The plan would be prepared by a consortium led by consultant KPMG and the project report is expected in six months

Looking to move beyond its dependence on Gulf traffic, which is under strain in due to drop is oil business, national carrier Air India's international low-cost subsidiary Air India Express (AIE) is drafting a 10-year-old plan for its future expansion and eyeing new routes.

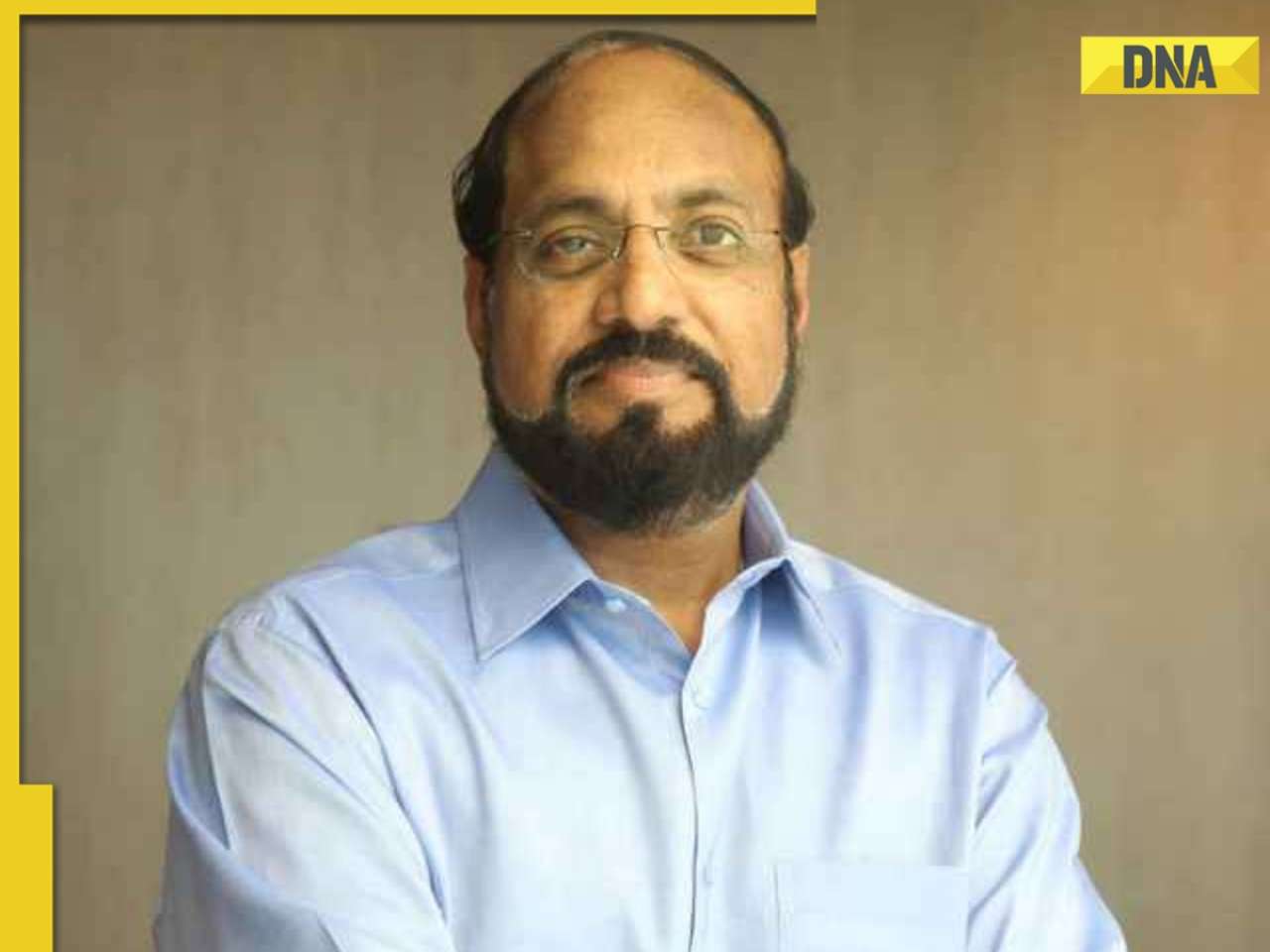

"We are in the process of drafting Mission 2026 plan which will be our roadmap for the decade ahead," Air India Express chief executive officer K Shyamsunder told DNA Money. The plan would be prepared by a consortium led by consultant KPMG and the project report is expected in six months.

The Kochi-headquartered AIE with a fleet of 23 Boeing 737-800 planes, flies to major international destinations within a distance of around four hours from India. It flies to 13 international destinations, mostly in Gulf.

To cut dependence on Gulf, the airline plans to increase reach to Southeast Asia, where it operates to just two destinations now – Singapore and Kuala Lumpur. It is also planning to connect Tehran by next year, which will be the first by an Indian airline after Air India in 1993-94 discontinued flights after economic sanctions on the country.

According to analysts, one of the main reasons for AIE's to expand to other destinations is slowing down of Gulf traffic on account of fall in oil business there. "All airlines operating on these routes will be affected if things don't improve in Gulf region," said Shyamsunder at an event in Mumbai.

Aviation industry experts said since its launch in 2004, AIE had been trying to establish its own identity away from its parent. "After the mess created by the merger of Air India and Indian Airlines and the subsequent losses, AIE too began to flounder due to labour and other operating issues," said a senior executive from the airline. "At one point of time, the vendors and others put us on cash and carry, even though we were a separate company operating independently of Air India. It's only after a lot of efforts from the government that things began to get better, and we began to get recognised as a different company," said the executive.

Further, only after the AIE management insisted that all dealings with its parent and sister concerns should be treated as a commercial deal and therefore payment needed to be made, things got still better.

"The Companies Act helped us. Later even the management backed us on that, though we do maintain synergies and don't operate on each other's routes. Recently, we have even signed code-shares with Air India for several routes," said another source.

AIE clocked revenues of Rs 1,897 crore during the first six months of this fiscal, of which Rs 415 crore was net profit. Air India, on the other hand, earned operating profit of Rs 105 crore during 2016 fiscal.

Devesh Agarwal, a Bengaluru-based aviation analyst said, "AIE is a reasonably efficiently run airline. The further, it moves away from Air India and government, better it will be for it. The airline definitely has to start looking beyond Gulf and Kerala."

![submenu-img]() Ex-India star takes a dig at Riyan Parag over his bizzare T20 World Cup remark, says, 'First be patriotic, then…'

Ex-India star takes a dig at Riyan Parag over his bizzare T20 World Cup remark, says, 'First be patriotic, then…'![submenu-img]() Kakuda trailer: Sonakshi Sinha, Riteish Deshmukh, Saqib Saleem team up to get rid of a ghostly curse in spooky comedy

Kakuda trailer: Sonakshi Sinha, Riteish Deshmukh, Saqib Saleem team up to get rid of a ghostly curse in spooky comedy![submenu-img]() From Launch to Leadership: Logistics Expert Streamlines Operations Across the Americas

From Launch to Leadership: Logistics Expert Streamlines Operations Across the Americas![submenu-img]() ISRO’s Aditya-L1 completes first halo orbit around Sun-Earth L1 point in….

ISRO’s Aditya-L1 completes first halo orbit around Sun-Earth L1 point in….![submenu-img]() Amazon Prime Day sale date announced; check details

Amazon Prime Day sale date announced; check details![submenu-img]() Prabhas' pan-India films ranked from best to worst

Prabhas' pan-India films ranked from best to worst![submenu-img]() Here's how much Pankaj Tripathi, Ali Fazal, other cast charged for Mirzapur 3

Here's how much Pankaj Tripathi, Ali Fazal, other cast charged for Mirzapur 3![submenu-img]() 9 Indian films with Hollywood-level special effects

9 Indian films with Hollywood-level special effects![submenu-img]() 5 moments from Tanaav 2 teaser that show Kabir's hunt for 'threat' Fareed Mir will be more intense

5 moments from Tanaav 2 teaser that show Kabir's hunt for 'threat' Fareed Mir will be more intense![submenu-img]() 9 Indian remakes of Korean dramas, films

9 Indian remakes of Korean dramas, films![submenu-img]() Meet woman who cleared UPSC exam at 21, bagged AIR 13 but didn't become IAS due to...

Meet woman who cleared UPSC exam at 21, bagged AIR 13 but didn't become IAS due to...![submenu-img]() Meet daughter of vegetable vendor whose mother mortgaged gold for her studies, failed to crack UPSC exam 4 times then...

Meet daughter of vegetable vendor whose mother mortgaged gold for her studies, failed to crack UPSC exam 4 times then...![submenu-img]() UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here

UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here![submenu-img]() Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...

Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...![submenu-img]() Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...

Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: India beat South Africa by 7 runs to lift second T20 World Cup title

In pics: India beat South Africa by 7 runs to lift second T20 World Cup title![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

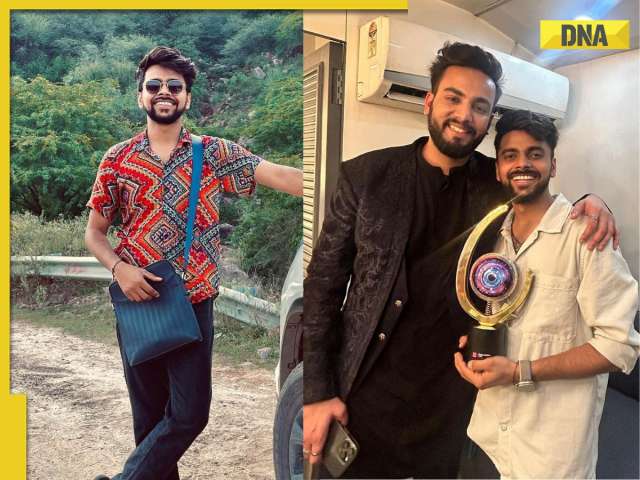

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Kakuda trailer: Sonakshi Sinha, Riteish Deshmukh, Saqib Saleem team up to get rid of a ghostly curse in spooky comedy

Kakuda trailer: Sonakshi Sinha, Riteish Deshmukh, Saqib Saleem team up to get rid of a ghostly curse in spooky comedy![submenu-img]() Divya Bharti shot for few days for this film before her death, Aishwarya, Sridevi rejected it, movie became hit after...

Divya Bharti shot for few days for this film before her death, Aishwarya, Sridevi rejected it, movie became hit after...![submenu-img]() Tahira Kashyap doesn't want Sharmajee Ki Beti to be called women-oriented: 'You make cinema for everyone' | Exclusive

Tahira Kashyap doesn't want Sharmajee Ki Beti to be called women-oriented: 'You make cinema for everyone' | Exclusive![submenu-img]() Anurag Basu reveals why he is jealous of Rajkumar Hirani: 'He has flexed his...'

Anurag Basu reveals why he is jealous of Rajkumar Hirani: 'He has flexed his...'![submenu-img]() Does Disha Patani's new 'PD' tattoo confirm she is dating Kalki co-star Prabhas? Know real story behind ink | Exclusive

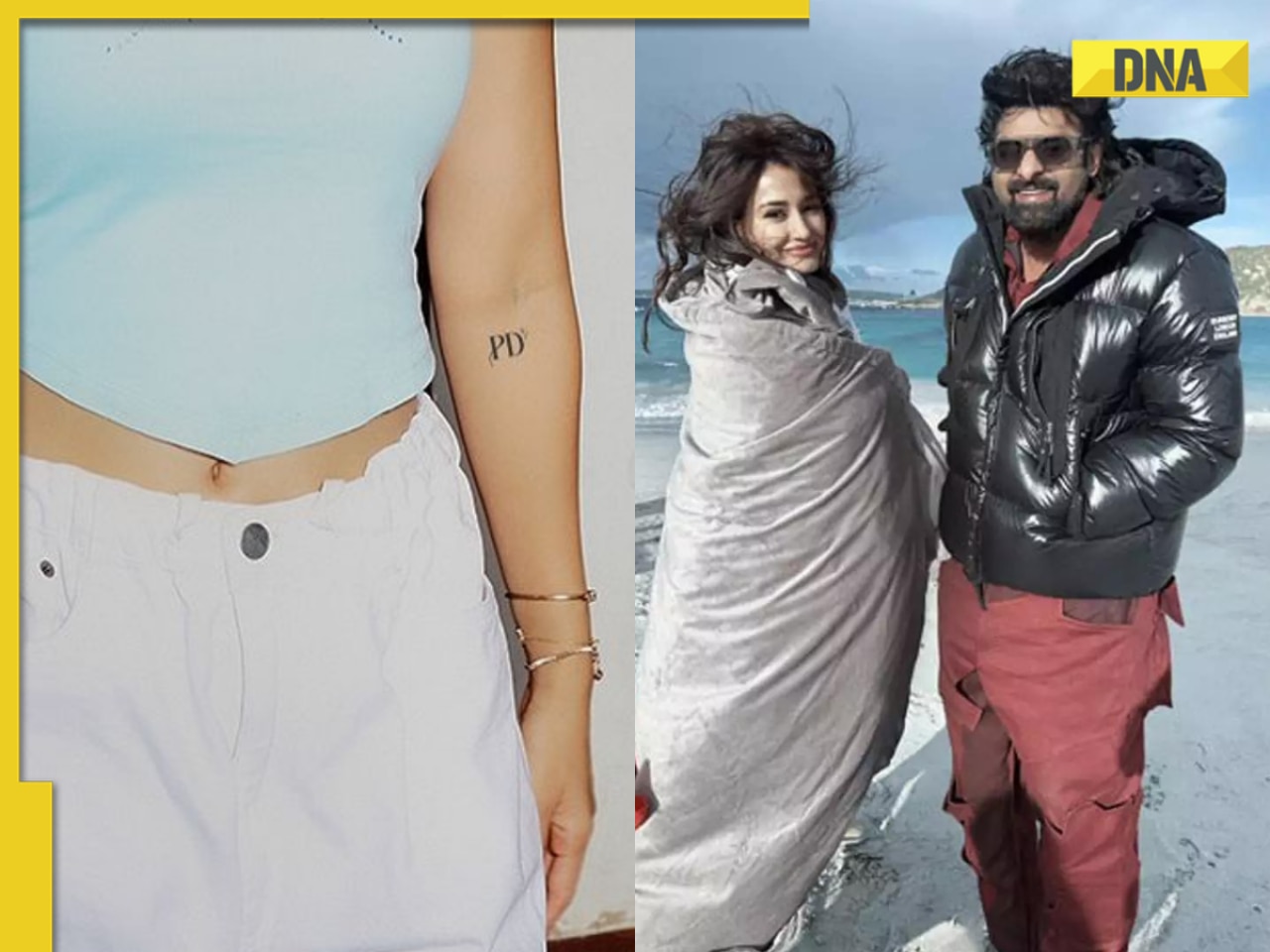

Does Disha Patani's new 'PD' tattoo confirm she is dating Kalki co-star Prabhas? Know real story behind ink | Exclusive![submenu-img]() Amazon Prime Day sale date announced; check details

Amazon Prime Day sale date announced; check details![submenu-img]() Gold mangalsutras, silver rings and...: Mukesh Ambani, Nita Ambani’s gifts to 50 couples at mass wedding; watch video

Gold mangalsutras, silver rings and...: Mukesh Ambani, Nita Ambani’s gifts to 50 couples at mass wedding; watch video![submenu-img]() Watch: Mukesh Ambani, Nita, Isha, Akash attend mass wedding ahead of Anant and Radhika Merchant's marriage

Watch: Mukesh Ambani, Nita, Isha, Akash attend mass wedding ahead of Anant and Radhika Merchant's marriage![submenu-img]() This is why Albert Einstein dropped out of school

This is why Albert Einstein dropped out of school![submenu-img]() Watch: Rahul Dravid’s emotional farewell speech in dressing room, thanks Rohit Sharma for November…

Watch: Rahul Dravid’s emotional farewell speech in dressing room, thanks Rohit Sharma for November…

)

)

)

)

)

)

)