In their Budget wish list, banks want tax concessions for cashless transactions and a surcharge on cash payment beyond a limit

Banks, under the aegis of Indian Banks Association (IBA), have asked the government to give tax concessions for cashless transactions, and disincentivise cash by imposing a surcharge on cash payments beyond a certain limit.

This, they say, will help all stakeholders to share the costs of turning India cashless and digital.

Arundhati Bhattacharya, chairman, State Bank of India, told DNA Money, "We have been suggesting incentives for non-cash and disincentives for cash transactions for some time now. It is a step in the right direction."

The government is already giving incentives for cashless transactions, but it has not imposed any surcharge on cash transactions.

Petroleum public sector units have been asked to give a discount of 0.75% on the sale of petrol or diesel if payment is made digitally. However, these are temporary measures to tide over cash shortage. Bankers say there should be a permanent process of incentives and disincentives.

Rajeev Rishi, chairman, IBA, and also chairman and managing director, Central Bank of India, told DNA Money, "We have asked the government to consider some concessions for people who go cashless, and have some surcharges for people who pay by cash for large transactions, which would discourage use of cash, fulfilling the government objective of going digital."

A senior banker said, "The government should have some permanent reliefs and impose charges for cash payments, and make it a part of the budgetary provisions. Now, banks are expected to invest in technology and also give up ATM fees and merchant discount rates (MDR), but the expenses cannot solely rest with the banks. The cost needs to be shared by other stakeholders."

Prior to demonetization, bank customers in six metros -- Delhi, Mumbai, Chennai, Kolkata, Hyderabad and Bengaluru -- were allowed to withdraw money free of charge five times a month from the banks where they have their accounts, and every transaction beyond that was charged at the rate of Rs 20 per transaction.

Post demonetization, all ATM transactions, both financial and non-financial, are made free of charge. Although cash withdrawal limit from ATMs has been raised by the Reserve Bank of India (RBI) to Rs 4,500 from the earlier Rs 2,500 on December 30, there is no official communication as far as free-of-charge transaction limit is concerned.

According to December 16 notification, RBI lowered MDR charges on payments made through debit cards to 0.25% for payment up to Rs 1,000 from January 1 to March 31. The MDR for debit card payments, including payments made to the government, will be capped at 0.25% for transactions up to Rs 1,000 and 0.5% between Rs 1,000 and Rs 2,000, RBI had said.

Similarly, it had asked banks and prepaid payment instrument issuers not to levy any charges for transactions up to Rs 1,000 from January 1 to March 31.

Another senior banker said, "If banks have to give up on all these fees, how will it invest in newer technology and install security features, which are essential for making these payments secure."

![submenu-img]() From enemies to soulmates: Hockey legend PR Sreejesh recalls his Bollywood style love story with wife Aneeshya

From enemies to soulmates: Hockey legend PR Sreejesh recalls his Bollywood style love story with wife Aneeshya![submenu-img]() When did Rohit Sharma, Virat Kohli and Jasprit Bumrah last play domestic cricket?

When did Rohit Sharma, Virat Kohli and Jasprit Bumrah last play domestic cricket?![submenu-img]() Apple iPhone gets massive discount, Reliance Digital offering Apple device under Rs...

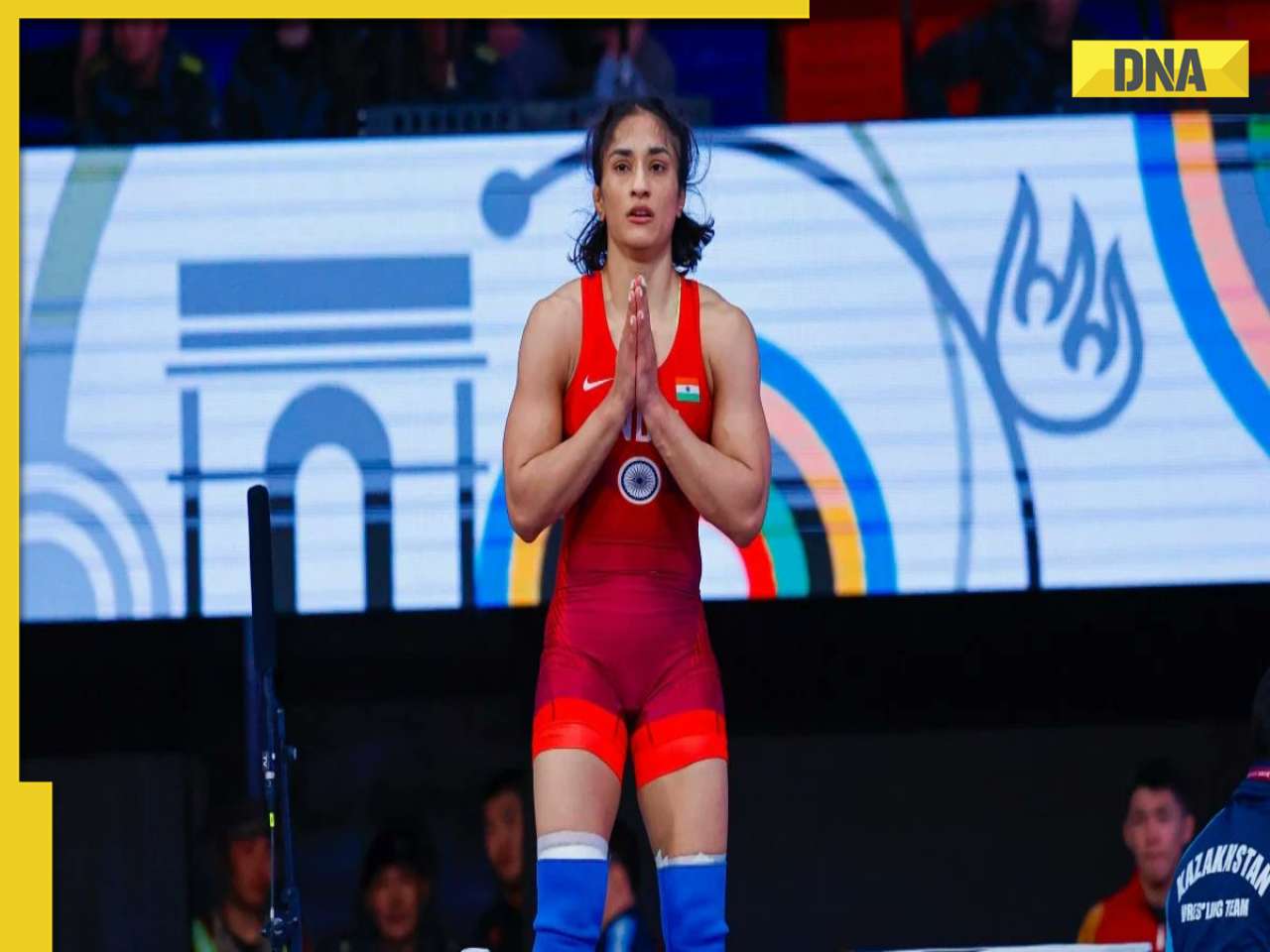

Apple iPhone gets massive discount, Reliance Digital offering Apple device under Rs...![submenu-img]() Revealed: Reason behind delay in ace wrestler Vinesh Phogat case

Revealed: Reason behind delay in ace wrestler Vinesh Phogat case![submenu-img]() Kolkata doctor rape-murder case: Rahul Gandhi breaks silence, said…

Kolkata doctor rape-murder case: Rahul Gandhi breaks silence, said…![submenu-img]() Paris olympics 2024: भारत को सिल्वर मेडल की उम्मीद पर फिरा पानी, Vinesh Phogat की अपील हुई खारिज

Paris olympics 2024: भारत को सिल्वर मेडल की उम्मीद पर फिरा पानी, Vinesh Phogat की अपील हुई खारिज ![submenu-img]() Sheikh Hasina ने बांग्लादेश छोड़ने के बाद कही मन की बात, 'मुझे भी न्याय मिले'

Sheikh Hasina ने बांग्लादेश छोड़ने के बाद कही मन की बात, 'मुझे भी न्याय मिले'![submenu-img]() Kolkata Doctor Rape Murder Case: कोलकाता रेप-मर्डर केस पर बोले राहुल गांधी, 'आरोपियों को बचाने की हो रही कोशिश'

Kolkata Doctor Rape Murder Case: कोलकाता रेप-मर्डर केस पर बोले राहुल गांधी, 'आरोपियों को बचाने की हो रही कोशिश'![submenu-img]() Kannauj minor rape case: नवाब सिंह यादव की जमानत याचिका पर सुनवाई टली, जानें पुलिस ने मामले में क्यों मांगा समय

Kannauj minor rape case: नवाब सिंह यादव की जमानत याचिका पर सुनवाई टली, जानें पुलिस ने मामले में क्यों मांगा समय![submenu-img]() X Outage In India: भारत में ठप पड़ा X! सोशल मीडिया यूजर्स के बीच मचा हड़कंप

X Outage In India: भारत में ठप पड़ा X! सोशल मीडिया यूजर्स के बीच मचा हड़कंप ![submenu-img]() Meet first Indian, who cracked UPSC exam at age of 21 to become IAS officer, he was...

Meet first Indian, who cracked UPSC exam at age of 21 to become IAS officer, he was...![submenu-img]() Where is UPSC topper IAS Tina Dabi now? Find out her current posting

Where is UPSC topper IAS Tina Dabi now? Find out her current posting![submenu-img]() Meet man, whose family used to earn Rs 2000, lived in a mud house, built Rs 3.5 crore business, he is...

Meet man, whose family used to earn Rs 2000, lived in a mud house, built Rs 3.5 crore business, he is...![submenu-img]() What is the real name of Drishti IAS owner Dr. Vikas Divyakirti, know truth behind his surname

What is the real name of Drishti IAS owner Dr. Vikas Divyakirti, know truth behind his surname![submenu-img]() Meet woman, a research scholar who cracked UPSC exam without coaching, got AIR 6, but didn’t became IAS officer due to…

Meet woman, a research scholar who cracked UPSC exam without coaching, got AIR 6, but didn’t became IAS officer due to…![submenu-img]() TATA Curvv EV Review: Style Quotient, Redefined! A Game Changer In Electric SUV I Auto Tech Review

TATA Curvv EV Review: Style Quotient, Redefined! A Game Changer In Electric SUV I Auto Tech Review![submenu-img]() DRDO Successfully Test Fires Made-In-India Portable Anti-Tank Guided Missile

DRDO Successfully Test Fires Made-In-India Portable Anti-Tank Guided Missile ![submenu-img]() Bigg Boss Winner Munawar Faruqui Apologises For Crass Joke On Konkani People After Backlash

Bigg Boss Winner Munawar Faruqui Apologises For Crass Joke On Konkani People After Backlash![submenu-img]() Bangladesh Unrest: Bangladesh Court Initiated Murder Investigation Against Sheikh Hasina

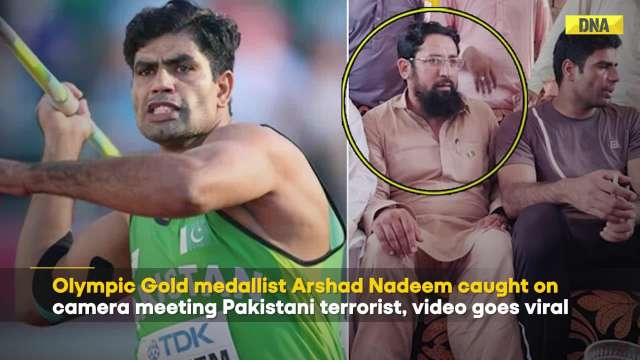

Bangladesh Unrest: Bangladesh Court Initiated Murder Investigation Against Sheikh Hasina![submenu-img]() Olympic Gold Medallist Arshad Nadeem Caught On Camera Meeting Pakistani Terrorist, Video Goes Viral

Olympic Gold Medallist Arshad Nadeem Caught On Camera Meeting Pakistani Terrorist, Video Goes Viral![submenu-img]() Revealed: Reason behind delay in ace wrestler Vinesh Phogat case

Revealed: Reason behind delay in ace wrestler Vinesh Phogat case![submenu-img]() Vinesh Phogat sets condition for India return, says 'will not come back until...'

Vinesh Phogat sets condition for India return, says 'will not come back until...'![submenu-img]() 'India ki saazish...': Pakistan makes bizarre claim about Olympic gold medalist Arshad Nadeem

'India ki saazish...': Pakistan makes bizarre claim about Olympic gold medalist Arshad Nadeem![submenu-img]() Amid wedding rumours with Manu Bhaker, Neeraj Chopra's video with dancer goes viral, 'meri zindagi mei...'

Amid wedding rumours with Manu Bhaker, Neeraj Chopra's video with dancer goes viral, 'meri zindagi mei...'![submenu-img]() Vinesh Phogat’s CAS appeal verdict for Olympic silver medal delayed till…

Vinesh Phogat’s CAS appeal verdict for Olympic silver medal delayed till…![submenu-img]() Independence Day 2024: What is the old name of Red Fort?

Independence Day 2024: What is the old name of Red Fort?![submenu-img]() Meet star who was bigger than Vijay, Ajith, Dhanush; was left paralysed, quit films, built Rs 3300 crore business empire

Meet star who was bigger than Vijay, Ajith, Dhanush; was left paralysed, quit films, built Rs 3300 crore business empire![submenu-img]() Raksha bandhan weekend 2024: Top 6 destination for siblings getaway

Raksha bandhan weekend 2024: Top 6 destination for siblings getaway![submenu-img]() Who is Jasmin Walia, Hardik Pandya's rumoured girlfriend? British singer said to be vacationing with cricketer in Greece

Who is Jasmin Walia, Hardik Pandya's rumoured girlfriend? British singer said to be vacationing with cricketer in Greece![submenu-img]() Independence Day 2024: 5 stunning Bollywood diva inspired tri-colour outfits

Independence Day 2024: 5 stunning Bollywood diva inspired tri-colour outfits![submenu-img]() Kolkata doctor rape-murder case: Rahul Gandhi breaks silence, said…

Kolkata doctor rape-murder case: Rahul Gandhi breaks silence, said…![submenu-img]() Delhi Airport's T1 terminal is ready days after old terminal collapsed, to be operational from...

Delhi Airport's T1 terminal is ready days after old terminal collapsed, to be operational from...![submenu-img]() Kolkata doctor rape-murder case: CBI begins probe, arrives at RG Kar Medical College

Kolkata doctor rape-murder case: CBI begins probe, arrives at RG Kar Medical College![submenu-img]() Weather Update: IMD issues orange alert in landslide-hit Wayanad, heavy rainfall predicted in other districts of Kerala

Weather Update: IMD issues orange alert in landslide-hit Wayanad, heavy rainfall predicted in other districts of Kerala![submenu-img]() Delhi-Ghaziabad-Meerut RRTS Corridor: Know how Namo Bharat is reshaping transit in Delhi-NCR with high speed

Delhi-Ghaziabad-Meerut RRTS Corridor: Know how Namo Bharat is reshaping transit in Delhi-NCR with high speed![submenu-img]() Wings of Refuge: Rafales escort Hasina to safety

Wings of Refuge: Rafales escort Hasina to safety![submenu-img]() Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister

Bangladesh in a crisis: A coup, protests and a fleeing Prime Minister![submenu-img]() DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?

DNA Explainer: What is Waqf Board Act and why does Modi government want to amend it?![submenu-img]() DNA Explainer: Why is Bangladesh burning again?

DNA Explainer: Why is Bangladesh burning again?![submenu-img]() Voter Sentiment: Harris outshines Biden among young and non-white voters

Voter Sentiment: Harris outshines Biden among young and non-white voters

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)