M&M, Tata Motors, Toyota raise prices from April 1 due to high input and regulatory compliance costs

Rising commodity prices and enhanced regulatory compliance are forcing automakers to take price hikes despite vehicle demand staying poor for the last six months.

Mahindra & Mahindra (M&M), Tata Motors, Toyota are among the vehicle makers that have announced price hikes from April 1. Interestingly, some of these companies had raised prices in January too.

M&M on Thursday announced raising prices of its range of personal and commercial vehicles by 0.5%-2.7%, or Rs 5,000-Rs 73,000, across its models from April 1.

Rajan Wadhera, president, automotive sector, M&M, said, "This year has seen record high commodity price increases. Further, regulatory compliances effective April 1 have also contributed to cost increases. While we have made efforts to reduce costs, it has not been possible to hold back the price increase."

Tata Motors last week announced raising passenger vehicle prices by up to Rs 25,000 from the next month. Mayank Pareek, President, PV business unit at Tata Motors, attributed the price hike to the rising input costs and external economic conditions.

N Raja, managing director, Toyota Kirloskar Motor, echoed the views of his counterparts. "We have been absorbing additional costs through a bouquet of cost reduction measures, including refinement in the production process. However, considering the trend of continuous increase, we are constrained to pass on a small portion to the customers," he said.

N Raja, managing director, Toyota Kirloskar Motor, echoed the views of his counterparts. "We have been absorbing additional costs through a bouquet of cost reduction measures, including refinement in the production process. However, considering the trend of continuous increase, we are constrained to pass on a small portion to the customers," he said.

A Mumbai-based analyst from a global consulting firm said it is a tricky situation for the automobile companies as they are being forced to increase the price though the demand is at nadir. He, however, did not rule out that some of the manufactures may offer "discounts" after raising the prices.

According to Sridhar V, partner, Grant Thornton India LLP, the steel, aluminium and copper prices have been showing an upward trend in the past three months, and hence the original equipment manufacturers (OEMs) would look at passing the increase to the buyers. The last price increase was in January where some OEMs increased prices by about 4-5%. "The input costs have not shown any reduction in the last quarter," Sridhar said.

On the regulatory front, beginning April 1, the vehicle manufactures have been mandated to include tamper-proof high security plates (HSRP) to protect against counterfeiting and anti-lock braking system (ABS), a braking safety feature. Both the compliances have increased the costs, industry insiders claim.

Within an annual production of over 24 million units, the Indian auto industry is estimated to be among the largest in the world. As per several estimates, the automobile industry contributes around 7.1% to the country's GDP and almost 49% to the manufacturing GDP.

However, the industry is currently going through a rough patch, which is unlikely to improve until the general elections. According to a ICICI Securities report, auto dispatches were weighed down by large inventory with the dealers. Total factory dispatches for February fell 2.5% year on year to 24.1 lakh units. According to the data by Federation of Automotive Dealers Association, domestic retail sales declined 8.1% month on month to 15.8 lakh units, with all segments showing a drop. PV segment inventories increased to 50-60 days of sales in February, while for two-wheelers they jumped to 80-90 days, and 100 days-plus in some cases.

![submenu-img]() T20 World Cup 2024: ICC reprimands Afghanistan captain Rashid Khan ahead of semi-final vs South Africa

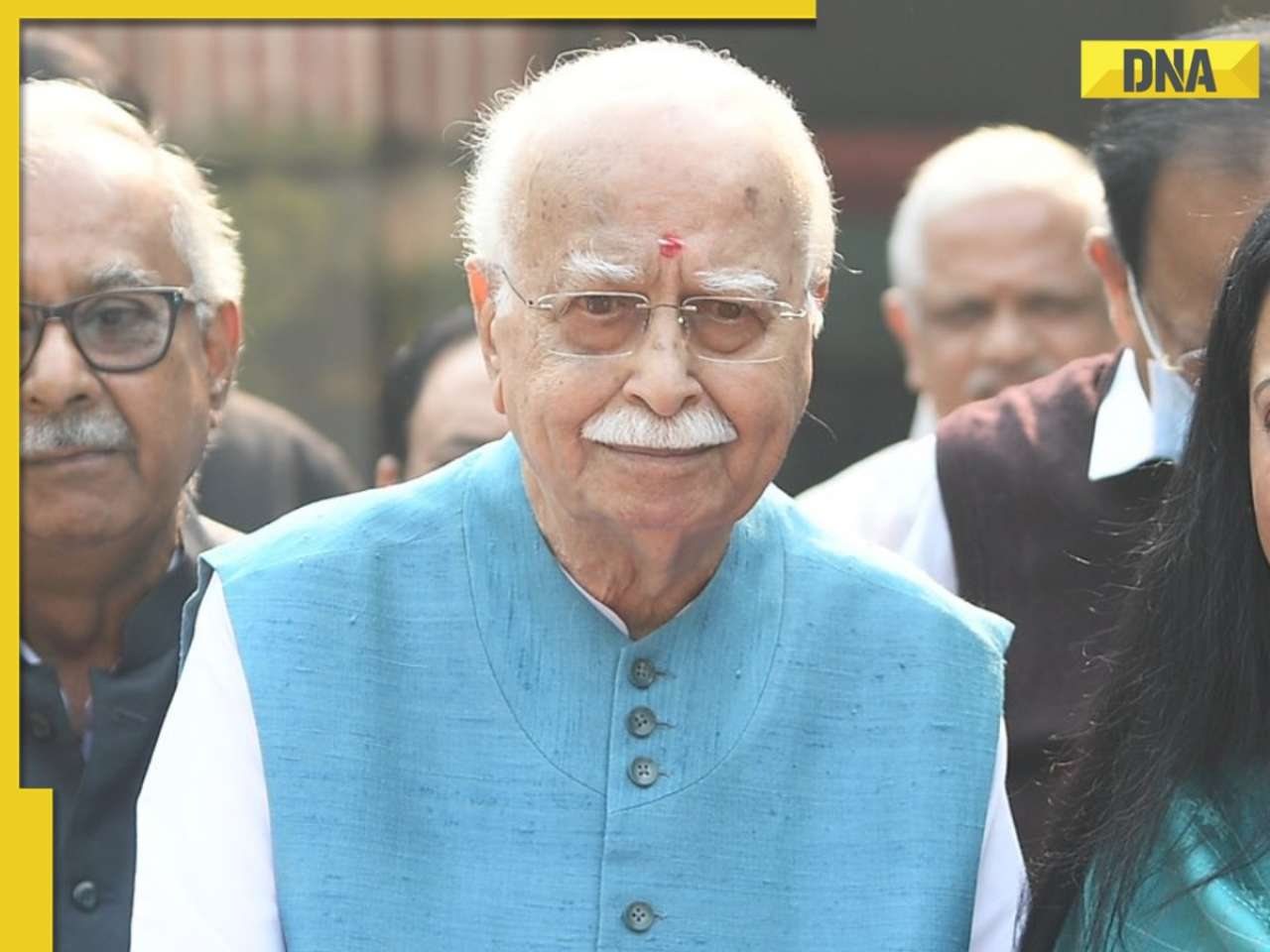

T20 World Cup 2024: ICC reprimands Afghanistan captain Rashid Khan ahead of semi-final vs South Africa![submenu-img]() Veteran BJP leader LK Advani admitted to AIIMS Delhi

Veteran BJP leader LK Advani admitted to AIIMS Delhi![submenu-img]() DNA TV Show: Did Delhi CM Arvind Kejriwal put blame on Manish Sisodia in liquor policy case?

DNA TV Show: Did Delhi CM Arvind Kejriwal put blame on Manish Sisodia in liquor policy case?![submenu-img]() Watch: Shatrughan Sinha shares inside photos, videos from Sonakshi Sinha, Zaheer Iqbal's 'wedding of the century'

Watch: Shatrughan Sinha shares inside photos, videos from Sonakshi Sinha, Zaheer Iqbal's 'wedding of the century'![submenu-img]() Kalki 2898 AD director Nag Ashwin reveals these two south stars will also appear in film, Prabhas reacts: Watch

Kalki 2898 AD director Nag Ashwin reveals these two south stars will also appear in film, Prabhas reacts: Watch![submenu-img]() Meet woman who topped class 10, 12, CLAT, law school, cracked UPSC in 1st attempt without coaching to become IAS with...

Meet woman who topped class 10, 12, CLAT, law school, cracked UPSC in 1st attempt without coaching to become IAS with...![submenu-img]() Meet IIT-JEE topper with AIR 7, daughter of Maths teacher, scored 332 marks in JEE Advanced 2024, planning to...

Meet IIT-JEE topper with AIR 7, daughter of Maths teacher, scored 332 marks in JEE Advanced 2024, planning to...![submenu-img]() UPSC topper IAS Tina Dabi's Class 12 marks goes viral on social media, check her scores in different subjects

UPSC topper IAS Tina Dabi's Class 12 marks goes viral on social media, check her scores in different subjects![submenu-img]() Meet woman who is not from IIT, IIM, VIT, NIT, got job with record-breaking package of...

Meet woman who is not from IIT, IIM, VIT, NIT, got job with record-breaking package of...![submenu-img]() Meet Indian genius who saved lakhs of lives with his discovery, received six Nobel nominations, but never won due to…

Meet Indian genius who saved lakhs of lives with his discovery, received six Nobel nominations, but never won due to…![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive

In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Watch: Shatrughan Sinha shares inside photos, videos from Sonakshi Sinha, Zaheer Iqbal's 'wedding of the century'

Watch: Shatrughan Sinha shares inside photos, videos from Sonakshi Sinha, Zaheer Iqbal's 'wedding of the century'![submenu-img]() Kalki 2898 AD director Nag Ashwin reveals these two south stars will also appear in film, Prabhas reacts: Watch

Kalki 2898 AD director Nag Ashwin reveals these two south stars will also appear in film, Prabhas reacts: Watch![submenu-img]() Kaun Banega Crorepati 16: Amitabh Bachchan introduces thought-provoking campaign, fans say 'eagerly waiting for show'

Kaun Banega Crorepati 16: Amitabh Bachchan introduces thought-provoking campaign, fans say 'eagerly waiting for show'![submenu-img]() Why Kalki 2898 AD makers chose June 27 release date? Know how it is connected to Mahabharata, Lord Vishnu

Why Kalki 2898 AD makers chose June 27 release date? Know how it is connected to Mahabharata, Lord Vishnu![submenu-img]() Ahead of Kalki 2898 AD's release, makers have this request from fans: 'Let's please respect...'

Ahead of Kalki 2898 AD's release, makers have this request from fans: 'Let's please respect...'![submenu-img]() Mukesh Ambani's son Anant Ambani and Radhika Merchant's wedding invite goes viral, watch video here

Mukesh Ambani's son Anant Ambani and Radhika Merchant's wedding invite goes viral, watch video here![submenu-img]() '4 bhk for 15 crore,': Netizens in shock after Noida man's video for house hunt goes viral

'4 bhk for 15 crore,': Netizens in shock after Noida man's video for house hunt goes viral![submenu-img]() Isha Ambani's latest picture with twins is going viral on social media due to...

Isha Ambani's latest picture with twins is going viral on social media due to...![submenu-img]() Gulbadin Naib under scrutiny, may face heavy fine after dramatic Afghanistan win

Gulbadin Naib under scrutiny, may face heavy fine after dramatic Afghanistan win![submenu-img]() Makeover of homeless woman leaves internet stunned, netizens says...

Makeover of homeless woman leaves internet stunned, netizens says...

)

) N Raja, managing director, Toyota Kirloskar Motor, echoed the views of his counterparts. "We have been absorbing additional costs through a bouquet of cost reduction measures, including refinement in the production process. However, considering the trend of continuous increase, we are constrained to pass on a small portion to the customers," he said.

N Raja, managing director, Toyota Kirloskar Motor, echoed the views of his counterparts. "We have been absorbing additional costs through a bouquet of cost reduction measures, including refinement in the production process. However, considering the trend of continuous increase, we are constrained to pass on a small portion to the customers," he said.

)

)

)

)

)

)