To improve the standards of online payments, RBI's new rule for credit cards and debit cards came into effect from October 1.

The Reserve Bank of India's (RBI) card-on-file (CoF) tokenization regulations went into effect on Saturday (October 1) with the intention of enhancing the security and safety of card transactions. Now, merchants, payment aggregators, and payment gateways won't be able to keep critical customer credit and debit card details including the three-digit CVV and expiration date for any purchases made online or through mobile apps. The RBI made the decision not to continue extending these deadlines for implementing these rules.

What is tokenisation?

Tokenization is the process of replacing actual card data with a unique alternate code called the "token." The token must be different for the card, token requester (the company that accepts client requests for card tokenization and forwards them to the card network to issue a relating token), and device.

READ | Skoda Auto Volkswagen starts to export made in India Kushaq SUV after Taigun, Virtus

How will tokenisation work?

By starting a request on the app that the token requester provides, the owner of a debit or credit card can have their card tokenized. The token requester will send the request to the card network, which will provide a token matching the combination of the card, the token requester, and the device with the approval of the card issuer. The customer won't pay anything to use the tokenization service.

Before, only interested cardholders' mobile phones and tablets had access to the facility for card tokenization. The RBI then made the decision to expand the scope of tokenization to encompass consumer devices like as laptops, desktops, wearables (wrist watches, etc.), and Internet of Things (IoT) devices as a result of an increase in tokenization activity.

READ | Bank of Baroda WhatsApp banking: Services and how to register, step-by-step guide

How to tokenise your debit card?

1. Visit any online store or vendor application to make a purchase and begin the payment process.

2. When checking out, enter your debit or credit card information. Alternately, pick a debit or credit card from the pre-selected list from the bank of your choice, then finish the rest of the form.

3. Select either "Save card as per RBI standards" or "Secure your card."

4. To confirm the purchase, enter the OTP that your bank gave to your email or mobile device.

READ | Home loan: Planning to apply for home loan? Know the procedure, documents required

5. The store receives the produced token and saves it along with the client identifying information (such as email address or mobile number).

6. When a customer visits the same e-commerce or dealer website, the last four digits of the saved card are shown, making it simpler for them to recognise it throughout the transaction. This demonstrates how a customer's debit card has been tokenized.

7. A special token is generated for each merchant website that has to hold debit card data.

![submenu-img]() NEET-UG row: INDIA bloc to raise exam paper leak issue in Parliament tomorrow

NEET-UG row: INDIA bloc to raise exam paper leak issue in Parliament tomorrow![submenu-img]() 'You are exploiting...': Gulshan Devaiah criticises Vivek Agnihotri for publicising trauma to sell his The Kashmir Files

'You are exploiting...': Gulshan Devaiah criticises Vivek Agnihotri for publicising trauma to sell his The Kashmir Files![submenu-img]() T20 World Cup, IND vs ENG: Who will qualify for final if rain plays spoilsport in Guyana? Know DLS rules, cut-off time

T20 World Cup, IND vs ENG: Who will qualify for final if rain plays spoilsport in Guyana? Know DLS rules, cut-off time![submenu-img]() Best Options Trading Courses in India

Best Options Trading Courses in India![submenu-img]() Restolane Launches Its Online Store for Restaurant Equipment

Restolane Launches Its Online Store for Restaurant Equipment![submenu-img]() The Meaning of Distance Learning Courses

The Meaning of Distance Learning Courses![submenu-img]() Meet Indian genius who built first car factory in India, he is called 'Father of...'

Meet Indian genius who built first car factory in India, he is called 'Father of...'![submenu-img]() Meet Indian scientist developed 'artificial cancer', he is called 'Father of...

Meet Indian scientist developed 'artificial cancer', he is called 'Father of...![submenu-img]() Meet genius born in poverty, walked barefoot to school, become one of India's top scientists

Meet genius born in poverty, walked barefoot to school, become one of India's top scientists![submenu-img]() Meet IAS officer who once lived like a monk, then cracked UPSC exam with AIR 30, she is posted at…

Meet IAS officer who once lived like a monk, then cracked UPSC exam with AIR 30, she is posted at…![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive

In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() 'You are exploiting...': Gulshan Devaiah criticises Vivek Agnihotri for publicising trauma to sell his The Kashmir Files

'You are exploiting...': Gulshan Devaiah criticises Vivek Agnihotri for publicising trauma to sell his The Kashmir Files![submenu-img]() Kalki 2898 AD: SS Rajamouli says Prabhas' film took him to 'whole new world', Suriya calls it 'all-time blockbuster'

Kalki 2898 AD: SS Rajamouli says Prabhas' film took him to 'whole new world', Suriya calls it 'all-time blockbuster'![submenu-img]() Meet Salman Khan's co-star, who was left penniless by husband, sister; did B-grade films, actor became her saviour by...

Meet Salman Khan's co-star, who was left penniless by husband, sister; did B-grade films, actor became her saviour by...![submenu-img]() 'Bloodbath is about to...': Varun Dhawan looks intense in new Baby John poster, fans call him 'killer'

'Bloodbath is about to...': Varun Dhawan looks intense in new Baby John poster, fans call him 'killer' ![submenu-img]() This superhit was remake of Kamal Haasan film, was rejected by SRK, Dilip Kumar, Naseer; opened on dull note, earned...

This superhit was remake of Kamal Haasan film, was rejected by SRK, Dilip Kumar, Naseer; opened on dull note, earned...![submenu-img]() 'I need your help': Ratan Tata is looking for a blood donor for...

'I need your help': Ratan Tata is looking for a blood donor for...![submenu-img]() Viral video: Pranksters splash water on moving train, get thrashed by passengers and police seize bike

Viral video: Pranksters splash water on moving train, get thrashed by passengers and police seize bike![submenu-img]() Shocking! Woman gets harsher sentence than her rapist due to...

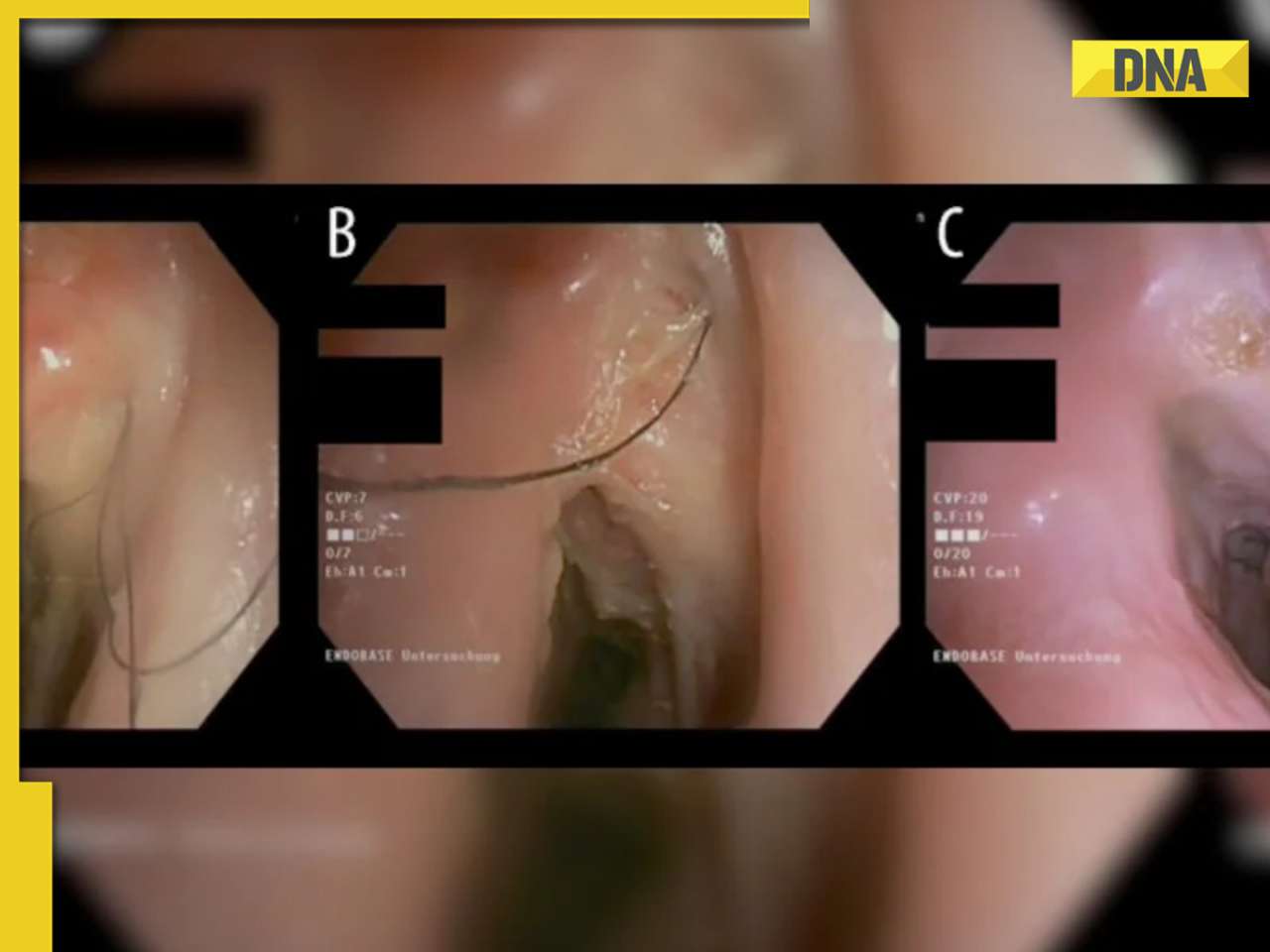

Shocking! Woman gets harsher sentence than her rapist due to...![submenu-img]() Bizzare: Man develops hair in throat due to...

Bizzare: Man develops hair in throat due to...![submenu-img]() Meet woman, daughter of millionaire, who gave up Rs 2500 crore property to marry a common man, her father is....

Meet woman, daughter of millionaire, who gave up Rs 2500 crore property to marry a common man, her father is....

)

)

)

)

)

)

)