US Fed Governor Christopher Waller recently said: “If these sanctions and policies are long-lasting, the shifting cross-border payments landscape, including the rapid growth of digital currencies, could also pose challenges to the dominant role of the US dollar”.

There has been an increasing trend towards ‘de-dollarisation’ or trade in non-dollar currencies between several countries in recent years. This has been attributed primarily to what has been dubbed by leaders of several countries as well as many analysts as the ‘weaponisation’ of the dollar – or imposition of strict sanctions on countries. The most recent instances being a series of stringent sanctions imposed on Iran and on Russia (in the aftermath of the Russia-Ukraine war).

There is no doubt, that China is keen to capitalise on the changing global economic and geopolitical situation and wants to create an alternative financial system, where the dominance of the US Dollar is reduced (well over half of global reserves are held in the US dollar). Significantly, March 2023 witnessed the cross-border payments made in RMB (48%) surpassing those made in USD (46.7%).

It is not just countries like China, Iran and Russia -- part of an anti-US axis -- which have been promoting de-dollarization, but even countries which share robust ties with the US which have been pushing for lesser dependence on the US dollar – two prominent examples of the same being India and UAE. These countries have been using non-dollar currencies for purchase of commodities. An estimated 1/5th of global trade in oil was carried out in non-dollar currencies in 2023.

Well over 90% of bilateral trade between Russia and China was carried out in either the Yuan or the ruble, while Russia and Iran also signed an agreement to carry out Non-Dollar trade in December 2023. India also purchased oil from UAE in Indian Rupees in December 2023 (an agreement had been signed for trade in local currencies between both countries in July 2023).

The US has acknowledged the possible impact of de-dollarization on the US Dollar. US Fed Governor Christopher Waller recently said: "If these sanctions and policies are long-lasting, the shifting cross-border payments landscape, including the rapid growth of digital currencies, could also pose challenges to the dominant role of the US dollar".

Waller in the past has emphatically stated that the US dollar is unlikely to lose its status of being the world’s reserve currency or its important in trade and finance. According to certain reports, advisors of Republican Presidential Candidate and former US President, Donald Trump have been exploring punitive measures against countries which are seeking to move away from the US Dollar.

It is not only the US, but even other countries which may be using de-dollarization -- for trade in commodities – which do realize that it is premature to write off the US dollar. One prominent example is India.

In this context a former Governor of India’s Reserve Bank of India (RBI), D Subba Rao -- while speaking at an event in Mumbai recently -- remarked: "America enjoys an "exorbitant privilege" because dollar is world's reserve currency"( former French Finance Minister Valery Giscard d'Estaing in the 1960s coined the term exorbitant privilege). The former RBI governor also underscored the point that several countries were looking beyond the US Dollar due to the US tendency to weaponise the same.

It would be pertinent to point out, that Beijing while pitching hard for an alternative financial order would not be in favour of the dollar collapsing given that a large chunk of Beijing’s foreign reserves – estimated at $3 trillion – are invested in US bonds.

Another point which is forgotten is that while some members of the BRICS+ grouping have been pitching for a BRICS currency, one of the members of the grouping India has been cautious regarding this proposal. New Delhi’s strained ties with Beijing apart from other reasons are one of the main reasons for the opposition to the same (India has sought views from several think tanks on this proposal).

In conclusion, while there is no doubt that US sanctions have resulted in many countries moving away from the US Dollar it is important to bear in mind that the US dollar has significant advantages which have been discussed earlier and while de-dollarization may have gained momentum, the domination of the US Dollar is here to stay. It is not just economic factors, but geopolitical dynamics which will ensure the same.

The author is a policy analyst and faculty member at the Jindal School of International Affairs, OP Jindal Global University, Sonipat.

(Disclaimer: The views expressed above are the author's own and do not reflect those of DNA)

![submenu-img]() Maa Kali teaser: Raima Sen, Abhishek Singh film narrates 'horrifying' Direct Action Day during British Raj Bengal

Maa Kali teaser: Raima Sen, Abhishek Singh film narrates 'horrifying' Direct Action Day during British Raj Bengal ![submenu-img]() Watch: Rohit Sharma, Virat Kohli lift T20 World Cup trophy together during Team India's victory parade in Mumbai

Watch: Rohit Sharma, Virat Kohli lift T20 World Cup trophy together during Team India's victory parade in Mumbai![submenu-img]() Meet Indian genius, who worked on NASA's Rs 73700 crore project, married to a scientist, she is...

Meet Indian genius, who worked on NASA's Rs 73700 crore project, married to a scientist, she is...![submenu-img]() Watch: Fan climbs tree to watch Team India's victory parade up close, video goes viral

Watch: Fan climbs tree to watch Team India's victory parade up close, video goes viral![submenu-img]() Hathras stampede: Congress MP Rahul Gandhi to meet victims of incident tomorrow

Hathras stampede: Congress MP Rahul Gandhi to meet victims of incident tomorrow![submenu-img]() Meet Indian genius, who worked on NASA's Rs 73700 crore project, married to a scientist, she is...

Meet Indian genius, who worked on NASA's Rs 73700 crore project, married to a scientist, she is...![submenu-img]() Meet woman, civil servant for 30 years, now becomes first female chief secretary of...

Meet woman, civil servant for 30 years, now becomes first female chief secretary of...![submenu-img]() Meet Indian genius, a celebrated physicist, who was denied Nobel Prize in 2005, converted to Hinduism because..

Meet Indian genius, a celebrated physicist, who was denied Nobel Prize in 2005, converted to Hinduism because..![submenu-img]() Meet Indian genius who passed classes 8-12 in 9 months, became one of India's youngest engineer at 15, joined IIT for...

Meet Indian genius who passed classes 8-12 in 9 months, became one of India's youngest engineer at 15, joined IIT for...![submenu-img]() Meet Indian genius, who began career as assistant, later led key NASA mission, works as...

Meet Indian genius, who began career as assistant, later led key NASA mission, works as...![submenu-img]() Godman Bhole Baba's Lawyers Deny ‘Charan Raj�’ Claim, Says Anti-Social Elements Behind Stampede

Godman Bhole Baba's Lawyers Deny ‘Charan Raj�’ Claim, Says Anti-Social Elements Behind Stampede![submenu-img]() Meet Rishi Shah, The Indian-American Sentenced To 7.5 Years In Prison For $1 Billion Fraud Scheme

Meet Rishi Shah, The Indian-American Sentenced To 7.5 Years In Prison For $1 Billion Fraud Scheme![submenu-img]() Severe Turbulence On Spanish Flight Injures 30, Video Of Man Thrown Into Overhead Bin Goes Viral

Severe Turbulence On Spanish Flight Injures 30, Video Of Man Thrown Into Overhead Bin Goes Viral![submenu-img]() Haryana: Goods Train To Amritsar Derailed In Karnal, Containers Fall Off, Rail Traffic Disrupted

Haryana: Goods Train To Amritsar Derailed In Karnal, Containers Fall Off, Rail Traffic Disrupted![submenu-img]() 'Played With Religious Sentiments': Chirag Paswan Slams Rahul Gandhi Over His Remarks In Parliament

'Played With Religious Sentiments': Chirag Paswan Slams Rahul Gandhi Over His Remarks In Parliament![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() 5 warm moments Ranveer Singh shared with fans that show why he is their favourite

5 warm moments Ranveer Singh shared with fans that show why he is their favourite![submenu-img]() In pics: Richa Chadha cheers for Ali Fazal, Isha Talwar, Vijay Varma, Shweta Tripathi pose at Mirzapur 3 screening

In pics: Richa Chadha cheers for Ali Fazal, Isha Talwar, Vijay Varma, Shweta Tripathi pose at Mirzapur 3 screening![submenu-img]() Meet Mickey Dhamejani, Jr Hrithik Roshan from Krrish, former child actor who quit films, is now...

Meet Mickey Dhamejani, Jr Hrithik Roshan from Krrish, former child actor who quit films, is now...![submenu-img]() In pics: India beat South Africa by 7 runs to lift second T20 World Cup title

In pics: India beat South Africa by 7 runs to lift second T20 World Cup title![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Hathras stampede: Congress MP Rahul Gandhi to meet victims of incident tomorrow

Hathras stampede: Congress MP Rahul Gandhi to meet victims of incident tomorrow![submenu-img]() Hathras stampede: Six sevadars including two women arrested by UP police, key accused still on run

Hathras stampede: Six sevadars including two women arrested by UP police, key accused still on run![submenu-img]() CST Advanced Systems revolutionizes tactical Operations

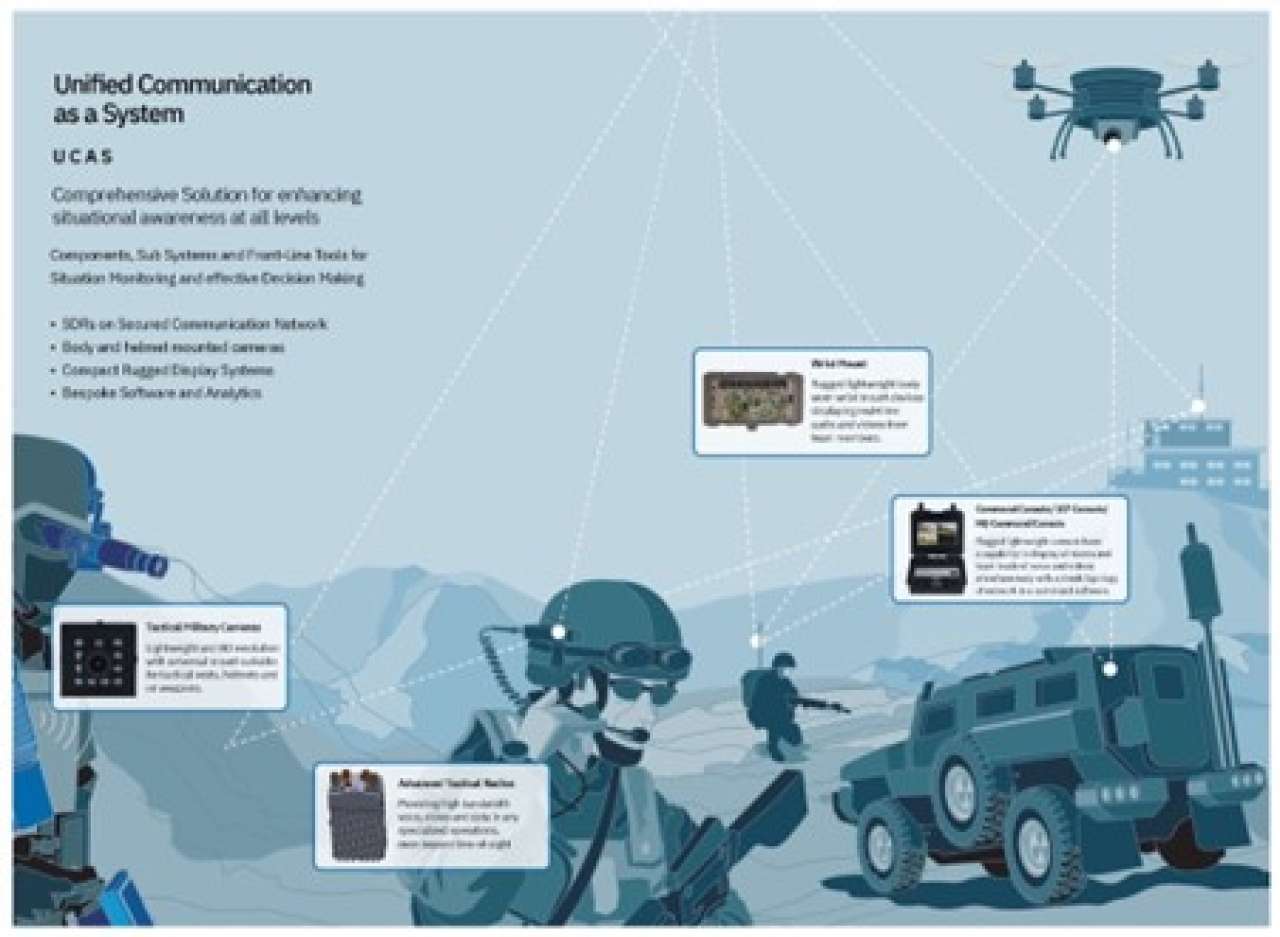

CST Advanced Systems revolutionizes tactical Operations![submenu-img]() 'We would all be...: ISRO chief issues eerie warning for humans and it's related to..

'We would all be...: ISRO chief issues eerie warning for humans and it's related to..![submenu-img]() This Pakistani leader was LK Advani's good friend, they both used to share letters in...

This Pakistani leader was LK Advani's good friend, they both used to share letters in...![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Maa Kali teaser: Raima Sen, Abhishek Singh film narrates 'horrifying' Direct Action Day during British Raj Bengal

Maa Kali teaser: Raima Sen, Abhishek Singh film narrates 'horrifying' Direct Action Day during British Raj Bengal ![submenu-img]() Kalki 2898 AD director Nag Ashwin reacts to audience reaction, reveals major details about Part Two: 'We shot about...'

Kalki 2898 AD director Nag Ashwin reacts to audience reaction, reveals major details about Part Two: 'We shot about...'![submenu-img]() This TV star to join Bigg Boss OTT 3 as wild card entry; it's not Shehzada Dhami, Bristi Samaddar, Rakhi Sawant

This TV star to join Bigg Boss OTT 3 as wild card entry; it's not Shehzada Dhami, Bristi Samaddar, Rakhi Sawant![submenu-img]() Auron Mein Kahan Dum Tha getting postponed is 'tough but good decision', exhibitors say 'we all know Munjya, Kalki...'

Auron Mein Kahan Dum Tha getting postponed is 'tough but good decision', exhibitors say 'we all know Munjya, Kalki...'![submenu-img]() Tahira Kashyap says husband Ayushmann Khurrana 'was not happy' with her books: 'He considers it blasphemous' | Exclusive

Tahira Kashyap says husband Ayushmann Khurrana 'was not happy' with her books: 'He considers it blasphemous' | Exclusive![submenu-img]() Mukesh Ambani's bahu Radhika Merchant dazzles in Durga shloka-inscribed lehenga for her 'mameru' ceremony, pics go viral

Mukesh Ambani's bahu Radhika Merchant dazzles in Durga shloka-inscribed lehenga for her 'mameru' ceremony, pics go viral![submenu-img]() Virat Kohli meets brother Vikas, family at Delhi hotel after returning from Barbados, see pics

Virat Kohli meets brother Vikas, family at Delhi hotel after returning from Barbados, see pics![submenu-img]() Viral video: AIIMS doctor grooves to ‘Tip Tip Barsa Paani’, sets internet on fire; watch

Viral video: AIIMS doctor grooves to ‘Tip Tip Barsa Paani’, sets internet on fire; watch![submenu-img]() Inside details of functions organised by Mukesh Ambani, Nita Ambani for Anant Ambani, Radhika Merchant's grand wedding

Inside details of functions organised by Mukesh Ambani, Nita Ambani for Anant Ambani, Radhika Merchant's grand wedding![submenu-img]() Mukesh Ambani, Nita Ambani's daughter Isha Ambani owns diamonds worth crores but her most prized jewellery is..

Mukesh Ambani, Nita Ambani's daughter Isha Ambani owns diamonds worth crores but her most prized jewellery is..

)

)

)

)

)

)

)