Price comparison, grievance redressal, auto claims payouts, and context-based, data-driven insurance products are few of the insurance innovations that every Indian should be aware of

Insurance itself is a simple concept in what it offers to do. However, complex jargon and multiple legal terms implore the common man to place their trust in agents. How can this trust be enforced? It is quite simple — Buy what you need not what you are sold. The era of "one cover fits all" approach that insurance companies have been using to draft the policies is being challenged gradually.

With a growing tendency among consumers to investigate and compare their investment channels and government regulations being put in place, the tide has changed in favour of the average Indian. Policies are now being carefully designed to fit the trends and needs of the masses while keeping into consideration the varying needs of different demographics. Insurance solutions like marathon insurance, fitness covers, women and student-focused covers are some of the examples in product innovation.

Insurance is a tricky financial product because the benefit is only received by a small fraction of consumers, and that too, in times of utmost distress. These benefits, or claims, are the most important part of providing a good customer experience in the insurance world.

Technology innovation impacting claims experience is most worthwhile and heartwarming. For example, claims payout for flight delay as part of travel insurance is seeing the most amount of action. Since flight delay information is freely available and the insurance company knows the customer's flight details from the ticketing website, insurance companies can provide benefit payouts with any claim. The retail customer should look for good claims experience, or as the future is coming to, automatic claims experience, while considering which insurer to buy from.

Insurers are also using the plethora of data in creating more context-based, relevant insurance products. Nothing in India is more relevant than farming. Crop insurance over the last couple of years has evolved from old school picture proof-based, yield-dependent insurance products to real-time, weather tower-based, detailed insurance product. With the aid of distribution channels such as banks, farmers, especially those taking a loan from banks, can get access to the weather-based crop insurance scheme (WBCIS) instantly.

To summarise, price comparison, grievance redressal, auto claims payouts, and context-based, data-driven insurance products are few of the insurance innovations that every Indian should be aware of. The day is not far away when most people in India will have at least one insurance product to cover one or more of their risks and insurance will become a part of the different digital journeys of the daily consumer life.

The writer is co-founder and CEO, Symbo Insurance

![submenu-img]() 'I’ve done my part...': CSK star all-rounder bids adieu to international cricket

'I’ve done my part...': CSK star all-rounder bids adieu to international cricket![submenu-img]() Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...

Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'

Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'![submenu-img]() Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener

Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener![submenu-img]() Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत

Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत![submenu-img]() Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'

Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'![submenu-img]() Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका

Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका![submenu-img]() India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत

India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत![submenu-img]() रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'

रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

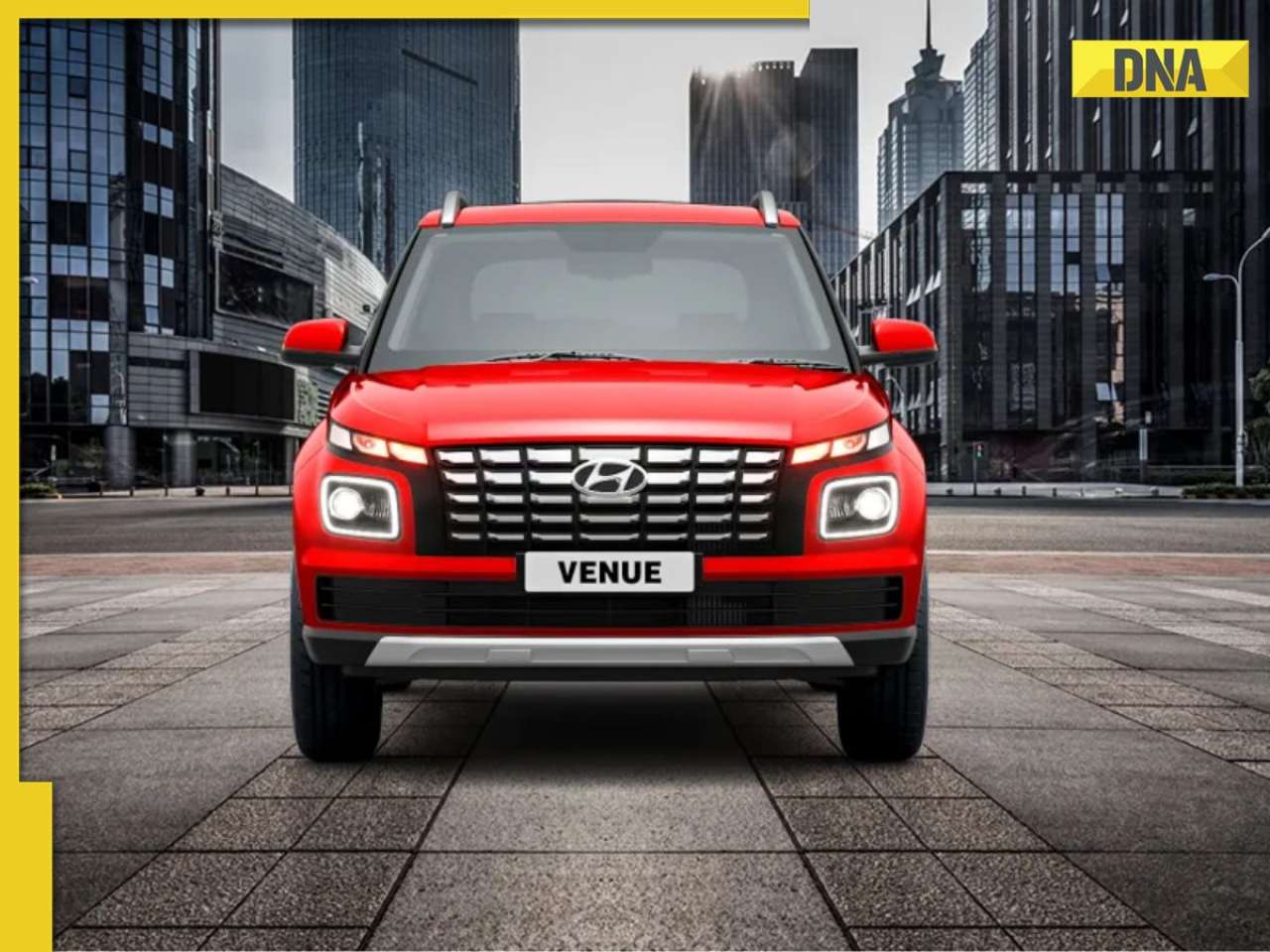

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...

Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...![submenu-img]() Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...

Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...![submenu-img]() Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects

Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects![submenu-img]() Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...

Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...

Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...![submenu-img]() Ratan Tata's company invests Rs 950 crore in this firm, plans to build...

Ratan Tata's company invests Rs 950 crore in this firm, plans to build...![submenu-img]() Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...

Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...![submenu-img]() Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...

Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...![submenu-img]() Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...

Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...![submenu-img]() From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story

From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story![submenu-img]() 6 reasons why you should buy Volkswagen Virtus

6 reasons why you should buy Volkswagen Virtus![submenu-img]() Apple to Amazon: First products launched by big tech giants

Apple to Amazon: First products launched by big tech giants![submenu-img]() Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...

Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...![submenu-img]() This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...

This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day

Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day![submenu-img]() 'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally

'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally![submenu-img]() Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….

Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….![submenu-img]() Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)