The Mumbai terror strikes of 26/11 have been one of the single largest insurance losses for India. But it won’t figure in the Top 5 costliest insured losses in 2008.

The Mumbai terror strikes of 26/11 have been one of the single largest insurance losses for India. But global estimates suggest it won’t figure in the Top 5 costliest insured losses in 2008.

This year, losses from from ‘acts of God’ have caused substantial more damages than ‘man-made disasters’. Property insurers globally are expected to face claims of over $50 billion in 2008, making it the second costliest year in terms of insured losses, after 2005.

Almost 86% of the total estimated property claims are estimated to emerge from natural catastrophes. Swiss Re, the world’s largest reinsurance company, stated in a recent report: “Catastrophes in 2008 cost society $225 billion.”

That figure includes both insured and uninsured losses to buildings, infrastructure and vehicles. The company said the earthquake in Sichuan, China, was the costliest catastrophe, causing $85 billion of damage. Hurricane Ike ranked second ($40 billion), followed by snowstorms and freezing rain across China ($20 billion).

In terms of man-made disasters, a ruptured pipeline on Varanus Island in Western Australia in June resulted in losses of at least $1.8 billion to industry and the local economy, the report said.

It is estimated that more than 238,000 people lost their lives due to natural calamities and man-made disasters during 2008. In Asia, the two biggest calamities came in early May, when tropical cyclone Nargis struck Myanmar and a devastating earthquake shook China’s Sichuan region in the same month.

Swiss Re estimates the two events set off the largest humanitarian crisis in recent history. Most of the losses from these two events were not insured. Man-made disasters continued to prove costly in 2008. “Explosions and major fires resulted in losses of $4.8 billion.

Damages to industry and industrial warehouse accounted for $2.1 billion, while oil and gas related incidents cost insurers another $1.5 billion,” the report said. Back home, the 26/11 losses are estimated to run into hundreds of crores, but the actual assessment is yet to be completed.

![submenu-img]() Ganesh Chaturthi 2024 shubh muhurat: Check city wise puja timings, visarjan date, and bhog for Ganpati Bappa

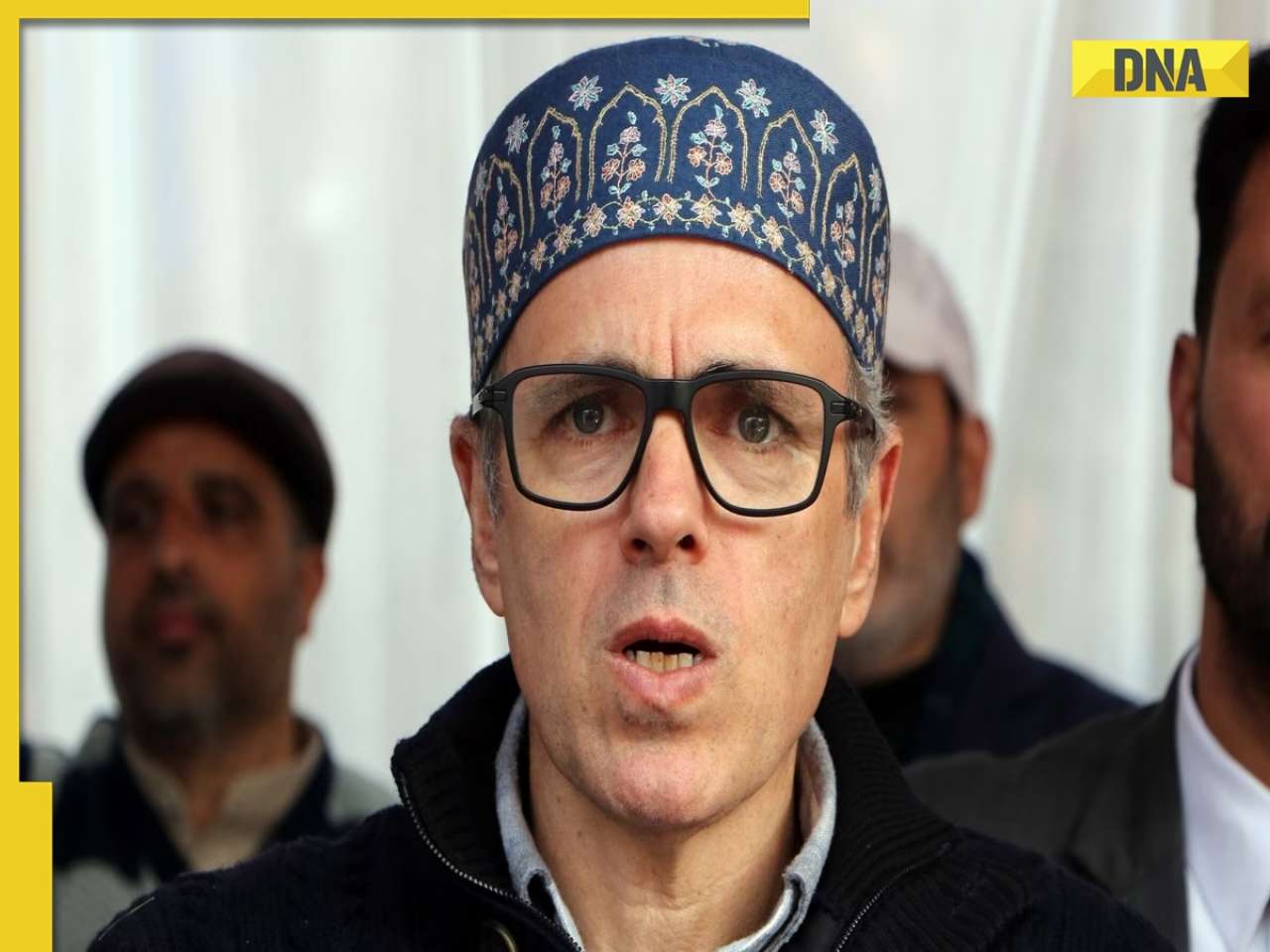

Ganesh Chaturthi 2024 shubh muhurat: Check city wise puja timings, visarjan date, and bhog for Ganpati Bappa![submenu-img]() 'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'

'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'![submenu-img]() Boney Kapoor announces new film, its title has a Mr India connect: 'Probably by December we...'

Boney Kapoor announces new film, its title has a Mr India connect: 'Probably by December we...'![submenu-img]() Meet actress, who worked for 17 hours straight on toxic sets, her mental health was affected, left industry, is now...

Meet actress, who worked for 17 hours straight on toxic sets, her mental health was affected, left industry, is now...![submenu-img]() Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'

Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'![submenu-img]() Aparajita Bill पर ममता बनर्जी को झटका, राज्यपाल ने कमियां गिना राष्ट्रपति के पास भेजा

Aparajita Bill पर ममता बनर्जी को झटका, राज्यपाल ने कमियां गिना राष्ट्रपति के पास भेजा![submenu-img]() Haryana Assembly Election 2024: हरियाणा में कांग्रेस प्रत्याशियों की पहली लिस्ट जारी, इस सीट से चुनावी मैदान में उतरी विनेश फोगाट

Haryana Assembly Election 2024: हरियाणा में कांग्रेस प्रत्याशियों की पहली लिस्ट जारी, इस सीट से चुनावी मैदान में उतरी विनेश फोगाट![submenu-img]() Hathras Accident: यूपी के हाथरस में बड़ा सड़क हादसा, 15 लोगों की मौत, कई घायल

Hathras Accident: यूपी के हाथरस में बड़ा सड़क हादसा, 15 लोगों की मौत, कई घायल![submenu-img]() Viral Video: Indigo की फ्लाइट में बंद हो गया एसी, गर्मी से परेशान यात्री हो गए बेहोश

Viral Video: Indigo की फ्लाइट में बंद हो गया एसी, गर्मी से परेशान यात्री हो गए बेहोश ![submenu-img]() Weather Alert: महाराष्ट्र-गुजरात में जोरदार बारिश, आंध्र-तेलंगाना में बाढ़, जानें दिल्ली-एनसीआर के लिए क्या है अलर्ट

Weather Alert: महाराष्ट्र-गुजरात में जोरदार बारिश, आंध्र-तेलंगाना में बाढ़, जानें दिल्ली-एनसीआर के लिए क्या है अलर्ट![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details

DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details![submenu-img]() Hyundai Creta Knight Edition launched in India: Check price, features, design

Hyundai Creta Knight Edition launched in India: Check price, features, design![submenu-img]() DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() UPSC topper IAS Shruti Sharma's marksheet goes viral on social media, check her scores in different subjects

UPSC topper IAS Shruti Sharma's marksheet goes viral on social media, check her scores in different subjects![submenu-img]() Meet man, who lost his mother in childhood, worked as milk seller, cracked NEET exam with AIR...

Meet man, who lost his mother in childhood, worked as milk seller, cracked NEET exam with AIR...![submenu-img]() Meet man who failed 35 exams, cracked UPSC exam twice, first became IPS then quit due to...

Meet man who failed 35 exams, cracked UPSC exam twice, first became IPS then quit due to...![submenu-img]() Meet man, who was forced into child marriage at 11, cracked NEET exam with AIR...

Meet man, who was forced into child marriage at 11, cracked NEET exam with AIR...![submenu-img]() Meet woman who cracked UPSC exam in first attempt without coaching at 22, got AIR 31, she is now posted as…

Meet woman who cracked UPSC exam in first attempt without coaching at 22, got AIR 31, she is now posted as…![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

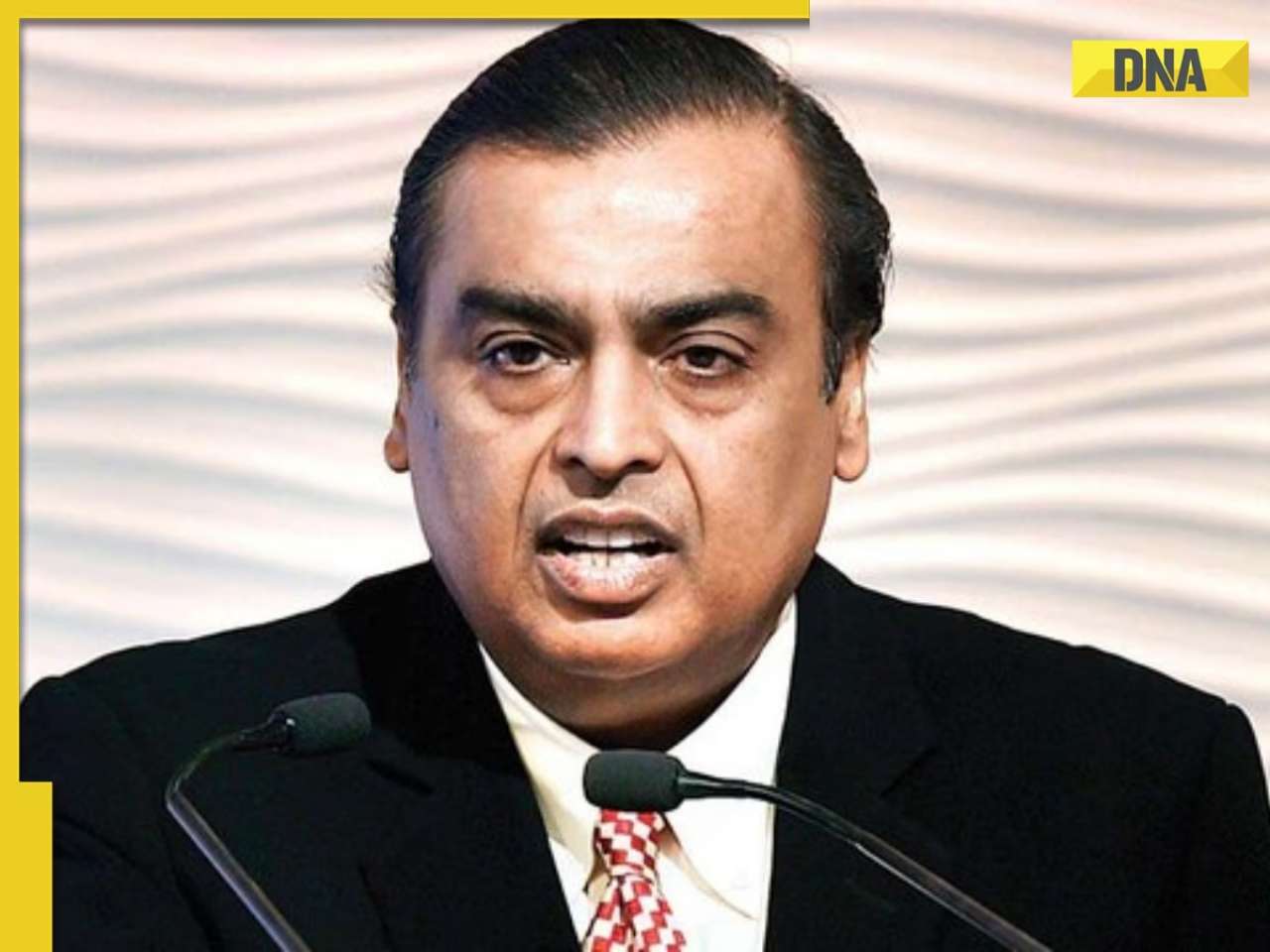

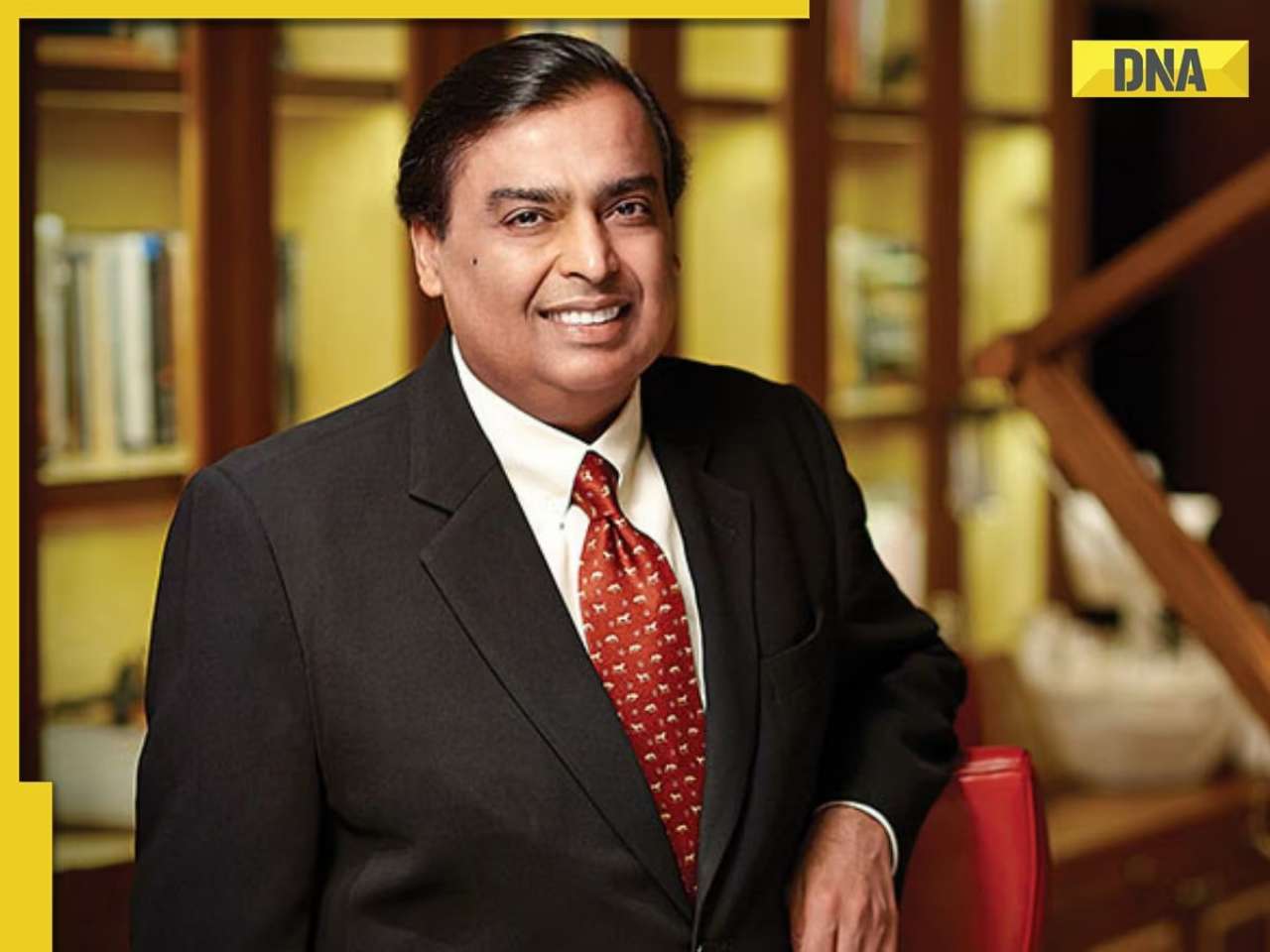

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Mukesh Ambani set to challenge Adani, ITC with his Rs 3900 crore plan for...

Mukesh Ambani set to challenge Adani, ITC with his Rs 3900 crore plan for...![submenu-img]() NPCI launches 'UPI circle', check what it is and how it works

NPCI launches 'UPI circle', check what it is and how it works![submenu-img]() Mukesh Ambani's Reliance Jio to give tough competition to BSNL with this plan, it offers 5G data at just Rs...

Mukesh Ambani's Reliance Jio to give tough competition to BSNL with this plan, it offers 5G data at just Rs...![submenu-img]() This company repays Rs 20000 crore debt for... and it has a Ratan Tata connection

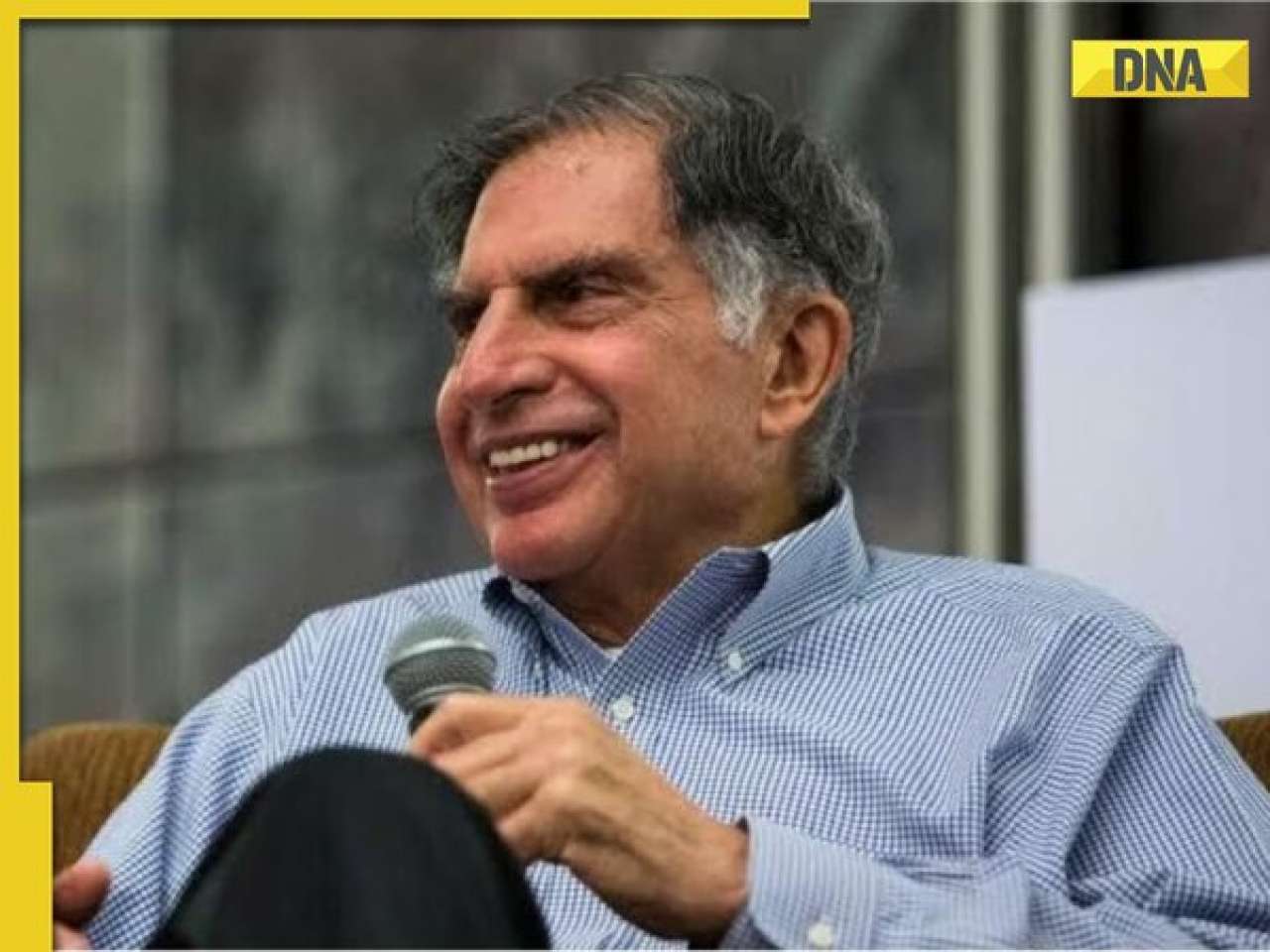

This company repays Rs 20000 crore debt for... and it has a Ratan Tata connection![submenu-img]() Meet woman, billionaire's daughter, who studied in London, now leads Rs 1124 crore company as...

Meet woman, billionaire's daughter, who studied in London, now leads Rs 1124 crore company as...![submenu-img]() From Cristiano Ronaldo to Virat Kohli: List of highest-paid athletes in last 12 months

From Cristiano Ronaldo to Virat Kohli: List of highest-paid athletes in last 12 months![submenu-img]() Meet actor who worked as waiter, sold tea, namkeen for 14 years, debuted in Bollywood at 42; now his net worth is...

Meet actor who worked as waiter, sold tea, namkeen for 14 years, debuted in Bollywood at 42; now his net worth is...![submenu-img]() Parents-to-be Deepika Padukone, Ranveer Singh seek blessings at Siddhivinayak with families days before baby's arrival

Parents-to-be Deepika Padukone, Ranveer Singh seek blessings at Siddhivinayak with families days before baby's arrival![submenu-img]() Gout remedies: 7 natural ways to lower uric acid levels in the body

Gout remedies: 7 natural ways to lower uric acid levels in the body ![submenu-img]() Active players with most centuries in international cricket

Active players with most centuries in international cricket ![submenu-img]() 'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'

'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'![submenu-img]() Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'

Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'![submenu-img]() 'When we were dragged on roads...': Wrestler Vinesh Phogat slams BJP

'When we were dragged on roads...': Wrestler Vinesh Phogat slams BJP![submenu-img]() India emerges as second-largest global 5G smartphone market, overtakes...

India emerges as second-largest global 5G smartphone market, overtakes...![submenu-img]() Union Home Minister Amit Shah releases BJP manifesto for J&K assembly elections

Union Home Minister Amit Shah releases BJP manifesto for J&K assembly elections

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)