Registering an offshore company is a popular option among investors, as these not only help to expand the business but also assist in tax optimization and risk mitigation.

As an experienced offshore corporate service provider, Business Setup Worldwide acknowledges the importance of offshore companies and helps find a suitable offshore jurisdiction for your business.

The Concept of Offshore Company

An offshore company can be defined as a legal entity incorporated outside your home country. The requirements for setting up an offshore company can depend on the jurisdiction chosen. It provides a wide range of financial services, a conducive business environment and confidentiality laws which help in the growth of the business.

Top 3 Jurisdictions for Offshore Company Formation

There are many offshore jurisdictions around the world which can be chosen for your offshore company formation. Here are the details of the top three offshore locations:

- British Virgin Islands (BVI)

The British Virgin Islands is recognized as one of the leading offshore jurisdictions, attracting entrepreneurs and business investors worldwide. The BVI government started providing offshore financial services in the mid-1980s and now generates 51.4% of government revenue. Let's have a look at the advantages of a BVI offshore company.

Benefits of Offshore Company Registration in BVI

- No taxes on the income generated outside of BVI

- Fast and simple incorporation process with less documentation.

- Flexibility to choose different corporate entities.

Requirements for BVI Offshore Company

The requirements for registering an offshore company in BVI are listed below:

- No requirement to make the records of the company and directors public.

- A minimum of one director and shareholder is required.

- There is no requirement of minimum paid-up capital.

- Must have a local and registered office address.

- A local registered agent must be appointed.

- Seychelles

An International Business Company (IBC) in Seychelles is governed by the Seychelles International Business Companies Act, according to which foreign-based income is not taxable. Investors worldwide prefer setting up an offshore company in Seychelles, as it helps reduce their tax liability.

Benefits of Offshore Company Registration in Seychelles

- Provides asset protection against potential claims or creditors.

- Allows free movement of capital.

- Not taxable for the income generated outside the country.

- Personal information of the company’s members is not disclosed publicly.

Requirements of a Seychelles Offshore Company

The requirements for offshore company registration in Seychelles are mentioned below:

- A local registered agent must be appointed

- Having a local and registered office address is necessary

- Having a company secretary is optional for a Seychelles offshore company

- There are no requirements to file an annual return or financial statements for foreign-based income.

- A minimum of one director and shareholder is required. They can be the same person or entity.

- Belize

Investors prefer setting up an offshore company in Belize due to its fast company incorporation and privacy policies. This Central American country is suitable for starting trading, e-commerce businesses, and consulting services, among other things. There is no mandatory requirement to reside in the country to start an offshore company, as it can be opened and managed remotely.

Benefits of Offshore Company Formation in Belize

Check out the following advantages of Belize offshore company incorporation:

- Provides various investment opportunities for foreign business investors.

- The personal information of the director and shareholder is not disclosed publicly.

- Belize is renowned for its offshore banking and financial services.

- Offers a perfect environment for ease of doing business.

Requirements of an Offshore Company Formation in Belize

- Every company in Belize must meet the accounting requirements and make the records public.

- A register needs to be maintained to maintain the privacy of the business operations.

- Nominee director services are available in Belize to maintain anonymity.

- A local registered agent must be appointed for a Belize offshore company.

These three locations are the most sought-after by investors for setting up an offshore company. The management needs to understand the requirements of a business and select the proper jurisdiction accordingly. There are many other offshore jurisdictions, too, which you can explore.

Making the decision to start a company in a foreign country can be complex and will require professional assistance. Business Setup Worldwide (BSW) can assist you in your entrepreneurial journey.

The consultants at BSW understand the challenges of opening an offshore company and will assist you throughout the company setup process. Contact us if you have any queries regarding offshore company setup and our team will get back to you within 24 hours.

(This article is part of IndiaDotCom Pvt Ltd’s Consumer Connect Initiative, a paid publication programme. IDPL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The IDPL Editorial team is not responsible for this content.)

![submenu-img]() Maa Kali teaser: Raima Sen, Abhishek Singh film narrates 'horrifying' Direct Action Day during British Raj Bengal

Maa Kali teaser: Raima Sen, Abhishek Singh film narrates 'horrifying' Direct Action Day during British Raj Bengal ![submenu-img]() Watch: Rohit Sharma, Virat Kohli lift T20 World Cup trophy together during Team India's victory parade in Mumbai

Watch: Rohit Sharma, Virat Kohli lift T20 World Cup trophy together during Team India's victory parade in Mumbai![submenu-img]() Meet Indian genius, who worked on NASA's Rs 73700 crore project, married to a scientist, she is...

Meet Indian genius, who worked on NASA's Rs 73700 crore project, married to a scientist, she is...![submenu-img]() Watch: Fan climbs tree to watch Team India's victory parade up close, video goes viral

Watch: Fan climbs tree to watch Team India's victory parade up close, video goes viral![submenu-img]() Hathras stampede: Congress MP Rahul Gandhi to meet victims of incident tomorrow

Hathras stampede: Congress MP Rahul Gandhi to meet victims of incident tomorrow![submenu-img]() Meet Indian genius, who worked on NASA's Rs 73700 crore project, married to a scientist, she is...

Meet Indian genius, who worked on NASA's Rs 73700 crore project, married to a scientist, she is...![submenu-img]() Meet woman, civil servant for 30 years, now becomes first female chief secretary of...

Meet woman, civil servant for 30 years, now becomes first female chief secretary of...![submenu-img]() Meet Indian genius, a celebrated physicist, who was denied Nobel Prize in 2005, converted to Hinduism because..

Meet Indian genius, a celebrated physicist, who was denied Nobel Prize in 2005, converted to Hinduism because..![submenu-img]() Meet Indian genius who passed classes 8-12 in 9 months, became one of India's youngest engineer at 15, joined IIT for...

Meet Indian genius who passed classes 8-12 in 9 months, became one of India's youngest engineer at 15, joined IIT for...![submenu-img]() Meet Indian genius, who began career as assistant, later led key NASA mission, works as...

Meet Indian genius, who began career as assistant, later led key NASA mission, works as...![submenu-img]() Godman Bhole Baba's Lawyers Deny ‘Charan Raj’ Claim, Says Anti-Social Elements Behind Stampede

Godman Bhole Baba's Lawyers Deny ‘Charan Raj’ Claim, Says Anti-Social Elements Behind Stampede![submenu-img]() Meet Rishi Shah, The Indian-American Sentenced To 7.5 Years In Prison For $1 Billion Fraud Scheme

Meet Rishi Shah, The Indian-American Sentenced To 7.5 Years In Prison For $1 Billion Fraud Scheme![submenu-img]() Severe Turbulence On Spanish Flight Injures 30, Video Of Man Thrown Into Overhead Bin Goes Viral

Severe Turbulence On Spanish Flight Injures 30, Video Of Man Thrown Into Overhead Bin Goes Viral![submenu-img]() Haryana: Goods Train To Amritsar Derailed In Karnal, Containers Fall Off, Rail Traffic Disrupted

Haryana: Goods Train To Amritsar Derailed In Karnal, Containers Fall Off, Rail Traffic Disrupted![submenu-img]() 'Played With Religious Sentiments': Chirag Paswan Slams Rahul Gandhi Over His Remarks In Parliament

'Played With Religious Sentiments': Chirag Paswan Slams Rahul Gandhi Over His Remarks In Parliament![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() 5 warm moments Ranveer Singh shared with fans that show why he is their favourite

5 warm moments Ranveer Singh shared with fans that show why he is their favourite![submenu-img]() In pics: Richa Chadha cheers for Ali Fazal, Isha Talwar, Vijay Varma, Shweta Tripathi pose at Mirzapur 3 screening

In pics: Richa Chadha cheers for Ali Fazal, Isha Talwar, Vijay Varma, Shweta Tripathi pose at Mirzapur 3 screening![submenu-img]() Meet Mickey Dhamejani, Jr Hrithik Roshan from Krrish, former child actor who quit films, is now...

Meet Mickey Dhamejani, Jr Hrithik Roshan from Krrish, former child actor who quit films, is now...![submenu-img]() In pics: India beat South Africa by 7 runs to lift second T20 World Cup title

In pics: India beat South Africa by 7 runs to lift second T20 World Cup title![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Hathras stampede: Congress MP Rahul Gandhi to meet victims of incident tomorrow

Hathras stampede: Congress MP Rahul Gandhi to meet victims of incident tomorrow![submenu-img]() Hathras stampede: Six sevadars including two women arrested by UP police, key accused still on run

Hathras stampede: Six sevadars including two women arrested by UP police, key accused still on run![submenu-img]() CST Advanced Systems revolutionizes tactical Operations

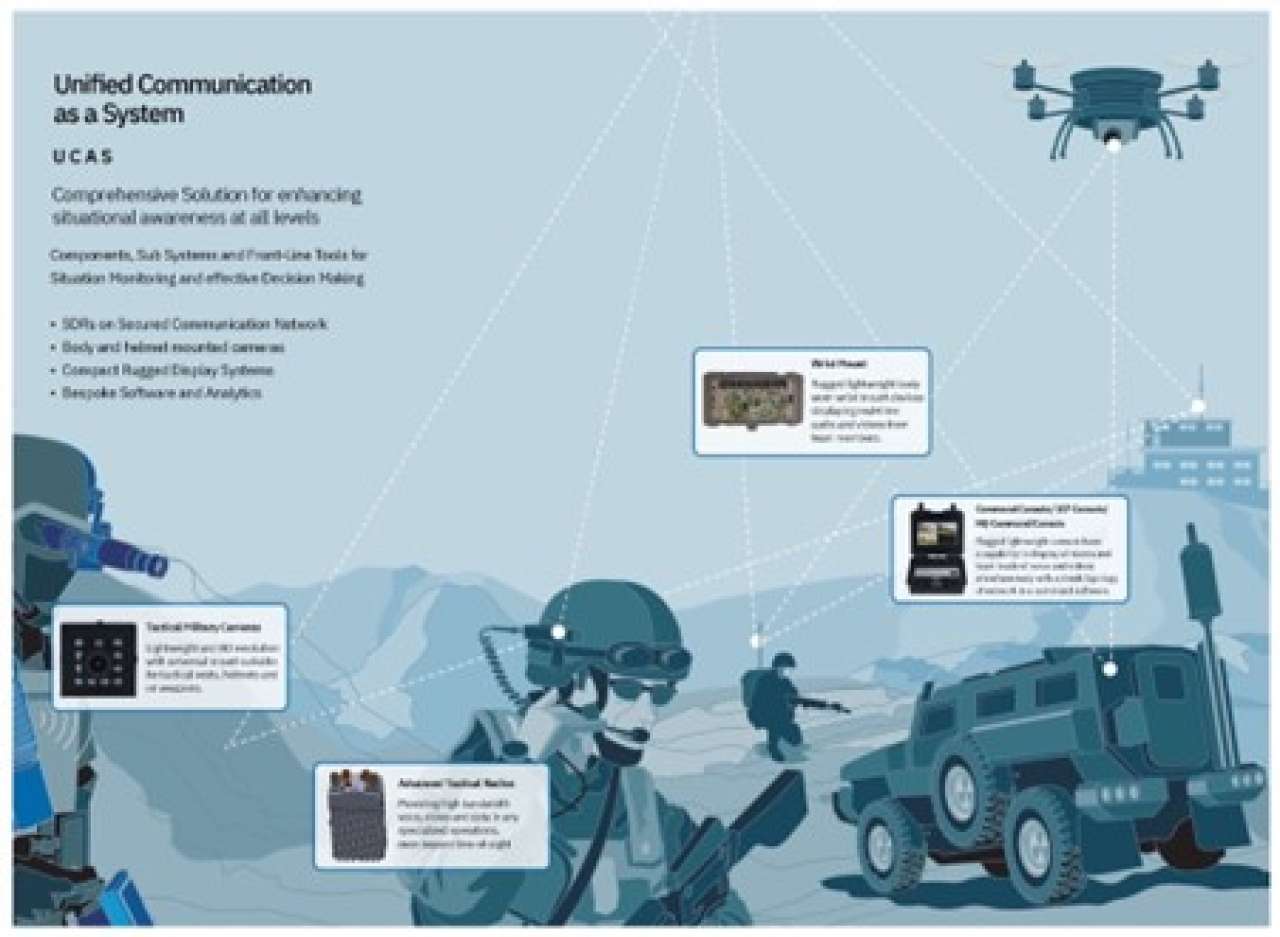

CST Advanced Systems revolutionizes tactical Operations![submenu-img]() 'We would all be...: ISRO chief issues eerie warning for humans and it's related to..

'We would all be...: ISRO chief issues eerie warning for humans and it's related to..![submenu-img]() This Pakistani leader was LK Advani's good friend, they both used to share letters in...

This Pakistani leader was LK Advani's good friend, they both used to share letters in...![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Maa Kali teaser: Raima Sen, Abhishek Singh film narrates 'horrifying' Direct Action Day during British Raj Bengal

Maa Kali teaser: Raima Sen, Abhishek Singh film narrates 'horrifying' Direct Action Day during British Raj Bengal ![submenu-img]() Kalki 2898 AD director Nag Ashwin reacts to audience reaction, reveals major details about Part Two: 'We shot about...'

Kalki 2898 AD director Nag Ashwin reacts to audience reaction, reveals major details about Part Two: 'We shot about...'![submenu-img]() This TV star to join Bigg Boss OTT 3 as wild card entry; it's not Shehzada Dhami, Bristi Samaddar, Rakhi Sawant

This TV star to join Bigg Boss OTT 3 as wild card entry; it's not Shehzada Dhami, Bristi Samaddar, Rakhi Sawant![submenu-img]() Auron Mein Kahan Dum Tha getting postponed is 'tough but good decision', exhibitors say 'we all know Munjya, Kalki...'

Auron Mein Kahan Dum Tha getting postponed is 'tough but good decision', exhibitors say 'we all know Munjya, Kalki...'![submenu-img]() Tahira Kashyap says husband Ayushmann Khurrana 'was not happy' with her books: 'He considers it blasphemous' | Exclusive

Tahira Kashyap says husband Ayushmann Khurrana 'was not happy' with her books: 'He considers it blasphemous' | Exclusive![submenu-img]() Mukesh Ambani's bahu Radhika Merchant dazzles in Durga shloka-inscribed lehenga for her 'mameru' ceremony, pics go viral

Mukesh Ambani's bahu Radhika Merchant dazzles in Durga shloka-inscribed lehenga for her 'mameru' ceremony, pics go viral![submenu-img]() Virat Kohli meets brother Vikas, family at Delhi hotel after returning from Barbados, see pics

Virat Kohli meets brother Vikas, family at Delhi hotel after returning from Barbados, see pics![submenu-img]() Viral video: AIIMS doctor grooves to ‘Tip Tip Barsa Paani’, sets internet on fire; watch

Viral video: AIIMS doctor grooves to ‘Tip Tip Barsa Paani’, sets internet on fire; watch![submenu-img]() Inside details of functions organised by Mukesh Ambani, Nita Ambani for Anant Ambani, Radhika Merchant's grand wedding

Inside details of functions organised by Mukesh Ambani, Nita Ambani for Anant Ambani, Radhika Merchant's grand wedding![submenu-img]() Mukesh Ambani, Nita Ambani's daughter Isha Ambani owns diamonds worth crores but her most prized jewellery is..

Mukesh Ambani, Nita Ambani's daughter Isha Ambani owns diamonds worth crores but her most prized jewellery is..

)

)

)

)

)

)

)