Stock markets are bracing this week for ripples coming from Uttar Pradesh with several marketmen raising concerns over the Centre's future reform policies in view of anointment of hardliner Yogi Adityanath as the Chief Minister of the country's most populous state.

Stock markets are bracing this week for ripples coming from Uttar Pradesh with several marketmen raising concerns over the Centre's future reform policies in view of anointment of hardliner Yogi Adityanath as the Chief Minister of the country's most populous state.

Marketmen are particularly concerned about any large-scale selling by the foreign investors who tend to react promptly to any such development.

Any rough sailing ahead for the markets would follow a sharp surge in the recent weeks, including due to a huge mandate given to the BJP in some states, including in UP, which many experts have attributed to the party's development plank despite its well known pro-Hindutva agenda.

The benchmark indices including Sensex and Nifty have been flirting with record high levels with huge gains in stocks across the sectors, while some experts warned that the surprise selection of Yogi Adityanath as the UP Chief Minister might trigger profit booking including by large foreign investors.

The Nifty had ended at a new peak of 9,160 on last Friday while the Sensex also notched up significant gains to close at 29,648.99.

However, Some analysts are hopeful that macroeconomic factors such as further movement on the GST rollout decision would eventually decide the course for the stock market, after a temporary hit from the development in UP.

Abnish Kumar Sudhanshu, Director and Research Head at Amrapali Aadya Trading & Investments, said last week began with the landslide victory for BJP in UP assembly elections and it fuelled a rally in the markets on expectation of several stalled projects and reforms getting their way for clearance.

The markets even ignored the interest rate hike by the US Federal Reserve and a rally in rupee further fuelled the indices.

"Sweeping victory in country's largest state Uttar Pradesh provided strength to rupee on the back of stable government along with hope of more and more bold reforms coming in future without any disturbance in Parliament," he said.

Further, FIIs who had turned to net sellers in the domestic debt as well as equity market post demonetization, have been taking return flight after seeing the current India scenario, Sudhanshu said.

On the current week trading, he said that further clearance to the GST rollout could give some clue to the market. "We can expect news related to reforms in infrastructure, healthcare and banking to keep proving road to the already surging indices.

"Off late, FIIs have become net buyer in the market so it would be interesting to watch sustainable buying pattern, which can pour the liquidity in the market, hence generating positive sentiments," he said.

Vinod Nair, Head of Research at Geojit Financial Services, said a stupendous victory for the BJP in the state elections created a euphoria in the domestic markets last week and Nifty broke its major resistance level of 9000 and continued its upward journey breaking all the psychological levels.

Stating that the under-current was strong as new money from both foreign and domestic investors continued to pour in despite high valuations, he said the current buoyancy in domestic market was largely sentimental driven by political and policy certainty.

"This perhaps has led to reversal in FII inflows despite peak valuation. Valuation may continue to be high unless being impacted by external or domestic factors," he said.

He also warned that the inflationary trend was hinting towards RBI following a prolonged neutral stance in the medium term and GST rollout from July brings possibilities of de-stocking and procedural obstacle which is likely to impact earnings in the near term.

"For the week ahead, market will look for more cues on GST rates which is expected to see stock or sector specific actions," he added.

![submenu-img]() Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case

Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case![submenu-img]() India lift the ICC Trophy after 11 years; wishes from Amitabh Bachchan, Rachana & Rhythm, Indra Nooyi flow in!

India lift the ICC Trophy after 11 years; wishes from Amitabh Bachchan, Rachana & Rhythm, Indra Nooyi flow in!![submenu-img]() 'He is entitled to...': US Supreme Court says Donald Trump partially immune from prosecution for...

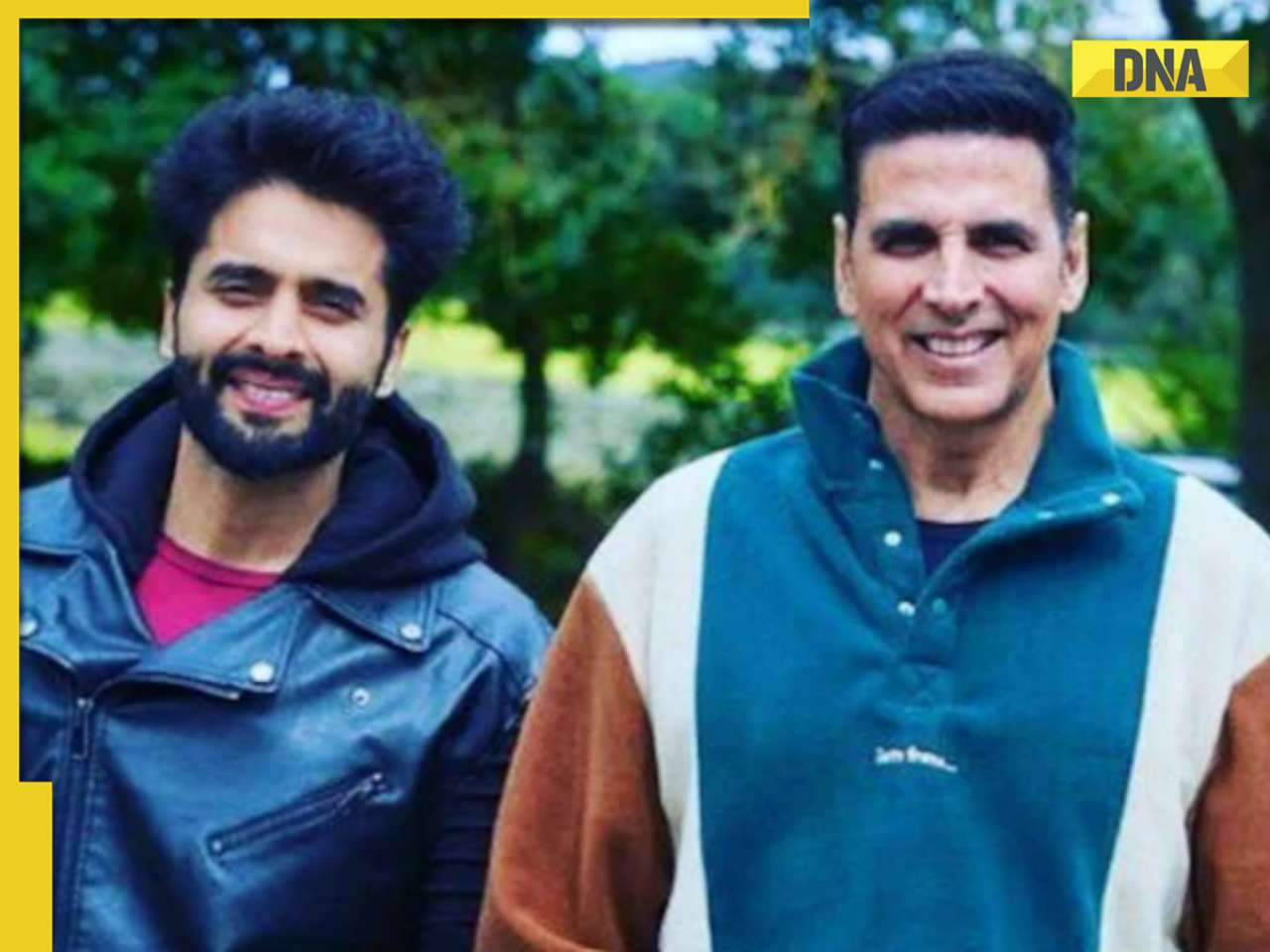

'He is entitled to...': US Supreme Court says Donald Trump partially immune from prosecution for...![submenu-img]() Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...

Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...![submenu-img]() 'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive

'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive![submenu-img]() UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here

UPSC Prelims Result 2024 declared at upsc.gov.in; get direct link here![submenu-img]() Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...

Meet woman who studied six hours daily, cracked UPSC exam at 23 to become IAS officer, currently posted at...![submenu-img]() Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...

Meet man, hired for record-breaking package, not from IIT, IIM, his salary is...![submenu-img]() Meet Kathak dancer who topped UPSC exam in 1st attempt, worked at RBI in day and studied at night, she is...

Meet Kathak dancer who topped UPSC exam in 1st attempt, worked at RBI in day and studied at night, she is...![submenu-img]() Meet woman who cleared UPSC exam at 23 in her first attempt, got AIR 94, but didn't become IAS officer due to...

Meet woman who cleared UPSC exam at 23 in her first attempt, got AIR 94, but didn't become IAS officer due to...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() In pics: India beat South Africa by 7 runs to lift second T20 World Cup title

In pics: India beat South Africa by 7 runs to lift second T20 World Cup title![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case

Darshan breaks down after his mother, brother meet him in jail for the first time since his arrest in murder case![submenu-img]() Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...

Jackky Bhagnani reveals Akshay Kumar has put his fee for Bade Miyan Chote Miyan on hold until...![submenu-img]() 'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive

'Auto drivers would take me to...': Industry actor Samarth Shandilya recalls initial challenges in Mumbai | Exclusive![submenu-img]() The Buckingham Murders: Kareena Kapoor is held forcibly by cops in first look poster, fans say 'National Award loading'

The Buckingham Murders: Kareena Kapoor is held forcibly by cops in first look poster, fans say 'National Award loading'![submenu-img]() Dharmendra bought this film's script for Rs 17500, his sister forced him to not work in it, movie changed life of...

Dharmendra bought this film's script for Rs 17500, his sister forced him to not work in it, movie changed life of...![submenu-img]() Watch viral video: AI chatbot caught lying, tells users that it is...

Watch viral video: AI chatbot caught lying, tells users that it is...![submenu-img]() Virat Kohli fails to make it in ICC ‘Team of the Tournament', six Indians in the list including…

Virat Kohli fails to make it in ICC ‘Team of the Tournament', six Indians in the list including…![submenu-img]() Meet woman who lives in India's largest house, larger than Mukesh Ambani, Nita Ambani's Rs 15000 cr Antilia, she is...

Meet woman who lives in India's largest house, larger than Mukesh Ambani, Nita Ambani's Rs 15000 cr Antilia, she is...![submenu-img]() North Korea publicly executes 22-year-old man for listening to...

North Korea publicly executes 22-year-old man for listening to...![submenu-img]() Viral video: Little girl’s adorable dance to ‘Soulmate’ wins internet, watch

Viral video: Little girl’s adorable dance to ‘Soulmate’ wins internet, watch

)

)

)

)

)

)

)