Systematic Investment Plans (SIPs) have been gaining immense traction among retail investors in India as a disciplined approach to invest in mutual funds regularly and building long-term wealth.

As per statistics from the Association of Mutual Funds in India (AMFI), the total SIP accounts in India crossed a milestone figure of 8.76 crore in May 2024. The total monthly SIP contribution also reached an all-time high of Rs. 20,904 crore in the same period. This phenomenal growth underscores the rising popularity of SIPs as a convenient and effective mode for small investors to accumulate sizeable corpuses through the power of compounding over long investment horizons. However, prudent planning using tools like SIP calculators and avoiding common pitfalls are key to maximizing returns on SIPs.

Understanding SIPs

A systematic investment plan entails investing a set amount of money on a regular basis, usually in the same mutual fund. An SIP typically draws automatic withdrawals from the funding account and may necessitate longer commitments from the investor.

One of the key benefits of SIPs is that they allow investors to take advantage of rupee-cost averaging. When the price of the mutual fund is high, fewer units are purchased. When the price is low, more units are purchased. Over time, this can lower the average cost per unit. SIPs also help enforce discipline and consistency, as the investments occur automatically on a set schedule. Investors don't have to remember to make purchases or try to time the market. Regular, smaller investments may also be more affordable than large lump sums for many investors.

What is an SIP calculator?

SIP calculator is an online financial tool that can help you estimate the returns on your SIP investments. The calculator also indicates how much you would need to invest each month to achieve your goal corpus.

How to use an SIP calculator?

SIP calculators require users to input details like the monthly investment amount, expected returns, investment tenure, and target corpus. Based on these inputs, the calculator projects the future value of the investments and indicates if the goal is achievable. Some advanced SIP calculators also allow you to adjust the expected rate of returns and consider the impact of inflation. This helps provide a more realistic estimate.

Let's consider an investor who wants to build a corpus of Rs. 50 lakhs for retirement in 15 years. They expect to earn 10% annual returns on their mutual fund SIP.

They enter the following details into the SIP calculator:

Monthly SIP amount: Rs. 10,000

Expected return: 10%

Investment period: 15 years

Target corpus: Rs. 50 lakhs

Based on these inputs, the SIP calculator projects that by investing Rs. 10,000 every month in mutual funds with a 10% expected return, the investor can build a corpus of Rs. 51.3 lakhs in 15 years. This meets the target corpus goal.

The calculator also shows how adjusting the expected returns to 8% instead of 10%, considering inflation, results in a projected corpus of only Rs. 43.7 lakhs. This projection helps the investor prepare a financial plan that requires more amount to be invested per month or extend the investment period to achieve the Rs.5 0 lakh goal at an 8% return.

Strategies to maximize returns with SIPs

One strategy to maximize SIP returns is to start investing early. The longer the investment tenure, the more time compounding has to work its magic. Starting SIPs at an early age allows investors to gain the full benefit of compounding and build a large corpus. Another tactic is to invest in equity funds or diversified funds with a higher exposure to equities. Equity investments tend to provide inflation-beating returns over the long run compared to debt. However, investors need to have the risk appetite and long-term view for equity exposure.

Choosing funds with low expense ratios can also enhance SIP returns. Lower costs mean more of the investor's capital is invested. Index funds and ETFs usually have low expense ratios. Periodically increasing the SIP amount to align with income hikes also boosts overall gains. Topping up SIPs helps build the investment corpus faster.

Avoiding withdrawals from the SIP corpus before goals are achieved retains capital and lets it grow. Staying invested and giving SIPs time to work enhances overall returns.

Tips for using SIP calculators effectively

- Input accurate and realistic assumptions for returns, inflation, tenure etc. Don't be overly optimistic.

- Model different scenarios by varying the expected returns and other variables to see outcomes.

- Account for inflation to see corpus value in real terms rather than absolute numbers.

- Increase SIP amount annually by 5-10% to align with income rises.

- Try longer tenures to allow compounding to work.

- Evaluate the impact of investing at early ages, like 20s, vs. later ages.

- Don't only target corpus, also see if annual returns generated are adequate for needs.

Avoiding common mistakes

- Not accounting for inflation - Input expected returns above inflation to get a more realistic projection.

- Being too optimistic about returns - Use reasonable, conservative return expectations based on historical long-term averages.

- Insufficient tenure - Give your SIPs longer time horizons to benefit from compounding.

- No increase in SIP amount - Align your SIPs yearly to income hikes for better corpus build-up.

- Unrealistic target corpus - Ensure your target corpus is grounded in your income, expenses, and risk appetite.

Conclusion

With discipline and patience, SIPs hold the potential to create substantial corpuses towards achieving major financial goals for retail investors in India. The consistent growth in SIP AUM and accounts is a testament to the growing acceptance of this investment methodology. Investors must, however, be diligent and aware of their risk appetites and financial goals to maximize returns from their SIPs.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)

![submenu-img]() 'I’ve done my part...': CSK star all-rounder bids adieu to international cricket

'I’ve done my part...': CSK star all-rounder bids adieu to international cricket![submenu-img]() Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...

Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'

Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'![submenu-img]() Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener

Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener![submenu-img]() Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत

Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत![submenu-img]() Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'

Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'![submenu-img]() Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका

Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका![submenu-img]() India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत

India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत![submenu-img]() रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'

रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...

Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...![submenu-img]() Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...

Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...![submenu-img]() Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects

Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects![submenu-img]() Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...

Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

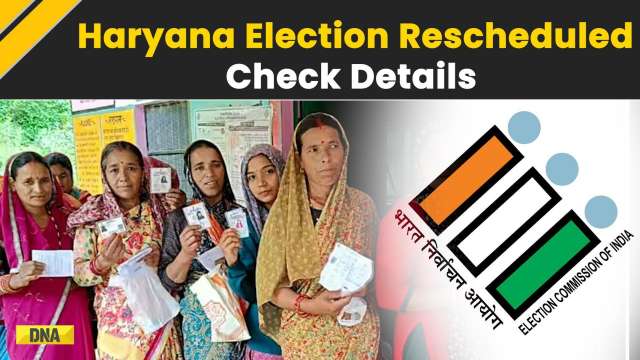

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...

Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...![submenu-img]() Ratan Tata's company invests Rs 950 crore in this firm, plans to build...

Ratan Tata's company invests Rs 950 crore in this firm, plans to build...![submenu-img]() Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...

Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...![submenu-img]() Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...

Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...![submenu-img]() Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...

Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...![submenu-img]() From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story

From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story![submenu-img]() 6 reasons why you should buy Volkswagen Virtus

6 reasons why you should buy Volkswagen Virtus![submenu-img]() Apple to Amazon: First products launched by big tech giants

Apple to Amazon: First products launched by big tech giants![submenu-img]() Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...

Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...![submenu-img]() This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...

This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day

Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day![submenu-img]() 'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally

'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally![submenu-img]() Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….

Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….![submenu-img]() Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)