anuradha who has come out of husband Anand Mahindra's shadow, this is what she does

Meet Anuradha who has come out of husband Anand Mahindra's shadow, this is what she does ![submenu-img]() Mukesh Ambani's BIG gift to shareholders, Reliance earns Rs 53652 crore in just 5 days

Mukesh Ambani's BIG gift to shareholders, Reliance earns Rs 53652 crore in just 5 days![submenu-img]() Haryana Elections 2024: BJP expels 8 rebels, including Sandeep Garg, for contesting as Independents

Haryana Elections 2024: BJP expels 8 rebels, including Sandeep Garg, for contesting as Independents![submenu-img]() Tamil Nadu cabinet rejig: MK Stalin's son Udhayanidhi Stalin is Deputy CM, Senthil Balaji back as minister

Tamil Nadu cabinet rejig: MK Stalin's son Udhayanidhi Stalin is Deputy CM, Senthil Balaji back as minister![submenu-img]() Chandrayaan-3 might have landed in moon's crater, 'ejecta' will reveal secrets

Chandrayaan-3 might have landed in moon's crater, 'ejecta' will reveal secrets![submenu-img]() J-K Elections 2024: Congress chief Mallikarjun Kharge’s health deteriorates during poll rally in Kathua - watch

J-K Elections 2024: Congress chief Mallikarjun Kharge’s health deteriorates during poll rally in Kathua - watch![submenu-img]() Hapur Horror: 5-year-old boy gang raped, assault captured on video, circulated online

Hapur Horror: 5-year-old boy gang raped, assault captured on video, circulated online

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)