FinTech companies operate in a highly regulated environment where compliance with regulatory mandates is crucial for maintaining market integrity and investor confidence.

In the rapidly evolving landscape of financial technology (FinTech), the importance of robust risk reporting systems cannot be overstated. As FinTech companies navigate a complex web of regulatory requirements, cybersecurity threats, and market volatility, the need for innovative and resilient risk management solutions has never been greater. Joseph Aaron Tsapa, a seasoned expert and thought leader in the field, has been at the forefront of developing and implementing cutting-edge risk reporting systems that leverage the latest advancements in artificial intelligence (AI) and predictive analytics.

FinTech companies operate in a highly regulated environment where compliance with regulatory mandates is crucial for maintaining market integrity and investor confidence. Regulatory compliance profoundly impacts the architecture, development, and deployment of risk reporting systems within the FinTech sector. The dynamic nature of regulatory landscapes and the need for agility and adaptability pose significant challenges for FinTech firms.

Tsapa's approach to architecting robust risk reporting systems is multifaceted, incorporating technological innovation, regulatory expertise, and strategic partnerships. He emphasizes the integration of AI and machine learning algorithms to enhance the accuracy and efficiency of risk-reporting processes. By leveraging these technologies, FinTech companies can process vast volumes of data in real-time, identify emerging risks, and implement proactive risk management strategies, ushering in a new era of risk reporting.

One of the key innovations in Tsapa's approach is using predictive analytics for proactive risk management. Predictive analytics utilizes historical data and statistical models combined with machine learning algorithms to forecast potential future risks. This allows FinTech companies to identify risky conditions early and take preemptive actions to mitigate them. For instance, predictive models can assess credit risk, detect fraudulent activities, and analyze market trends, providing FinTech firms with valuable insights to make informed decisions.

Tsapa's research also highlights the role of cloud computing in building secure and reliable software infrastructure for risk reporting. Cloud technologies offer a scalable and flexible environment that supports real-time data processing, best-in-class analytics, and customizable reporting capabilities. However, integrating regulatory requirements into cloud technologies remains a challenge, necessitating specialized training and strategic partnerships to optimize platform use.

While AI and predictive analytics offer immense potential, Tsapa underscores the importance of addressing ethical concerns and ensuring data quality. AI algorithms must be transparent, fair, and free from biases to maintain trust and credibility in the banking sector. Additionally, the success of AI-driven risk reporting systems depends on the quality and integrity of the input data. Implementing robust data governance frameworks is essential to guarantee the accuracy and relevance of the data used in these systems.

Looking ahead, Joseph Aaron Tsapa envisions a future where AI-driven risk reporting systems become integral to the FinTech industry. These systems will not only enhance risk management practices but also improve operational efficiency and regulatory compliance. By automating routine tasks and providing real-time insights, AI-powered risk reporting systems will enable FinTech companies to stay ahead of emerging risks and capitalize on market opportunities.

Joseph Aaron Tsapa's contributions to the field of FinTech risk reporting are paving the way for more resilient and innovative risk management solutions. His emphasis on AI, predictive analytics, and cloud computing reflects a forward-thinking approach that addresses the unique challenges faced by FinTech companies. As the industry continues to evolve, Tsapa's work will undoubtedly serve as a blueprint for building robust risk reporting systems that ensure financial stability and stakeholder trust.

Joseph Aaron Tsapa's approach to architecting robust risk reporting systems in FinTech exemplifies the innovative and strategic thinking required to navigate the complexities of the modern financial landscape. His work not only highlights the transformative potential of AI and predictive analytics but also underscores the importance of ethical considerations and data quality in building trustworthy and effective risk management solutions.

![submenu-img]() Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case

Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case![submenu-img]() India lift the ICC Trophy after 11 years; wishes from Amitabh Bachchan, Rachana & Rhythm, Indra Nooyi flow in!

India lift the ICC Trophy after 11 years; wishes from Amitabh Bachchan, Rachana & Rhythm, Indra Nooyi flow in!![submenu-img]() 'He is entitled to...': US Supreme Court says Donald Trump partially immune from prosecution for...

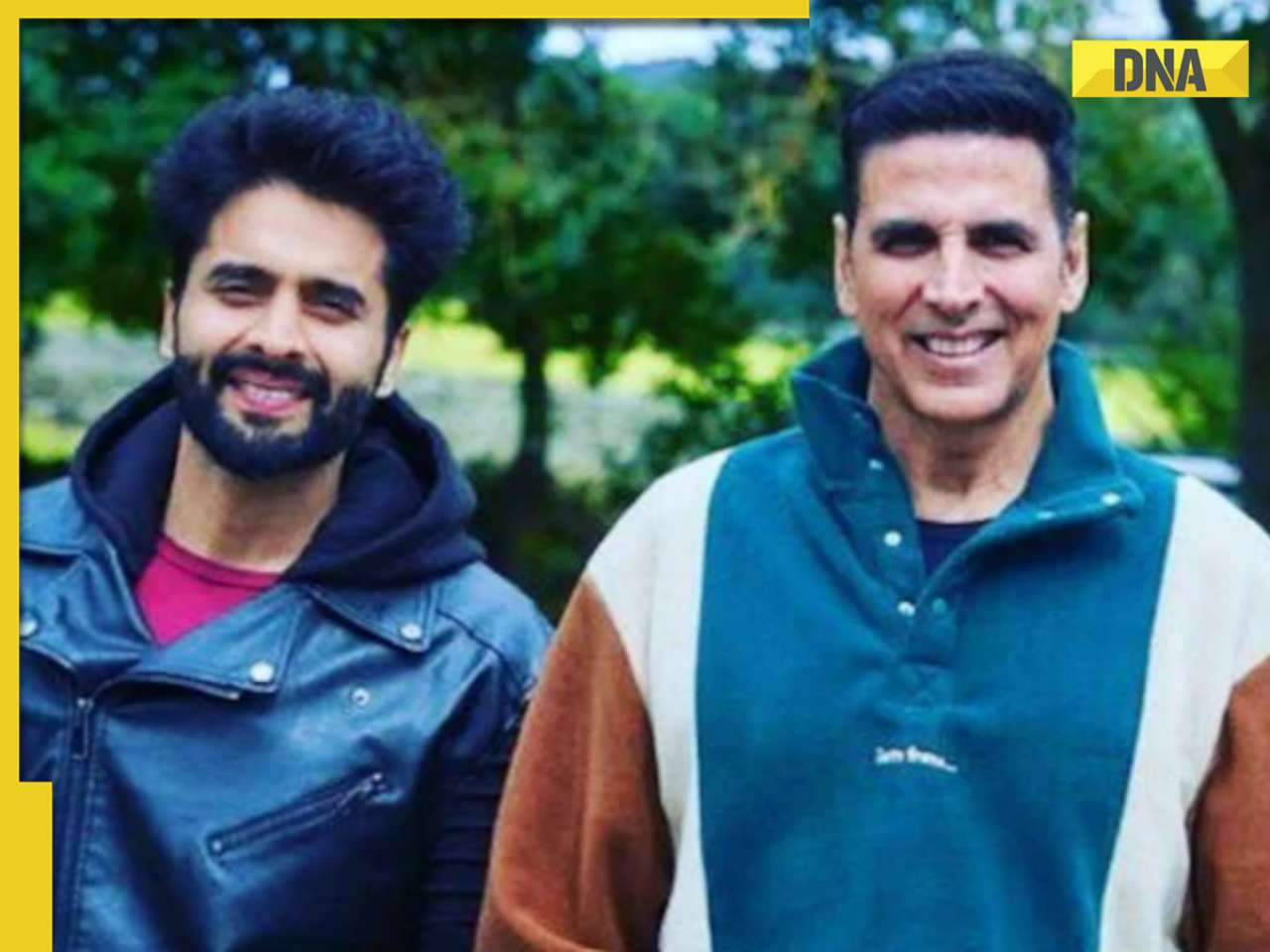

'He is entitled to...': US Supreme Court says Donald Trump partially immune from prosecution for...![submenu-img]() Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...

Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...![submenu-img]() 'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive

'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive![submenu-img]() UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here

UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here![submenu-img]() Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...

Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...![submenu-img]() Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...

Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...![submenu-img]() Meet Kathak dancer who topped UPSC exam in 1st attempt, worked at RBI in day and studied at night, she is...

Meet Kathak dancer who topped UPSC exam in 1st attempt, worked at RBI in day and studied at night, she is...![submenu-img]() Meet woman who cleared UPSC exam at 23 in her first attempt, got AIR 94, but didn't become IAS officer due to...

Meet woman who cleared UPSC exam at 23 in her first attempt, got AIR 94, but didn't become IAS officer due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

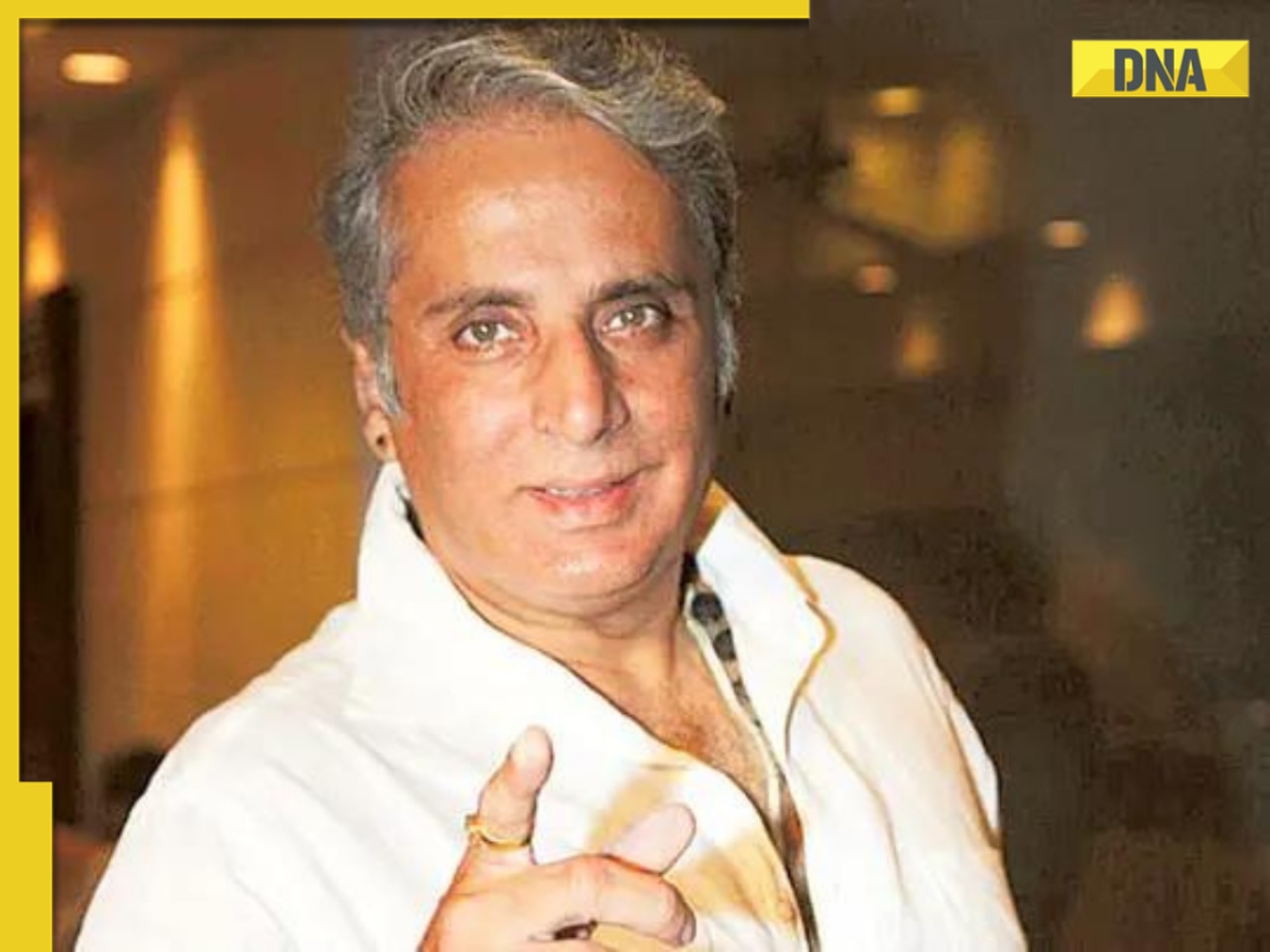

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: India beat South Africa by 7 runs to lift second T20 World Cup title

In pics: India beat South Africa by 7 runs to lift second T20 World Cup title![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case

Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case![submenu-img]() Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...

Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...![submenu-img]() 'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive

'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive![submenu-img]() The Buckingham Murders: Kareena Kapoor is held forcibly by cops in first look poster, fans say 'National Award loading'

The Buckingham Murders: Kareena Kapoor is held forcibly by cops in first look poster, fans say 'National Award loading'![submenu-img]() Dharmendra bought this film's script for Rs 17500, his sister forced him to not work in it, movie changed life of...

Dharmendra bought this film's script for Rs 17500, his sister forced him to not work in it, movie changed life of...![submenu-img]() Watch viral video: AI chatbot caught lying, tells users that it is...

Watch viral video: AI chatbot caught lying, tells users that it is...![submenu-img]() Virat Kohli fails to make it in ICC ‘Team of the Tournament', six Indians in the list including…

Virat Kohli fails to make it in ICC ‘Team of the Tournament', six Indians in the list including…![submenu-img]() Meet woman who lives in India's largest house, larger than Mukesh Ambani, Nita Ambani's Rs 15000 cr Antilia, she is...

Meet woman who lives in India's largest house, larger than Mukesh Ambani, Nita Ambani's Rs 15000 cr Antilia, she is...![submenu-img]() North Korea publicly executes 22-year-old man for listening to...

North Korea publicly executes 22-year-old man for listening to...![submenu-img]() Viral video: Little girl’s adorable dance to ‘Soulmate’ wins internet, watch

Viral video: Little girl’s adorable dance to ‘Soulmate’ wins internet, watch

)

)

)

)

)

)

)