- Home

- Latest News

![submenu-img]() Khatron Ke Khiladi 14 first promo shows Karan Veer Mehra getting electrocuted, Sumona Chakravarti performing...

Khatron Ke Khiladi 14 first promo shows Karan Veer Mehra getting electrocuted, Sumona Chakravarti performing... ![submenu-img]() After Reliance Jio and Airtel, Vodafone Idea raises mobile tariff from...

After Reliance Jio and Airtel, Vodafone Idea raises mobile tariff from...![submenu-img]() ‘Sikhaane waale ko na sikhaaye’: Inzamam-ul-Haq hits back at Rohit Sharma's reverse swing jibe

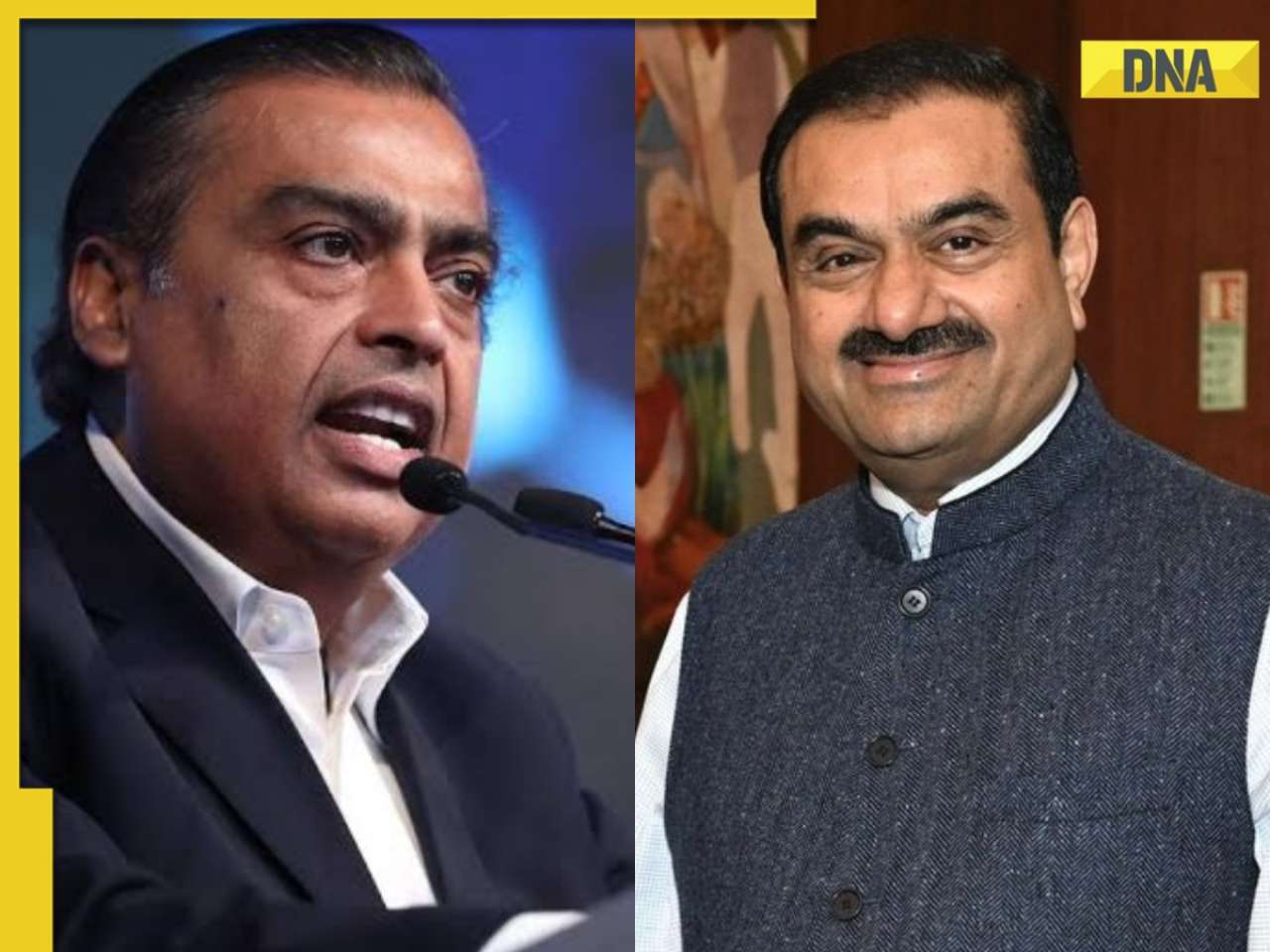

‘Sikhaane waale ko na sikhaaye’: Inzamam-ul-Haq hits back at Rohit Sharma's reverse swing jibe ![submenu-img]() India's most valuable brand at Rs 238390 crore revealed, not run by Mukesh Ambani, Adani

India's most valuable brand at Rs 238390 crore revealed, not run by Mukesh Ambani, Adani![submenu-img]() This flop film reunited 2 superstars, was loosely based on Hollywood classic, rejected by SRK, Aamir; earned only...

This flop film reunited 2 superstars, was loosely based on Hollywood classic, rejected by SRK, Aamir; earned only...

- Election 2024

- Webstory

- T20 WC

- Education

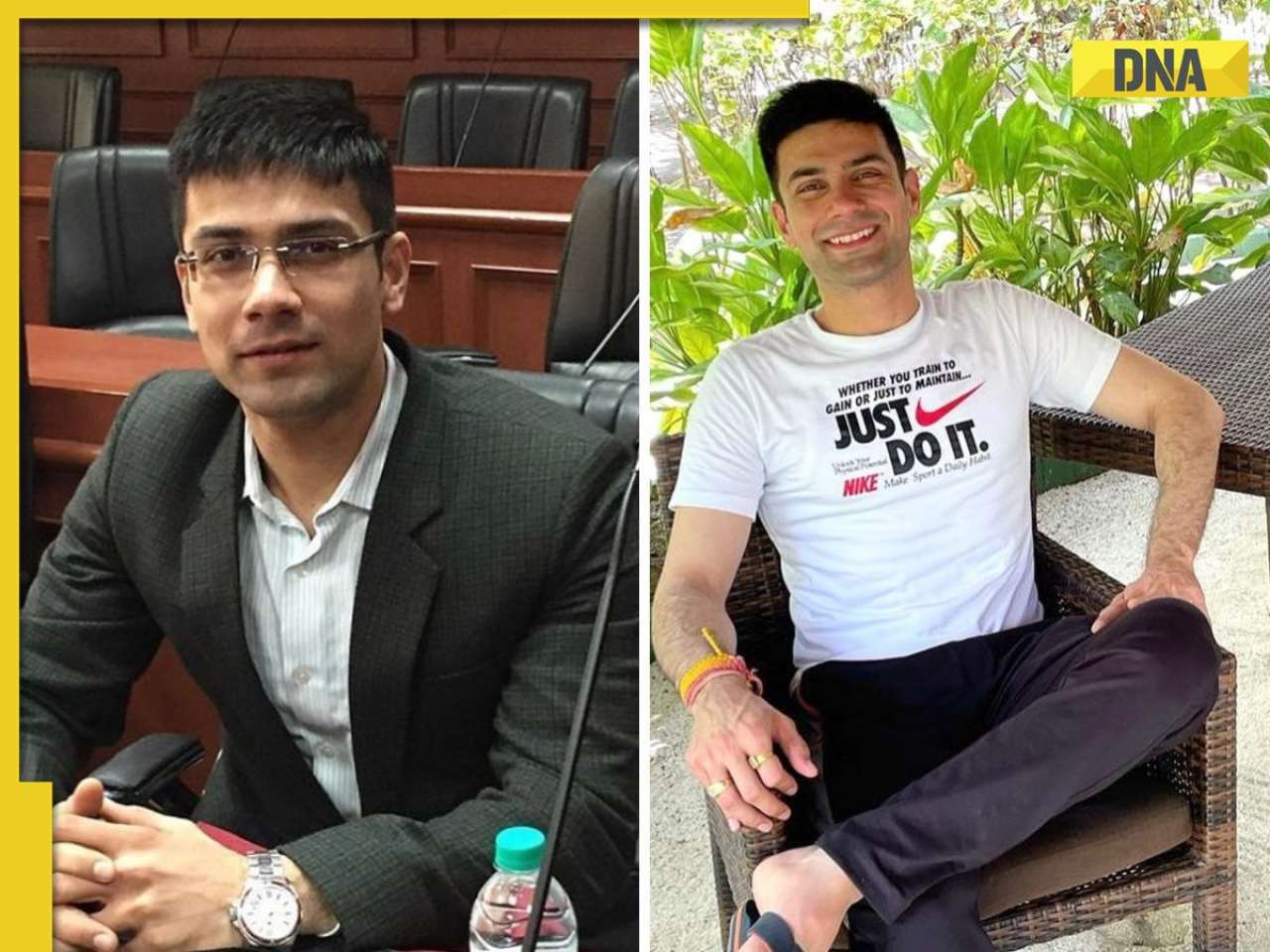

![submenu-img]() UPSC topper IAS Tina Dabi is handling two crucial responsibilities, know details here

UPSC topper IAS Tina Dabi is handling two crucial responsibilities, know details here![submenu-img]() Meet Indian, world's youngest female Chartered Accountant who secured AIR 1, her score was...

Meet Indian, world's youngest female Chartered Accountant who secured AIR 1, her score was...![submenu-img]() Meet man, who cracked UPSC exam to become IAS officer, later resigned due to...

Meet man, who cracked UPSC exam to become IAS officer, later resigned due to...![submenu-img]() The Meaning of Distance Learning Courses

The Meaning of Distance Learning Courses![submenu-img]() Meet Indian genius who built first car factory in India, he is called 'Father of...'

Meet Indian genius who built first car factory in India, he is called 'Father of...'

- DNA Verified

![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

- Her DNA

- Photos

![submenu-img]() Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'

Alia Bhatt mesmerises in gown, Ranbir Kapoor looks classy in tuxedo in latest romantic photos, fans say 'couple goals'![submenu-img]() Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception

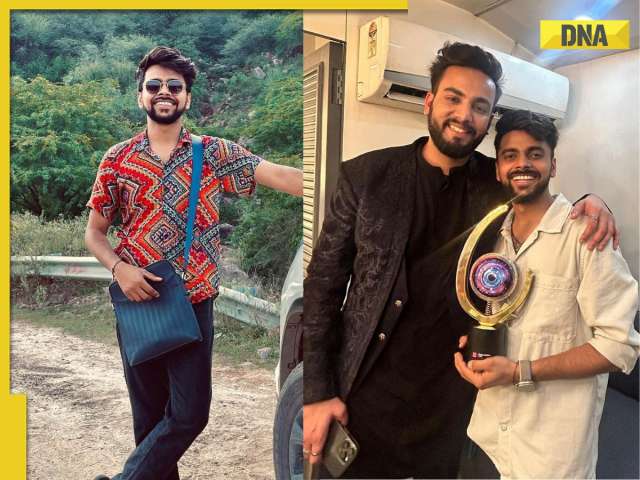

Newlyweds Sonakshi Sinha-Zaheer Iqbal pose candidly with paps; Anil Kapoor, Kajol, Huma Qureshi attend wedding reception![submenu-img]() Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...

Meet Lovekesh Kataria: Elvish Yadav's close friend, Bigg Boss OTT 3 contestant who lied to father, spent his fees on...![submenu-img]() From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala

From Highway to Chandu Champion: 5 underrated gems from Sajid Nadiadwala![submenu-img]() In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive

In pics: Bigg Boss OTT 3 house with dragons, two-sided walls is all about fantasy coming alive

- DNA Explainers

![submenu-img]() Lok Sabha Speaker's Election: What does the Constitution say?

Lok Sabha Speaker's Election: What does the Constitution say?![submenu-img]() Explained: Why is Kerala demanding to change its name to Keralam?

Explained: Why is Kerala demanding to change its name to Keralam?![submenu-img]() DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal?

DNA Explainer: What is Kafala system that is prevalent in gulf countries? Why is it considered extremely brutal? ![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

- Entertainment

![submenu-img]() Khatron Ke Khiladi 14 first promo shows Karan Veer Mehra getting electrocuted, Sumona Chakravarti performing...

Khatron Ke Khiladi 14 first promo shows Karan Veer Mehra getting electrocuted, Sumona Chakravarti performing... ![submenu-img]() This flop film reunited 2 superstars, was loosely based on Hollywood classic, rejected by SRK, Aamir; earned only...

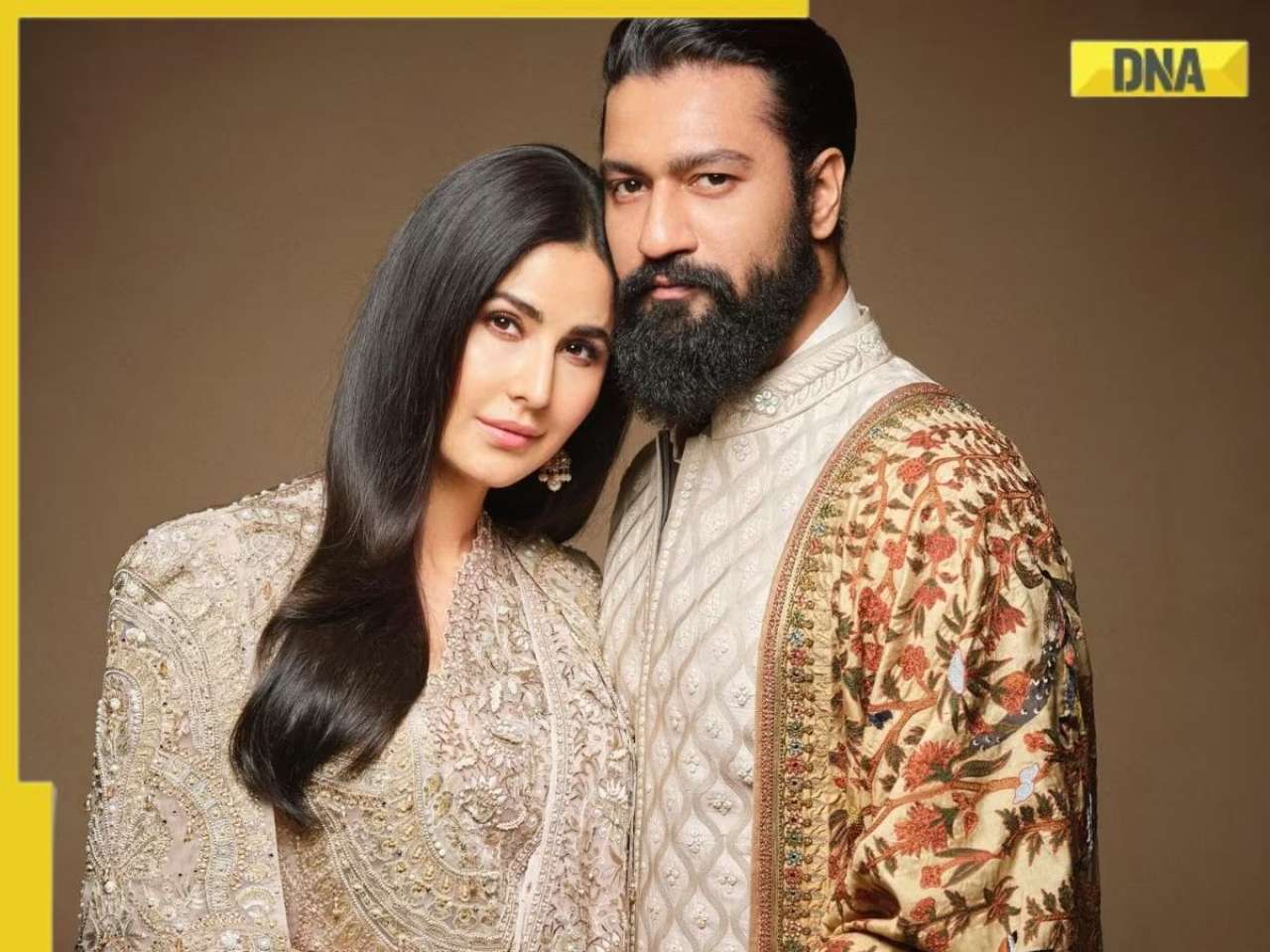

This flop film reunited 2 superstars, was loosely based on Hollywood classic, rejected by SRK, Aamir; earned only...![submenu-img]() Vicky Kaushal breaks his silence on pregnancy rumours of Katrina Kaif: 'Jab uska time...'

Vicky Kaushal breaks his silence on pregnancy rumours of Katrina Kaif: 'Jab uska time...'![submenu-img]() Bad Newz trailer: Vicky Kaushal fights for Tripti Dimri, protects Katrina Kaif from Ammy Virk, fans say 'yeh toh...'

Bad Newz trailer: Vicky Kaushal fights for Tripti Dimri, protects Katrina Kaif from Ammy Virk, fans say 'yeh toh...'![submenu-img]() India's most unsuccessful director has 26 flops, no hit since 1998, was once called great, now works with porn stars

India's most unsuccessful director has 26 flops, no hit since 1998, was once called great, now works with porn stars

- Viral News

![submenu-img]() This Muslim country's currency is weakest in world, one can become millionaire with just Rs 2000, Rs 1 equal to...

This Muslim country's currency is weakest in world, one can become millionaire with just Rs 2000, Rs 1 equal to...![submenu-img]() Watch viral video: Indian mom dries clothes on balcony of Dubai's Atlantis, The Palm; hotel reacts

Watch viral video: Indian mom dries clothes on balcony of Dubai's Atlantis, The Palm; hotel reacts![submenu-img]() 'Men, women are equal but...': Sudha Murty's unique take on gender equality goes viral

'Men, women are equal but...': Sudha Murty's unique take on gender equality goes viral![submenu-img]() Mukesh Ambani, Nita Ambani's son Anant Ambani's wedding card adorned in gold, silver goes viral, it costs...

Mukesh Ambani, Nita Ambani's son Anant Ambani's wedding card adorned in gold, silver goes viral, it costs... ![submenu-img]() Viral video: Good samaritans rescue stranded turtle on remote beach, internet hearts it

Viral video: Good samaritans rescue stranded turtle on remote beach, internet hearts it

)

)

)

)

)

)

)