The issue will open for subscription on March 20 and close on March 23. It will comprise 25.8 lakh equity shares constituting 25.81% of the post-offer capital

MUMBAI: Credit rating firm Icra on Monday announced a price band of Rs 275-330 per share for its initial public offering. The issue will open for subscription on March 20 and close on March 23. It will comprise 25.8 lakh equity shares constituting 25.81% of the post-offer capital

IFCI, State Bank of India and administrator of the specified undertaking of UTI (SUTI) are making this offer of sale. IFCI and SUTI, which hold 21.13% and 7.95%, respectively, will fully liquidate their holdings through the issue, while SBI’s stake will come down to 9.99% from 11.59%.

According to Naresh Thakkar, managing director, Icra, the rating firm is not raising any money for itself through the issue. However, it is planning an employee stock option plan (ESOP) for its top management.

“Our existing shareholder capital is Rs 8.80 crore. As per listing guidelines, we need to raise it to Rs 10 crore. So, the differential will be issued to the employee welfare trust and also to Moody’s Investor Service,” said Thakkar.

Global rating agency Moody’s Investors Service, which is a strategic partner, will get a preferential allotment at the same offer price. It will hold a stake of about 28.51 % in ICRA after the IPO.

The offer is being made through the 100% book building process, wherein up to 50% of the offer will be allotted to QIBs.

Interestingly, even though the company is in the business of rating, which includes grading of IPOs, it has opted out of any grading for its IPO. “Since the process involves disclosing all confidential information to one of the competitors for grading, we decided not to go for grading,” PK Choudhury, vice chairman and group CEO, said.

Kotak Mahindra Capital Co and SBI Capital Markets Ltd are the managers for the issue.

![submenu-img]() Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case

Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case![submenu-img]() India lift the ICC Trophy after 11 years; wishes from Amitabh Bachchan, Rachana & Rhythm, Indra Nooyi flow in!

India lift the ICC Trophy after 11 years; wishes from Amitabh Bachchan, Rachana & Rhythm, Indra Nooyi flow in!![submenu-img]() 'He is entitled to...': US Supreme Court says Donald Trump partially immune from prosecution for...

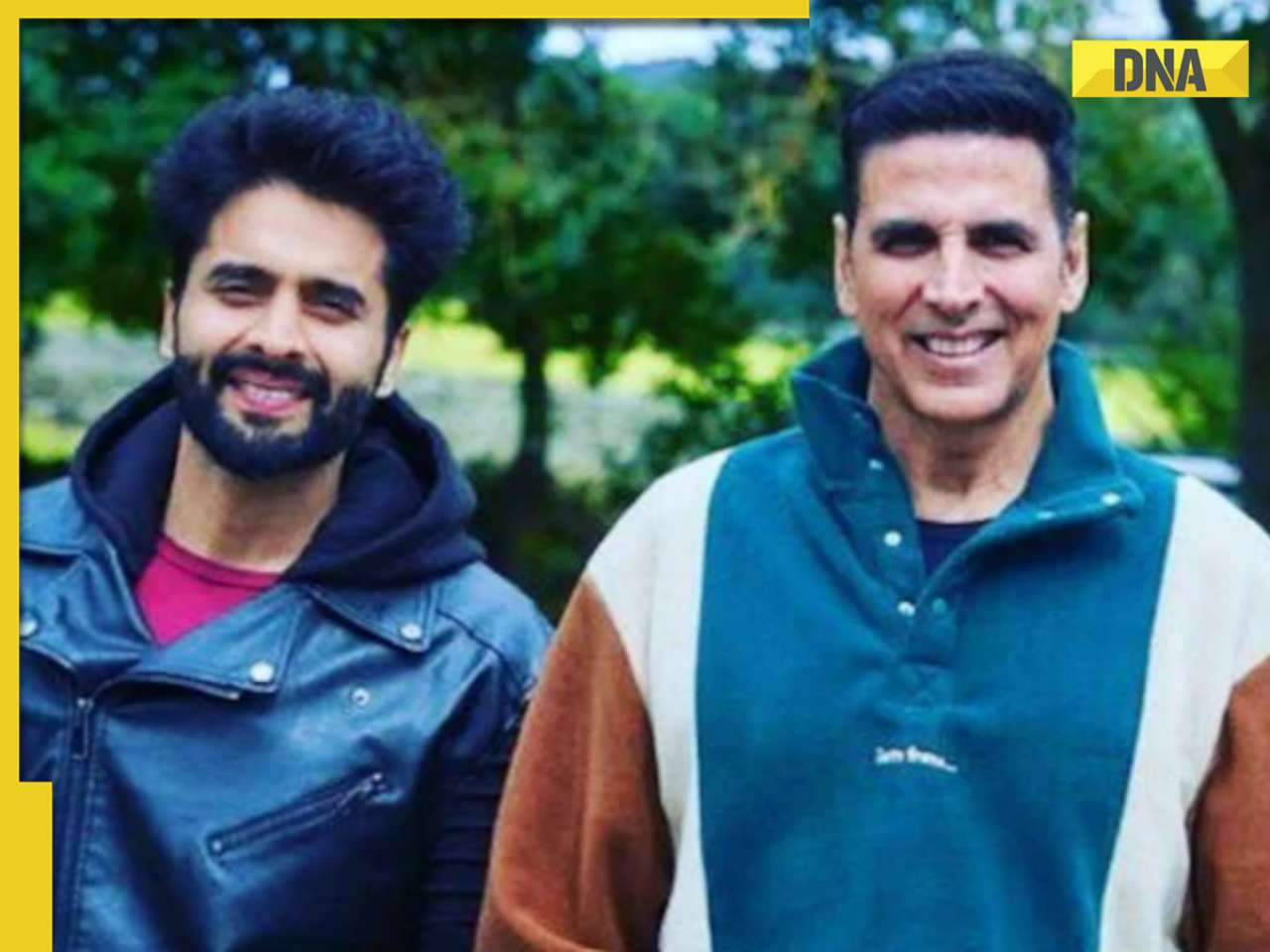

'He is entitled to...': US Supreme Court says Donald Trump partially immune from prosecution for...![submenu-img]() Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...

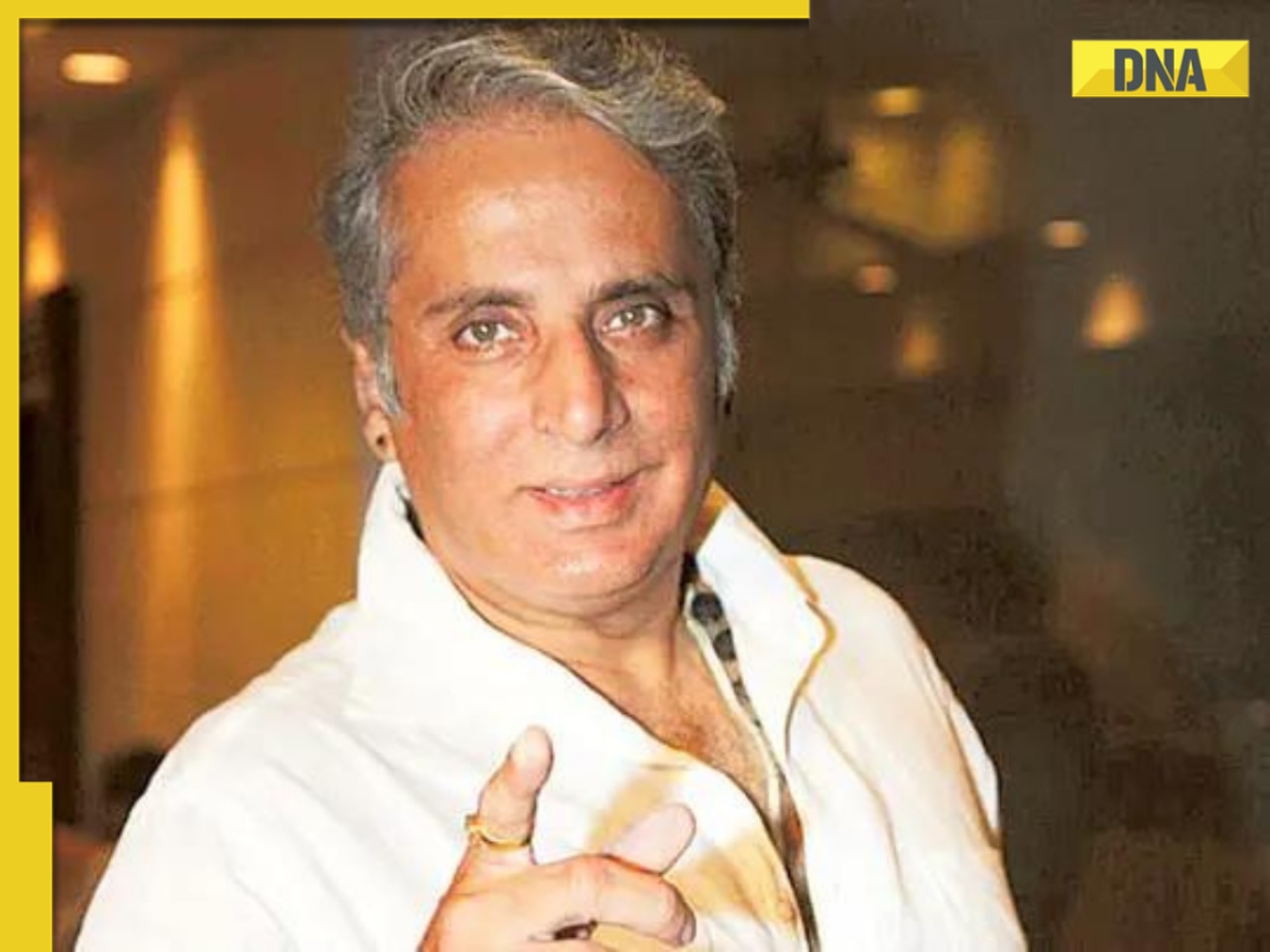

Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...![submenu-img]() 'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive

'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive![submenu-img]() UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here

UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here![submenu-img]() Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...

Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...![submenu-img]() Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...

Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...![submenu-img]() Meet Kathak dancer who topped UPSC exam in 1st attempt, worked at RBI in day and studied at night, she is...

Meet Kathak dancer who topped UPSC exam in 1st attempt, worked at RBI in day and studied at night, she is...![submenu-img]() Meet woman who cleared UPSC exam at 23 in her first attempt, got AIR 94, but didn't become IAS officer due to...

Meet woman who cleared UPSC exam at 23 in her first attempt, got AIR 94, but didn't become IAS officer due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: India beat South Africa by 7 runs to lift second T20 World Cup title

In pics: India beat South Africa by 7 runs to lift second T20 World Cup title![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case

Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case![submenu-img]() Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...

Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...![submenu-img]() 'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive

'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive![submenu-img]() The Buckingham Murders: Kareena Kapoor is held forcibly by cops in first look poster, fans say 'National Award loading'

The Buckingham Murders: Kareena Kapoor is held forcibly by cops in first look poster, fans say 'National Award loading'![submenu-img]() Dharmendra bought this film's script for Rs 17500, his sister forced him to not work in it, movie changed life of...

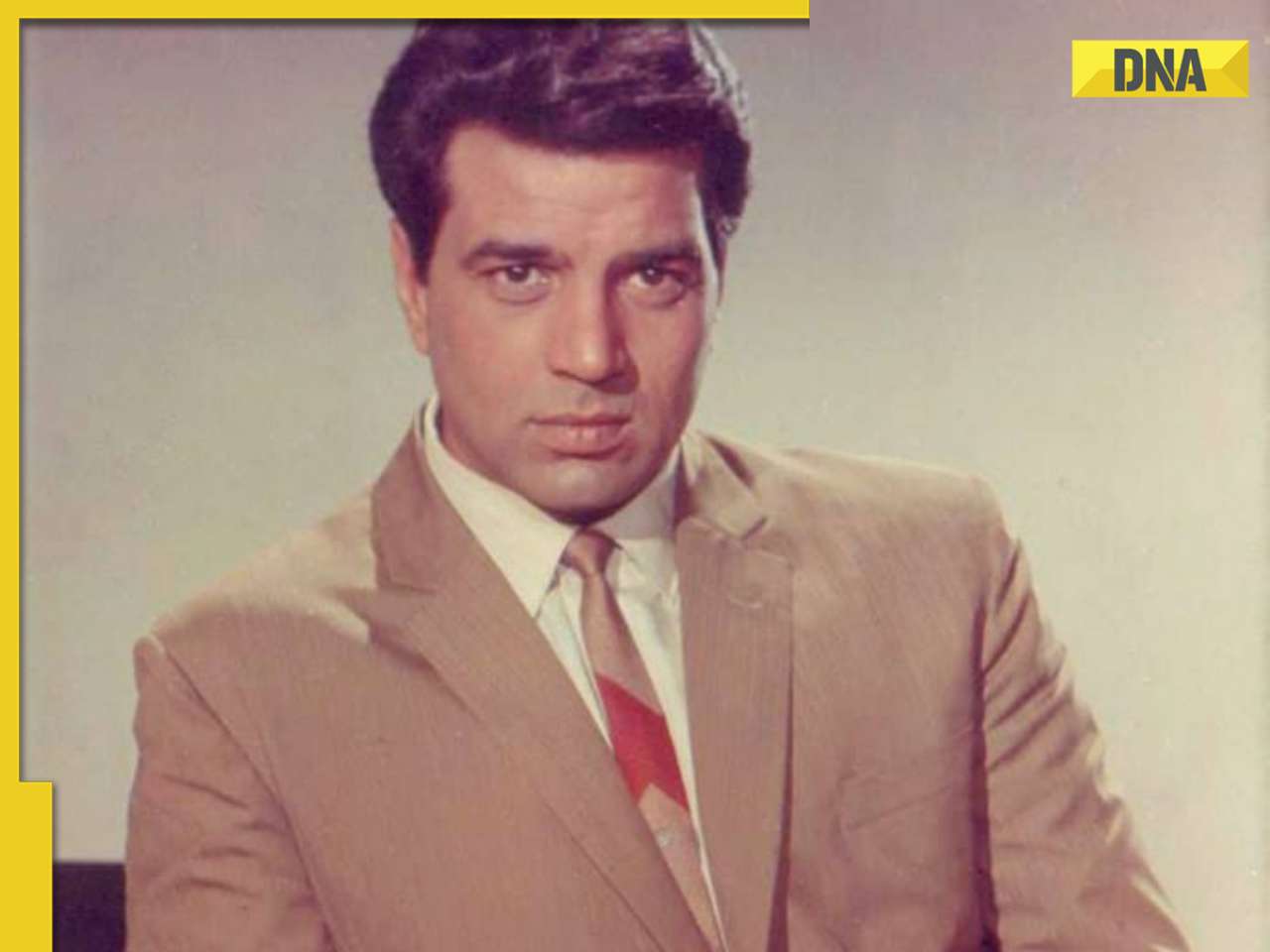

Dharmendra bought this film's script for Rs 17500, his sister forced him to not work in it, movie changed life of...![submenu-img]() Watch viral video: AI chatbot caught lying, tells users that it is...

Watch viral video: AI chatbot caught lying, tells users that it is...![submenu-img]() Virat Kohli fails to make it in ICC ‘Team of the Tournament', six Indians in the list including…

Virat Kohli fails to make it in ICC ‘Team of the Tournament', six Indians in the list including…![submenu-img]() Meet woman who lives in India's largest house, larger than Mukesh Ambani, Nita Ambani's Rs 15000 cr Antilia, she is...

Meet woman who lives in India's largest house, larger than Mukesh Ambani, Nita Ambani's Rs 15000 cr Antilia, she is...![submenu-img]() North Korea publicly executes 22-year-old man for listening to...

North Korea publicly executes 22-year-old man for listening to...![submenu-img]() Viral video: Little girl’s adorable dance to ‘Soulmate’ wins internet, watch

Viral video: Little girl’s adorable dance to ‘Soulmate’ wins internet, watch

)

)

)

)

)

)