Silicon Valley Bank crises: The next two months will be crucial for many of these Indian businesses as they attempt to work out a short-term financing strategy.

Y Combinator-backed Indian firms have been struck hard by the closure of Silicon Valley Bank (SVB), with many now unable to cover basic operating costs. Several businesses are trying to work out a short-term financing strategy for the next two months while waiting for the US Federal Reserve to respond.

Impact on Indian startups

According to Tracxn statistics, SVB has invested in roughly 21 firms in India, albeit the precise value of such investments is unknown. Bluestone, Carwale, InMobi, and Loyalty Rewardz are just some of the other firms that have received funding from SVB. From what we can tell from Tracxn, SVB has not made any significant investments in Indian firms since 2011. Paytm, Paytm Mall, and One97 Communications are all on Tracxn's list of supported services.

Founder Vijay Shekhar Sharma claims that Silicon Valley Bank (SVB) has fully cashed out its $1.7 million investment in Paytm and made substantial profits. After years of ownership, Sharma has verified that SVB is no longer a part of Paytm.

At least 40 YC-backed Indian firms have between USD 250,000 and $1 million in deposits with SVB, and more than 20 of them have deposits above $1 million apiece, according to a YC WhatsApp survey cited by The Economic Times.

Companies like Razorpay, Meesho, and Zepto that are larger and supported by Y Combinator in India have no dealings with SVB. The failure of the bank, however, is having an effect on companies in their early and mid stages of development. Several of India's largest YC firms have been transferring money abroad over the previous two weeks out of fear of market disruption.

Based on Tracxn data, these are the exposed Indian companies:

| Company |

Total funding in USD |

| Divitas Networks |

4 million |

| Shaadi |

8 million |

| CarWale |

9 million |

| iCafe Manager |

10 million |

| GeodesicTechniques |

11 million |

| Sarva |

12 million |

| Asklaila |

12 million |

| Anantara Solutions |

13 million |

| Games2win Media |

13 million |

| Loylty Rewardz |

28 million |

| Genesis Colors |

74 million |

| iYogi |

85 million |

| TutorVista |

102 million |

| BlueStone |

111 million |

| Naaptol |

133 million |

| Bharat Financial Inclusion |

144 million |

| lnMobi |

265 million |

| Paytm Mall |

808 million |

| One97 Communications |

2787 million |

| Paytm |

4637 million |

Future

A special meeting of the Federal Reserve Board of Governors will be held behind closed doors on March 13, 2023, following accelerated procedures. Federal Reserve Banks' advance and concession rates were announced to be reviewed and established by the Board on March 12.

Also, READ: ‘Ab number aayega inka…’: Ashneer Grover's prediction after Silicon Valley Bank collapse

This week, Union Minister Rajeev Chandrasekhar plans to meet with Indian entrepreneurs to discuss the problem and learn how the government of Narendra Modi can best assist.

![submenu-img]() Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case

Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case![submenu-img]() India lift the ICC Trophy after 11 years; wishes from Amitabh Bachchan, Rachana & Rhythm, Indra Nooyi flow in!

India lift the ICC Trophy after 11 years; wishes from Amitabh Bachchan, Rachana & Rhythm, Indra Nooyi flow in!![submenu-img]() 'He is entitled to...': US Supreme Court says Donald Trump partially immune from prosecution for...

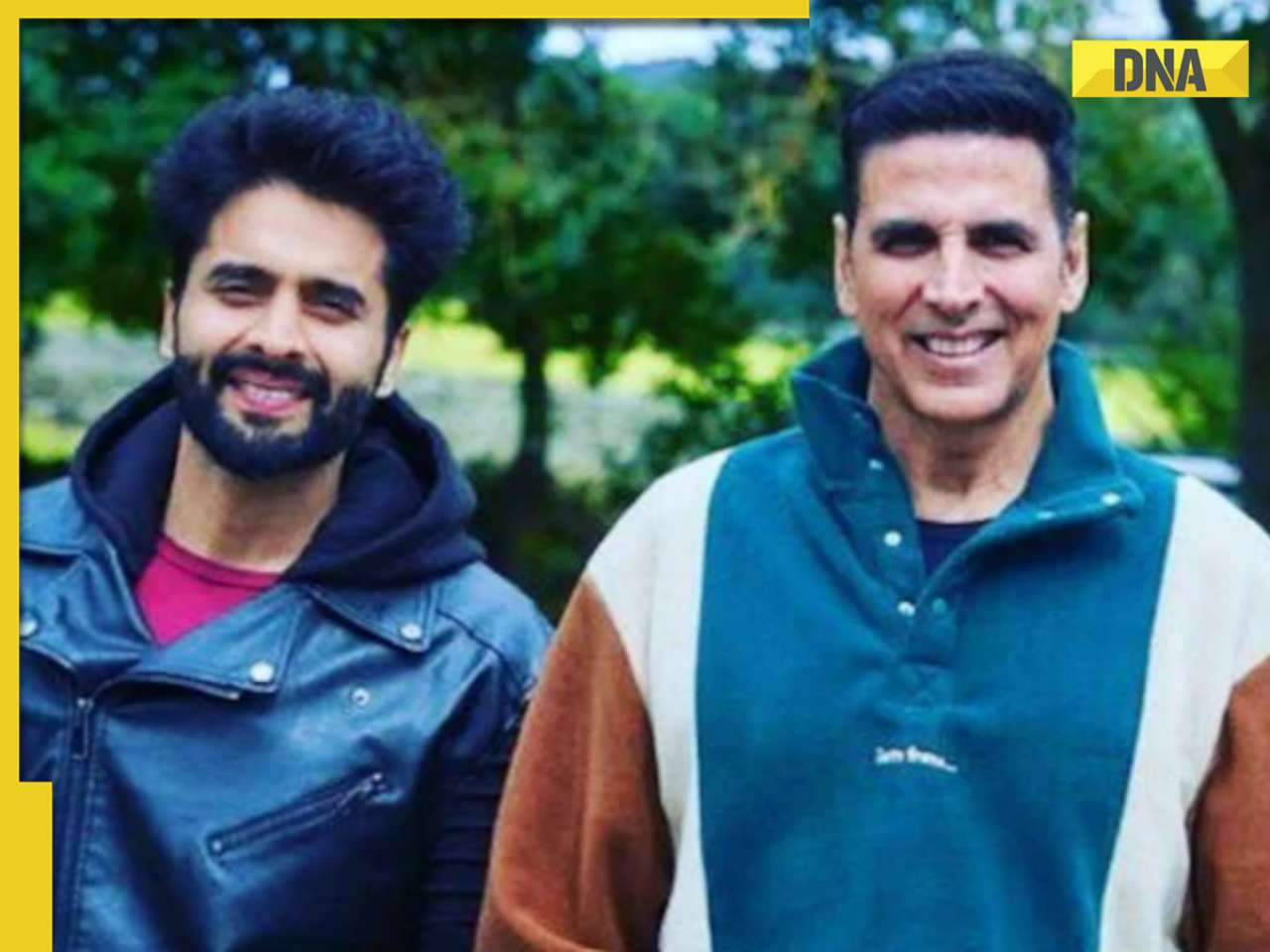

'He is entitled to...': US Supreme Court says Donald Trump partially immune from prosecution for...![submenu-img]() Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...

Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...![submenu-img]() 'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive

'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive![submenu-img]() UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here

UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here![submenu-img]() Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...

Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...![submenu-img]() Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...

Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...![submenu-img]() Meet Kathak dancer who topped UPSC exam in 1st attempt, worked at RBI in day and studied at night, she is...

Meet Kathak dancer who topped UPSC exam in 1st attempt, worked at RBI in day and studied at night, she is...![submenu-img]() Meet woman who cleared UPSC exam at 23 in her first attempt, got AIR 94, but didn't become IAS officer due to...

Meet woman who cleared UPSC exam at 23 in her first attempt, got AIR 94, but didn't become IAS officer due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: India beat South Africa by 7 runs to lift second T20 World Cup title

In pics: India beat South Africa by 7 runs to lift second T20 World Cup title![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

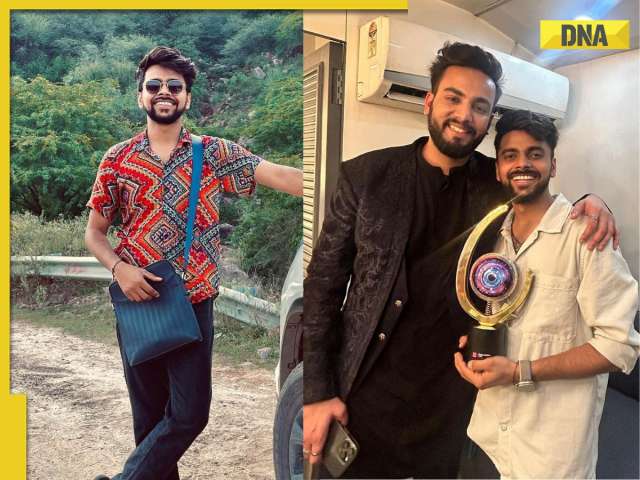

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case

Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case![submenu-img]() Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...

Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...![submenu-img]() 'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive

'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive![submenu-img]() The Buckingham Murders: Kareena Kapoor is held forcibly by cops in first look poster, fans say 'National Award loading'

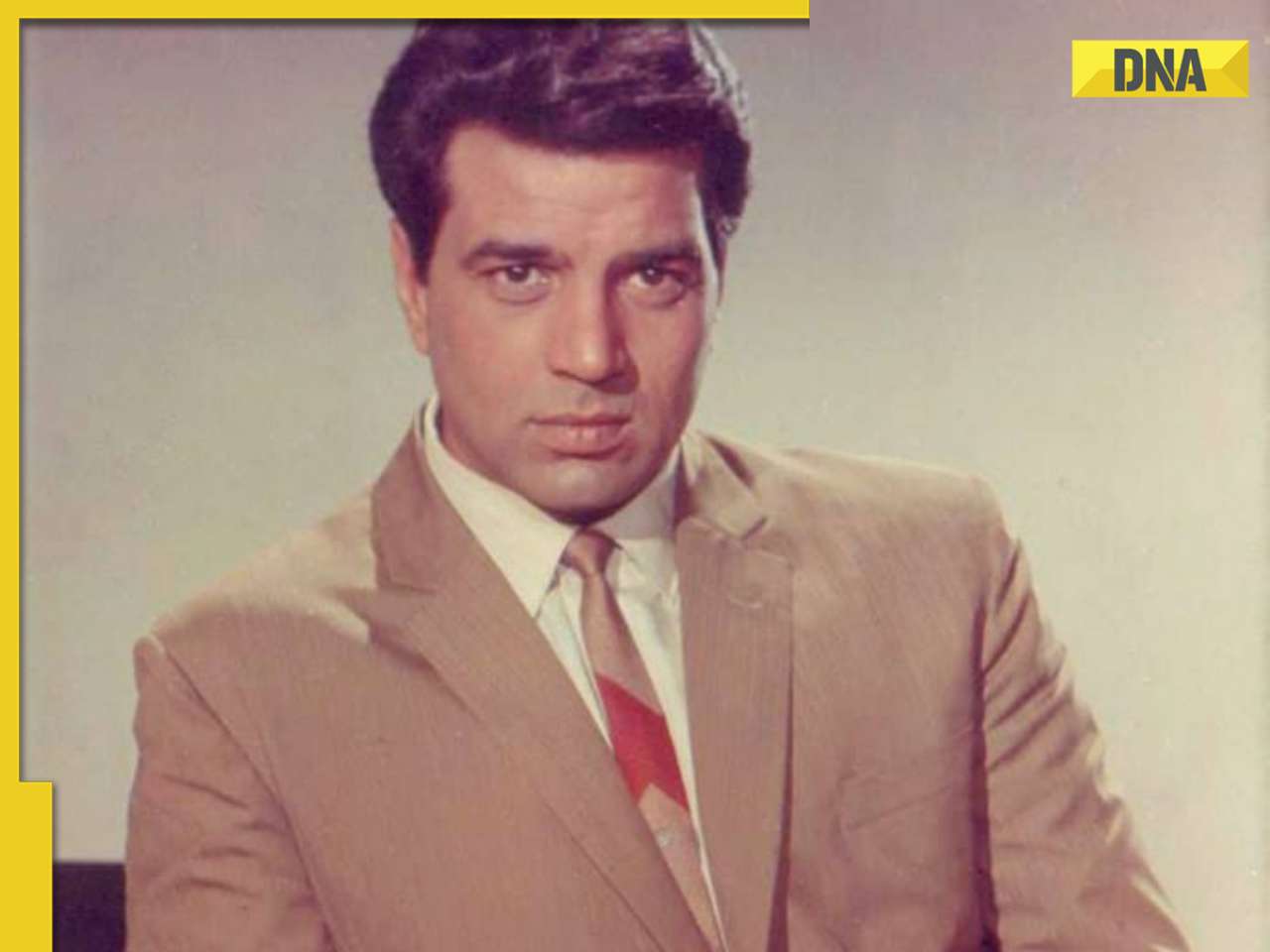

The Buckingham Murders: Kareena Kapoor is held forcibly by cops in first look poster, fans say 'National Award loading'![submenu-img]() Dharmendra bought this film's script for Rs 17500, his sister forced him to not work in it, movie changed life of...

Dharmendra bought this film's script for Rs 17500, his sister forced him to not work in it, movie changed life of...![submenu-img]() Watch viral video: AI chatbot caught lying, tells users that it is...

Watch viral video: AI chatbot caught lying, tells users that it is...![submenu-img]() Virat Kohli fails to make it in ICC ‘Team of the Tournament', six Indians in the list including…

Virat Kohli fails to make it in ICC ‘Team of the Tournament', six Indians in the list including…![submenu-img]() Meet woman who lives in India's largest house, larger than Mukesh Ambani, Nita Ambani's Rs 15000 cr Antilia, she is...

Meet woman who lives in India's largest house, larger than Mukesh Ambani, Nita Ambani's Rs 15000 cr Antilia, she is...![submenu-img]() North Korea publicly executes 22-year-old man for listening to...

North Korea publicly executes 22-year-old man for listening to...![submenu-img]() Viral video: Little girl’s adorable dance to ‘Soulmate’ wins internet, watch

Viral video: Little girl’s adorable dance to ‘Soulmate’ wins internet, watch

)

)

)

)

)

)

)