The last date for filing income tax return (ITR) is July 21, just four days away. Taxpayers need to submit their ITR for the financial year 2021-22 (or assessment year 2022-23) before the deadline to avoid any fine or penalty.

The last date for filing income tax return (ITR) is July 21, just four days away. Taxpayers need to submit their ITR for the financial year 2021-22 (or assessment year 2022-23) before the deadline to avoid any fine or penalty.

However, filing ITR online is followed by another important step, which if left incomplete, will lead to failure of failing of your tax return. One you are done filing your income tax return, the next step is to verify it.

The Income Tax Department processes your return only if it is verified. Hence, you will receive refunds only if the return is submitted and verified.

Six different ways of e-verification

As per income tax laws, “ITR will not be considered valid if it is not verified within 120 days from the date of filing”. As per the rule you can verify this in six ways.

- Generate Aadhaar OTP

- Existing Aadhaar OTP

- Existing EVC

- Generate EVC through a bank account

- Generate EVC through the Demat account

- Generate EVC through bank ATM option (offline)

How to e-verify your ITR through Aadhaar

- Log on to Income Tax Department’s official website www.incometax.gov.in and go to your e-filing account

- Under the e-filing tab, select Income Tax Returns > e-Verify Return

- In the ‘e-Verify Return’ page, select the method of e-verification to Aadhaar

- Under the e-verify return page, select ‘I would like to e-verify using OTP on a mobile number registered with Aadhaar.

- A pop-up will appear on your screen. You will be required to select the tick box saying ‘I agree to validate my Aadhaar details’ and click on the ‘Generate Aadhaar OTP’ button.

- An SMS with the 6-digit OTP will be sent to your registered mobile number.

- Enter the OTP received in the box where it is required and click on the ‘Submit’ button. On successful submission, your ITR will be verified. OTP is valid only for 15 minutes.

Benfits of e-verification

e-Verification with an Electronic Verification Code (EVC) or an Aadhaar OTP, as the case may be, is beneficial in as much as you can do away with signing and sending a hard copy of the return filing acknowledgement. Further, e-verification also helps quick processing of your return when compared to the other modes of verification.

![submenu-img]() Ganesh Chaturthi 2024 shubh muhurat: Check city wise puja timings, visarjan date, and bhog for Ganpati Bappa

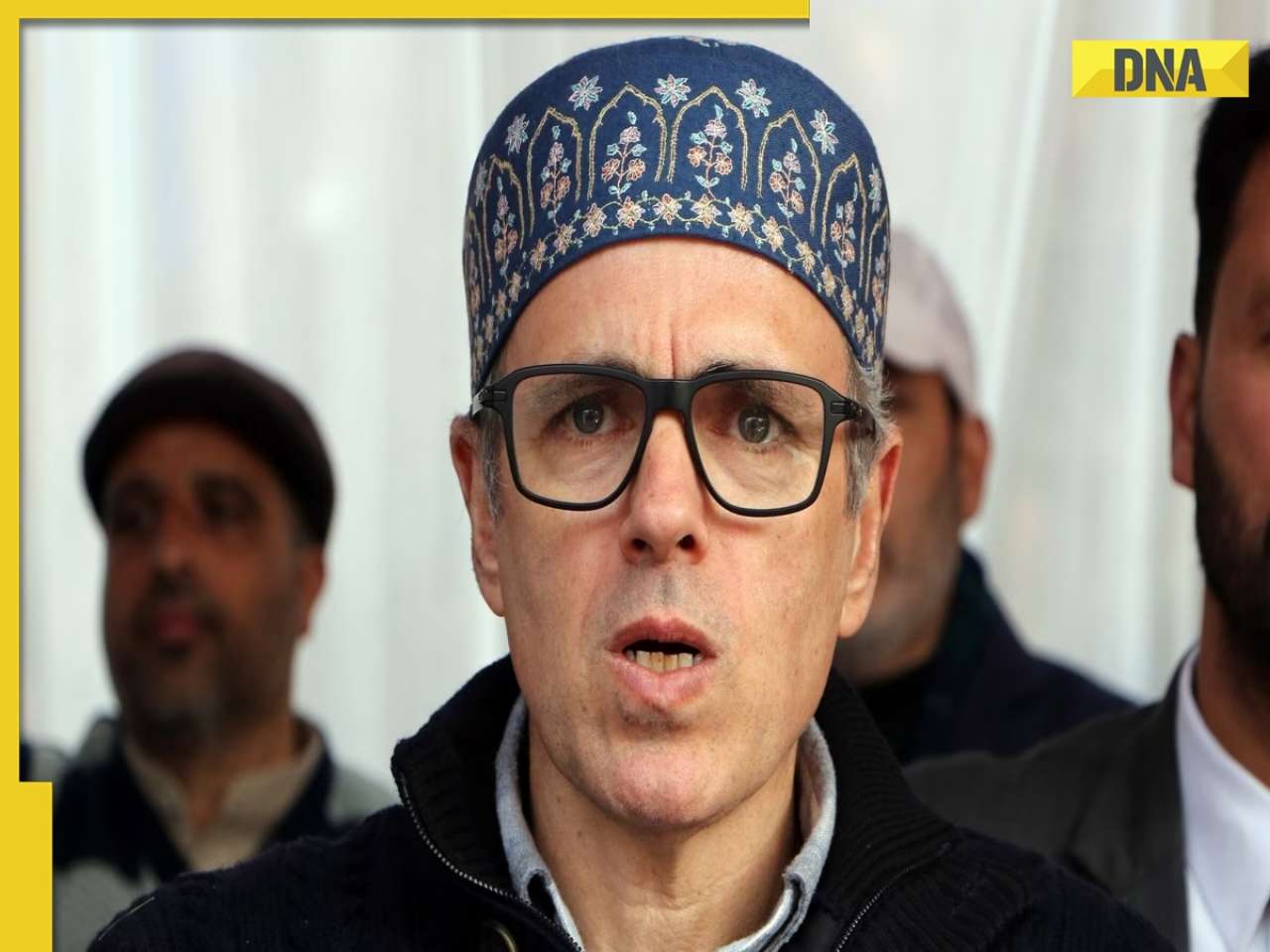

Ganesh Chaturthi 2024 shubh muhurat: Check city wise puja timings, visarjan date, and bhog for Ganpati Bappa![submenu-img]() 'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'

'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'![submenu-img]() Boney Kapoor announces new film, its title has a Mr India connect: 'Probably by December we...'

Boney Kapoor announces new film, its title has a Mr India connect: 'Probably by December we...'![submenu-img]() Meet actress, who worked for 17 hours straight on toxic sets, her mental health was affected, left industry, is now...

Meet actress, who worked for 17 hours straight on toxic sets, her mental health was affected, left industry, is now...![submenu-img]() Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'

Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'![submenu-img]() Breaking News: मध्य प्रदेश के Jabalpur में बड़ा रेल हादसा, सोमनाथ एक्सप्रेस के 2 डिब्बे पटरी से उतरे

Breaking News: मध्य प्रदेश के Jabalpur में बड़ा रेल हादसा, सोमनाथ एक्सप्रेस के 2 डिब्बे पटरी से उतरे ![submenu-img]() 'नीतीश तीसरी बार नहीं करेंगे ये गलती', बिहार CM को लेकर ऐसा क्यों बोले जीतन राम मांझी

'नीतीश तीसरी बार नहीं करेंगे ये गलती', बिहार CM को लेकर ऐसा क्यों बोले जीतन राम मांझी![submenu-img]() Happy Ganesh Chaturthi 2024: 'लड्डू जिनका भोग है मूषक है सवारी....' यहां से शानदार मैसेज भेज सबको दें गणेश चतुर्थी की बधाई

Happy Ganesh Chaturthi 2024: 'लड्डू जिनका भोग है मूषक है सवारी....' यहां से शानदार मैसेज भेज सबको दें गणेश चतुर्थी की बधाई![submenu-img]() Haryana Assembly Election 2024: हरियाणा में कांग्रेस प्रत्याशियों की पहली लिस्ट जारी, इस सीट से चुनावी मैदान में उतरी विनेश फोगाट

Haryana Assembly Election 2024: हरियाणा में कांग्रेस प्रत्याशियों की पहली लिस्ट जारी, इस सीट से चुनावी मैदान में उतरी विनेश फोगाट![submenu-img]() Petrol-Diesel Price Today: पंप पर आज इस रेट में मिलेगा पेट्रोल-डीजल, �यहां चेक करें ताजा दाम

Petrol-Diesel Price Today: पंप पर आज इस रेट में मिलेगा पेट्रोल-डीजल, �यहां चेक करें ताजा दाम ![submenu-img]() DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Maruti Suzuki Swift nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details

DNA Auto Awards 2024: Hyundai Alcazar Facelift nominated for ‘CAR OF THE YEAR’; check details![submenu-img]() Hyundai Creta Knight Edition launched in India: Check price, features, design

Hyundai Creta Knight Edition launched in India: Check price, features, design![submenu-img]() DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Citroen Basalt nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features

DNA Auto Awards 2024: Tata Curvv nominated for ‘CAR OF THE YEAR’; check price, features![submenu-img]() UPSC topper IAS Shruti Sharma's marksheet goes viral on social media, check her scores in different subjects

UPSC topper IAS Shruti Sharma's marksheet goes viral on social media, check her scores in different subjects![submenu-img]() Meet man, who lost his mother in childhood, worked as milk seller, cracked NEET exam with AIR...

Meet man, who lost his mother in childhood, worked as milk seller, cracked NEET exam with AIR...![submenu-img]() Meet man who failed 35 exams, cracked UPSC exam twice, first became IPS then quit due to...

Meet man who failed 35 exams, cracked UPSC exam twice, first became IPS then quit due to...![submenu-img]() Meet man, who was forced into child marriage at 11, cracked NEET exam with AIR...

Meet man, who was forced into child marriage at 11, cracked NEET exam with AIR...![submenu-img]() Meet woman who cracked UPSC exam in first attempt without coaching at 22, got AIR 31, she is now posted as…

Meet woman who cracked UPSC exam in first attempt without coaching at 22, got AIR 31, she is now posted as…![submenu-img]() Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed

Mumbai: Fire Breaks Out At Times Tower In Mumbai, 9 Fire Units Deployed![submenu-img]() 'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project

'Dharavi Project Is About Restoring Dignity...', Says Gautam Adani | Dharavi Redevelopment Project![submenu-img]() Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure

Kolkata Doctor Case: CBI Visits RG Kar, Seizes Documents On Funds Used During Sandip Ghosh’s Tenure![submenu-img]() Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested

Giriraj Singh Attacked: Union Minister Giriraj Singh Assaulted In Begusarai, Bihar; Accused Arrested![submenu-img]() Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here

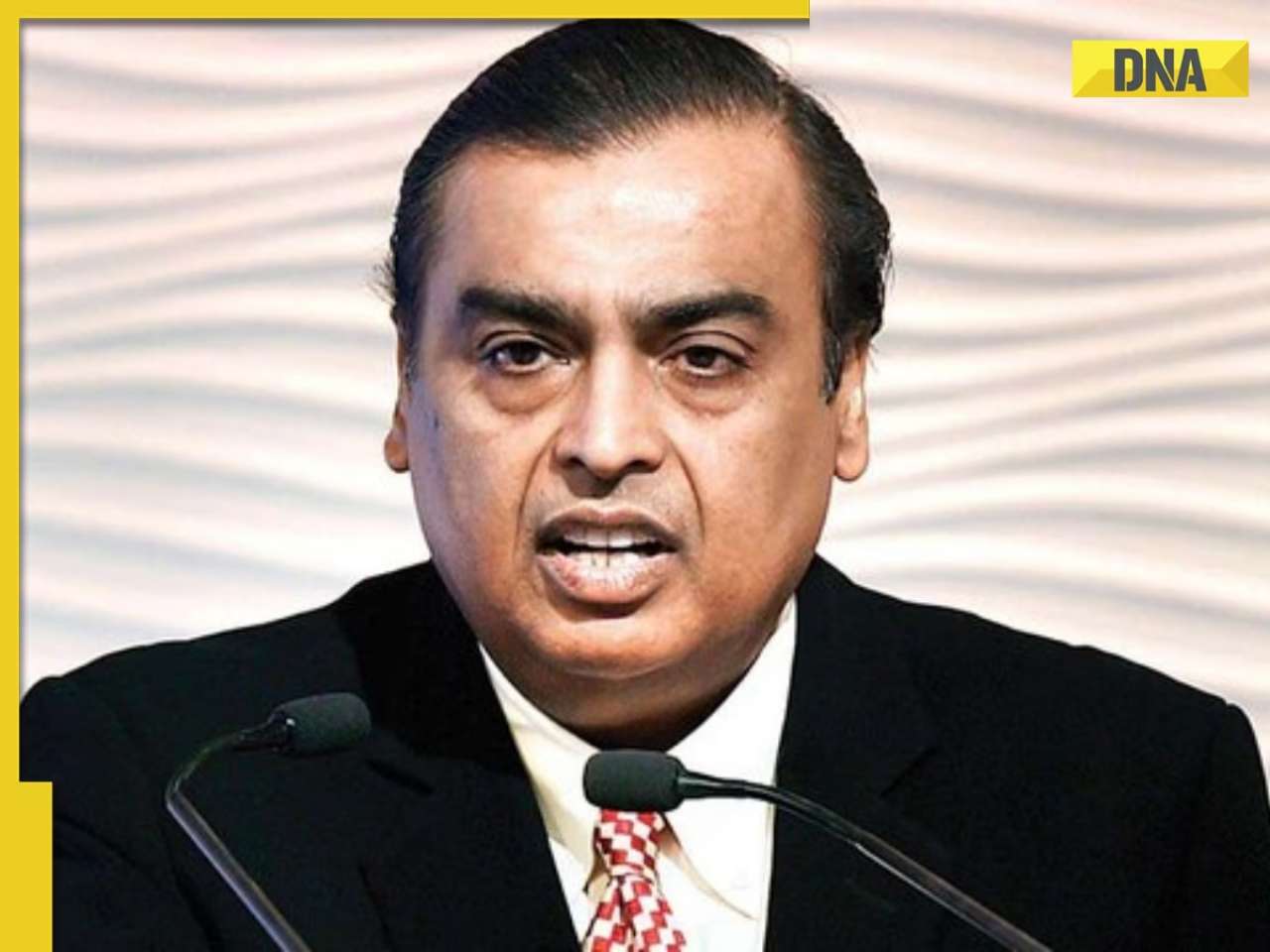

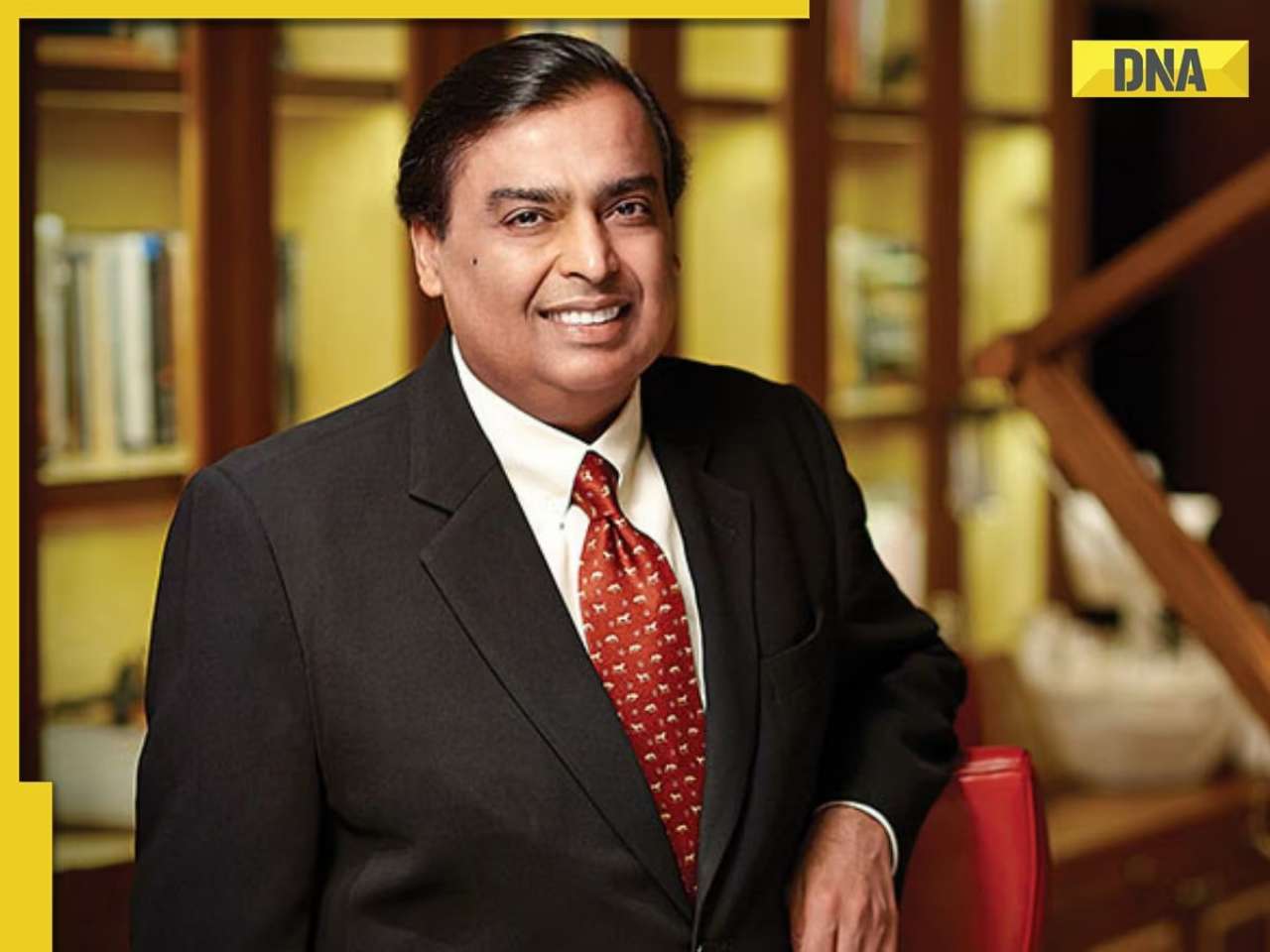

Haryana Assembly Election 2024: Haryana Assembly Election Date Changed, Check Details Here![submenu-img]() Mukesh Ambani set to challenge Adani, ITC with his Rs 3900 crore plan for...

Mukesh Ambani set to challenge Adani, ITC with his Rs 3900 crore plan for...![submenu-img]() NPCI launches 'UPI circle', check what it is and how it works

NPCI launches 'UPI circle', check what it is and how it works![submenu-img]() Mukesh Ambani's Reliance Jio to give tough competition to BSNL with this plan, it offers 5G data at just Rs...

Mukesh Ambani's Reliance Jio to give tough competition to BSNL with this plan, it offers 5G data at just Rs...![submenu-img]() This company repays Rs 20000 crore debt for... and it has a Ratan Tata connection

This company repays Rs 20000 crore debt for... and it has a Ratan Tata connection![submenu-img]() Meet woman, billionaire's daughter, who studied in London, now leads Rs 1124 crore company as...

Meet woman, billionaire's daughter, who studied in London, now leads Rs 1124 crore company as...![submenu-img]() From Cristiano Ronaldo to Virat Kohli: List of highest-paid athletes in last 12 months

From Cristiano Ronaldo to Virat Kohli: List of highest-paid athletes in last 12 months![submenu-img]() Meet actor who worked as waiter, sold tea, namkeen for 14 years, debuted in Bollywood at 42; now his net worth is...

Meet actor who worked as waiter, sold tea, namkeen for 14 years, debuted in Bollywood at 42; now his net worth is...![submenu-img]() Parents-to-be Deepika Padukone, Ranveer Singh seek blessings at Siddhivinayak with families days before baby's arrival

Parents-to-be Deepika Padukone, Ranveer Singh seek blessings at Siddhivinayak with families days before baby's arrival![submenu-img]() Gout remedies: 7 natural ways to lower uric acid levels in the body

Gout remedies: 7 natural ways to lower uric acid levels in the body ![submenu-img]() Active players with most centuries in international cricket

Active players with most centuries in international cricket ![submenu-img]() 'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'

'Leaders in Delhi never liked me…’ Omar Abdullah alleges poll 'conspiracy'![submenu-img]() Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'

Over 200 Patients celebrate freedom from diabetes in Madhavbaug's nationwide campaign 'Azadi Diabetes Se'![submenu-img]() 'When we were dragged on roads...': Wrestler Vinesh Phogat slams BJP

'When we were dragged on roads...': Wrestler Vinesh Phogat slams BJP![submenu-img]() India emerges as second-largest global 5G smartphone market, overtakes...

India emerges as second-largest global 5G smartphone market, overtakes...![submenu-img]() Union Home Minister Amit Shah releases BJP manifesto for J&K assembly elections

Union Home Minister Amit Shah releases BJP manifesto for J&K assembly elections

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)