Investors lost over Rs 2.67 lakh crore in early trade in a largely negative stock market on Friday. The trigger was a crisis in the US.

India’s stock markets saw heavy selling in financial, IT and capital goods stocks making Nifty and Sensex plunge by over 1 percent. Investors lost over Rs 2.67 lakh crore in early trade on Friday. In a largely negative market, 1,966 of the 3,206 stocks traded declined.

The top losers were HDFC, IndusInd Bank, HDFC Bank, L&T, ICICI Bank, Reliance Industries, Axis Bank, Infosys, TCS, Adani Enterprises and Ultratech Cement.

Why stock market crashed on Friday?

As per analysts, the stock plunge was triggered by weak Asian markets combined with sell-off in the US market overnight where major losses have dented benchmark indices. The reason behind the sell-off was a crash of over 60 percent in stocks of SVB Financials, also called Silicon Valley Bank. As per analysts, the SVB crisis affected market sentiment leading to hammering for banking stocks amid fears that rising interest rates may spark loan repayment defaults.

What is the SVB financial crisis?

SVB is a bank that majorly invests in tech startups. It saw its worst even single-day drop of over 60 percent. After-hour trading further led to a 20 percent plunge for SVB.

The bank is one of the important lenders for startups in early-stage businesses and has backed around half of venture-backed technology and healthcare firms in the US that were listed on stock markets last year, BBC reported.

The reason for the slump was a $1.75 billion share sale announcement by Silicon Valley Bank which was looking to shore up finances. However, it led to investors withdrawing their deposits with SVB in what was dubbed as a “brutal” and “wild” day.

SVB had decided on the share sale move after losing nearly $1.8 billion upon offloading a portfolio of assets which mainly comprised US Treasuries. However, a bigger concern for SVB now is that some startups are being advised to withdraw their money deposited with the bank.

The SVB crash triggered a drop in stock prices of banks globally including the biggest US banks like JP Morgan and Wells Fargo shedding over $50 billion in market value.

READ | Meet Shobhit Singh, once lived as a monk in ashram, now owns a multi-crore company

(With inputs from PTI, IANS)

![submenu-img]() 11 times costlier than Mukesh Ambani, Nita Ambani's Rs 15000 crore Antilia: This diamond was found in India in...

11 times costlier than Mukesh Ambani, Nita Ambani's Rs 15000 crore Antilia: This diamond was found in India in...![submenu-img]() Meet 10th pass, labourer’s son who worked as office boy for Rs 9000, now CEO of 2 companies worth crores, owns first...

Meet 10th pass, labourer’s son who worked as office boy for Rs 9000, now CEO of 2 companies worth crores, owns first...![submenu-img]() Bhavish Aggarwal's Ola Electric IPO price band announced for subscription; check details

Bhavish Aggarwal's Ola Electric IPO price band announced for subscription; check details![submenu-img]() Meet woman, who returned from London, cracked UPSC exam thrice, became IES, IRS, IAS officer, she is collector of...

Meet woman, who returned from London, cracked UPSC exam thrice, became IES, IRS, IAS officer, she is collector of...![submenu-img]() Rapid rail metro will reduce travel time from Noida Airport till Delhi Aerocity to 66 mins; check deadline, route, cost

Rapid rail metro will reduce travel time from Noida Airport till Delhi Aerocity to 66 mins; check deadline, route, cost![submenu-img]() Meet woman, who returned from London, cracked UPSC exam thrice, became IES, IRS, IAS officer, she is collector of...

Meet woman, who returned from London, cracked UPSC exam thrice, became IES, IRS, IAS officer, she is collector of...![submenu-img]() Include marks from Classes 9th, 10th, 11th in Class 12th finals, suggests NCERT's PARAKH

Include marks from Classes 9th, 10th, 11th in Class 12th finals, suggests NCERT's PARAKH ![submenu-img]() CUET UG result out: DU, JNU to start next admission phase from...

CUET UG result out: DU, JNU to start next admission phase from...![submenu-img]() Meet woman who studied at IIT, IIM, left lucrative job to crack UPSC exam, became IPS then IAS, her AIR was..

Meet woman who studied at IIT, IIM, left lucrative job to crack UPSC exam, became IPS then IAS, her AIR was..![submenu-img]() ICAI CA Foundation Result 2024 to be out today; check direct link, how to download marksheet

ICAI CA Foundation Result 2024 to be out today; check direct link, how to download marksheet![submenu-img]() India Vs Sri Lanka Highlights: Ravi Bishnoi, Hardik Pandya Help IND Beat SL By 8 Wickets

India Vs Sri Lanka Highlights: Ravi Bishnoi, Hardik Pandya Help IND Beat SL By 8 Wickets![submenu-img]() Paris Olympics 2024: Indian Boxer Nikhat Zareen Enters Pre-Quarterfinals In Women's 50 KG Category

Paris Olympics 2024: Indian Boxer Nikhat Zareen Enters Pre-Quarterfinals In Women's 50 KG Category![submenu-img]() Paris Olympics 2024: Indian Shooter Manu Bhaker Reacts To Her Historic Win

Paris Olympics 2024: Indian Shooter Manu Bhaker Reacts To Her Historic Win![submenu-img]() PM Modi Congratulates Manu Bhaker On Winning Bronze Medal

PM Modi Congratulates Manu Bhaker On Winning Bronze Medal![submenu-img]() Paris Olympics 2024: India's Shooter Manu Bhaker Wins India's 1st Medal, Clinches Bronze In Paris

Paris Olympics 2024: India's Shooter Manu Bhaker Wins India's 1st Medal, Clinches Bronze In Paris![submenu-img]() Disha Patani sets the internet on fire in bikini in middle of the sea, fans say 'global warming will increase'

Disha Patani sets the internet on fire in bikini in middle of the sea, fans say 'global warming will increase'![submenu-img]() Warning signs on your face that tell you are sick, unhealthy

Warning signs on your face that tell you are sick, unhealthy![submenu-img]() In pics: What was it like to eat at McDonald's in 1980s

In pics: What was it like to eat at McDonald's in 1980s![submenu-img]() Meet Bollywood singer who was thrown out of music class, sang at nightclubs, got first award after 42 years; now owns...

Meet Bollywood singer who was thrown out of music class, sang at nightclubs, got first award after 42 years; now owns...![submenu-img]() Remember Kim Sharma from Mohabbatein? Dated former Indian cricketer, quit films for marriage, got divorced, is now...

Remember Kim Sharma from Mohabbatein? Dated former Indian cricketer, quit films for marriage, got divorced, is now...![submenu-img]() Four persons killed in blast in J-K's Sopore area

Four persons killed in blast in J-K's Sopore area![submenu-img]() Who is Abhishek Gupta, owner and CEO of Rau's IAS coaching centre, where 3 UPSC aspirants died?

Who is Abhishek Gupta, owner and CEO of Rau's IAS coaching centre, where 3 UPSC aspirants died?![submenu-img]() SC refuses to interfere with Jharkhand HC's order granting bail to Hemant Soren

SC refuses to interfere with Jharkhand HC's order granting bail to Hemant Soren![submenu-img]() Delhi IAS Coaching Incident: MCD begins 'bulldozer action' to demolish illegal structures of institutes, 5 more arrested

Delhi IAS Coaching Incident: MCD begins 'bulldozer action' to demolish illegal structures of institutes, 5 more arrested![submenu-img]() CBI files chargesheet against Arvind Kejriwal, others in Excise policy case

CBI files chargesheet against Arvind Kejriwal, others in Excise policy case![submenu-img]() Voter Sentiment: Harris outshines Biden among young and non-white voters

Voter Sentiment: Harris outshines Biden among young and non-white voters![submenu-img]() Beyond the Headlines: India, Pakistan and the hidden agenda of chaotic US poll

Beyond the Headlines: India, Pakistan and the hidden agenda of chaotic US poll![submenu-img]() DRDO fortifies India's skies: Phase II ballistic missile defence trial successful

DRDO fortifies India's skies: Phase II ballistic missile defence trial successful![submenu-img]() Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing

Gaza Conflict Spurs Unlikely Partners: Hamas, Fatah factions sign truce in Beijing![submenu-img]() Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas

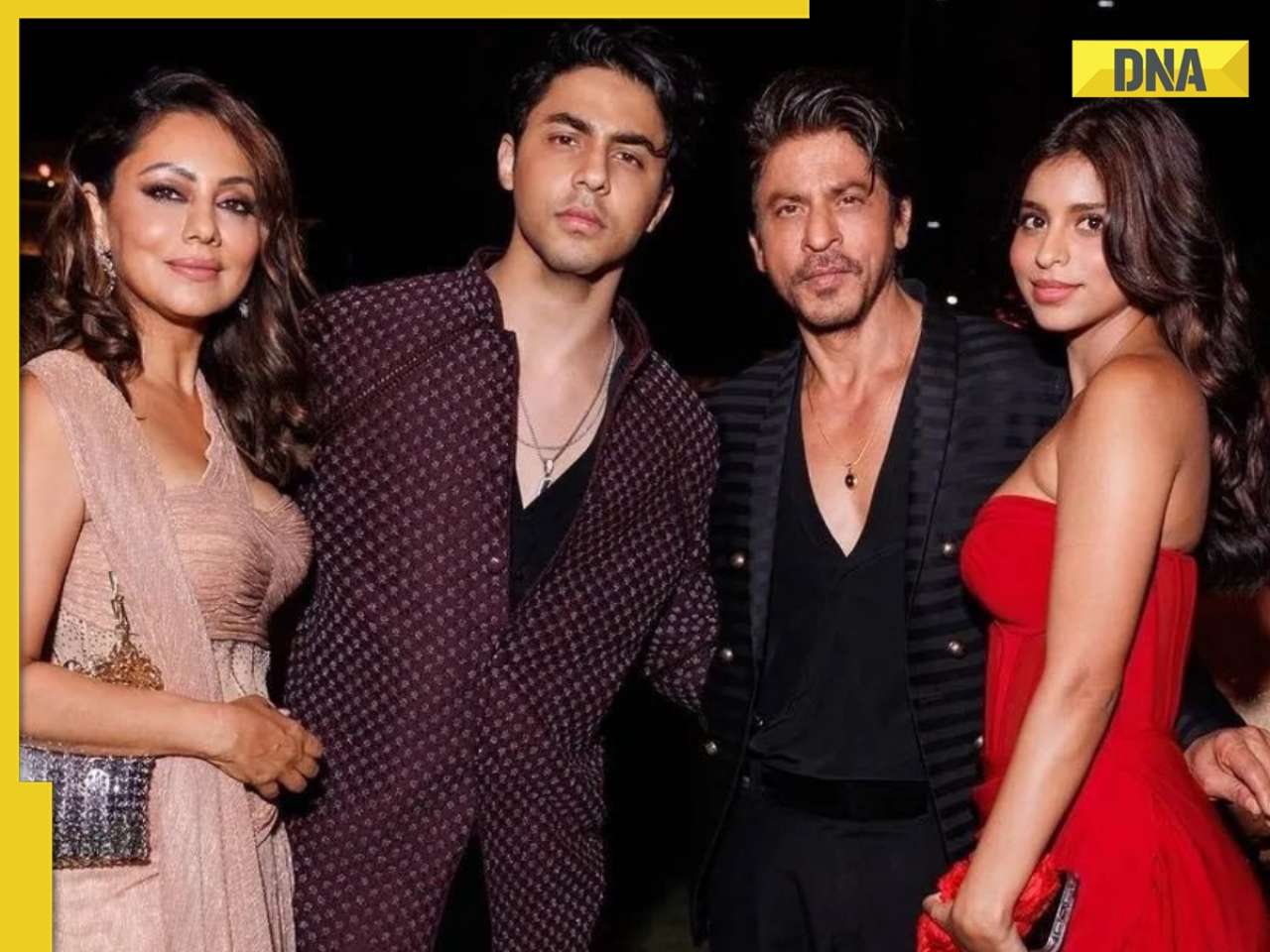

Crackdowns and Crisis of Legitimacy: What lies beyond Bangladesh's apex court scaling down job quotas![submenu-img]() Aryan Khan buys 2 floors in Delhi, it has special connection with Shah Rukh Khan, Gauri, it's worth....

Aryan Khan buys 2 floors in Delhi, it has special connection with Shah Rukh Khan, Gauri, it's worth....![submenu-img]() 'Are you serious': Priyanka Chopra adorable reaction after she meets 8-month-old koala named after her goes viral

'Are you serious': Priyanka Chopra adorable reaction after she meets 8-month-old koala named after her goes viral![submenu-img]() 'Utha ke yahi patak dunga': Angry Rohit Shetty bashes Asim Riaz, throws him out of Khatron Ke Khiladi 14

'Utha ke yahi patak dunga': Angry Rohit Shetty bashes Asim Riaz, throws him out of Khatron Ke Khiladi 14![submenu-img]() Javed Akhtar's X account hacked, lyricist warns about 'harmless' Paris Olympics tweet

Javed Akhtar's X account hacked, lyricist warns about 'harmless' Paris Olympics tweet![submenu-img]() Meet India’s biggest flop actor, worked with superstars, gave 25 flop films, quit acting forever, he is now…

Meet India’s biggest flop actor, worked with superstars, gave 25 flop films, quit acting forever, he is now…![submenu-img]() 11 times costlier than Mukesh Ambani, Nita Ambani's Rs 15000 crore Antilia: This diamond was found in India in...

11 times costlier than Mukesh Ambani, Nita Ambani's Rs 15000 crore Antilia: This diamond was found in India in...![submenu-img]() Meet woman, an Indian, who lives in world’s largest house, larger than Mukesh Ambani, Nita Ambani’s Antilia, she is...

Meet woman, an Indian, who lives in world’s largest house, larger than Mukesh Ambani, Nita Ambani’s Antilia, she is...![submenu-img]() Vande Bharat sleeper train to start soon: Check date, route, top speed to be...

Vande Bharat sleeper train to start soon: Check date, route, top speed to be...![submenu-img]() Paris Olympics 2024: Who is Barbara Butch, slammed for 'mocking Jesus' at opening ceremony?

Paris Olympics 2024: Who is Barbara Butch, slammed for 'mocking Jesus' at opening ceremony?![submenu-img]() 11-year-old genius writes 600 lines of code to build rocket, he is from...

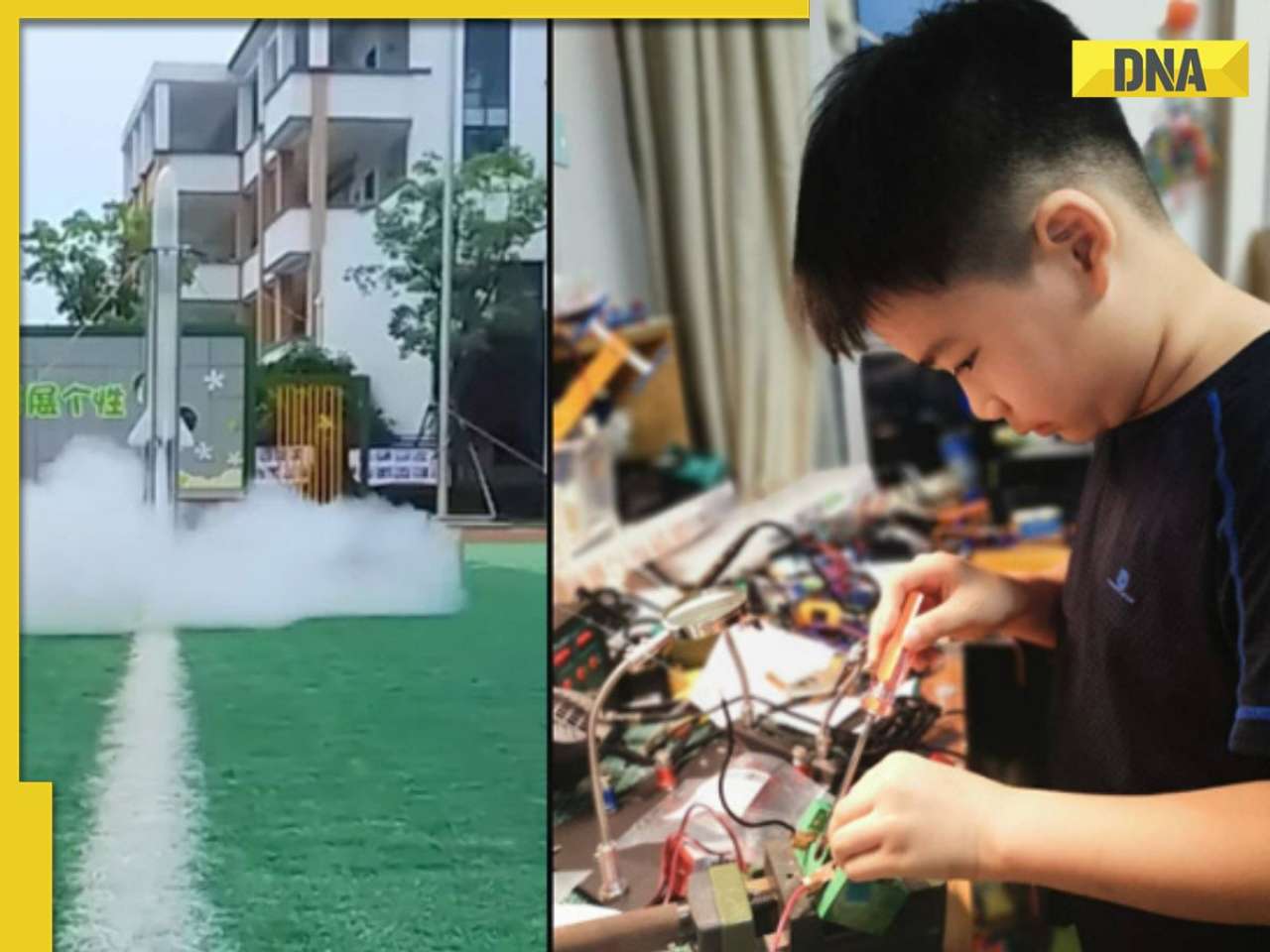

11-year-old genius writes 600 lines of code to build rocket, he is from...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)