Once leading a thriving conglomerate, Anil Ambani saw his fortunes wane as his businesses accrued massive debts, ultimately leading him to declare bankruptcy.

Mukesh Ambani has been India’s richest man for several years, with a net worth exceeding USD 110 billion (Rs 9.1 lakh crore). However, there was a time when his younger brother, Anil Ambani, who inherited half of the Reliance fortune, was wealthier than Mukesh.

Once leading a thriving conglomerate, Anil Ambani saw his fortunes wane as his businesses accrued massive debts, ultimately leading him to declare bankruptcy.

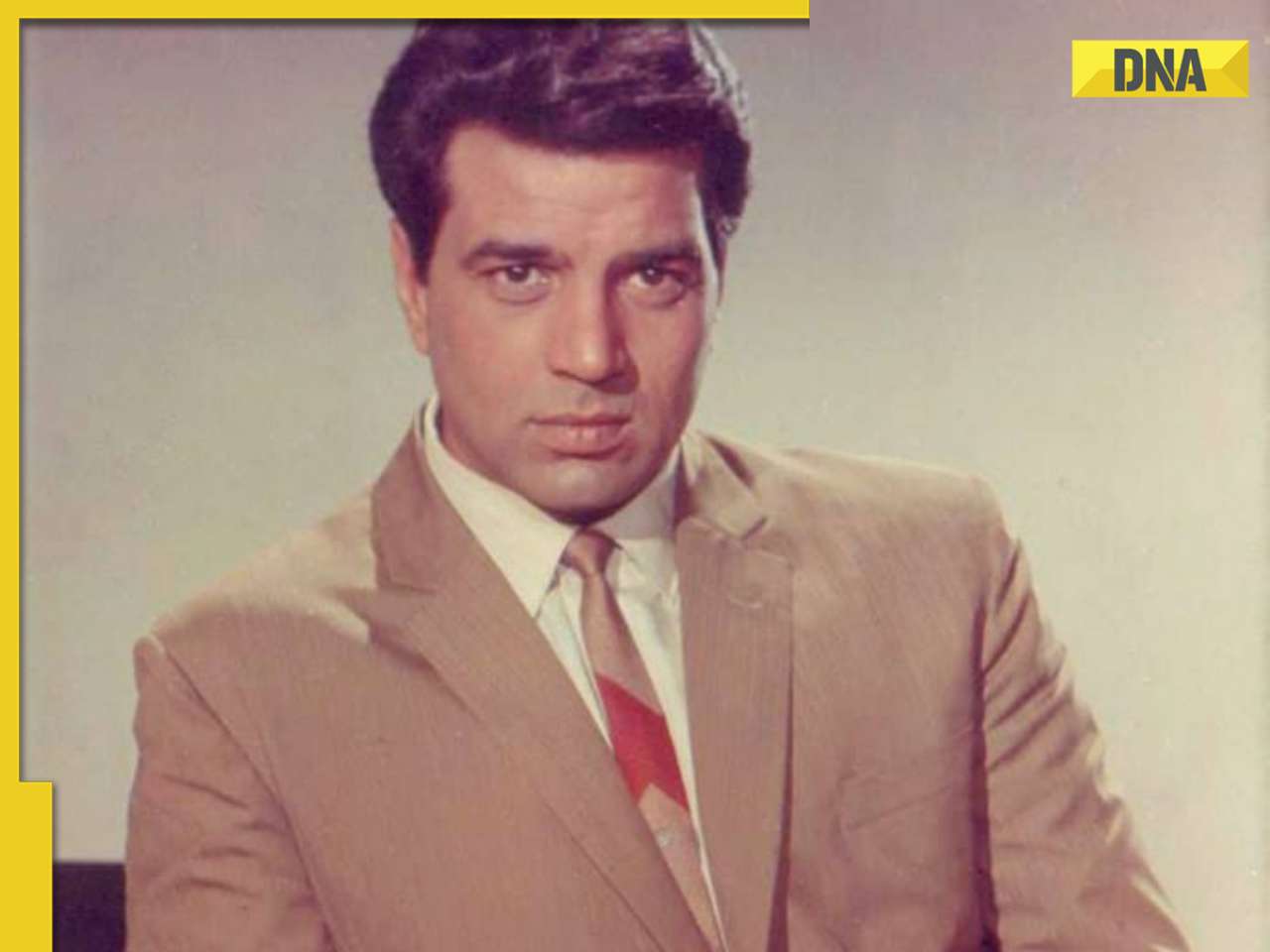

The sudden passing of Reliance patriarch Dhirubhai Ambani created a rift between Mukesh and Anil, culminating in a significant financial dispute. The USD 15 billion Reliance empire was divided between the two brothers, which initially spurred Anil’s rapid financial ascent.

By 2008, six years after their father's death, Anil Ambani had risen to become the sixth richest person globally, boasting a net worth of USD 42 billion. This surge was driven by the listing of Reliance Power, which made history as the largest initial public offering in India at that time.

However, Anil's meteoric rise was followed by a series of controversies and poor investment choices, leading to his downfall. One notable misstep was a USD 2 billion investment in a deal with South African company MTN, which collapsed and plunged Reliance Communications into debt.

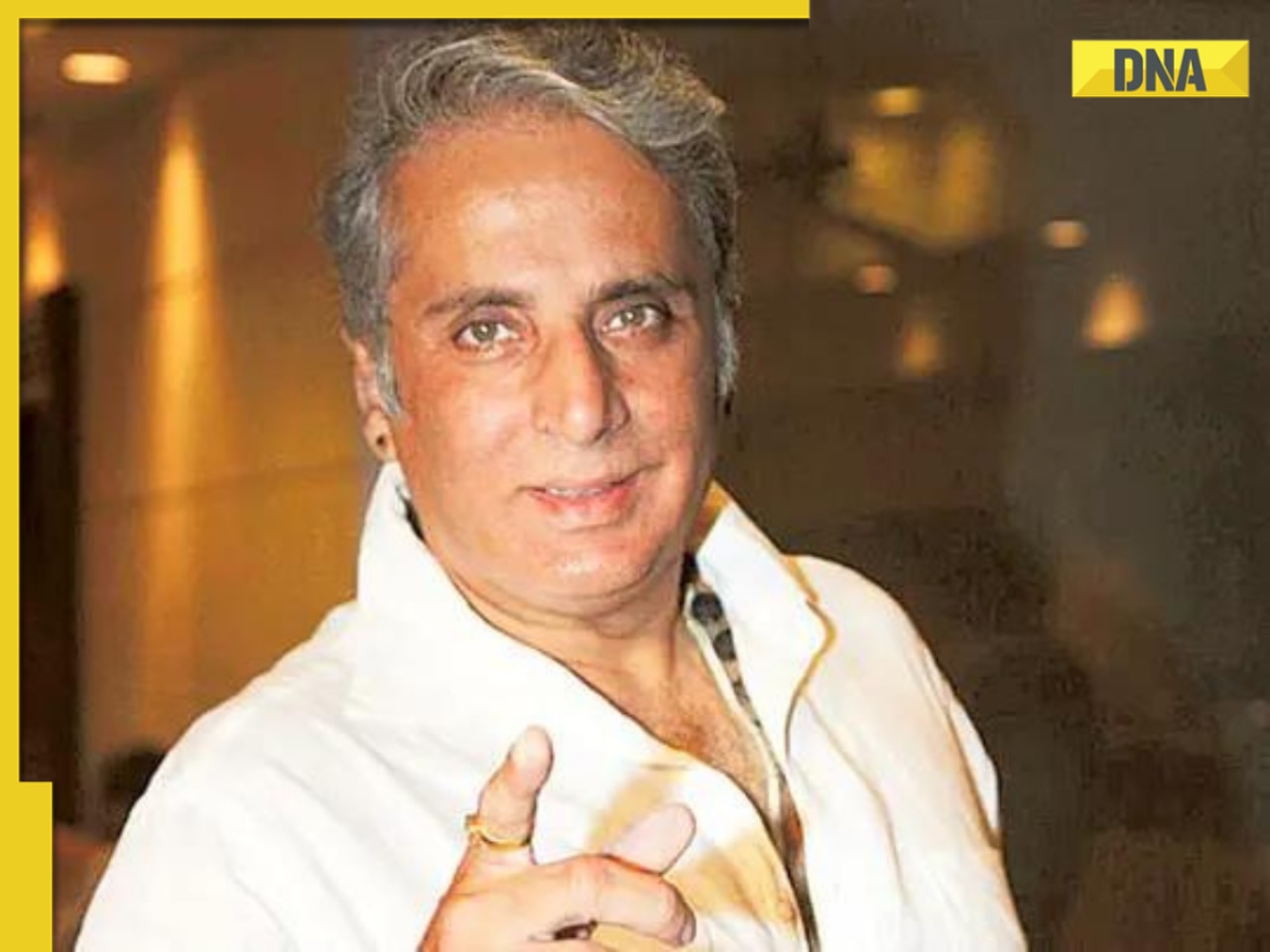

Further complicating matters were financial scandals, substantial loans from Chinese banks, and the competitive entry of Mukesh Ambani’s Jio, which devastated Anil’s telecom business. Over a decade, Anil's net worth plummeted from USD 42 billion to just USD 1.7 billion, while his companies amassed a consolidated debt of over Rs 40,000 crore. In 2020, Anil declared bankruptcy and disclosed that he had to sell his family’s jewellery to pay legal fees.

Amid these challenges, Anil Ambani’s sons, Jai Anmol Ambani and Anshul Ambani, are making significant efforts to revive their father's business empire. With Reliance Capital gaining operational success and Reliance Infrastructure lightening its debt load, Anil is devising a plan with his sons to ensure the company’s recovery. Their primary objectives are to reduce debt and stimulate business growth.

Jai Anmol has independently built a business valued at 2,Rs 000 crore through persistent effort. He and his brother Anshul are actively involved in revitalizing the business through their venture, LimeLight. Their strategy encompasses debt reduction, increased investments, and business expansion.

Under Anil’s guidance, Reliance Power aims to become debt-free by the end of FY25. Progress is underway, with substantial debt restructuring agreements recently made with ICICI, DBS Bank, and Axis Bank. Additionally, Reliance Power secured a ₹132 crore deal with JSW Renewables to sell a 45-megawatt wind power project in Maharashtra, enhancing investor confidence.

The company plans to raise $350 million (Rs 3,000 crore) through Foreign Currency Convertible Bonds (FCCBs) to further reduce debt and launch new ventures. Reliance Infrastructure will establish four new companies focusing on manufacturing deals related to fuel transportation and vehicle equipment, aiming to capitalize on sectors with increasing demand.

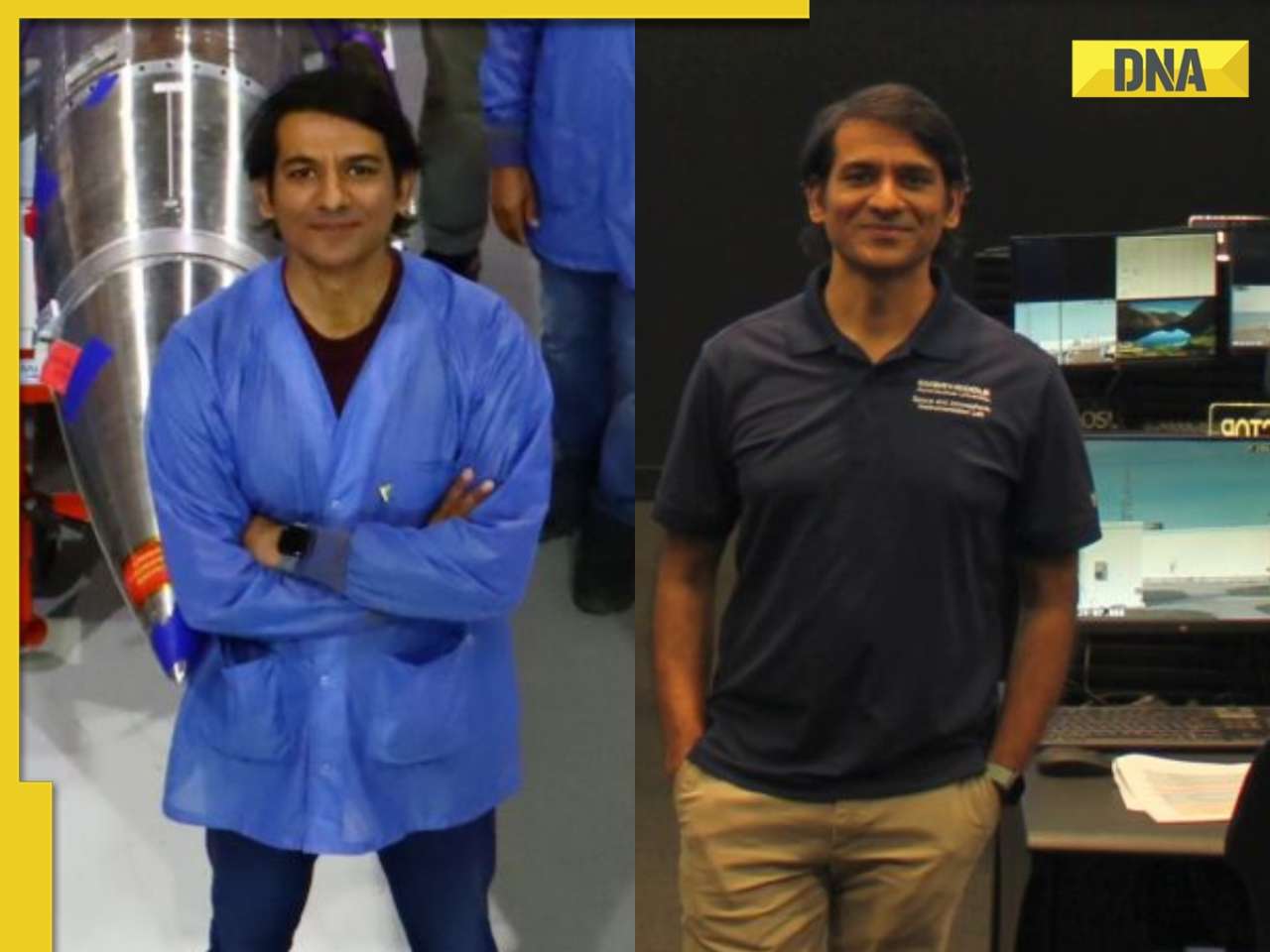

![submenu-img]() Meet Indian genius, who began career as assistant, later led key NASA mission, works as...

Meet Indian genius, who began career as assistant, later led key NASA mission, works as...![submenu-img]() Bigg Boss OTT 3: Poulomi Das gets evicted from show, Lovekesh Kataria chooses her and saves...

Bigg Boss OTT 3: Poulomi Das gets evicted from show, Lovekesh Kataria chooses her and saves...![submenu-img]() Meet actor who saved 128 Nepalese women from sex trafficking in Mumbai, sent them home safely, kept it secret because...

Meet actor who saved 128 Nepalese women from sex trafficking in Mumbai, sent them home safely, kept it secret because...![submenu-img]() Isha Ambani wears lavish mustard kurta set during Ambani family's mass wedding event, it is worth...

Isha Ambani wears lavish mustard kurta set during Ambani family's mass wedding event, it is worth...![submenu-img]() Chasing Dreams: Lohith Tamanana's Path from IT to Entrepreneur, Providing His Parents a Life of Luxury

Chasing Dreams: Lohith Tamanana's Path from IT to Entrepreneur, Providing His Parents a Life of Luxury![submenu-img]() Meet Indian genius, who began career as assistant, later led key NASA mission, works as...

Meet Indian genius, who began career as assistant, later led key NASA mission, works as...![submenu-img]() Meet doctor, daughter of bus conductor who cracked UPSC in 1st attempt while doing job, became IAS officer with AIR...

Meet doctor, daughter of bus conductor who cracked UPSC in 1st attempt while doing job, became IAS officer with AIR...![submenu-img]() Meet Indian genius, ignored by Nobel Prize committee for his work, served as govt officer, he is called 'Father of...'

Meet Indian genius, ignored by Nobel Prize committee for his work, served as govt officer, he is called 'Father of...'![submenu-img]() Meet woman who cleared UPSC exam at 21, bagged AIR 13 but didn't become IAS due to...

Meet woman who cleared UPSC exam at 21, bagged AIR 13 but didn't become IAS due to...![submenu-img]() Meet daughter of vegetable vendor whose mother mortgaged gold for her studies, failed to crack UPSC exam 4 times then...

Meet daughter of vegetable vendor whose mother mortgaged gold for her studies, failed to crack UPSC exam 4 times then...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Meet Mickey Dhamejani, Jr Hrithik Roshan from Krrish, former child actor who quit films, is now...

Meet Mickey Dhamejani, Jr Hrithik Roshan from Krrish, former child actor who quit films, is now...![submenu-img]() In pics: India beat South Africa by 7 runs to lift second T20 World Cup title

In pics: India beat South Africa by 7 runs to lift second T20 World Cup title![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

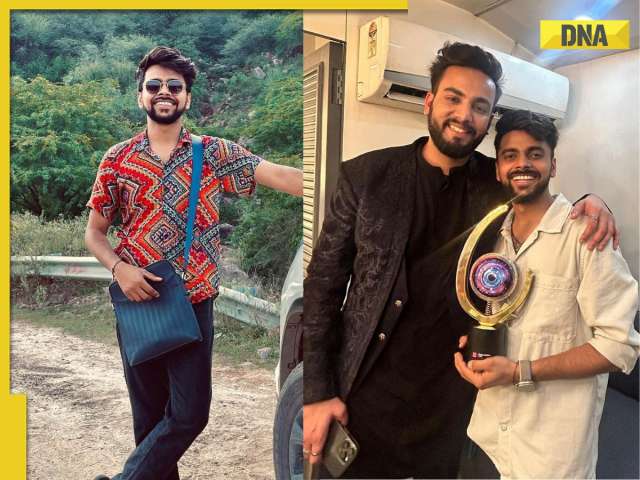

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Bigg Boss OTT 3: Poulomi Das gets evicted from show, Lovekesh Kataria chooses her and saves...

Bigg Boss OTT 3: Poulomi Das gets evicted from show, Lovekesh Kataria chooses her and saves...![submenu-img]() Meet actor who saved 128 Nepalese women from sex trafficking in Mumbai, sent them home safely, kept it secret because...

Meet actor who saved 128 Nepalese women from sex trafficking in Mumbai, sent them home safely, kept it secret because...![submenu-img]() Producer Ramesh Taurani comments on problematic star's fees, entourage cost: Shah Rukh, Salman, Aamir do...'

Producer Ramesh Taurani comments on problematic star's fees, entourage cost: Shah Rukh, Salman, Aamir do...'![submenu-img]() CISF personnel who slapped Kangana Ranaut reinstated and transferred to Bengaluru? Here's what we know

CISF personnel who slapped Kangana Ranaut reinstated and transferred to Bengaluru? Here's what we know![submenu-img]() This Kapil Sharma film was box office disaster, couldn't even earn Rs 5 lakh, still holds Guinness World Record for...

This Kapil Sharma film was box office disaster, couldn't even earn Rs 5 lakh, still holds Guinness World Record for...![submenu-img]() Isha Ambani wears lavish mustard kurta set during Ambani family's mass wedding event, it is worth...

Isha Ambani wears lavish mustard kurta set during Ambani family's mass wedding event, it is worth...![submenu-img]() Anant-Radhika's mameru ceremony: Mukesh Ambani, Isha, Akash seen enjoying with kids at Antilia, watch viral video

Anant-Radhika's mameru ceremony: Mukesh Ambani, Isha, Akash seen enjoying with kids at Antilia, watch viral video![submenu-img]() This is the richest Muslim country in world, it is not Saudi Arabia or UAE

This is the richest Muslim country in world, it is not Saudi Arabia or UAE![submenu-img]() Viral video: Woman eats 'golgappas' filled with live eel, internet is unhappy

Viral video: Woman eats 'golgappas' filled with live eel, internet is unhappy![submenu-img]() Viral video: Man faces backlash for tattoo of 'Vada Pav Girl', watch

Viral video: Man faces backlash for tattoo of 'Vada Pav Girl', watch

)

)

)

)

)

)

)