Trump's officials saiid that his administration's trade strategy would be to protect American jobs with the withdrawal from the 12-nation Trans-Pacific Partnership trade pact.

The dollar slipped and Asian shares were on the defensive on Monday as worries about President Donald Trump's protectionist policies outweighed optimism that he will follow through on promises of tax cuts and other stimulus.

Japan's Nikkei dropped 1.3% while shares in South Korea and Australia dropped 0.3%, though dollar-denominated MSCI's broadest index of Asia-Pacific shares outside Japan was flat.

US stock futures dipped 0.2%, erasing gains made on Friday.

In his inaugural address, Trump pledged to end what he called an "American carnage" of rusted factories and vowed to put "America first".

"His speech sounded protectionist. It's something markets were already expecting but wasn't really a catalyst for risk-on trading," said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management.

Trump also said on Sunday he plans talks soon with the leaders of Canada and Mexico to begin renegotiating the North American Free Trade Agreement (NAFTA).

Prior to that, his administration said on his first day in the office that its trade strategy to protect American jobs would start with withdrawal from the 12-nation Trans-Pacific Partnership (TPP) trade pact.

"The market is getting nervous about the possibility that the world's trade might shrink," said Koichi Yoshikawa, executive director of financial markets at Standard Chartered Bank in Tokyo.

"Many of his policies, including tax cuts and infrastructure spending, needs approval from the Senate and (may not be) that easy to realise. So it is hard to expect rosy news that would please markets," he added.

"The markets that had been led by expectations on his policy since the election are now the dragged down by the reality," he said.

The dollar had soared late last year on expectations that his pledges to cut taxes and hike infrastructure spending would boost the US economy, but it has since lost steam.

In early Monday trade, the dollar fell 0.7% against the yen to 113.86 yen, edging towards its seven-week low of 112.57 yen touched on Wednesday.

The euro rose 0.1% to $1.0721, its highest level since Dec. 8.

The 10-year US Treasuries yield fell to 2.445%, after having risen briefly on Friday to 2.513%, its highest since Jan. 3.

The two-year yield, which is more sensitive to the Fed's policy outlook, dropped sharply to 1.184% from Thursday's three-week high of 1.250%, giving back much of gains made after Wednesday's upbeat comments from Federal Reserve Chair Janet Yellen.

The Mexican peso, however, rose 0.3% on Monday to at 21.520 per dollar, after having risen 1.7% on Friday, its biggest gains in two months.

Oil prices held firm after ministers from OPEC and non-OPEC countries said they have made a strong start to lowering their oil output under the first such pact in more than a decade.

International benchmark Brent crude futures rose 0.1% to $55.74 per barrel, building on Friday's 2.5% gains.

![submenu-img]() Ganesh Chaturthi 2024 shubh muhurat: Check city wise puja timings, visarjan date, and bhog for Ganpati Bappa

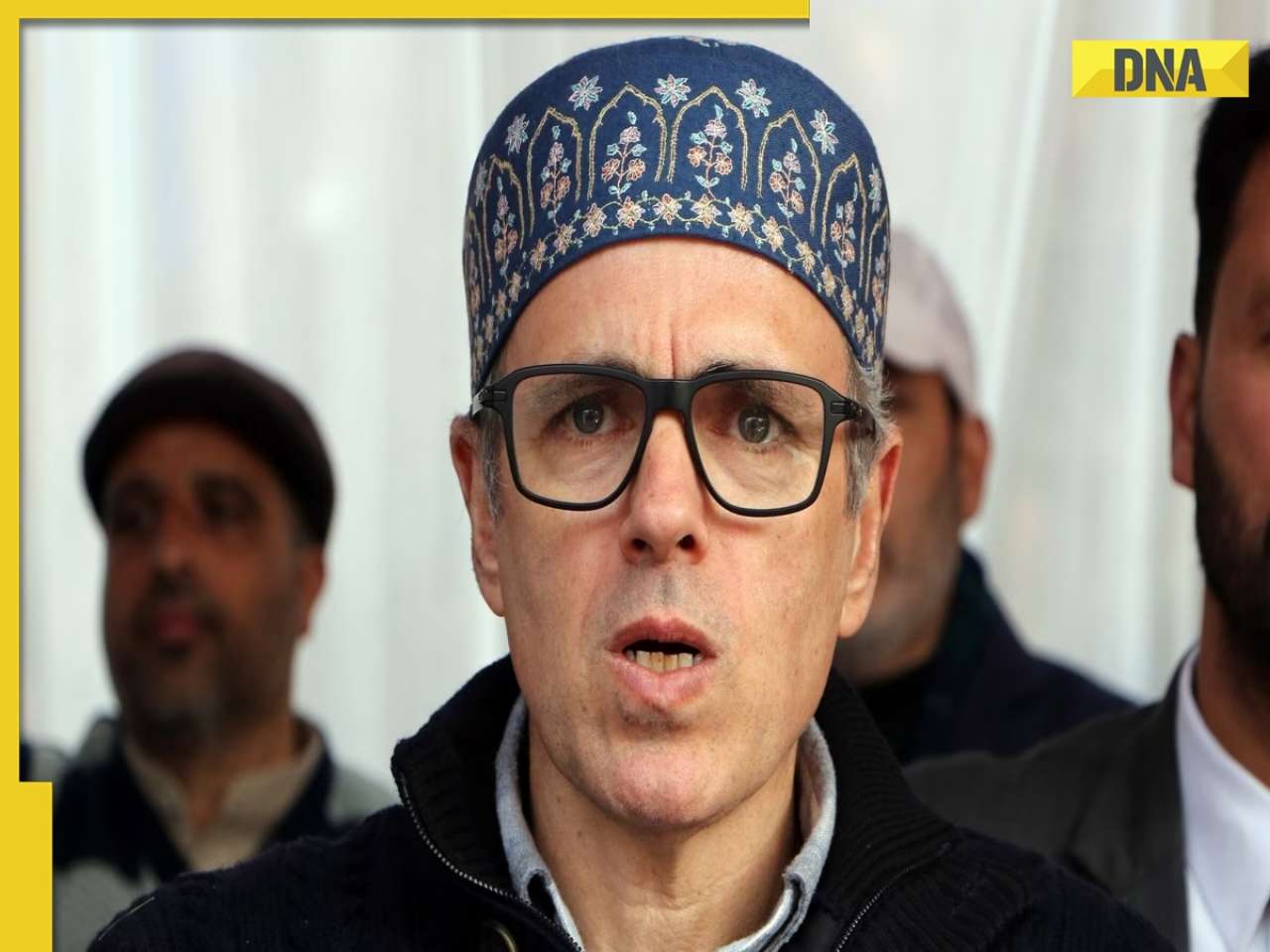

Ganesh Chaturthi 2024 shubh muhurat: Check city wise puja timings, visarjan date, and bhog for Ganpati Bappa![submenu-img]() 'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'

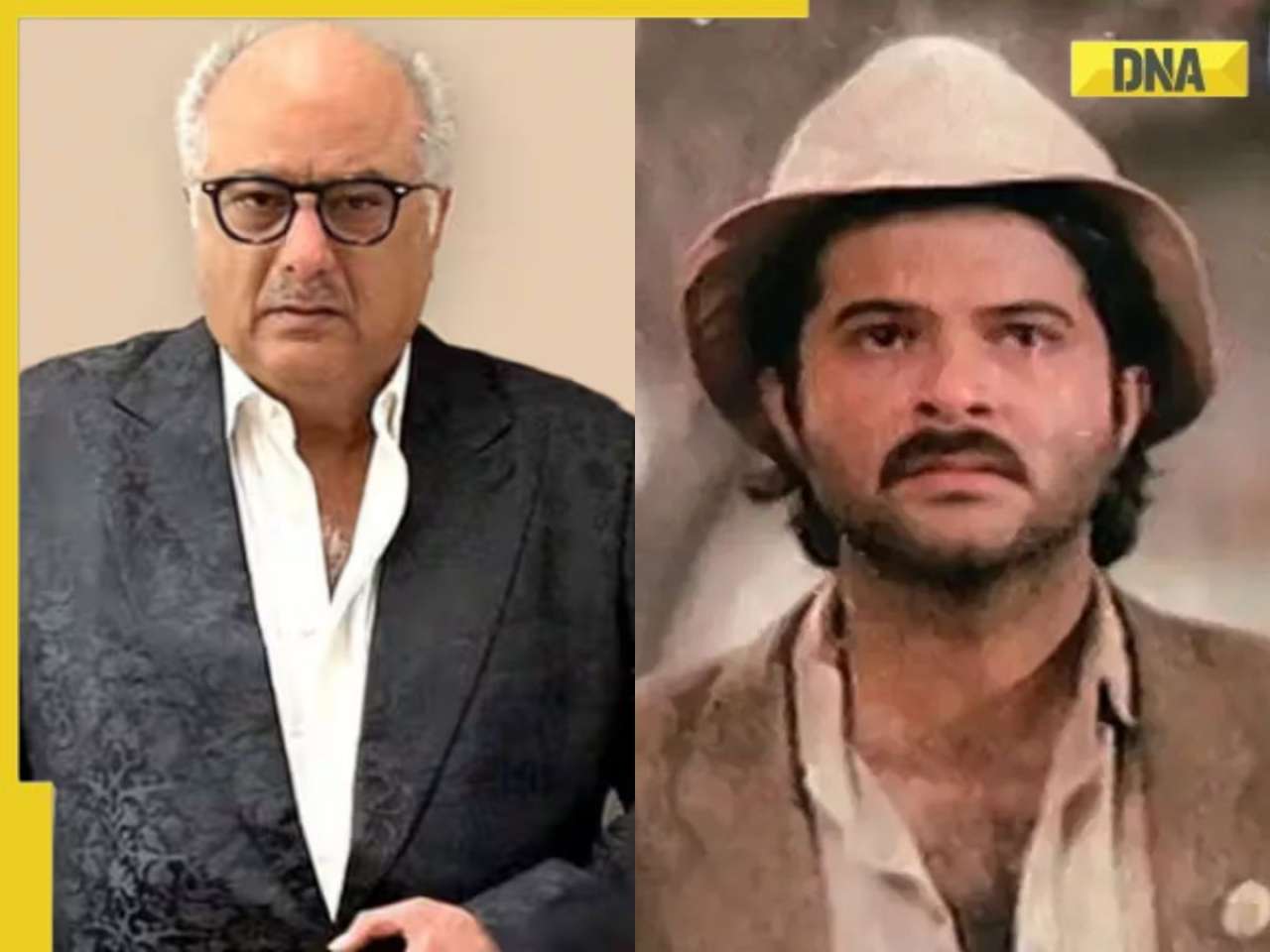

'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'![submenu-img]() Boney Kapoor announces new film, its title has a Mr India connect: 'Probably by December we...'

Boney Kapoor announces new film, its title has a Mr India connect: 'Probably by December we...'![submenu-img]() Meet actress, who worked for 17 hours straight on toxic sets, her mental health was affected, left industry, is now...

Meet actress, who worked for 17 hours straight on toxic sets, her mental health was affected, left industry, is now...![submenu-img]() Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'

Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'![submenu-img]() Breaking News: मध्य प्रदेश के Jabalpur में बड़ा रेल हादसा, सोमनाथ एक्सप्रेस के 2 डिब्बे पटरी से उतरे

Breaking News: मध्य प्रदेश के Jabalpur में बड़ा रेल हादसा, सोमनाथ एक्सप्रेस के 2 डिब्बे पटरी से उतरे ![submenu-img]() 'नीतीश तीसरी बार नहीं करेंगे ये गलती', बिहार CM को लेकर ऐसा क्यों बोले जीतन राम मांझी

'नीतीश तीसरी बार नहीं करेंगे ये गलती', बिहार CM को लेकर ऐसा क्यों बोले जीतन राम मांझी![submenu-img]() Happy Ganesh Chaturthi 2024: 'लड्डू जिनका भोग है मूषक है सवारी....' यहां से शानदार मैसेज भेज सबको दें गणेश चतुर्थी की बधाई

Happy Ganesh Chaturthi 2024: 'लड्डू जिनका भोग है मूषक है सवारी....' यहां से शानदार मैसेज भेज सबको दें गणेश चतुर्थी की बधाई![submenu-img]() Haryana Assembly Election 2024: हरियाणा में कांग्रेस प्रत्याशियों की पहली लिस्ट जारी, इस सीट से चुनावी मैदान में उतरी विनेश फोगाट

Haryana Assembly Election 2024: हरियाणा में कांग्रेस प्रत्याशियों की पहली लिस्ट जारी, इस सीट से चुनावी मैदान में उतरी विनेश फोगाट![submenu-img]() Petrol-Diesel Price Today: पंप पर आज इस रेट में मिलेगा पेट्रोल-डीजल, �यहां चेक करें ताजा दाम

Petrol-Diesel Price Today: पंप पर आज इस रेट में मिलेगा पेट्रोल-डीजल, �यहां चेक करें ताजा दाम ![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details

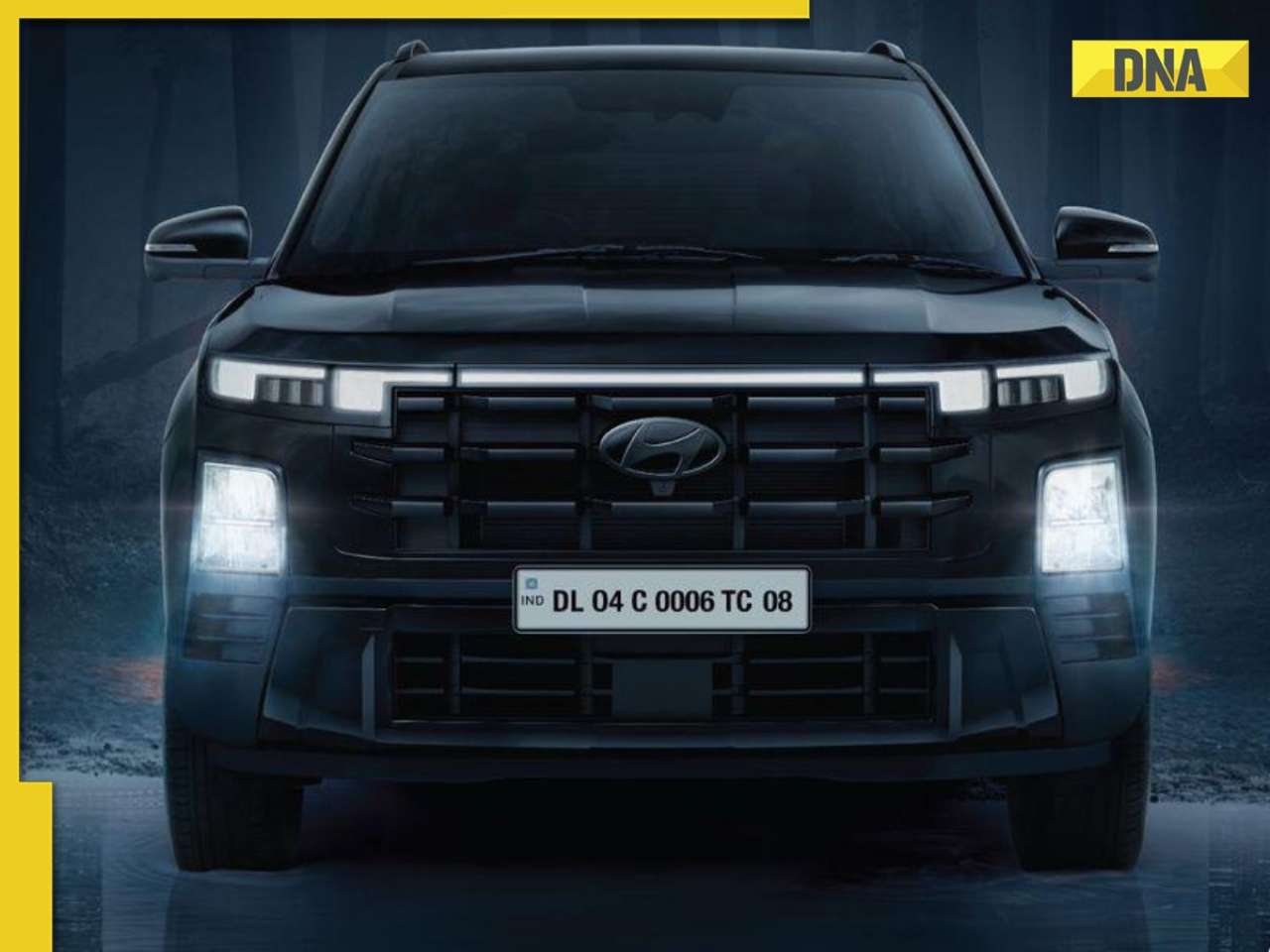

DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details![submenu-img]() Hyundai Creta Knight Edition launched in India: Check price, features, design

Hyundai Creta Knight Edition launched in India: Check price, features, design![submenu-img]() DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() UPSC topper IAS Shruti Sharma's marksheet goes viral on social media, check her scores in different subjects

UPSC topper IAS Shruti Sharma's marksheet goes viral on social media, check her scores in different subjects![submenu-img]() Meet man, who lost his mother in childhood, worked as milk seller, cracked NEET exam with AIR...

Meet man, who lost his mother in childhood, worked as milk seller, cracked NEET exam with AIR...![submenu-img]() Meet man who failed 35 exams, cracked UPSC exam twice, first became IPS then quit due to...

Meet man who failed 35 exams, cracked UPSC exam twice, first became IPS then quit due to...![submenu-img]() Meet man, who was forced into child marriage at 11, cracked NEET exam with AIR...

Meet man, who was forced into child marriage at 11, cracked NEET exam with AIR...![submenu-img]() Meet woman who cracked UPSC exam in first attempt without coaching at 22, got AIR 31, she is now posted as…

Meet woman who cracked UPSC exam in first attempt without coaching at 22, got AIR 31, she is now posted as…![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Mukesh Ambani set to challenge Adani, ITC with his Rs 3900 crore plan for...

Mukesh Ambani set to challenge Adani, ITC with his Rs 3900 crore plan for...![submenu-img]() NPCI launches 'UPI circle', check what it is and how it works

NPCI launches 'UPI circle', check what it is and how it works![submenu-img]() Mukesh Ambani's Reliance Jio to give tough competition to BSNL with this plan, it offers 5G data at just Rs...

Mukesh Ambani's Reliance Jio to give tough competition to BSNL with this plan, it offers 5G data at just Rs...![submenu-img]() This company repays Rs 20000 crore debt for... and it has a Ratan Tata connection

This company repays Rs 20000 crore debt for... and it has a Ratan Tata connection![submenu-img]() Meet woman, billionaire's daughter, who studied in London, now leads Rs 1124 crore company as...

Meet woman, billionaire's daughter, who studied in London, now leads Rs 1124 crore company as...![submenu-img]() From Cristiano Ronaldo to Virat Kohli: List of highest-paid athletes in last 12 months

From Cristiano Ronaldo to Virat Kohli: List of highest-paid athletes in last 12 months![submenu-img]() Meet actor who worked as waiter, sold tea, namkeen for 14 years, debuted in Bollywood at 42; now his net worth is...

Meet actor who worked as waiter, sold tea, namkeen for 14 years, debuted in Bollywood at 42; now his net worth is...![submenu-img]() Parents-to-be Deepika Padukone, Ranveer Singh seek blessings at Siddhivinayak with families days before baby's arrival

Parents-to-be Deepika Padukone, Ranveer Singh seek blessings at Siddhivinayak with families days before baby's arrival![submenu-img]() Gout remedies: 7 natural ways to lower uric acid levels in the body

Gout remedies: 7 natural ways to lower uric acid levels in the body ![submenu-img]() Active players with most centuries in international cricket

Active players with most centuries in international cricket ![submenu-img]() 'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'

'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'![submenu-img]() Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'

Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'![submenu-img]() 'When we were dragged on roads...': Wrestler Vinesh Phogat slams BJP

'When we were dragged on roads...': Wrestler Vinesh Phogat slams BJP![submenu-img]() India emerges as second-largest global 5G smartphone market, overtakes...

India emerges as second-largest global 5G smartphone market, overtakes...![submenu-img]() Union Home Minister Amit Shah releases BJP manifesto for J&K assembly elections

Union Home Minister Amit Shah releases BJP manifesto for J&K assembly elections

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)