Aakash over time observed there are significant lags in many banks regarding transaction processing time and that itself was a weakness.

In the current digital landscape, customer satisfaction is the key. Even banks that were once believed to be quite conservative and traditional have not remained unaffected due to the advanced technologies. Aakash Aluwala, the leader of banking and technology knows this concept well, so he has come up with functional strategies which contain ways of enhancing the use of technology in financial activities. Such strategies improve the user experience and, customer satisfaction in the banking services.

Revolutionising Banking with a Customer-Centric Approach

Aakash over time observed there are significant lags in many banks regarding transaction processing time and that itself was a weakness. Today, with customer attention span rapidly reducing, the client wants service delivery to be smooth and fast; if not, they end up being frustrated with such services offered to them.

In this approach, he applies monitoring tools to identify bottlenecks in the transaction flow. In the process, these tasks, indicators, and targets would be scrutinized down to a detail that would allow him to note the opportunities for change. This would result in some great decreases in the processing times. Now imagine a situation when a customer tries to make a wire transfer. Historically, this approach entails some processes that would also add to hours of waiting time. Aakash’s strategy shall pin down such delays and rationalize the process so that the customer may realize the efficient transfer.

Therefore, his skills in business analysis are not limited to transaction processing. He understood that with the existing setup, he was only making the customers more confused as most banking user interfaces (UIs) were complex and not very user-friendly. For instance, it is sometimes possible to create an ineffective user interface for a mobile banking application that hides most of the necessary options in the drop-down lists and submenus; thus, people who need to learn their account balance or pay the utility bill in the blink of an eye will have to waste their precious time on searching for what they need.

These are some of the areas of pain that Aakash recognizes and as a solution, redesigns the User Interface to make it as useful as possible. This could include for instance: good flow and organization, clear and recognizable icons and buttons, and functionalities that have default buttons on the home screen. Due to Aakash’s identified strategies that focused on the simplification of the UI and the centrality of the client’s requirements, we can conclude that the goals set lead to a more effective and satisfactory use of banking services.

Fortunately, unlike many people, he already realizes that innovation is not a one-off process. Intending to perpetuate the level of customer satisfaction, he has introduced the feedback loop that relies on actual data. This system is capable of tracking users’ activity and collecting customer feedback in the form of a questionnaire or poll. This information is then processed todetermine how the user experience can be made better. For example, the feedback loop may suggest that one of the ‘sub-features’ of the mobile app is not popular among the clients or is unclear. This way, it is possible for Aakash’s team to enhance the feature’s capabilities or even exclude it and make the general process smoother.

His functional strategies offer several different benefits for both banks and their customers:

• Enhanced Customer Satisfaction:Customer loyalty would be enhanced with this solution since they were highly satisfied due to shorter transaction time complex user interface and personalized services.

• Improved Operational Efficiency:By selecting Aakash’s solution, the costs of banking can be shortened. The solution largely reduces the occurrence of transaction types and includes a simple interface, which would lighten the burden on customer service departments. Not only would it save the bank money, it would spur increased efficiency as a result of having to go through the extra step.

• Data-Driven Decision Making:The information derived from the feedback loop could be used by the banks to predict future trends and plan product strategies. Therefore, the use of this approach ensures that the different banks are adapting to the changing needs of their clients.

• Stronger Customer Relationships:With the above being executed by the bank, it could be very certain that they have fostered good customer relations. This would occur through the appearance of personalized services, and care for the customer needs that enhance trust between the banks and the customers.

Aakash Aluwala’s functional strategies are long overdue and seem to have bright prospects in the growth and development of banking. Through such approaches, the banking institutions will be in a position to shift from constraining techniques and come up with activities that customers appreciate. This would culminate in a future where banking is effective, convenient, and, in essence, more fulfilling to all the stakeholders. Thus, with the help of technology, Aakash provides a glimpse into the future by presenting a new approach to banking. This is where the power lies in the hands of banks as they try to sustain and grow in the face of competition while actively working on the formation of a more profound and valuable bond with the clients.

![submenu-img]() 'I’ve done my part...': CSK star all-rounder bids adieu to international cricket

'I’ve done my part...': CSK star all-rounder bids adieu to international cricket![submenu-img]() Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...

Former Indian football team head coach Igor Stimac set to receive Rs 33600000 from AIFF as...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'

Nicole Kidman skips receiving Best Actress award at Venice Film Festival due to her mother's death: 'I am in shock'![submenu-img]() Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener

Asian Hockey Champions Trophy: Defending champions India beat China 3-0 in campaign opener![submenu-img]() Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत

Pakistan में भारी बवाल, इमरान खान के समर्थकों और पुलिस की झड़प में 7 की मौत![submenu-img]() Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'

Kolkata Rape Case: बंगाल के राज्यपाल का ममता बनर्जी को अल्टीमेटम, 'कोलकाता पुलिस कमिश्नर को हटाएं'![submenu-img]() Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका

Congress Candidate List: हरियाणा विधानसभा चुनाव के लिए कांग्रेस की दूसरी लिस्ट जारी, जानें किसे कहां से मिला मौका![submenu-img]() India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत

India squad for first Test vs Bangladesh: बांग्लादेश के खिलाफ पहले टेस्ट के लिए टीम इंडिया का ऐलान, यश दयाल की चमकी किस्मत![submenu-img]() रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'

रेसलर बजरंग पून�िया को मिली जान से मारने की धमकी, मैसेज में लिखा-'कांग्रेस छोड़ दो, ये हमारी पहली और आखिरी चेतावनी है'![submenu-img]() Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared

Jawa 42 FJ vs Royal Enfield Classic 350: Price, engine, specs compared ![submenu-img]() Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…

Bhavish Aggarwal’s Ola Electric set to challenge Mahindra, Bajaj as his company plans to launch…![submenu-img]() Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…

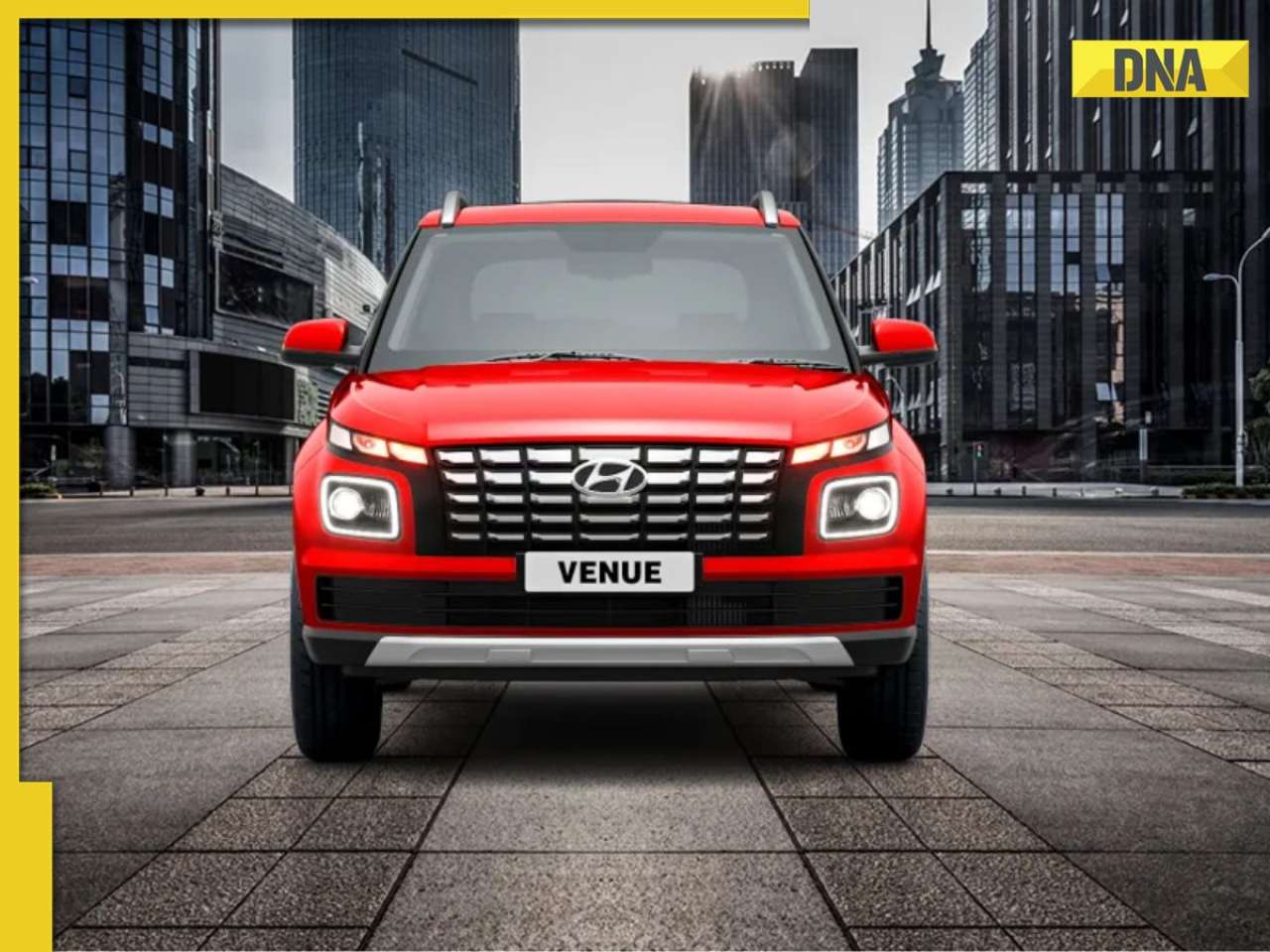

Skoda-Auto Volkswagen India to invest Rs 15000 crore to set up EV plant in…![submenu-img]() Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…

Hyundai Venue E+ with electric sunroof launched in India; price starts at Rs…![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...

Meet woman, who got separated from her son, cracked UPSC exam to become IAS officer with AIR 2, she is...![submenu-img]() Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...

Meet man, who cracked UPSC exam with AIR 646, became IPS officer, now suspended due to...![submenu-img]() Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects

Marksheet of IAS Sonal Goel goes viral on social media, check her UPSC exam scores in different subjects![submenu-img]() Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...

Meet woman, who cracked UPSC exam at the age 22, became IAS officer, secured AIR 51, she is...![submenu-img]() Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...

Meet IIT topper who left corporate job to become IAS officer, failed four times in UPSC exam, he is...![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...

Meet Indian man, who is likely to become world's 2nd trillionaire after Elon Musk, has net worth of...![submenu-img]() Ratan Tata's company invests Rs 950 crore in this firm, plans to build...

Ratan Tata's company invests Rs 950 crore in this firm, plans to build...![submenu-img]() Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...

Meet Indian genius who established 10 famous brands, built Rs 10000 crore company, not from IIT, IIM, runs iconic...![submenu-img]() Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...

Meet man who earns over Rs 11 crore monthly, highest-paid executive in Indian company, he is Ratan Tata's...![submenu-img]() Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...

Meet woman, an Indian, who is CEO of Rs 55683 crore company in US, her business is...![submenu-img]() From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story

From getting secretly engaged to becoming parents to baby girl: A look at Deepika Padukone, Ranveer Singh's love story![submenu-img]() 6 reasons why you should buy Volkswagen Virtus

6 reasons why you should buy Volkswagen Virtus![submenu-img]() Apple to Amazon: First products launched by big tech giants

Apple to Amazon: First products launched by big tech giants![submenu-img]() Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...

Made in Rs 82 crore, this superstar's film crashed after bumper opening, debutant actress left Bollywood, film earned...![submenu-img]() This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...

This film won five National Awards, hero acted for free; Manoj Bajpayee was first choice for villain, was replaced by...![submenu-img]() Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8

Lucknow building collapse: Police lodged FIR against owner as death toll rises to 8![submenu-img]() Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day

Weather Update: Heavy rain continues to lash Rajasthan, IMD issues yellow, orange alerts for several parts till this day![submenu-img]() 'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally

'Ready for dialogue with Pakistan if...': Defence Minister Rajnath Singh in J-K election rally![submenu-img]() Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….

Bangladesh plans to extradite ex-PM Sheikh Hasina from India, put her on trial for….![submenu-img]() Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

Haryana Assembly Polls: AAP MP Raghav Chadha gives big update on AAP-Congress alliance, says, ‘both parties trying to..'

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)